Winter energy crisis

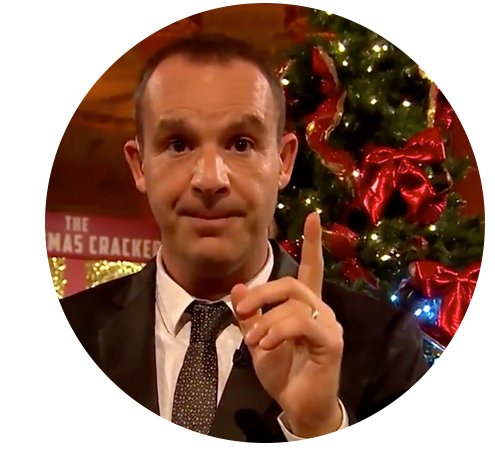

12 things EVERYONE needs to know

Firms collapsing, new price cap, costs exploding Firstly, a message from Martin: "There is energy market

turmoil. Two suppliers with about 400,000 customers combined have collapsed since last week's email, and I wouldn't be surprised if more followed this winter. Plus we're seeing firms playing tricks such as hiking direct debits by 40%+ over winter.

The cause is simple: there's been a huge increase in wholesale prices (which energy firms pay). Even the market's very cheapest 1yr fix deal costs 13% more today than just three months ago. Combine that with the fact we've over-expanded our energy market, without proper checks on new firms' financial viability and customer service capacity, and things look rocky. And that's before I mention the Jan price cap.

Yet that doesn't mean you should sit on your hands. As Tina tweeted: "Just did your energy price comparison and switched. Straightforward, took 5 mins, will save £15/mth or £180/yr. DO IT NOW. Thanks @MartinSLewis." And some save many times that.

So the team and I have put together the following 12 must-knows for everyone who pays an energy bill..." - What happens if your energy supplier goes bust? Last week both Extra Energy and Spark Energy collapsed, the fifth and sixth providers to fail this year. If you're affected, see our Extra Energy collapse help and Spark Energy collapse help guides. Yet the Ofgem 'safety net' means three important things.

- Your gas and electricity will stay on, so there's continuity of supply.

- Any credit you have will be protected.

- You will automatically be moved to a new company.

That means there is some peace of mind. Though if you moved to a small firm for its cheap tariff, you'll likely lose that if it goes bust. Yet things may soon change, as after listening to us, Ofgem is consulting on how to improve firms' stability.

URGENT: Big Switch Event 12 ending. Cheaper than the market's cheapest 1yr and 2yr fixes. A couple of weeks ago, we negotiated two deals that undercut the cheapest, after MSE cashback. There can be regional variance, so we deliberately take you via a full market comparison. URGENT: Big Switch Event 12 ending. Cheaper than the market's cheapest 1yr and 2yr fixes. A couple of weeks ago, we negotiated two deals that undercut the cheapest, after MSE cashback. There can be regional variance, so we deliberately take you via a full market comparison.

Both are from Green Network Energy (GNE), a UK offshoot of a big Italian firm, plus we've arranged enhanced MSE customer service, so if it doesn't sort the problem, we can get involved.

- MSE WINNER 1: Cheapest 1yr fix. Very few left. There was only a limited number to begin with, and at time of writing there are fewer than 1,000 left, so it may've gone by the time you read this. To check, click this GNE MSE 1yr fix link and it'll let you know.

The rate you pay is locked in for a year, and for someone with typical usage is an average £240/yr cheaper than a big-six standard tariff for new customers, factoring in the expected price cap rates.

- MSE WINNER 2: The cheapest 2yr fix. Ends Fri 4pm. The GNE MSE 2yr fix is unlimited, so apply in time and you'll get it. Here the rate you pay is locked in for two years, so two winters, and someone with typical usage could save £400+ over the next 2yrs on typical use compared to a big-six standard tariff.

Here are key notes that apply to both...

- They're for new custs, on monthly direct debit & paperless bills.

- There are early exit fees of £25/fuel (£50 dual fuel).

- They're not portable, so you can't take them with you if you move.

- They're for dual fuel (ie, gas and elec) or elec-only, but NOT gas-only.

- No-brainer British Gas deal for British Gas customers, or anyone wanting a big name. Yes, staggeringly, British Gas currently has a cheap deal, but only if you opt for it - don't ask, don't get.

The rate on British Gas's Energy + boiler cover Oct 19 - for new and existing customers - is locked till 31 Oct 2019. In that time someone with typical use will likely save £200-ish vs a big-six standard tariff on typical use - when you factor in £25 MSE dual fuel cashback (via the link above). Plus most homeowners get 'free' £60ish boiler cover.

It's for dual fuel customers, but you must go via a comparison site. To qualify, you need to get a 'free' smart meter if you don't have one.

- Your price will NOT be capped at £1,137. The regulator Ofgem is introducing a new cap for everyone on a standard price on 1 Jan 2019 (prepayment customers already have a different one in place).

Incorrectly, some news reports said "this is the most anyone'll pay". That's balderdash, baloney or any other b word you can think of. The £1,137 is an indicative price based on typical usage. Yet this isn't a price cap, it's a rate cap. So you need to know two things:

- The cap varies regionally, on typical use from £1,111 to £1,173/yr.

- As it's a rate cap, if you use more your cap will be higher, use less and it'll be lower - there's no set maximum.

Plus on 1 Apr, the cap will be updated, and then again every 6mths. As we know the methodology, and it's based on avg wholesale prices from Aug to Jan, at current rates it looks like it'll jump to £1,250 - a huge rise. All saving figures we quote here are based on the two prices above, which over the next year average £1,219 on typical usage. Yet in an actual comparison, your cap depends on your region and use. Obviously, this isn't a great scenario, so read Martin's letter to Ofgem about price cap confusion. -

Outfox the Market hikes winter direct debits by 40% - will others follow? We've been flooded with complaints about this small firm, which has been very cheap for a while, see outfox the Outfox hike.

It has now split direct debits into winter and summer, with winter making up 70% of total payments. This volte-face has resulted in huge bill shock for many, which causes cashflow difficulties (and is likely a sign of its own cashflow challenges due to huge wholesale price hikes).

- Is it allowed to do this? Unfortunately, yes. Ofgem rules just state any change has to be clearly explained with 10 days' notice.

- What can I do? Most customers are on deals with no exit fees. So you can ditch and switch. Though it is a balance between Outfox's cheap rates, and its nasty short term direct debit hike. Yet if you're substantially in credit, tell it the rate is too high, and it says it'll look at it case by case. More in Fight unfair direct debits. - The sin of doing nothing is worse than the sin of inaccuracy - spend 5mins checking. If worried about comparing, just bite the bullet. Even if you don't know your usage (say you've just moved home) comparisons can estimate for you. While the answer may not be perfect, it's far worse to stick with an overly costly supplier.

The reason for suggesting you do a comparison is prices vary by use and region, so compare via our Cheap Energy Club which is whole-of-market by default. Plus if we can switch you, we give you roughly half what we get as cashback - £25 per dual fuel switch - so it's cheaper than going direct.

If you're worried about which firm to switch to, we've some special filtered comparisons which make going through the results easier.

- The 'I only want firms with good service' comparison.

- The 'No price hikes' comparison - ie, only fixed rates.

- The 'I only want names I know' comparison - only big names.

- The 'I like my current provider, find me its cheapest' comparison.

- The 'Green me up, I want renewable energy' comparison.

- Not much changes when you switch. Don't worry that you'll be cut off, that doesn't happen. Plus when you switch it's the same gas, elec and safety. Only customer service and price change.

- Should you get a 'fixed fee deal' where what you pay doesn't depend on usage? Three suppliers - British Gas, E.on and Green Star (existing custs only) - now offer 'unlimited tariffs', where you pay a fixed amount each month regardless of how much energy you use.

The price is based on what you used the year before, but they're not cheap. If you use the same, you'd be better with a cheap deal. Where they're good is if you are likely to use much more and are worried about the bill. Eg, you've retired and are now at home all day. For more help, see Unlimited energy pros and cons.

- Renters can switch without landlords' permission. If you pay the energy bills directly (as opposed to your landlord via an all-in-one rent payment), you are allowed to switch without permission, though you may want to inform them out of courtesy.

The only exception is if you physically change the property such as switching from a prepayment to credit meter.

It's not just switching - use less energy too. It's possible to get free insulation and boiler help, though usually you need to be in receipt of certain benefits. Or go old-school with thrifty heat-saving tips, incl sausage-dog draught excluders, chimney sheep and lining your curtains with fleece. Many also ask questions such as Is it better to leave the heating on low all day? It's not just switching - use less energy too. It's possible to get free insulation and boiler help, though usually you need to be in receipt of certain benefits. Or go old-school with thrifty heat-saving tips, incl sausage-dog draught excluders, chimney sheep and lining your curtains with fleece. Many also ask questions such as Is it better to leave the heating on low all day?

- Over 64 or on benefits? Are you eligible for winter cash from the Govt? Winter can be tough but there's help available.

a) Winter fuel payments. If you were born on or before 5 Nov 1953, regardless of income, you're eligible for the up-to-£300 one-off payment. If you get certain benefits, eg, state pension, pension credit or jobseeker's allowance, you'll usually get it automatically, otherwise you may have to claim. See Winter fuel payments.

b) Warm Home Discount. If you were on pension credit on 8 Jul 2018, most get an automatic one-off £140 rebate on their electricity bill between Oct and Mar, unless they're with some smaller suppliers. If you've a prepay or pay-as-you-go meter you won't get it automatically, but you can apply for it. Other low-income families may also be eligible - check if your provider pays the discount.

c) Cold weather payments. If you're on certain benefits, eg, income support, jobseeker's allowance or pension credit, you may get £25 for every seven consecutive days it's zero degrees or below from Nov to Mar, paid automatically. Full details in Cold weather payments.

- Are you forced to choose between heating and eating this winter? It's a disgraceful choice, but sadly a dilemma too many face. Check if you're eligible for special help via special free advice services:

- Eng, Wales, NI. See Simple Energy Advice or call 0800 444 202.

- In Scotland, contact Home Energy Scotland on 0808 808 2282.

- Also see our Housing & Energy Grants and Debt Help guides. |