- BIG festive sales, including Boots, Ikea, John Lewis & more

- Energy bills UP from Wednesday - your need-to-knows

- Shift Christmas debt to 0% for 31mths

- £10 champers & lots more While saving money's probably the last thing on most people's minds, the hardworking elves at MSE Towers have been rustling up the last tips of the year (don't worry, it's a much shorter list than usual!). We've timely tips on return rights for bad presents, how to sort Christmas debt, what January will bring for energy bills and some highlights from Martin's podcast. Not forgetting where to find the cheapest bubbly to help you ring in the New Year. So, without further ado, here are our 12 tips of (post) Christmas (with nary a partridge or a pear tree in sight)... - Boxing Day/January sales, including Argos, Boots, Ikea, John Lewis, M&S and Next. Festive discounts are in full swing, and we expect many to be boosted further over the coming days. Get the latest in our full sales round-up & analysis, including what the 'up to XX% off' really means for each retailer.

IMPORTANT: Sales are great if you need something, it's discounted, and the store has the right size or model. But don't get sucked in by the hype. Before buying, remember Martin's Money Mantras: Do I need it? Can I afford it? Have I checked prices elsewhere? If the answer is 'no' to any of those questions, DON'T buy it.

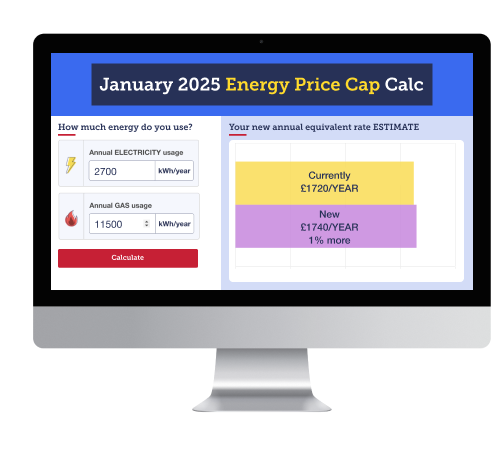

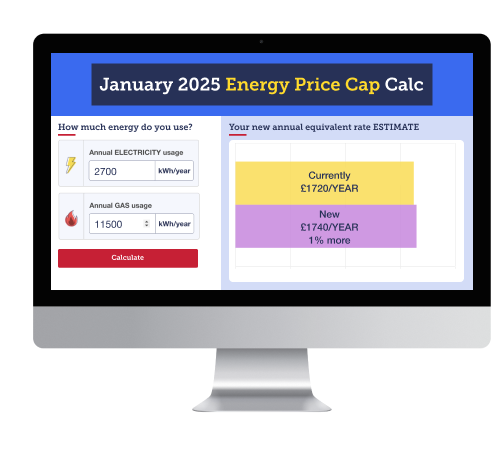

It's Meter Reading Week. Energy bills are going UP an average 1% on Wed 1 Jan - here's what you need to know. On Wednesday, the new January to March Energy Price Cap kicks in, which dictates the rates that about 80% of homes (in England, Scotland & Wales) pay. Rates will go up on average 1%, but the % increase you actually pay depends on where you live and how much energy you use. Our 'What'll I pay from Jan?' calc gives a bespoke answer, or see full region-by-region rates. For broad-brush, here are the average Direct Debit rates: It's Meter Reading Week. Energy bills are going UP an average 1% on Wed 1 Jan - here's what you need to know. On Wednesday, the new January to March Energy Price Cap kicks in, which dictates the rates that about 80% of homes (in England, Scotland & Wales) pay. Rates will go up on average 1%, but the % increase you actually pay depends on where you live and how much energy you use. Our 'What'll I pay from Jan?' calc gives a bespoke answer, or see full region-by-region rates. For broad-brush, here are the average Direct Debit rates:

GAS. Unit rate 6.34p per kilowatt hour (kWh), UP 0.53p (1.6%). Standing charge 31.65p per day, DOWN 0.01p.

ELEC. Unit rate 24.86p per kWh, UP 0.36p (1.5%). Standing charge 60.97p per day, DOWN 0.02p.

- It's Meter Reading Week. If you've not got a WORKING smart meter, aim to give an up-to-date meter reading within a few days either side of 1 Jan, reducing the risk that your supplier estimates that you've used more at the new higher rate than you have. See our firm-by-firm when & how to do a reading.

- Are you paying the right amount? Use our 'Direct Debit too high?' calculator.

- Most can save by fixing energy now. Today's cheapest standalone one-year fixes are up to 9% cheaper than the 1 Jan Cap - to find your cheapest use our Cheap Energy Club comparison.

- New. 2024's best bits from The Martin Lewis Podcast. In the Christmas special, Martin's pulled together some best bits from this year's pod, including what you need to know about mortgages, how to save as a first-time buyer, the most joy you've got from spending a fiver, and what people did with their first pay packet. Plus, there's a car insurance Mastermind. Do listen to the new Martin Lewis Podcast via BBC Sounds, Apple or Spotify, or wherever you get your Martin fix.

Festive credit card debt piling up? Shift it to 0% for up to 31 months. If you pay interest on credit or store card debt, put your details into our Balance Transfer Eligibility Calculator to see your odds of getting a 0% deal. Festive credit card debt piling up? Shift it to 0% for up to 31 months. If you pay interest on credit or store card debt, put your details into our Balance Transfer Eligibility Calculator to see your odds of getting a 0% deal.

Balance transfer credit cards pay off debt on old cards for you, so you owe the new one instead, but with 0% interest for a set time. If you've a choice, go for the card with the lowest fee which has a long enough 0% period for you to pay it off in. Top deals for accepted new cardholders include:

- The longest 0% cards: The two longest cards both offer 'up to' 31 interest-free months with similar fees, though they work slightly differently in our eligibility calc. If 'pre-approved' for Barclaycard's 'up to' 31mths 0% (3.45% fee), you'll get the full 0% period - if not, some could be accepted and get just 14mths. You also get £20 cashback if transferring £2,500+ within 60 days. Alternatively, apply via our link for MBNA's new 'up to' card and you'll be told what 0% length and fee you'll get before you apply, so you'll be pre-approved for 31mths 0% (3.2% fee) OR 14mths 0% (3.49% fee), or you'll be rejected.

- The longest definite 0%: If you're not pre-approved for the longest cards above and don't want to risk a shorter 0%, try Tesco Bank's 29mths 0% (2.95% fee) card. All accepted get the full 29mths. The lower fee also means it beats the cards above if you know you can pay off the debt in time.

- If you can repay quicker: Barclaycard's 'up to' 14mths 0% NO FEE. Note, unless pre-approved in our eligibility calc, some could be accepted and offered just 12 or 10 months 0%. You also get £20 cashback if transferring £2,500+ within 60 days.

More options in Best balance transfers... though always follow the Golden Rules...

a) Clear the card before the 0% ends, or it's 24.9%+ rep APR interest.

b) Never miss the minimum monthly repayment or you could lose the 0%.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate.

d) You normally must transfer within 60 days to get the 0%.

- Struggling with debt? DON'T DELAY - get free help. If the cost-of-living crisis has left you feeling desperate about your finances, help is at hand. Several charities offer impartial, one-to-one help for FREE, but it's best to make contact ASAP as demand always soars in January. Full info in our Debt help guide.

- Switch bank & get a FREE £175 plus perks. We've seen many (legal) bank bribes this year, with providers offering free cash and a variety of perks for your custom. These deals often tail off around Christmas, but there are still three left which pay you £150+ to switch...

- First Direct 1st Account*: FREE £175, access to a linked 7% regular saver you can put up to £300/mth in, and fee-free overseas spending on the debit card, plus many get a £250 0% overdraft (credit-check dependent). It's also been top or near-top of every customer service poll we've ever done.

- Nationwide FlexDirect: FREE £175, 5% interest on up to £1,500 and 1% cashback (max £5/mth), both for the first year, access to a 6.5% regular saver you can put up to £200/mth in and a 0% overdraft 'buffer' of up to £50.

- Santander Edge*: FREE £150, 6% easy-access savings on up to £4,000, 1% cashback on bills (max £10/mth) and 1% on supermarket and fuel/travel spending (max £10/mth) - plus fee-free overseas card spending. Though there's a £3/mth fee.

Full info and eligibility criteria in Best current accounts.

Sign up for the FREE MSE Academy of Money course to sharpen your financial knowledge. If you've quiet time over the festive period you want to make use of, you could join 10,000s of others who have already signed up to our online financial education course (in partnership with the Open University). Sign up for the FREE MSE Academy of Money course to sharpen your financial knowledge. If you've quiet time over the festive period you want to make use of, you could join 10,000s of others who have already signed up to our online financial education course (in partnership with the Open University).

The course is free, available in English and Welsh, and covers six key areas of personal finance: 1) Making good spending decisions; 2) Budgeting and taxation; 3) Borrowing money; 4) Understanding mortgages; 5) Saving and investing; 6) Planning for retirement. Read all about it and see what other personal finance educational resources are available (including for kids) in our Financial education guide.

- £10 champers & £4.75 prosecco - great if you want to see in the New Year with a glass of fizz. We've rounded up corking champagne & prosecco deals, but please be Drinkaware.

- Did Santa bring you a new smartphone? Use our 15 quick tips to keep it secure. Unfortunately, phone theft's rife and thieves have sneaky tactics to ensure they wreak the most financial havoc on victims, including a growing trend of 'shoulder surfing' to steal your personal data and access banking apps. Tool up with our 15 tips to protect your phone from thieves.

- 'Oh Santa, why did you get me socks again?!' Your gift return rights. If the big fella got you something ghastly, misjudged your size or it broke on his sleigh, you may be in luck. Technically only the buyer has rights, but many stores allow recipients to get a refund or exchange with proof of purchase (which may mean awkwardly fessing up to the buyer...). Full help in our Christmas return rights guide. Here's key info:

- You've no legal rights to a refund or exchange if the gift was bought in a store (unless it's faulty). In Martin's Twitter/X poll of more than 26,000 people, only 41% knew this. You can watch his 2-min return rights video for full info, but in brief... - You've no legal rights to a refund or exchange if the gift was bought in a store (unless it's faulty). In Martin's Twitter/X poll of more than 26,000 people, only 41% knew this. You can watch his 2-min return rights video for full info, but in brief...

If you just don't like the item and it was bought in a shop, neither you nor the buyer is entitled to a refund. That said, many stores allow you to return non-sale items in good condition for about one month after purchase, whatever the reason, though you may need to settle for an exchange or store credit. Of course, if it's faulty, different rights apply.

- If the gift was bought online, the buyer has the legal right to a refund. Essentially, they have 14 days after they receive their order to tell the seller they want a refund and a further 14 days to actually return the item. (There are exemptions, eg, personalised or perishable goods.)

- Many stores offer longer return periods over Christmas. For example, John Lewis is allowing shoppers to return items bought between 26 Sep and 24 Dec 2024 by 23 Jan 2025.

- Can you save £667.95 in 2025 with the 1p Savings Challenge? A fun MoneySaving activity to kick off the New Year - it sees you save 1p on 1 Jan, 2p on 2 Jan, 3p on 3 Jan and so on. For full info, see MSE Olivia's 1p Savings Challenge 2025 explainer.

- From A to Z, the MSE Forum's 2024 highlights. A feathered squatter, a deceased pop star and a six-figure competition win... check out our rundown of the forum's most memorable MoneySaving moments from the past year.

|