| | | It's a debt like any other, so don't ignore - cut costs & pay it back

The overdraft market is due a shake-up. Regulator the Financial Conduct Authority is considering banning fees for busting your limit, while Britain's biggest bank Lloyds is completely reshaping its charges. The overdraft market is due a shake-up. Regulator the Financial Conduct Authority is considering banning fees for busting your limit, while Britain's biggest bank Lloyds is completely reshaping its charges.

Yet right now many live in their overdrafts, paying high fees, without realising it's a real debt. So don't rest on your laurels, even if you only dip into the red - sort it. The key is to cut the rate, repay faster and regularly check your balance to avoid penalties... Four ways to cut overdraft costs to 0% It's often difficult to see what an overdraft truly costs per year as small fees here and there can be added, yet for someone who averages a £100 overdraft balance, it can cost up to £365/year - a hugely disproportionate sum. All four deals below - which require a credit check to get the account and overdraft/offer - can cut your costs so more of your money goes to reducing your borrowing, not servicing interest or fees. | 1. | Get PAID £100 to get a 0% overdraft. Good for overdrafts up to £350 or if you just dip in occasionally. First Direct* gives eligible new customers a 0% overdraft of £250 (15.9% EAR above), and gives switchers a free £100 which comes a month or so after they make their first monthly pay-in. It's a clear winner for those with overdrafts up to £350 as the £100 can go to clearing some.

What's more, it's won every customer service poll we've done - 90% of its overdrawn customers rated it 'great' in our poll that closed this week. To get the bonus and ensure there's no fee, you need to pay in at least £1,000/mth (equiv to £12,850+/yr salary). Full info and eligibility in First Direct help. | | | | 2. | Larger 0% overdraft for 12 months? Good if you can clear in that time. New Nationwide's FlexDirect customers can get a year's fee-free overdraft. There's no set limit - it depends on a credit check - but we've had reports of bigger amounts than First Direct's set 0% limit. Eg, Ben: "Nationwide matched my overdraft - £1,400. Saved a fortune while clearing my debt." Full info and eligibility in Nationwide help.

If you're doing this, use the year to clear your overdraft as after it's 50p/day if more than £10 overdrawn, which is £180ish/yr if permanently overdrawn within your limit, whatever the amount. | | | | 3. | SHIFT overdrafts to special credit cards too. Good if you need longer to pay it off. A few specialist cards offer a 'money transfer' that lets you pay cash into your bank. Use it to pay off your overdraft, then you owe the card instead, but at 0%. It's useful for longer-to-clear overdrafts as you've more time, though there's a smallish fee.

The top deal is 41mths 0% from Virgin Money (eligibility calc incl pre-approval / apply*), but there's a one-off fee of 3.8% of the amount shifted. If you can repay quicker, a 36mth 0% Virgin Money card (eligibility calc incl pre-approval / apply*) has a lower 2.9% fee. These are complex so get step-by-step help in Money Transfers.

Always follow the Money Transfer Golden Rules:

a) Never just take cash from an ATM, ask the card firm to "do a money transfer to my current account".

b) Always repay the monthly minimum or you'll lose the 0% deal.

c) Plan to clear by the end of the 0% period or they jump to 20.9% rep APR. (See APR Examples.) | | | | 4. | Likely to struggle to get the deals above? 0% option if you've poor credit. Useful but needs to be done carefully. Sadly, there's no route for just shifting your overdraft to another account or card directly, so this requires a workaround using a 0% for spending card. This is generally best for those who are close to busting their limit and need urgent respite.

First use our 0% Spending Cards Eligibility Calculator in case you're accepted for a longer 0% deal than this card below. If your chances are slim, the Marbles card* offers 5mths at 0% on spending even to some with county court judgments or defaults over a year old. Though after that it's a horrid 34.9% rep APR.

How to use it to clear your overdraft:

- Use it for normal spending, but only repay the monthly minimum.

- As you're using it rather than spending from your bank, when you get paid it should reduce your overdraft.

- That should buy you time to clear the card before the 0% ends, or it's 34.9% APR (that's still often cheaper than overdraft-busting charges).

Find a bigger explanation of this in our Marbles Help (APR Examples). See other tips below for more help too. | | | Six ways to keep your overdraft in check It's not just about rate, how you handle your finances plays a big part in keeping fees to a minimum. This includes ensuring you've got the best deal on EVERYTHING to minimise expenditure - see our full Money Makeover guide - and following these overdraft-specific tips. | 5. | Just moving direct debit dates can save a fortune on overdraft fees. It's simple. If your direct debits go out the day after you're paid and you go overdrawn you pay fees all month. If they go out just before you're paid you only get them for a couple of days.

So call your energy, broadband, mobile etc providers and ask them to move direct debits to later in your monthly financial cycle to just before payday. This means you're overdrawn for less time, meaning fewer charges - but know these bills are coming, don't overspend during the month. | | | | 6. | Got savings, even just for emergencies? Don't be afraid to use 'em to clear your overdraft. Overdrafts cost massively more than savings earn, eg, a fairly typical £1,000 overdraft costing £20/mth is £240/yr, but the same in easy-access savings earns a paltry £13/yr at best. So repay debt with savings and you're £227 per £1,000 up each year.

You may think you'll have no savings if the boiler packs up. True, but if an emergency strikes, you can go back into your overdraft and you'll be no worse off. To beat the fear, read Repay Debt With Savings? | | | | 7. | If your overdraft's more expensive than other debts, prioritise repaying it. If you've multiple debts, see which charges most, adding up interest and fees for the true costs.

If your overdraft's the most expensive (having first tried the steps above to cut costs), make minimum payments on all other debts, and focus on using incoming cash to clear the overdraft. If it's not the costliest, stay in your overdraft, never bust your limit and use spare cash to pay as much off the costliest as you can.

Once the most expensive debt's cleared, you're ready to tackle the next, and so on. See full Debt Repayments help. | | | | 8. | Struggle to control spending? Shift to a no-overdraft account. Basic bank accounts provide a no-frills, no-overdraft current account. So clear your current overdraft and you could move to one.

They used to charge fees if you spent more than you had, eg, for unpaid direct debits or rejected transactions, but since January 2016 these have stopped. Full info and best buys in Basic Bank Accounts. | | | | 9. | Reclaim £100s of bank charges for busting overdraft limits. Reports of the death of bank-charge reclaiming have been greatly exaggerated. It can still be done, though now you need to be in financial hardship to claim. Full step-by-step help and template letters in Reclaim Bank Charges For Free.

Scott's email should inspire you: "Initially the bank said I wasn't due anything, despite me being stuck in an overdraft cycle. I then used the MSE info to push it and was offered £576. Thank you." | | | | 10. | Don't be afraid to tell the bank if you're in trouble. It may not feel like it sometimes, but your bank has a duty to treat its customers fairly. So if you've a big overdraft you're struggling to deal with, you can ask it to extend it or waive interest/fees to give a respite from over-limit charges, but don't see it as an excuse to borrow more.

If it won't play ball or you're really in the mire, free one-on-one debt-counselling help may be suitable - especially if you've other debts. Try Citizens Advice, CAP, StepChange or National Debtline. They're there to help, not judge. Full info in Debt Help. | | |

| | | | | | | | | | | | | | | | | | Check your savings now - some pay just 0.01%. So here's MSE founder Martin Lewis's SIMPLE savings masterclass

If you've any savings, check what they pay. Most are paltry, pitiful, spitworthily low, some just 0.01% (10p interest per £1,000 saved). Yet easy-access and fixed rates are improving a smidgeon. So today no clever tricks - it's back to basics, with 5 solutions in order of simplicity and some FAQs to start... If you've any savings, check what they pay. Most are paltry, pitiful, spitworthily low, some just 0.01% (10p interest per £1,000 saved). Yet easy-access and fixed rates are improving a smidgeon. So today no clever tricks - it's back to basics, with 5 solutions in order of simplicity and some FAQs to start...

Q. How do you switch savings? Just withdraw cash from the old account, open the new one, and put it in.

Q. I've not heard of one of these banks, is it safe? All accounts here have the UK savings safety, meaning in the unlikely event they went bust, you're protected up to £85,000/person & institution.

Q. Isn't it better under the mattress? No. There's no interest. And most home insurance only covers up to £1,000 cash.

-

New top easy-access account - 1.3%. Here, you can add and withdraw cash whenever you want. The new top payer is Bank of Cyprus at 1.3%, though 0.7% of this is a bonus which ends after a year, while RBS-owned Ulster Bank's 1.25% is a straight rate - both are online accounts accessible across the UK. As every basic 20% rate taxpayer can now earn £1,000 of INTEREST (£500 at the higher 40% rate) without paying tax, these accounts are tax-free for all but those with huge savings. So most should go for these over the top 1.05% cash ISA. -

Lock money away to earn up to 2.2%. If you've savings you won't need to touch, top fixed accounts give you a higher set rate for a time, but you can't access your cash during it. Top rates are the Shawbrook 1yr 1.9% fix (min deposit £1,000), United Trust 2yr 2.05% fix (min £500), PCF Bank 3yr 2.22% (min £1,000) and NS&I savings bond 2.2% (MAX deposit £3,000). You can get fixed cash ISAs too, yet rates are far lower. For more info see top fixed savings. -

Save money each month? Earn up to 5%. Regular savings accounts pay more but you can only put up to about £300ish/mth in them. To get the top payers you have to have (or switch to) their linked bank account. So if you bank with First Direct, M&S Bank, Nationwide, Santander 123 or HSBC Advance/Premier click the link to see what's available for you. Otherwise Leeds Building Society pays 2.3% and anyone can open it. -

High-interest bank savings - up to 5% on lump sums. Some current accounts offer high-interest easy-access as a loss leader to draw in your custom. You can get 5% on up to £2,500 or 1.5% on up to £20,000. You can do these as second accounts without switching your main one. Full help in 5% interest with top bank accounts. -

Potential first-time buyer? Get 25% boost to your savings. This is a no-brainer for anyone who may one day want to buy a home. The Lifetime ISA and Help to Buy ISA add £250 per £1,000 saved. Click the links to find which is best for you. | | | | | £34 of No7 beauty products for £10ish. Incl mascara, nail polish, eye shadow and eye contour brush. Ltd stock. No7

Martin Lewis - 'The four things you need to be successful.' Recorded at his old uni, the London School of Economics. Martin's tips for success

Sky TV or broadband cust? How to bag a FREE Sky Store film download & DVD. It's easy, see Sky VIP.

Need last-min holiday cash? NEVER change it at the airport. Rates are hideous - instead use our TravelMoneyMax comparison tool which speedily finds the best rates from 30+ bureaux. Eg, on Tue, £100 got you €110 via our tool but a pathetic €93 at Gatwick Airport.

Walk away with someone else's luggage this summer - it could be worth £100s. Ever watched Storage Hunters? Now you can do-it-yourself with lost luggage auctions.

£1 for a foot-long sausage roll. A lot of grub, but 1,650 calories, so please eat responsibly. Sausage feast

425 spring bulbs £10 all-in (norm £35ish). MSE Blagged. Incl muscari, brodiaea, oxalis, allium and scilia. Thompson & Morgan | | | | | | | | | | | Get paid in points to spend on a credit card at no cost to you whatsoever - top 0% deal

There are two ways to see this deal. Either a way to bag £50 off shopping at Sainsbury's or owt else you can spend Nectar points on, at no cost. Or as a way to get a best-buy 0% for spending credit card with an option for a 'free £50' on top. -

How do I get the free points? Accepted new Sainsbury's Bank 31mth 0% card (eligibility calc / apply*) holders, who apply via this specific link by 10am Mon, get 1,000 Nectar pts (worth £5) for every £35+ spent at Sainsbury's in the first two months, up to 10,000 pts (£50 worth). How do I get the free points? Accepted new Sainsbury's Bank 31mth 0% card (eligibility calc / apply*) holders, who apply via this specific link by 10am Mon, get 1,000 Nectar pts (worth £5) for every £35+ spent at Sainsbury's in the first two months, up to 10,000 pts (£50 worth).

To max it you just need to do your normal shopping in Sainsbury's, and crucially SPLIT YOUR SHOP. So if spending, say, £110, you're allowed to put it through as 3 transactions of £35, £35 and £40 - and each gets you 1,000 pts.

-

I do need a 0% card - is this one any good? Yes, very. 31mths at 0% is only a month short of the longest 0% spending card on the market and - if accepted - you get the full 31mths at 0%. Whereas the longer AA card (eligibility calc / apply*) is 'up to' 32mths 0%, so some accepted get fewer months. Full info and top picks in 0% Spending Cards. However, be wary of new borrowing - get it wrong and you can get burnt. So ensure you plan what you'll spend, don't do it willy-nilly, budget to repay, never bust the credit limit, and clear it before the 0% ends. -

I don't need credit - can I just bag the points? Yes. Get the card and set up a direct debit to repay in full, so there's no risk of interest. Then only use it for the Sainsbury's spend. Once done put it away or cancel it. The only reason not to do this is if you've an important credit application due soon (eg, a mortgage) - as applying for the card could have a minor short-term impact on your credit score. -

Will I be accepted? All credit cards credit-score you, so the easy way to find out is to use our eligibility calculators, which you'll see linked after each card name. These show your odds of acceptance in advance. -

0% Card Golden Rules. Full info and top picks in 0% Spending Cards (APR Examples).

a) Always pay at least the set monthly minimum or you can lose the 0% (and stick within the credit limit).

b) Plan to clear the card (or balance-transfer) before the 0% ends or both rates jump to 18.9% rep APR after.

c) These cards are usually ONLY cheap for spending, so avoid cash withdrawals or balance transfers on them. | | | | | 10% off 1yr railcards code. Incl 16-25, Two Together, Family & Friends and Senior. Railcards

Free Sunday cinema ticket for buying £3 of chocolate. Works at Cineworld, Empire, Showcase and some independents. 'Free' cinema

2for1 at Alton Towers, Legoland, Thorpe Park etc when you buy chocs, cereals or snacks. Valid at 20+ attractions. Merlin deals

Ends Thu. BT Broadband cust? Pay equiv £4/mth for a 3GB, unltd mins & texts Sim. Apply via this BT link* to get a 4G Sim on a 1yr contract for £8/mth + a £45 Amazon/iTunes vch. Use the vch and it's equiv to £4.25/mth. Annoyingly, you must CLAIM the vch, so use this form between 2 weeks and 3 months after activation. It should arrive within 45 days. Full info and options in Cheap Sim-only Deals.

Good with numbers? Take the National Numeracy test. Martin got 98 out of 100 - can you beat him? National Numeracy test

£30 free-range meat hamper (cheaper than supermarkets). MSE Blagged. Incl sirloin, rump, gammon and pork-loin steaks, sausages and bacon. 2,500 avail. Meat hamper | | | | | They can get this email free every week | | | | | | | | | The AA, BT, RAC, Sky etc usually give their best deals to newbies, but haggling can unlock hidden savings

It's time to loosen that British stiff upper lip. Haggling with call centres to get a better deal on broadband, breakdown, TV and more services is an art, and when done with charm and know-how it can save £100s. Our Haggle with Sky, AA & more guide has top tricks, plus we've a host of company and industry-specific guides (below) to show you how... -

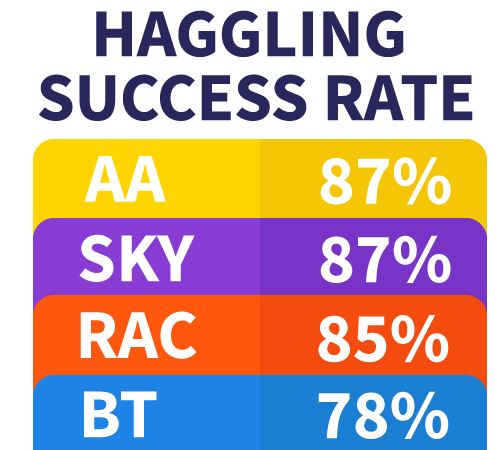

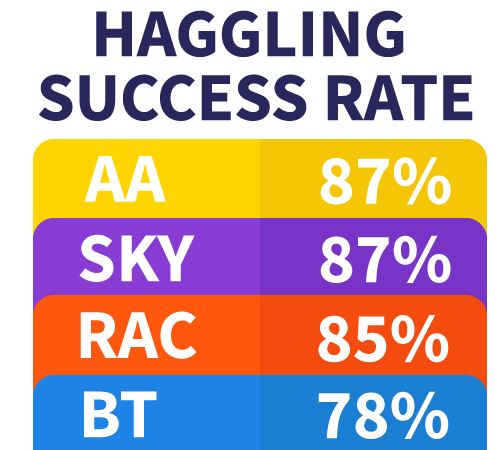

Broadband, phone & TV - £720/yr haggle. These firms are among the easiest to haggle with - in our most recent poll, a huge 87% of Sky customers and 78% of those with BT who tried haggling succeeded. Janet said: "I followed your suggestions and was offered £20/mth off my Sky bill but kept going and got £60/mth off. Very happy." See our dedicated BT, Sky, TalkTalk, Plusnet and Virgin haggling guides. For others, read Broadband Haggling tips. Broadband, phone & TV - £720/yr haggle. These firms are among the easiest to haggle with - in our most recent poll, a huge 87% of Sky customers and 78% of those with BT who tried haggling succeeded. Janet said: "I followed your suggestions and was offered £20/mth off my Sky bill but kept going and got £60/mth off. Very happy." See our dedicated BT, Sky, TalkTalk, Plusnet and Virgin haggling guides. For others, read Broadband Haggling tips.

-

Breakdown cover - £170/yr haggle. This is another area where haggling's powerful - 87% of AA customers and 85% with the RAC report success, eg, Lynda: "Just got my AA cover renewal reduced from £342 to £169/year - I've never haggled before, so I'm chuffed." Full help in Breakdown Cover Haggling. -

Mobile phone contracts - £360/yr haggle (and a better allowance). If a firm says it's upping prices (and most of the biggies have this year), that's valuable haggling ammunition. Stacy said: "After reading your article, I contacted Vodafone and haggled from £49/mth DOWN to £19/mth with more data. What a saving, thanks." See full Mobile Haggling Help. | | | | | Student working this summer? Are you entitled to tax back? Check out our student tax help tip.

FREE 'The Pet Show' tickets code (norm £8-£11). Stafford, Sat 19 and Sun 20 Aug, 3,000 avail. Paw-some

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"Thanks for the tip to fill water bottles up at the boarding gate. Saved me £2.15 a bottle at WHSmith." See our 50+ Overseas Travel Tips guide for how to find free water at airports.

MSE is looking for a Money Writer and a Senior Utilities Writer. Based in London. For this and more opportunities, see MSE jobs. | | | | | | | | | | Does mental health affect your debts? We're updating our research on links between mental health issues and debt problems. It's argued either one can cause the other. So let us know in our latest poll: Does mental health affect your debts? Please answer even if you don't have mental health issues, as it'll help. And if you've been affected, see our Mental Health & Debt guide for help. First Direct is yet again top of the table, RBS takes the wooden spoon... In our biannual poll we ask you to rate your bank, and 6,111 of you gave your views in the latest, which closed this week. A huge 90% of First Direct customers think it's 'great' while RBS is only 37% 'great'. See full banking poll results. | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 10 Aug - Good Morning Britain, ITV, Deals of the Week, 7.40am

Fri 11 Aug - This Morning, ITV, Martin's Quick Deals, time TBC

Mon 14 Aug - This Morning, ITV, time TBC

Mon 14 Aug - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast | | | | Fri 11 Aug - BBC South West stations, breakfast

Tue 15 Aug - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: I'm with Virgin Media for my broadband and phone line but I haven't used my house phone for at least three years. Can I cancel it and still receive Virgin broadband? Phil, via email.  MSE Weleid's A: You can, though it's not often worth it because the system is a farce. MSE Weleid's A: You can, though it's not often worth it because the system is a farce.

Virgin is the only major provider that allows you to have broadband with no phone line, but it's usually cheaper to take a deal for broadband AND line rental from it or another firm. Almost all providers other than Virgin compel you to pay line rental - with them or another firm - if you take their broadband. See our Cheap Broadband & Phone guide for the top deals. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go... how often do you clean your clothes and would you risk stinking the place out, like Bill, to save a few pennies on water and energy bills? Our users are discussing their washing habits, so get involved in our Facebook post: 'How long do you leave clothes before giving them a wash?' We hope you save some money,

The MSE team | | | | | | |