|

| - | - | - | - | - |

| |

|

| |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Saved cash? Shout it from the rooftops.If this email's ever helped you, please forward it to friends and suggest they get it via moneysavingexpert.com/tips |

| Savers, you're still being screwed - shift to earn up to 2% The base rate rose last week but most savings rates have moved about as much as Santa on Boxing Day Be warned. Last week's base rate rise - from 0.25% to 0.5% - doesn't mean YOUR savings rate will follow. In fact, only seven of the 31 banks and building societies we've contacted have confirmed they will up rates, and even then most are from pitifully low levels. Yet there are still decent deals to be had. So if you've a pants account paying less than 1%, ditch it. Here are the current top deals... All accounts below have £85,000 per person UK savings protection.

There are other options. If you can save small amounts regularly you can get up to 5% in a regular savings account. And if you pay tax on savings (eg, you're a basic-rate taxpayer earning over £1k/yr interest, £500 if higher rate), consider cash ISAs. If saving for a first home, see Help to Buy and Lifetime ISAs. |

| Stop press. BT hikes prices for 10m - how to beat it. Incl broadband, BT Sport and calls. BT hikes M&S beauty advent calendar (worth £250) for £35, incl Ren & Eyeko. It's a knock-down price but only if you spend £35 on clothing and homeware too. Not just any advent calendar British Gas customers - there's a hidden way to cut £130 off your bill. All customers of the energy giant should read Martin's new British Gas saving blog. TWO pairs of specs for £15 code. MSE Blagged. Incl lenses and delivery. Ends Sun. Spec-tacular Cheapest iPhone X. Not MoneySaving, and early adopters often pay more, but if you're going to do it (do you really need to?), here's the cheapest way. iPhone X Warning: Will Lloyds/Halifax overdraft changes cost you £100s? Banking giant Lloyds Banking Group, which includes Halifax and Bank of Scotland, just changed its charges. We analyse winners and losers and what you should do to keep your costs down. Lloyds overdraft changes |

| |

|---|

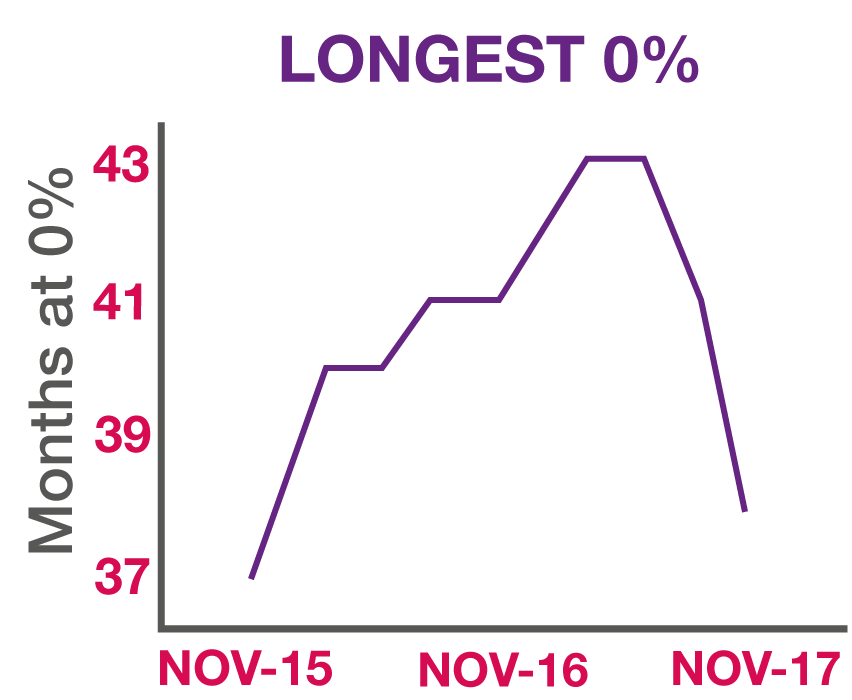

| 4 ways to cut your overdraft costs to 0% (and earn £125 doing it) There are many bad or indifferent overdrafts (Lloyds/Halifax customers see above). Some charge a fortune, for instance, a constant £200 overdraft could cost you £365 A YEAR, and if you bust the limit they can be worse than payday loans. Yet there are some goodies, which let you borrow at 0%, and even give free cash which can help to clear the debt. Full info in Cut Overdraft Costs but here are the best options... All accounts below require a credit check and the new overdraft limit isn't guaranteed.

Can't get a better deal or struggling? Ask for help. Regulator the Financial Conduct Authority says firms must ensure customers are treated fairly. So if you've a big overdraft and can't switch, try calling your bank. Full info in Cut Overdraft Costs. |

| Urgent. Check NOW if you're entitled to benefits - the system's changing & you may get MUCH less if you wait. See our Universal Credit help. Asda Xmas shopping trick - get an up-to-4% spending boost. Top up Asda's savings card by 5pm on Sun and on Mon you'll get up to an extra £6. Iceland and Co-op have schemes too - see Supermarket Xmas Savings Schemes. Harvey Nichols rare up-to-25% off. Not MoneySaving but if you'll buy anyway, get it when cheaper. Valid Wed-Fri (only Thu in store). Harvey Nicks Ends Fri. 4GB Sim, unltd mins & texts for '£8/mth'. MSE Blagged. This 12mth Three* Sim for new customers costs £13/mth and you're sent a £60 Amazon vch automatically within 90 days. If you'd have spent that anyway, factor it in and the cost is equiv to £8/mth. You also get 'free' roaming in places such as the US and Oz, and Europe. Full info and more options in Top Sims. Starbucks 2for1 'festive' drinks. Thu-Sun but only for a few hours each day. See Starbucks 2for1. £45 Ted Baker beauty set £22.50. Boots 'Star Gift' from Friday, incl lipstick, nail polish, eyeshadow. Ted Baker |

| AT A GLANCE BEST BUYS

|

| Renters' rights boost, FREE furniture & 54 more tips for tenants Incl save 60%+ on rent 'baby-sitting' properties, free app to split bills, save £100s switching energy & more Letting agents in England and Wales CAN currently charge fees but the Government's proposing to ban 'em in England - which could save you £100s if you rent. It could still take months to come into force though - see the latest on the possible lettings fees ban. Plus we've 56 Tips for Renters to help you rent cheaply and safely. Here are five to get you started...

See the full guide with 50+ tips for renters. |

| Earn £15 M&S/Amazon vchs doing quick online surveys. MSE Blagged. Popular with MoneySavers - you fill in surveys and search online for pts. We've a link for you to earn £5 worth and get a bonus £10. Newbies only. Swagbucks SUCCESS OF THE WEEK: (Send us yours on this or any topic) Free managing money course for 16 to 18-year-olds. Martin's worked with the Open University on this course, which helps young people understand debt, savings, tax, budgeting and more. Financial education |

| CAMPAIGN OF THE WEEK Help stop hunger at Christmas. December is the busiest month for foodbanks, with 45% more referrals from Citizens Advice and other organisations. To help, the UK Money Bloggers organisation is urging people to take part in a 'reverse advent calendar' by donating to a foodbank every day in the run-up to Christmas. Find out what's needed and where your local food bank is and then share pics of what you've donated on social media using #foodbankadvent. |

| THIS WEEK'S POLL Do you use banking apps - and which are the best? There were 159 banking app logins per second last year. And now there are even app-only banks. So we want to know what you think of them, considering ease of use, customer service and range of features. Which banking apps are best? Cheques aren't bouncing back... Last week we asked if you still use cheques. Despite the fact people wrote 275 million in the UK last year, our poll showed that 47% of you use 'em about once a year or less, and 55% of under-25s have never paid with one. Though they're still popular with those 65+, with 77% using them a few times a year or more. See who still uses cheques. |

| MONEY MORAL DILEMMA Should I keep my free shoes? I ordered some shoes online, but realised they wouldn't arrive in time for my holiday. I decided to buy another pair in store and cancelled my online order - I got a refund but the delivery still turned up. Should I ask the company if it wants the shoes back? Enter the Money Moral Maze: Should I keep my free shoes? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: Had my light bulb moment |

|

| |

|---|

| MARTIN'S APPEARANCES (WED 8 NOV ONWARD) Thu 9 Nov - Good Morning Britain, ITV, Deals of the Week, 7.40am. See previous MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 8 Nov - BBC Cumbria, Money Talks with Ben Maeder, from 6pm |

| QUESTION OF THE WEEK Q: If I switch energy supplier and have a smart meter, will it still work with my new supplier? Terry, by email. MSE Andrew's A: There are plans to upgrade the software in these meters so in future when you switch you'll keep all the smart elements. But this is unlikely to happen until the end of next year at the earliest. See our Smart Meters guide for full info on how they work and the planned upgrade. If saving money is your priority, don't let this put you off switching - as many can save about £300/yr via our Cheap Energy Club. |

| HAVE YOU TURNED YOUR HEATING ON YET? We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email barclaycard.co.uk, uk.virginmoney.com, lloydsbank.com, sainsburysbank.co.uk, bank.marksandspencer.com, halifax.co.uk, three.co.uk, firstdirect.com, hsbc.co.uk, mbna.co.uk, moneysupermarket.com, confused.com, gocompare.com, comparethemarket.com, directline.com, aviva.co.uk, admiral.com Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). The registered office address of both MoneySupermarket.com Group PLC and MoneySupermarket.com Financial Group Limited (registered in England No. 3157344) is MoneySupermarket House, St. David's Park, Ewloe, Chester, CH5 3UZ. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |