| Hi - here are your latest deals, freebies, tricks and messages to help you save.  THE TOP TIPS IN THIS EMAIL

| | The overseas summer holiday checklist: 19 things to do NOW to save when you go Incl flight charges, cheap currency, car hire & turn sun cream around It's summer holiday time - some schools have already broken up, some do it this week, others shortly after that. So if you're heading abroad soon, we've a last-minute checklist to ensure you get more bang for your buck (or euro): -

Beat airlines' seat reservation charges and sit together for FREE on BA, Easyjet, Virgin etc. A family of four could pay up to £240 extra to guarantee they sit together on return flights. It's usually unnecessary - but it's all about knowing your timings. We've airline-by-airline help in our Airline Seating guide. (Beware Ryanair though - even we struggle to find a way to stop it charging. Grrrrr...) Beat airlines' seat reservation charges and sit together for FREE on BA, Easyjet, Virgin etc. A family of four could pay up to £240 extra to guarantee they sit together on return flights. It's usually unnecessary - but it's all about knowing your timings. We've airline-by-airline help in our Airline Seating guide. (Beware Ryanair though - even we struggle to find a way to stop it charging. Grrrrr...)

- Why turning your sun cream bottles around can save you cash. Teases that we are, we'll make you click to find out - see turn your sun cream around (it even includes a handy diagram).

- EHICs are still valid - if you're going to Europe, ensure you have one and CHECK IT'S IN DATE. We haven't left the EU yet, so the European Health Insurance Card still gives access to medical care at state-run hospitals/GPs at the price a local pays. Yet 5.4m expire this year, so check yours is still in date and if not renew ASAP. Remember, NEVER PAY to get an EHIC as they're always free - beware copycat websites.

And it's really worth getting, as MoneySaver Jayne told us: "I renewed my EHIC - then dodged a bill for £1,000s weeks later when I broke my ankle." Read her full story.

- You can take EMPTY water bottles through airport security - so do, and avoid rip-off prices for bottled water. See our airport-by-airport guide to where you can fill up at free water fountains.

- 'Free' tapas in Barcelona, free loos in Paris... our MoneySaving destination guides. We've a fiesta of free and cheap things to do. See our 35 Barcelona tips, 43 Costa del Sol tips, 29 Paris tips and 35 New York tips.

- Book car hire ASAP to drive a bargain, eg, save £30+/day. When hiring abroad in summer, early booking generally wins. But if you haven't sorted it yet, doing so right away can still save. Eg, on Tue we found a car for £5.51/day in Malaga in Aug, but it can cost £40/day if booked on the day. Find the cheapest via comparisons from Skyscanner*, Kayak*, TravelSupermarket* or Carrentals*. Full info in Cheap Holiday Car Hire.

- Already booked car hire? If you've not got excess insurance, prepare for the hard (and costly) sell when you pick the car up. They often try to flog cover for as much as £25/day, with warnings of huge bills for just a scratch. Yet you can buy it separately in advance for just £2/day. See Martin's tips on how to beat the holiday car hire cowboys.

- Download maps for your phone's sat-nav in advance to avoid hefty roaming charges. If you're driving abroad, esp outside the EU where roaming charges can be steep, don't just rely on checking your phone on the spot. Instead, download maps before you go to turn your mobile into a free worldwide sat-nav. Plus, master public transport in 39 cities with the free Citymapper app.

- The cheapest way to spend abroad is on the right plastic - apply NOW and get £20 cashback too. Spend on most cards and they add a 'non-sterling exchange rate fee' of 3%-ish, meaning £100 of euros can cost £103. But some specialist cards don't add this, meaning you get near-perfect exchange rates - smashing bureaux de change. Apply now as they can take 1-2 weeks to come.

Our top pick right now is the Halifax Clarity (eligibility calc / apply* ) credit card which also gives £20 cashback on your first spend within 90 days. Of course repay IN FULL so there's no 19.9% rep APR interest. It's better to spend on the card than withdraw cash (as then you do pay interest even if cleared in full).

Alternatively, the Starling Bank (apply*) debit card has near-perfect rates and no cash fee (you can withdraw max £300/day cash), and of course no interest to pay. While it's a current account, you can just put cash into it, then spend overseas. It's easier to get than the Halifax card, but you don't get Section 75 consumer protection, and it doesn't have as long a track record of good feedback. It's much of a muchness between them though.

See Top Travel Cards for more options, and for full help on cheap spending overseas, see last week's 11 travel money must-knows.

- Want to take cash? Find the best rates from 30+ bureaux. NEVER exchange cash at the airport, where rates are a rip-off. Instead, speedily compare 30+ bureaux with our TravelMoneyMax comparison tool to find the cheapest travel cash near you.

- Don't try to take deodorant or perfume in bottles bigger than 100ml through security (or, er, live crabs). We found this week that travellers who got the rules wrong had to chuck tonnes of toiletries last year - as well as some more unusual items. So check now what you can and can't take (plus what needs to fit in the liquids bag). See our Airport security rules news story.

- Roam 'free' with your mobile in the EU (for now) - but beware eye-watering charges beyond. We don't yet know what'll happen after Brexit, but you can use your UK allowance of mins, texts and (most) data in the EU this summer. There are some catches to watch out for though - see EU roaming rules.

If you're going outside the EU (incl Turkey), it's a different story. For full help on how to avoid hefty up-to-£7/MB charges, see our Cheap Mobile and Data Roaming guide.

- Run out of sun cream? See how to bag a new bottle for as little as £1.

- Learn to talk like a local. Don't be a classic 'Brit abroad' - learn the lingo before you go with a free app to help you talk like a local. Plus when you're there, a free app can translate 59 languages offline .

- Avoid airport drop-off charges - now as high as £5 for 10 mins. Many were pricey anyway, but our recent probe found eight airports have hiked fees over the last year. See our airport-by-airport guide to how to beat 'kiss and fly' charges.

- Get travel insurance from £6 (if you've booked, you need it NOW). You should always buy cover ASAB (As Soon As you've Booked), so you're protected if you need to cancel - eg, if you or a family member gets ill. We focus on the cheapest deals that meet our minimum criteria for levels of cover. For full info and help, see our guides...

- Cheap travel insurance

- Cheap over-65s' travel insurance

- Cheap travel insurance if you've a pre-existing medical condition

Of course, knowing how your insurer will respond to a claim is tough, so remember, if you're unhappy you can always go to the Financial Ombudsman Service.

- Don't just turn up at the airport to park - book ahead (even if it's just on the day). Prices can be sky-high if you wait. Turn up at Manchester long-stay car park and it's £320 for a week. Booking even a day ahead it was £56 using our discounted links for airport parking comparison sites...

Check Holiday Extras* (6-35% off standard prices), Looking4Parking.com* (5-35% off), SkyParkSecure* (5-30% off) and FHR* (5-30% off). See Cheap Airport Parking for more.

- Check if your hotel's got CHEAPER - the rebook trick can save £100s. If the price of your hotel's dropped and your booking allows free cancellation, you can simply rebook for less. Check latest prices on comparison sites Skyscanner*, Kayak* and TripAdvisor* - see Hotel Tricks for full help. Andy tweeted: "We saved £150 by cancelling and rebooking."

- Going to the States or elsewhere outside the EU? Check if you need to sort a visa or other documents in advance. If heading Stateside, even in transit, you must get an ESTA at least 72 hours ahead - see our ESTA guide. Elsewhere (eg, India) you may need a visa which can take weeks, and some countries require at least 6mths left on your passport. See the Govt's foreign travel advice for the full requirements.

| | DON'T believe the fake ads on Facebook

Lots of scam ads that litter social media lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Martin's warning. Is yours one of 11m UK homes on your energy provider's standard tariff? The GOOD news: from Oct the price cap's likely to be £80/yr cheaper The BAD news: even then you're still being RIPPED OFF by £300/yr

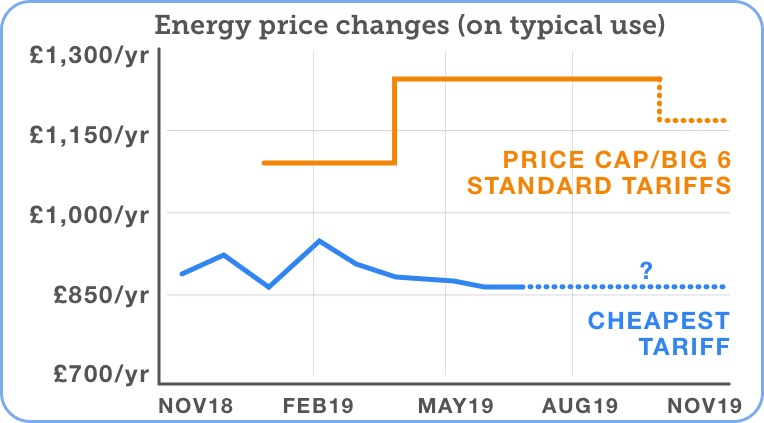

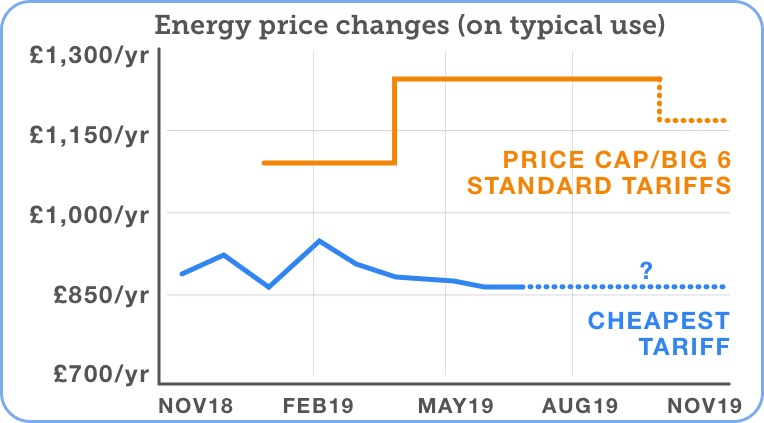

Don't let the energy price cap lull you into false security.  It may be a "fair" price, but it's far from a good one. If you haven't switched in over a year, you're likely on your supplier's standard 'price-capped' tariff, paying £100s/yr over the odds. Now we've news that this Oct the price cap is predicted to be cut by £80/yr. While that's good news for those who'll never switch, if you get this email, you're someone who's engaged in their finances, so DON'T ACCEPT THE PRICE CAP PRICE - it's far too high. Here are my five key points... It may be a "fair" price, but it's far from a good one. If you haven't switched in over a year, you're likely on your supplier's standard 'price-capped' tariff, paying £100s/yr over the odds. Now we've news that this Oct the price cap is predicted to be cut by £80/yr. While that's good news for those who'll never switch, if you get this email, you're someone who's engaged in their finances, so DON'T ACCEPT THE PRICE CAP PRICE - it's far too high. Here are my five key points...

1. Find out how much you're overpaying in just 5 minutes. Fill what details you have (the sin of inaction is bigger than the sin of inaccuracy) into our MSE Cheap Energy Club whole-of-market comparison. It'll show the cheapest deals, but I'd use the filters to exclude those with poor service, and you'll still likely save shedloads. Or just view our top picks. 2. The price cap ISN'T a price cap and isn't cheap, but is changing. The price cap is currently set at '£1,254/yr', but that isn't the max anyone will pay - it's just the cap for someone on 'typical' use. The cap is actually on rates per unit, not prices, so use more and your cap's higher; use less and your cap's lower.

The price cap launched last Jan, was reviewed in Apr, and is due to change next in Oct. As regulator Ofgem's formula is published and based on six months' worth of wholesale prices, analysts at Cornwall Insight are now predicting it will get £83/yr cheaper in Oct (for someone on typical use), but as this graph shows, it's still miles more than the cheapest deals.  3. Big names let you LOCK IN for a year at super-cheap rates - but only if you ask. All Big 6 firms now charge exactly the price cap. Yet many also offer much cheaper deals for switchers. The current standout is an EDF 1yr fix (which lets existing customers switch as well as new), which is just £910/yr for typical use (incl MSE cashback) - so £345/yr cheaper than the current cap, £260/yr cheaper than the new one. And as it's a fix the rate's locked in. Use our big name-only comparison to see others.

4. Switch to 100% renewable and save £100s too. The GNE Green Spring Special is £340/yr cheaper than Big 6 standard deals, has 100% renewable elec and a 69% 'great' customer service rating. Save money & help the planet too. 5. Don't stress over switching - it doesn't change much (except the price). It's the same gas, same electricity, same safety. The only changes are the price and customer service (which is why it's important to check a firm's rating first). If you're really scared off, as a min just find your supplier's cheapest tariff. More help and hand-holding in our Cheap Gas & Elec guide. | New. Martin: 'Lost a spouse/parent in the last 20yrs? You can still reclaim their PPI.' A PPI claim doesn't die with the person. Millions who've passed away are owed money, and their relatives can get justice for them. Like Mands who tweeted: "@martinslewis Just been offered £2,000 for my deceased husband's PPI. Thank you. He died 13yrs ago." Yet the deadline's weeks away, so act fast. See Martin's PPI reclaiming for deceased relatives blog. Related: Reclaim PPI for free. Amazon 'Prime Day' starts on Mon yet rival deals already on, eg, £24 Google Home Mini (norm £49). We've full analysis & tips in our Amazon Prime day predictions and alternatives. New. 13 Eurocamp tricks, incl save £100s booking via Euro sites & late summer 2019 deals. Don't think lumpy groundsheets & grotty communal washrooms - these days Eurocamp (and other Euro holiday park firms) offer well-equipped mobile homes and other comfy camping options. See how to cut the cost in our new 13 Eurocamp tricks blog. Related: 16 Center Parcs Tricks. £50 summer activity break for 16-17-year-olds (or free for some). Govt-backed Eng & NI scheme incl nights away and activities such as abseiling, canoeing and life skills during the summer hols. National Citizen Service Cheap Ray-Ban tips, incl how to avoid fakes & code to get £70 sunnies. Full info in our spec-tacular new blog. Urgent. Sort your tax credit renewal NOW. Nearly 5m renewals have been sent out. You MUST check it - if details are wrong you could have the nightmare of being forced to repay cash you've already spent. The deadline's 31 July, but do it now - if you need to call, phone lines can get clogged up. See full Tax credit renewal help. PS: To avoid overpayment hell, always TELL 'EM IF ANYTHING CHANGES (eg, moving in/out with partner, working hours, kids). | Need to cut credit card interest but normally rejected? You may be able to get 6mths 0% - but you need to know how to use it safely...

A balance transfer credit card pays off debt on old credit and store cards for you, so you owe the new card instead, but at 0% interest. This means you can be debt-free quicker, as more of your repayments clear the debt, not interest. Perversely, many who need cheaper credit the most get rejected due to poor credit scores. Yet there is something to try... -

Poor-credit 0% balance transfers. Never assume you'll be rejected, as each lender scores you differently. First, ALWAYS use a 0% Balance Transfer Eligibility Calc to see whether you can get the top cards (up to 29mths 0%) - unlike applying, this won't impact your ability to gain credit in future. Poor-credit 0% balance transfers. Never assume you'll be rejected, as each lender scores you differently. First, ALWAYS use a 0% Balance Transfer Eligibility Calc to see whether you can get the top cards (up to 29mths 0%) - unlike applying, this won't impact your ability to gain credit in future.

If you've a poor credit history though, it'll likely show your best chances as Capital One (eligibility calc / apply*) or Aqua ( eligibility calc / apply* ). Both let new cardholders shift debt to 6mths 0% for a 3% fee (min £3 for Aqua). They accept some with defaults and county court judgments over a year old and Aqua accepts some with bankruptcies over 18mths old too.

- Warning: The rate after the 0% is REALLY expensive, so plan how much you'll shift. The cards above are a horrid 34.9% rep APR after the 6mths 0% is up. So compare that rate to that of the card you're shifting debt from...

- If your current card has the same or a higher APR: Shift as much debt as you can up to the credit limit.

- If the new card is higher: You've two choices. For simplicity, just shift what you can repay within the 0% period. Or if you know what you're doing, shift as much as you can up to the credit limit, to get max gain from the 0%. Then at the end of the 0%, shift the remainder back to the original card (though it's not 100% certain every card will allow you to do that).

-

If the eligibility checker only gives me a 60% chance, should I still apply? We're often asked something like this. Actually, 60% is pretty decent odds. It means over half the people in your position get accepted. People avoid it to protect their credit score, but trying to cut debt cost is exactly what you should use your credit score for. Martin's story may help:

"I sat with a MoneySaver who had costly credit card debts and a poor credit history. The eligibility calc showed zero chance of all balance transfers, except one at 20%. She asked: 'Is there any point?' I explained as it was the only thing she needed credit for, 20% chance was better than nowt and the worst that could happen was she wouldn't get it. She applied and got a 26mth 0% card with a £1,500 limit." -

Always follow the Balance Transfer Golden Rules. Full help in Best Balance Transfers (see APR Examples).

a) Try to stop borrowing anywhere else - the fact you're struggling to get credit is a worrying sign.

b) Clear the card or transfer again before the 0% period ends. Otherwise you'll pay the high APR.

c) Never miss the min monthly repayment or you'll lose the 0% and get a £12 fee and possible credit-file black mark.

d) Don't spend/withdraw cash. It usually isn't at the cheap rate.

e) You must usually transfer within 60 days of opening to get the 0%. If you're struggling and none of these solutions work, find out how to get free one-on-one debt crisis help. | Tell your friends about us They can get this email free every week | Now 2yr mortgages down to 1.35% - we've not seen cheaper in 2019 Check NOW if you can cut your mortgage cost - not everyone can get this, but it shows just how cheap fixes are  The cheapest 2yr fixed mortgage is now 1.35%. It's not for everyone - for a start there's a biggish fee, and you need to be remortgaging with a 60% or less loan to value (ie, borrowing 60% or less of your home's value). But it's a symbol of how many fixes are getting cheaper. Even at 90% loan to value (LTV) there's a 1.79% 2yr fix. Many 5yr rates are under 2% too. The cheapest 2yr fixed mortgage is now 1.35%. It's not for everyone - for a start there's a biggish fee, and you need to be remortgaging with a 60% or less loan to value (ie, borrowing 60% or less of your home's value). But it's a symbol of how many fixes are getting cheaper. Even at 90% loan to value (LTV) there's a 1.79% 2yr fix. Many 5yr rates are under 2% too. Of course there's always a chance rates will drop further - then again there's even more room for them to rise, so this is a safe time to check if you can save by remortgaging. Many can save £1,000s, as Bryan on Facebook found: "Sorted our remortgage. Fixed for 5yrs at 1.9% - £300/mth better off." Here are our quick tips: - Check your mortgage details (and what your bank will give you).

a) What's the rate? Plus monthly payments & outstanding debt.

b) What type is it? A fix, tracker or standard variable rate etc? See fixes vs variables.

c) When's the intro deal over? Eg, when does the 2yr fix end? And what rate will it go to?

d) When must it all be repaid? Eg, in 10, 20, 25yrs?

e) Will I be penalised to switch? Any early repayment/exit penalties?

f) What's the LTV - the proportion of your home's value you borrow? Eg, £180k on a £200k home is 90% LTV. See LTV help.

If your rate's about to end, ask your existing lender what its best deals are. These can have low fees as you're not switching - and can set a benchmark for what you want to beat.

- Not sure what you're doing? We've a FREE 66-page printed guide to help. Grab a free printed copy or download a PDF of our Remortgage Guide, or see the First-Time Buyers' Guide.

- Find the cheapest mortgages available in minutes. Use our Mortgage Best Buys comparison to see the huge majority of top deals - though the cheapest 1.35% 2yr fix is a Santander online-only exclusive that sadly we can't list.

Obviously what counts though is if you'll be accepted. That depends on your credit score and lenders' affordability checks, which can be tough. That's why, after comparing deals, if it looks like you can save, many people should consider using a mortgage broker - they have access to info about what each lender is looking for that's not available to the general public. See how to find a good mortgage broker.

- Use our range of calculators to do the numbers for you. We've different mortgage calculators to help you work out most things you need, including...

| THIS WEEK'S POLL Where are you going on holiday this summer (if at all)? The big summer getaway is on. So are you planning to head abroad or are you set for a summer staycation? Where are you going on holiday? Most MoneySavers are proud of their work and enjoy it. Last week, we asked about your job satisfaction and 3,400+ responded. The results were positive: in every income bracket for those employed and self-employed, the answer "I'm proud of what I do, enjoy what I do, but the work is hard" came top. See full poll results. | Ristorante - £1 Dr Oetker pizza at Iceland (norm £2.50)

Flavourly - 10 craft beers for £10 delivered

Adidas - £55 Arsenal or Man Utd shirt via code (norm £65)

Coast - 25% off everything, incl 'up to 70% off' sale

Aldi - '£4.50' school uniform in stores from Thu | | | MARTIN'S APPEARANCES (WED 10 JUL ONWARDS)

Thu 11 Jul - Good Morning Britain, ITV, 7.35am

Fri 12 Jul - This Morning, ITV, Martin's Quick Deals, from 10.30am

Mon 15 Jul - This Morning, ITV, from 10.30am

Mon 15 Jul - BBC Radio 5 Live, Lunch Money Martin, 12.20pm MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 10 Jul - BBC Radio Cumbria, Money Talks with Neil Smith, from 6pm

Fri 12 Jul - BBC South West stations, Good Morning with Joe Lemer, from 5am

Mon 15 Jul - TalkRadio, Breakfast with Julia Hartley-Brewer, 9.45am

Tue 16 Jul - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, 2.20pm | QUESTION OF THE WEEK Q: I recently attempted to travel from Newcastle to London King's Cross, but my train was delayed and then cancelled. Can I claim compensation? Carlotta, via email.

MSE Kelvin's A: If you had a train ticket for a set time and decided not to travel when the train was cancelled, you're entitled to a full refund. To get it, take your unused tickets to a ticket office, call the train company in question or fill in its online refund form. MSE Kelvin's A: If you had a train ticket for a set time and decided not to travel when the train was cancelled, you're entitled to a full refund. To get it, take your unused tickets to a ticket office, call the train company in question or fill in its online refund form. If instead you travelled on a different service, but your arrival was delayed as a result, you may still be entitled to compensation. How much you'll get depends on the length of delay and which firm you travelled with - most now offer compensation for delays of 30+ mins, and many for delays of 15+ mins. For full help, see our Train Delays guide. Please suggest a question of the week (we can't reply to individual emails). | THE DEVIL WEARS PRIMARK, AND OTHER MONEYSAVING BLOCKBUSTERS That's it for this week, but before we go... we decided to have a little fun and asked users to give the title of their favourite movie a MoneySaving twist. We've been deluged with brilliant suggestions, from 'Tight Club' and 'ISA Wonderful Life' to 'Saving for Private Ryan' and 'Harry Potter and the Half-Price Prince'. Our favourite though? That well-known Audrey Hepburn classic 'Breakfast at H Samuel'. See the full list and add your own in our MoneySaving films Facebook post. We hope you save some money,

The MSE team | |