| |

It's meant to be getting warmer at home and the hot weather only brings the thought of summer hols closer. Yet you need to act NOW to ensure you get the best deals and top rates, even if you're not heading off for a couple of months. So we've a plane-load of new tricks and old favourites to book in advance if you want to give your hols a head start. | 1. |  Access an airport lounge for FREE. Can take 4-6 weeks to sort. Don't pay a royal sum to lounge like a prince. Our new Free and Cheap Airport Lounges guide has tips for free access, plus 25% off well-regarded No1 lounges at key UK airports. Calum tweeted: "I've twice used lounge at Malaga for free. Great lounge." Access an airport lounge for FREE. Can take 4-6 weeks to sort. Don't pay a royal sum to lounge like a prince. Our new Free and Cheap Airport Lounges guide has tips for free access, plus 25% off well-regarded No1 lounges at key UK airports. Calum tweeted: "I've twice used lounge at Malaga for free. Great lounge." | | | | 2. | New. Get £20 cashback on one of the cheapest ways to spend abroad. Cards take 1-3 weeks to arrive. Most debit and credit cards add a 3%-ish 'exchange fee', so £100 worth of euros costs £103. But if you pass their credit check, specialist overseas credit cards don't charge so you get near-perfect exchange rates.

- £20 cashback on long-term top pick. The Halifax Clarity (eligibility calc / apply*) card just got better. Apply, then buy anything abroad by 30 Sep and you get £20 cashback within 90 days. It's 18.9% rep APR on spending and cash, so pay IN FULL to avoid interest on spending, though you pay a small amount of interest on cash till it's paid off.

- Top credit card for cash withdrawals. New custs who apply for the Barclaycard Platinum travel credit card (eligibility calc / apply*) from around mid-morning today (Wed) won't pay exchange fees on purchases or cash withdrawals till Aug 2022. (Be careful. Barclaycard says it'll go live at 9am so if you apply before you'll only get fee-free till Aug 2018 - we'll direct the link to the new deal when it's live). Unlike most other specialist overseas cards, you'll also pay 0% interest on overseas (not UK) withdrawals if you pay your bill IN FULL (18.9% rep APR on spending & 27.9% on cash if not). See our Top Overseas Spending Cards for full help and more options.

- Don't fancy or can't get a credit card? Grab a fee-free prepaid card. You load money on them in advance. The top deals offer near-perfect rates and are fee free, though in the past some have added fees later. See Prepaid Travel Cards. | | | | 3. | The big question... should you buy holiday cash now or after the election? You've asked this in your droves due to the pound's recent volatility. So read Martin's 'Should I buy currency now?' blog. | | | | 4. | Book car hire ASAP to drive a bargain, eg, save £200+ on a week in Spain. When hiring abroad, early booking is generally cheaper. We found £11/day for car hire in Malaga in August, but it can cost £40/day on the day. Full help in cheap holiday car hire, but at speed...

a) Find cheapest via comparisons: Skyscanner*, TravelSup*, Carrentals* & Kayak*.

b) Check stealth fuel charges. Some make you pay for a full tank & return it empty - that can add £80 if you don't drive far. Enjoy Car Hire* only shows fair fuel quotes & Skyscanner*, TravelSup* & Carrentals* let you filter by fuel policy.

c) Get cheap excess insurance. It's worthwhile protection, yet hire companies will try and sell it for up to £25/day when you collect - ignore them by buying in advance from £2/day. See Cheap Excess Insurance for more info. Glyn tweeted: "Followed your guide, got excess insurance for £13 all-in, instead of £12/day." | | | | 5. | Check your EHIC now - 5.3m are due to expire. Normally takes 7-10 days to arrive. A European Health Insurance Card (EHIC) is a must if going to Europe. Yet millions expire every year. See our Free EHIC guide for how to renew for FREE. | | | | 6. | See TRUE flight costs including luggage and payment fees, before booking. Comparison site Kayak* lets you include luggage and card fees in your search - good for comparing real costs which can add hundreds to a family booking.

Always use a comparison to speedily find the best prices - others to try incl Skyscanner* and Momondo*. Sometimes they reveal the SAME flight at vastly different prices, showing the best way to book. Eg, we found London to Las Vegas return on a Virgin Atlantic plane in June for £750 booked on Virgin, but the SAME flight booked via Delta was £830.

See Cheap Flights for more tips plus our specific Ryanair and Easyjet tricks. | | | | 7. | Driving to France? Get an emissions sticker, or you could be fined. Takes up to 30 days to arrive. Fines can be as high as €68 (£59). How to get one and why. | | | | 8. | Already booked? Get travel insurance NOW - don't risk £1,000s for a fiver. If you've paid but don't have insurance, and you need to cancel because you fall ill or suffer a bereavement, you won't be covered.

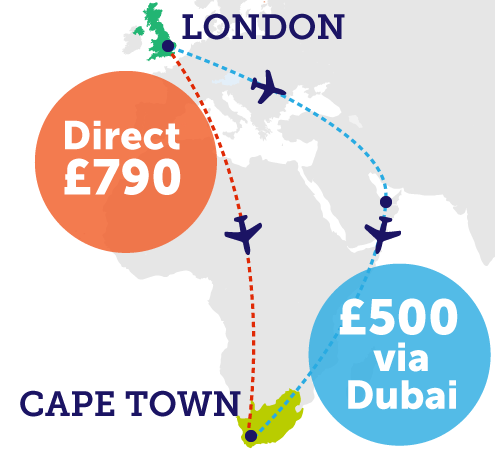

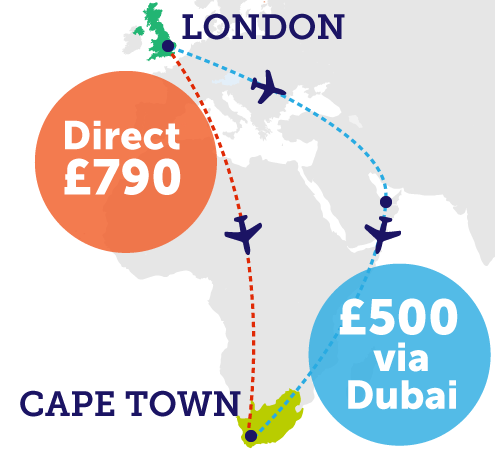

- Cheapest annual policies - best if you go away 2+ times a year: A year's Europe cover that meets our minimum cover level for a 30-yr-old starts from £9, worldwide from £19. Your winner depends on age and number travelling - Holidaysafe Lite* and Leisure Guard Lite* often win, but Coverwise* can beat it in some combinations. For top value, incl feedback and past payouts, LV* is from £67 for Europe, and £111 worldwide. Full help and minimum criteria in Cheap Annual Travel Insurance.

- Cheapest single policies. Again, for almost any combination Leisure Guard Lite* or Holidaysafe Lite* are usually cheapest. Eg, from £5 for a solo under-45 for 1wk in Europe, and £16 worldwide. See Single-trip travel insurance.

- Over 65? Pre-existing conditions? Prices can rise so see our specialist Cheap over-65s travel insurance and Pre-existing conditions travel insurance help. | | | | 9. | Save £150+ paying in advance for airport parking. It gets far more expensive closer to the time. Our Cheap Airport Parking guide has full info but the easy way is to use our discounted links to comparison sites incl APH 20% off* (London, Manc, Birm, Edin), Holiday Extras 10%-30%*, SkyParkSecure up to 30%*, FHR 12%-30%* & Trusted Travel 16% off. Robert emailed: "Used MSE link & got 8 nights' parking at Aberdeen for £44." | | | | 10. |  Slash long-haul costs by £100s (and see a new city at the same time). If you break up your trip (for a few hours, or even longer to sample a new city) you can often save a packet, eg, we found London to Cape Town return in November for £790 direct or £500 via Dubai. See Stopover savers for more. Slash long-haul costs by £100s (and see a new city at the same time). If you break up your trip (for a few hours, or even longer to sample a new city) you can often save a packet, eg, we found London to Cape Town return in November for £790 direct or £500 via Dubai. See Stopover savers for more. | | | | 11. | The hotel re-book trick can save you £100s. When booking a room we always say check comparison sites such as Trivago*, TravelSupermarket* and TripAdvisor*. Some hotels offer free cancellation, though sometimes for a premium. Yet if the price drops later you may be able to cancel and rebook at the lower price up to 24 hours before arriving. Alison tweeted: "Saved £200 when price dropped 2 days pre-travel." See Hotel tricks for much more. | | | | 12. | ESTA and other entry requirements are YOUR responsibility. Passports can take 3 weeks to renew. If heading Stateside, even just to change planes, you'll need to apply for an ESTA at least 72 hours before you go - see our ESTA guide for how to apply. Elsewhere you may need a visa (eg, Turkey) and you may need to have at least six months left on your passport. To check entry requirements, see the Government's foreign travel advice. | | | | 13. | DIY isn't always best - package hols may still win. We found a week in August in Spain for a family of four for £285/pp. Late deals can work well too but don't forget to haggle - full help on how to do it in our Cheap Package Holidays guide. | | |

| | | | | | | | | | | | | | | | | | It's with that savings giant, er... Ford (yes, the car firm) and speed is key as it's likely to vanish quickly

Regular savings accounts pay high interest but only on small sums for a short time, and you often need a linked bank account to get the best deals. Yet Ford - via its new money arm launched in April - has powered through with a decent 4% rate, that's open to all, and proved so popular its standard 4% regular saver went within 24 hours, leaving just the 4% regular saver ISA. So if you want it, go quick... (All accounts below have full £85,000 savings safety protection.) -

Earn 4% fixed for a year in an ISA. This Ford Money regular saver ISA pays 4% fixed for a year and you can save up to £250 in it each month. Earn 4% fixed for a year in an ISA. This Ford Money regular saver ISA pays 4% fixed for a year and you can save up to £250 in it each month.

Anyone 16+ can open it, but it's an ISA, and you're usually limited to one cash ISA a year. However you can still split your full £20,000 allowance with Ford Money's other cash ISAs. Its easy access cash ISA pays 0.9%, which isn't the best, but isn't far off. See top cash ISAs for more options and full details + regular savings for non-ISA alternatives. -

Earn 5% fixed for a year via top current accounts. If you don't have these current accounts already, you'll need to open one first before setting up the regular saver. All credit check you when you apply, and have specific criteria you must meet.

- 5% regular saver + £125 to switch & top customer service. First Direct* pays a fixed 5% on £25-£300/mth for 1yr if you've its First Account. Switch to its current account via this link and you get a £125 bonus (£100 direct), plus it's been voted No.1 for customer service in all our polls. You must pay in £1,000/mth to avoid its £10/mth fee.

- 5% regular saver + £125 gift card to switch & £5/mth. You need to switch to M&S Bank* to get its linked regular saver offering 5% on £25-£250/mth, fixed for 1yr. You also get a £125 M&S gift card and a £5/mth top-up on it for a year if you pay a min £1k/mth into the bank account and switch & keep 2+ active direct debits.

- 5% regular saver + 5% on £2,500 in yr1. Anyone who has the Nationwide FlexDirect account can save up to £500/mth in its 5% variable regular saver. The current account also pays 5% AER on up to £2.5k, fixed for 1yr, if you pay in £1k+/mth (1% AER variable after).

- 5% regular saver + 1.5% on up to £20k, up to 3% cashback on bills. The Santander 123* current account has a linked regular saver giving 5% on up to £200/mth, fixed for 1yr. The main account also pays 1.5% AER variable on up to £20k, and up-to-3% cashback on bills (which for most easily covers the £5/mth fee). To get interest & cashback, you need to pay in £500/mth and have 2+ active direct debits. -

Don't listen to the bad press on regular savers. You'll never get the headline rate on your end-of-year balance. Interest is calculated on your daily account balance. So if you save the same amount every month, you get the rate on approx half your end balance. Full reasons why in Regular Savings - don't believe the bad press. | | | | | | | | | | | | | | | Halifax is giving £20 cashback on any transfer over £100, likely cutting how much you owe

If you've store/credit card debt you pay interest on, a new balance transfer card is a no-brainer. It pays off your existing card, so you owe it instead but at 0% - helping you get debt-free quicker, as repayments cover debt, not interest. And the £20 cashback with this Halifax card means anyone shifting less than £3,390 will see their debt cut, even after fees. Will you be accepted? Don't just apply - our Balance Transfer Quick Eligibility Calc shows which cards you've best odds of getting, or our FULL Credit Club gives your free Credit Report and Credit & Affordability Scores too. Both do a 'soft' search on your credit file that lenders can't act on, so there's no impact on your creditworthiness. -

New. Get £20 cashback when you shift debt to up to 33mths 0%. This Halifax card (eligibility calc / apply*) allows new cardholders to shift debt to 0% for up to 33 months, for a low 0.59% fee (min £3). Transfer at least £100 and you get £20 cashback, meaning it cuts your debt if you transfer less than £3,390 as it's greater than the fee. New. Get £20 cashback when you shift debt to up to 33mths 0%. This Halifax card (eligibility calc / apply*) allows new cardholders to shift debt to 0% for up to 33 months, for a low 0.59% fee (min £3). Transfer at least £100 and you get £20 cashback, meaning it cuts your debt if you transfer less than £3,390 as it's greater than the fee.

-

Get £25 cashback at a slightly higher fee for 32mths 0%. Apply for this M&S Bank card (eligibility calc / apply*) via this link by 31 May (no cashback if applying direct) and new cardholders get £25 cashback when shifting £100+. Its 0.99% fee (min £5) means it's only a better deal than Halifax above when shifting less than £1,250 once fees and cashback are factored in. -

Need longer? Get 42mths 0%. You can get even longer at 0% but for higher fees. For full info and loads more deals, see Top Balance Transfer cards (APR Examples). -

Balance Transfer Golden Rules.

a) Choose the lowest fee in the time you can pay it off. If unsure, go long, even with a bigger fee.

b) Some cards have an 'up to' 0% length, so you may get fewer months at 0% even if accepted.

c) Never miss the min monthly repayment, or you could lose the 0% deal.

d) Clear the card or transfer again before the 0% ends, or rates rocket to the rep APR - both above are 18.9%.

e) Don't spend/withdraw cash on these. It usually isn't at the cheap rate and cash withdrawals hit your credit file.

f) You must usually do the balance transfer within 60/90 days to get the 0% & cashback. | | | | | | | | | They can get this email free every week | | | | | | | | | Do you/have you paid a monthly charge for your bank account? 100,000s were mis-sold, reclaim for FREE

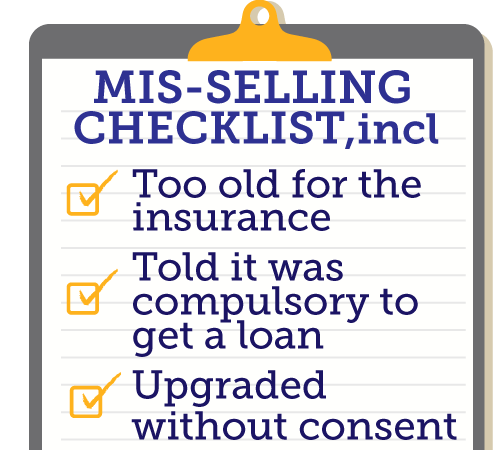

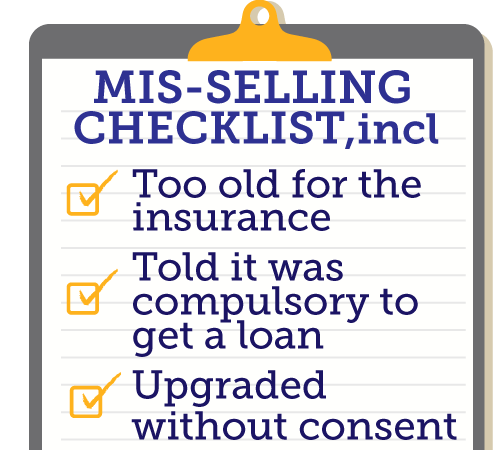

If you've got, or have ever had, a packaged bank account - eg, Barclays Additions, Lloyds Platinum or NatWest Select - paying £10-£20/mth for extras incl travel, breakdown & mobile insurance - you may be owed £1,000s. Some choose 'em for the right reasons but many were given the hard sell by incentivised sales staff, even though they weren't suitable. We've full help in our Reclaim Packaged Accounts guide, incl our free reclaiming tool - here are the basics:  Was your packaged bank account mis-sold? The key checklist. Just being bad value isn't enough (though it's a good enough reason to cancel). Check our full mis-selling checklist, incl... Was your packaged bank account mis-sold? The key checklist. Just being bad value isn't enough (though it's a good enough reason to cancel). Check our full mis-selling checklist, incl...

- You weren't covered, eg, you were over the travel insurance age limit.

- You were told you had to have it to get a loan.

- You were upgraded without consent, or without being told of a fee-free alternative.

-

If mis-sold, reclaim for FREE. Don't give away 30% by paying a claims handler. Last year we launched our Packaged Bank Account Reclaim Tool; it's part of our collaboration with complaints site Resolver (see our Resolver guide), merging our template letters & experience with its technology. Just enter your details and it helps draft the complaint, sends it, keeps track & escalates it to the Ombudsman if necessary. -

Successes flood in daily... Complaining works. Mandy emailed: "I complained about my packaged account being mis-sold and have just received £3,255.88. I almost used a PPI company but used your template instead. Thank you." And Andreya emailed: "Did a check on account we've had for 30+ years. Got £1,400 by using your tool. Thanks." -

Some fee-paying accounts ARE worth it. Eg, get £600 of insurance for £120. Ask what value you get - ie, do you need the insurance and what it'd cost bought separately. If paying a fee's right for you, for £10/mth Nationwide's FlexPlus* gives cover for ALL the family's smartphones, world family travel insurance up to age 74 and UK & Euro breakdown cover for account holders in any car. Bought separately it could cost up to £600/yr. Full options and alternatives in Top Packaged Accounts. Also see Fee-free Accounts, incl £250 switch & stay bonus. | | | | | 2for1 Ideal Home Show tix (Glasgow & Manc). If you missed out on the freebies last week, we've 2for1s for Glasgow (26-29 May) and Manchester (8-11 Jun). Ideal Home Show 2for1

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"I changed to a water meter saving £26 month. Then I haggled my TV, broadband and phone and saved a whopping £51 a month and have more channels. Two phone calls = £77 a month saved. A big thank you." See our Cut Your Water Bills and Haggle with BT guide to do it yourself.

Laura Ashley 40% off almost everything. Online and in stores. Ends Mon. Laura Ashley | | | |

| | Are you interested in investing your money? With savings rates in the toilet, more people are looking to invest their hard-earned cash, which involves risk. We’d like to hear your opinions, eg, what are the most important things to consider before starting? Have you been tempted but then decided not to? Or are you a committed investor with tips to pass on? Share yours/read others': Your experiences of investing Past topics: View all | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Wed 24 May - BBC Radio Cumbria, 'Money Talks', from 6pm

Thu 25 May - BBC Radio Tees, 10.35am

Fri 26 May - BBC South West stations, breakfast

Tue 30 May - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: I have an over 60s London Oyster card which entitles me to free travel, but with all the delays I've had, can I claim compensation for them? Michael, via email  MSE Megan's A: No, according to Transport for London's T&Cs which state you need to have paid for a ticket to be able to claim for a delay - see Oyster card refunds for the formal process. I also checked with the other rail companies you can travel with using the card, and they came back with the same answer. MSE Megan's A: No, according to Transport for London's T&Cs which state you need to have paid for a ticket to be able to claim for a delay - see Oyster card refunds for the formal process. I also checked with the other rail companies you can travel with using the card, and they came back with the same answer.

The above is all about the official reclaim for delays process but it doesn't stop you complaining to the companies about the general service. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week but before we go, sometimes dates don't go to plan. But one man from Texas took it a step further than most by attempting to sue his female companion for the $17 he shelled out because she 'ruined the date' by texting during Guardians of the Galaxy 2. While such an extreme reaction is rare, what's the worst money you've spent on a date? Let us know in our Dates from hell Facebook post. We hope you save some money,

The MSE team | | | | | | |