| | | How to MAKE £250 and SAVE £100s more to ease cost of the big day

I don't want to say the C-word this early. I hate festive creep. Jingle Bells played in October annoys me as much as the next Scrooge. Yet it isn't about early celebration, it's about preparation. There are some things you can do NOW to reduce financial and other stresses for the big day. And that matters... I don't want to say the C-word this early. I hate festive creep. Jingle Bells played in October annoys me as much as the next Scrooge. Yet it isn't about early celebration, it's about preparation. There are some things you can do NOW to reduce financial and other stresses for the big day. And that matters...

Every January people tell me they're skint (it's debt counsellors' biggest month). When I ask why, they say, "Christmas, of course". Yet it's not an unexpected expenditure - some MoneySavers have already got everything done.

So as this last weekend the calendar ticked under 100 days to go, here's my checklist of things to do now. And for those who'll be celebrating Chanukah (like me) or owt else this winter, don't worry - in the main the same tips apply.

| 1. | Not saved for it? Do it now - so you can split the cost by four. The surveys say a typical family spends about £800 on Christmas. For most, that's totally unsustainable from one month's income.

So if you haven't put anything aside yet, there's still time. For example, if you save £200 from your Sep, Oct and Nov income, you can spread the cost. Put it in a top savings account and you'll earn a little interest too, and know the money is protected. If you're saying, "No way - I can't afford that", fair enough. But accept you'll need to go cold turkey. | | | | | 2. |  Make £150 in time for Xmas by switching bank accounts (+ £50 later). One big festive help is extra cash. Perhaps the easiest way to get that is to switch bank accounts to one willing to PAY YOU for your custom. As it can take up to 60 days to get the cash, do it now and you'll definitely have it in time for any necessary pre-Christmas spending. Here are some top picks... Make £150 in time for Xmas by switching bank accounts (+ £50 later). One big festive help is extra cash. Perhaps the easiest way to get that is to switch bank accounts to one willing to PAY YOU for your custom. As it can take up to 60 days to get the cash, do it now and you'll definitely have it in time for any necessary pre-Christmas spending. Here are some top picks...

- HSBC free £200: New switchers to HSBC Advance* get £150, plus a further £50 after a year (good for next Christmas). You need to pay in £1,750/mth (earn over £26,100 and it just means pay your salary in there, as that's £1,750+ after tax - you can take the money out straightaway if you like).

- First Direct £100 cash, or M&S £125 gift card + £5/mth: First Direct's* won every customer service poll we've ever done and gives switchers £100. M&S Bank* gives a £125 gift card and adds £5/mth to it for a year. Both offer a small 0% overdraft and a linked 5% regular savings account too. To get all the perks and no monthly fee you need to pay in £1,000/mth with both.

With all accounts you usually need to be a new customer, pass their (not too tough) credit check, use their 7 day switching service and switch 2+ direct debits. As Nicola (@nicolajpriest) tweeted: "All successfully #switched to @firstdirect thanks to @MoneySavingExp. Easy peasy and no hassle." Full info and options in Best Bank Accounts. | | | | | 3. | Try our DemoHOHOtivator tool to see how much you can save. Small sacrifices can add up. Eg, if you buy a £2 coffee every working day, cut it out now and you'll have over £130 extra in the Christmas kitty by the big day.

Our DemoHOHOtivator tool lets you see how all YOUR little cuts add up. I'm not telling you to give up everything, but to make an active choice: would you prefer cash at Christmas or your treats? | | | | | 4. | Walk around your home looking for owt unused since last Xmas. Shops don't just value the cash in their tills, they value their stock too. So why not do a personal stock check? If you've unused toys, prams, old coffee makers, mobile phones, gadgets or even clothes, why not flog 'em for cash?

For how to do this, and to get the best price, see our 40+ eBay Selling Tricks and Facebook Selling guides. And if you're selling CDs, DVDs, books etc and prefer speed and ease to sell quick, see Flog it help. | | | | 5. | Free £100 Amazon/M&S/Boots voucher in time for Christmas. Another yuletide purse-boost. Accepted new American Express Rewards Gold charge card (eligibility calc / apply*) customers get 20,000 bonus points for spending £2,000+ on it in the first 3mths. These can be swapped for a £100 Amazon/M&S/Boots etc gift card (shops can change), or airline/hotel points.

Just put all your normal spending on it - it's not an excuse to spend more - and as long as that's over c. £700+/mth (not huge for a family), you'll qualify. You also get two free airport lounge passes, and earn points for spending.

Warning: The card is fee-free in year one, but £140/yr after. To avoid paying it, cancel before then. As it's a charge card, it must be fully repaid each month. Don't miss that or it costs £12 and means a credit file black mark. Full info and options in Reward Credit Cards (APR Examples).

Won't spend that much before Xmas? The Amex Rewards credit card (eligibility calc / apply*) gives 10,000 bonus points (so £50 voucher) for a lower £1,000+ spend in the first 3mths. This is a credit card though, so make sure you repay IN FULL each month or it's 22.9% rep APR. | | | | | 6. | Agree now with friends to BAN unnecessary Christmas presents. I've been campaigning on this for years - you may enjoy the detailed theory behind it in my Ban Unnecessary Xmas Gifts? blog.

In a nutshell, many feel pressured to buy gifts for an extended list of friends, family and colleagues, often panicking, "I've got to get 'em something, anything" - even if they won't want it. This tit-for-tat giving means we end up with tat.

Even 'the joy of giving' can be selfish as it obligates someone to buy back for you - even if they can't afford it. The best gift may be releasing someone from the obligation of buying you something. Or at least cap the cost with a Secret Santa - then if you want to give more, donate to charity.

- Julia (@Julia1965) tweeted: "@MartinSLewis, finally told family I can't afford Xmas presents. What a weight off my mind. Thank you."

- John (@JohnGillibrand) tweeted: "Excellent - wise comments about restraining financial & other pressures of Christmas. I tweet this as a vicar."

- Patsy (@PatsySandy) tweeted: "We do this. Even telling people not to worry about our children. They have so much anyway and anything I want, I get myself..." | | | | 7. | Train-ing home for Christmas? Get ready to book. Train tickets are usually released 12 weeks before the date of travel, and that means it's the best time to ensure you get hold of cheap advance tickets. So if you know when you want to go, we're nearly at the booking point for Christmas and New Year. Full help and loads more tips in Train Ticket Tricks. | | | | 8. | Don't plan the perfect Christmas. That's a dangerous mindset. Instead first work out your budget, and let your financial situation rule. Then ask yourself: "What's the best Christmas I can have on the money I've got?" Remember it is just one day. Far better to have a slightly less expensive Christmas than a financially frantic New Year. | | | | 9. | How to get 5% off all your pre-Christmas shopping. Spend on a cashback credit card and you get money back after a year - effectively paying you to spend on it. To find out which you're most likely to be accepted for, use our Cashback Cards Eligibility Calculator.

The top payer is the fee-free Amex Everyday* card which pays 5% cashback (max £100) for the first 3mths - so apply now and you get this high rate in the high-spend pre-Xmas period. Yet ensure you pay it off IN FULL each month to avoid the 22.9% rep APR interest or that'll dwarf the cashback gain.

After the intro boost, the cashback rates are tiered up to 1% - though there's a minimum £3,000+ annual spend to get any cashback. Full info and options in Top Cashback Credit Cards (APR Examples). | | | | 10. | 60p iPhone case, 22p belt and more stocking fillers, from China... Rock-bottom prices INCLUDING delivery are possible on sites such as AliExpress, but you'll need to order early. Of course this isn't without risk, especially for toys and electricals, so do read how to buy safely from China. | | | | 11. | Set up a Christmas cupboard, then POUNCE when things are cheapest. Prices fluctuate (just look at online price tracker CamelCamelCamel to see this on Amazon). Your aim, wherever you shop, should be to buy things on your Christmas list (yes, do have a list) whenever it is at its cheapest.

So get a cupboard ready, and once you buy something, you can wrap it, tag it, and store it all ready. To find the best prices:

a) Monitor this email - we'll include all big bargains, vouchers and flash sales.

b) Regularly check our Vouchers, Hot Bargains and Sales pages.

c) Use the Forum WOW Deals Feed to track MSE Forum users' best-rated deals, updated every minute. | | | | 12. | DON'T borrow for Christmas... but if you will (don't) then ensure it's at 0%. Borrowing for Christmas is a bad idea - DON'T DO IT. Far better to cut your cloth accordingly. Yet if you won't listen and will do it anyway (DON'T), at least keep it cheap. That means a 0% card, where done right there is no cost (did I mention - best not to do this).

To find a 0% card that will accept you, use our 0% Spending Card Eligibility Calculator - the longest current 0% deal is Sainsbury's Bank* at 32mths 0%. If you do this, always stick to the credit limit and never miss a minimum monthly repayment or you can lose the 0% rate.

Normally with 0% cards I say to plan to clear the debt or do a balance transfer before the 0% ends - or the rate jumps to the rep APR (18.9% with Sainsbury's). Yet for Christmas borrowing, make sure you clear it well before next Christmas or you'll just compound your problems (or better still, don't do it). | | |

And this is just the tip of the iceberg (or the fairy on the tree). For much more, see our full 50 Christmas Cost-Cutting Crackers guide. | | | | | | | | | | | | | | | | | | - EVERYONE, check if you can save - our specially negotiated cut-price EDF deal ends 11.59pm Thu

- With Brit Gas? If like most you're on a standard tariff, your price is UP an avg 7% & you were already overpaying

So far over 90,000 have taken part in our latest Big Switch Event. For the rest of you, the clock's ticking - one cheap deal ended last week, and our special EDF tariff goes tomorrow. If you're one of 66% of households on a standard tariff, you're paying massively over the odds, so it's crucial to do this before winter hits - as Mandy (@MandyShep863) tweeted:"@MartinSLewis thank you, just saved £438 switching from British Gas." We've tried to make it as EASY as possible. Here are the key options...

All savings are for someone on typical dual-fuel use, paying by monthly direct debit, compared to the average Big 6 standard tariff at £1,151/yr. Plus as our Cheap Energy Club gives you £25 dual-fuel cashback if it can switch you, we include that in the saving, and order results with that in.  OPTION 1: Find the very cheapest - but the firm will likely have no or poor feedback. Typical saving £330/yr. The energy market's swamped with new firms. Often at launch they offer super-cheap deals to build a customer base; yet feedback is limited or poor. OPTION 1: Find the very cheapest - but the firm will likely have no or poor feedback. Typical saving £330/yr. The energy market's swamped with new firms. Often at launch they offer super-cheap deals to build a customer base; yet feedback is limited or poor.

Your cheapest will depend on your location and usage. To compare purely on price (it works well for some) use our Cheap Energy Club cheapest provider comparison or compare while filtering out those with no or poor feedback. It's best if you have bills to hand - if not the tool can estimate your usage.

OPTION 2: Find the cheapest name you know - incl last chance MSE EDF fix. Typical saving £260/yr. We keep hearing, "I only want a firm I've heard of", so for the Big Switch we negotiated a special cut-price EDF Simply Fixed Sep 2018 deal, for new and existing customers.

On average it's the cheapest deal from the Big 6. Plus the price is locked in for a year, so no hikes, and EDF has good customer service, with a 64% 'great' rating in our poll. However, as prices vary depending on where you live, our compare big-name firms filter finds your best deal (you can opt to add small firms after if you want). But act quickly - the MSE EDF fix ends 11.59pm Thu, or sooner if the remaining 15,500 dual-fuel switches go. OPTION 3: Switch to your existing provider's cheapest. Typical saving up to £270/yr. EVERY Big 6 provider has a cheaper deal than its standard tariff. So through gritted teeth let us say, if you won't switch as you're loyal to your existing firm, at least ensure you're on its cheapest tariff. To do this, use our compare my supplier's tariffs filter. Switching's easy, but if you're worried about it or want to know how it works, see our detailed MSE Energy Club FAQs. | | | | | Urgent. Millions of super-cheap Easyjet seats released TODAY (Wed), incl for Easter 2018. Full info in Cheap Easyjet.

Is your £1 coin worth more than £1? Some old ones are worth up to £20, so check before changing. What to look out for

Revealed: Where to find the cheapest meat, fish and cheese at the supermarket. The results may surprise you. Fresh counters vs aisles analysis

50+ free treats for your birthday, eg, free Body Shop £5, doughnuts, prosecco and more. As September's the most popular birth month in the UK, we've updated our 50+ birthday freebies round-up.

Do you know when your MOT is due? Get a FREE reminder to avoid a £1,000 fine. Takes 1min. MOT reminder

Hit by Ryanair's flight chaos? Your rights & how to claim. 100,000s of passengers are affected by cancellations. Full info on compensation plus what to try if you've lost out on hotels, car hire and more in Ryanair cancellation help.

Toy sales, incl Mothercare ELC 3for2, Smyths & Asda up to 50% off. Good if you're stocking up for Xmas. Toy sales | | | | | | | | | | | NO CATCHES. Just a straightforward monthly fee with 'FREE' line rental for 18 months

We always say short-lived promos are the best way to get broadband. But you often have to pay upfront or claim cashback to get 'em. Right now though there's a best-buy that's a simple pay-monthly deal, and for superfast it's over £350/yr cheaper than BT's standard non-promo price equivalent...

-

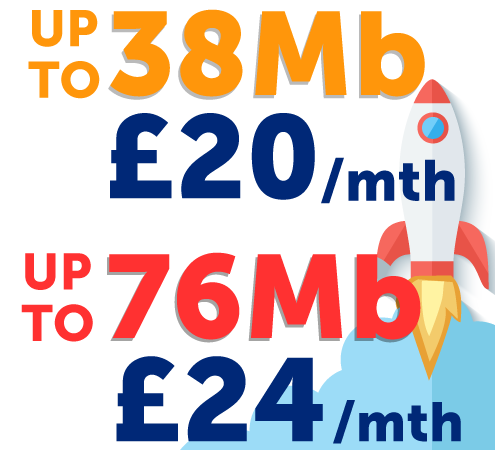

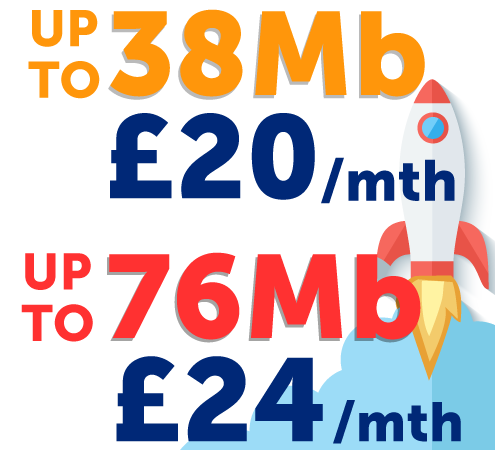

HOME fibre b'band & line rental - fast £20/mth, superfast £24/mth. Vodafone Broadband* is the mobile giant's attempt to crack the home broadband market. It's got two 18-month deals which are seriously price-competitive. HOME fibre b'band & line rental - fast £20/mth, superfast £24/mth. Vodafone Broadband* is the mobile giant's attempt to crack the home broadband market. It's got two 18-month deals which are seriously price-competitive.

- Who can get them? New customers or existing out-of-contract customers can apply. They're available to 83% of UK postcodes. To see if you can get them, use our Broadband Unbundled tool which only shows deals available in your area - just select a fast speed filter.

- Up-to-38Mb fast fibre (2x standard speed) for £20/mth. Jumps to £25/mth after.

- OR up-to-76Mb superfast fibre (4x standard) for £24/mth. Jumps to £30/mth after.

- You get 'free' line rental. For at least the contract's duration. Calls aren't included.

Further info: If you're switching from cable or need a new line installed it'll cost £60 but you'll know before committing. If Vodafone hikes prices during the contract, you can leave penalty-free. See Cheap Broadband for full info. You can sometimes get cashback via a top cashback site - but prices and contract lengths can vary. -

Do you need superfast fibre? Fast fibre's good for heavy downloading, streaming, gaming or multiple users. Superfast up-to-76Mb fibre is very much at the luxury end of the market - but it may be for you if you've a large household with many devices, you stream 4K content or 'normal' fibre just isn't fast enough. -

Don't need fibre? Get up-to-17Mb b'band & line for equiv £12.45/mth. Anyone who doesn't currently have EE broadband installed can get 18mths' broadband and line for £324, plus you can claim a £100 Mastercard. Check Broadband Unbundled for other top alternatives. | | | | | | | | | They can get this email free every week | | | | | | | | | If you've a poor or no credit history, a specialist card used right can make you much more financially attractive

To get credit, you need to have credit. That's because lenders try to predict your future repayment behaviour based on your past - so if you've a poor, or no, history (eg, just starting uni), you're more likely to get rejected. Perversely a credit card can help, but this isn't about borrowing, so here are the steps to follow to (re)build your score... -

Step 1: Check your credit score for FREE to see where you are now. Your credit score's an indicator of whether lenders see you as a good or bad risk, so it's important you manage it properly. Get your free credit score, along with your full credit report and unique affordability score, with our Credit Club. It also gives tips on how to boost your credit chances. Step 1: Check your credit score for FREE to see where you are now. Your credit score's an indicator of whether lenders see you as a good or bad risk, so it's important you manage it properly. Get your free credit score, along with your full credit report and unique affordability score, with our Credit Club. It also gives tips on how to boost your credit chances. -

Step 2: See which card you're most likely to get BEFORE applying. Most (re)builder cards (including those below) accept people with past county court judgments/defaults and even old bankruptcies. However, as each application marks your file, our Credit (Re)Build Cards Eligibility Calc tells you which are most likely to accept you before applying. And some even pay you... - Get £25 Amazon vch to (re)build your credit. MSE Blagged. Apply for Aqua Advance (eligibility calc incl pre-approval / apply*) via this link, and it sends you a £25 Amazon vch after 3mths if you pay on time and don't bust your limit.

Alternatively Aqua Reward (eligibility calc incl pre-approval / apply*) cardholders get 0.5% cashback on all spending (up to £100 cashback/yr). Both have a horrible 34.9% rep APR so repay IN FULL each month to avoid. -

Step 3: Just do affordable, normal spending, and repay IN FULL each month. Spend £50-£100/mth and never withdraw cash, miss a payment or bust your limit - and pay off IN FULL each month to avoid horrid interest. Within a year your score will likely improve. Regularly check in to Credit Club to see how it's progressing. Full info: Credit Rebuild Cards (APR Examples). | | | | | £15 A2-ish photo canvas (norm £58). MSE Blagged. 60cm x 40cm personalised print. Plus bigger sizes available. Picanova

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"Followed you for years for our own finances, but after an elderly relative fell ill we had to deal with her bills. Reduced her home insurance by £350/yr and saved her £70/mth switching electricity. Thanks."

MSE is looking for three editorial interns. Based at MSE Towers in London. For these and more opportunities, see MSE jobs. | | | | | | | | | | How do you access your bank? With over 750 bank branches being closed this year, the digital revolution is taking over - not just online, but now with a host of app-based banks too. So we wanted to find the most common way you access your bank and whether it depends on your age. How do you access your bank? A typical MoneySaver is 46-55, has a university degree and lives in the South East... In last week's poll we asked a few questions about you in our annual MSE census, and 10,900 responded. Among the findings, more of you are female, 60% get most of their news from the BBC and while you'd generally rather not go on a TV show, if you had to choose it'd be Strictly. Find out more in the results of our fourth annual MSE census. | | | | | | | | | | | | | | | | | | | | | | | | | | | Mon 25 Sep - This Morning, ITV, time TBC. View previous

Mon 25 Sep - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast | | | | Wed 20 Sep - BBC Cumbria, Money Talks with Adam Powell, from 6pm

Fri 22 Sep - BBC South West stations, Good Morning with Joe Lemer, from 5am

Tue 26 Sep - BBC Radio Cambridgeshire with Jeremy Sallis, 2.20pm | | | | | | | Q: I've sold my house but haven't found a new place to move to yet. I've therefore got a lot of money floating about - is it protected in the bank? Anne, via email.  MSE Karl's A: The Financial Services Compensation Scheme (FSCS) normally protects up to £85,000 per person, per financial institution, if that bank, building society or credit union (or group of banks) goes bust. MSE Karl's A: The Financial Services Compensation Scheme (FSCS) normally protects up to £85,000 per person, per financial institution, if that bank, building society or credit union (or group of banks) goes bust.

But for certain 'life events' - including selling your home - you get higher protection for six months, on up to £1 million. This £1 million is NOT per institution though - it's the total protection you get for all your savings during that life event, so you could hold the funds in one or several different accounts and be protected up to that limit. If you think you'll have the cash for more than six months - and so be subject to the £85,000 limit - it's best to spread your cash across a few accounts to protect yourself in the unlikely event the worst happens. If you're unsure whether your bank is protected under the FSCS, contact it to ask. For more on this protection, see our Savings Safety guide. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go... the brand-new iPhone X will cost up to an eye-watering £1,149. However, it's a lot less abroad, and rumour has it that it's cheaper to fly all the way to the US to get one. It sounded unlikely, so we crunched the numbers to see if it was possible - see what we found and let us know what you think in our blog: 'Can it REALLY be cheaper to travel abroad to buy a new iPhone X?' We hope you save some money,

The MSE team | | | | | | |

I don't want to say the C-word this early. I hate festive creep. Jingle Bells played in October annoys me as much as the next Scrooge. Yet it isn't about early celebration, it's about preparation. There are some things you can do NOW to reduce financial and other stresses for the big day. And that matters...

I don't want to say the C-word this early. I hate festive creep. Jingle Bells played in October annoys me as much as the next Scrooge. Yet it isn't about early celebration, it's about preparation. There are some things you can do NOW to reduce financial and other stresses for the big day. And that matters...