|

| - | - | - | - | - |

| |

|

|

|---|

Saved cash? Shout it from the rooftops.If this email's ever helped you, please forward it to friends and suggest they get it via moneysavingexpert.com/tips |

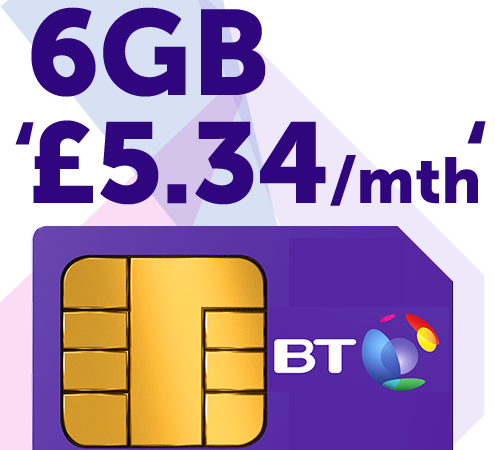

| Ends Thu. Hot BT Sim: 6GB, unlimited mins & texts '£5/mth' The price of Sims - the little chips you put in your phone to make calls, send texts and go online - just keeps falling. A year ago 6GB of data cost £12.50/mth, last week it was equivalent to £7, now it's equiv a fiver. So if you're happy with your handset and out of contract, or need a Sim to stick in a new phone, you could make a nice little pre-Christmas saver.

|

| New. 1.3% Post Office easy-access savings. This new Post Office deal is the best right now if you want to access your cash at any time, paying 1.3% variable (incl a fixed 1.05% bonus for 12mths) on £1+. See Top Savings for more. Boxing Day sales starting EARLY, incl Ugg up to 50% off on NOW. Full updates as they launch throughout the week in Early Boxing Day sales. Cheap Christmas food, incl 28p for 2.5kg potatoes & 19p for 1kg carrots. Plus chocs and fizz. Cheap Xmas food A Christmas request from Martin - do you have experience of mental health issues? If so, we need you. "Two years ago I set up the Money and Mental Health Policy Institute charity. Its purpose is to investigate and lobby to change policy, firms' behaviour and regulation, in order to break the hideous connection between debt and mental illness. Our community now has 4,000+ people (including carers) who make a huge impact, confidentially sharing their stories and telling us what would help - but we need more (especially men). If you can, please join the community." Heads up. 30% off Travelodge on 1m+ rooms. Biggest we've seen in a few years. Starts Boxing Day for 1 or 2-night stays from Jan-Apr, with some exclusions. Travelodge code Two months' Now TV for price of one. Cinema, Entertainment or Kids packages for £2.99+. Newbies only. Now TV deals |

| |

|---|

| 'I CUT my home insurance by over £500.' Pocket a nice Christmas bonus in just 5 mins by following our simple steps to cutting costs We love it when a plan comes together - like it did for MoneySaver Ish, who saved over £500 on home insurance. You should never just auto-renew, instead compare quotes at renewal to slash costs as Ish did: "Thanks to your website I saved £515 on my home insurance. Was shocked to be charged £695 - now I'm paying £180 for more cover." See how to get cheap home insurance, here are the main building blocks...

|

| Last chance. Amazon £5 off £25 spend. Some app newbies may get £5 off a £25 spend when they sign in for the first time. Likely ends today (Wed), but Amazon won't confirm when. Check if you're eligible for £5 off at Amazon. Christmas decorations sales now boosted, eg, up to 50% off John Lewis & M&S. Plus big discounts at House of Fraser, Debenhams & Wilko. Full info in Cheap decorations for some last-min additions. Toys R Us fears - what you need to know. The toy retailer is struggling, and while there's uncertainty for staff, if you have gift cards or are in its 'Take Time to Pay' scheme you may lose out if it goes bust. See Toys R Us alert. Also see our Gift voucher warning. Get 20% off first month's payment on train season ticket scheme. MSE Blagged. CommuterClub buys your annual season ticket (incl London travelcard) for you upfront and you pay it back in 11 monthly instalments. It's cheaper than paying a train firm monthly, but costs more than if you pay in one go (incl via interest-free loans from work). CommuterClub Charity gifts, incl £13 goat, £14.50 polio vaccines etc. If unsure what to give, don't give tat, give a gift you KNOW will be used. See charity gifts for inspiration. Plus we wanted to give a gift on your behalf, so we've given £2k for polio vaccines to protect kids. Track Santa's location as he delivers presents on Christmas Eve. Free website to track Santa. |

| AT A GLANCE BEST BUYS

|

| 100,000s have OVERPAID student loans - are you owed money? Repaying student loans is a chore. Yet the way payments are calculated and then collected automatically via your employer means 100,000s of you who have taken out a loan since 1998 have been repaying when you didn't need to, and sometimes without even knowing. Some are now owed £1,000s - but the onus is usually on you to reclaim. We've full details in our new Student Loan Overpayments guide. It explains how you or your kids can get money back, here are the key lessons...

Related: Should I repay my student loan? | Student loan interest rates are now 6.1% - should I panic or pay it off? |

| FREE e-books or audiobooks to keep (norm £30+), incl The Break by Marian Keyes. MSE Blagged. Nine books, can be read on Kindles, e-readers and mobiles. Free books MARRIAGE TAX ALLOWANCE - SUCCESS OF THE WEEK "Claiming marriage tax allowance took literally 5 mins. HMRC was very quick and a cheque for £431 is on its way to me. Thank you for your help. It was so easy." |

| CAMPAIGN OF THE WEEK Charity urges Govt to stop people with Parkinson's missing out on benefits. Parkinson's UK is campaigning for sufferers to get fairer assessments. You can get more info and sign its petition to show your support. |

| THIS WEEK'S POLL Which celebrity chef would you want to cook your Christmas dinner? Whether you plump for turkey, goose, ham or a good-old nut roast for your festive meal, which celebrity chef would you want to cook it? Almost 70% of you have switched energy provider this year. In last week's poll, we asked what you've switched in 2017, with options including broadband provider, mortgage and home insurer. It seems our energy switching message is getting through, with 67% of women and 70% of men switching their gas and/or electricity this year. But you're not switchers across the board, as only about 30% of you switched your bank account, and only 3% switched partners. Find out what else you switched. |

| MONEY MORAL DILEMMA Should I share my discount with friends? I often book theatre tickets for myself and friends, who pay me back. However, I recently bought a £40 discount card that gets money off. Should I continue to charge my friends full-price until I've recovered the cost of the card, or just ask them to pay me the discounted price? Enter the Money Moral Maze: Should I share my discount with friends? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: 2018 Frugal Living Challenge |

|

| MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 20 Dec - BBC Cumbria, Money Talks with Ben Maeder, from 6pm |

| QUESTION OF THE WEEK Q: Does a lump-sum payment made by a bank for switching my main account to it count towards the £1,000 tax-free savings allowance? Or is it entirely tax-free? John, by email.

Please suggest a question of the week (we can't reply to individual emails). |

| A CHRISTMAS CLOWN FROM THE 1800s & A 50-YEAR-OLD ELF That's all for this week, but before we go.. what's the oldest Christmas decoration you have? After a man hit the headlines for using the same Christmas lights since 1969, we were inundated with tales from MoneySavers who still use their ancient decorations each year, including a Santa from the 1930s, a 45-year-old snowflake and nativity figures from the 1960s. Let us know the festive favourites you still use in our Christmas decorations Facebook discussion. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email holidayextras.co.uk, looking4.com, skyparksecure.com, bookfhr.com, autoaidbreakdown.co.uk, holidaysafe.co.uk, coverwise.co.uk, leisureguardlitetravelinsurance.com, productsandservices.bt.com, idmobile.co.uk, virginmedia.com, three.co.uk, moneysupermarket.com, comparethemarket.com, gocompare.com, confused.com, directline.com, aviva.co.uk, insure4retirement.co.uk, co-opinsurance.co.uk, barclaycard.co.uk, sainsburysbank.co.uk, paybyfinance.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). The registered office address of both MoneySupermarket.com Group PLC and MoneySupermarket.com Financial Group Limited (registered in England No. 3157344) is MoneySupermarket House, St. David's Park, Ewloe, Chester, CH5 3UZ. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |