| Plus... insurance rip-offs banned, cheap iPhone, BT Sport hike, free Tesco food, Hoover code  THE TOP TIPS IN THIS EMAIL

| | Totally free. Whole of market. SAVE £100s year after year

Today we launch the UK's first free full AUTO COMPARE & SWITCH energy tool - let us do it all for you

You'll never need to switch yourself again

For years on here, the telly and the radio, I've yelled, cajoled, ranted and tried to seduce the millions languishing on big energy providers' standard tariffs to ditch, switch and stop wasting £100s a year. For years on here, the telly and the radio, I've yelled, cajoled, ranted and tried to seduce the millions languishing on big energy providers' standard tariffs to ditch, switch and stop wasting £100s a year. Today I'm smiling. I hope we've cracked it (fingers crossed). I first came up with what we call the auto-compare-and-switch concept over five years ago. And after an 18mth build, by a big and brilliant team, that concept's come to fruition. Forget the 'price cap', this will save many £150-£250/year over that right now, and some very substantially more.

| MSE Autoswitch in a nutshell...

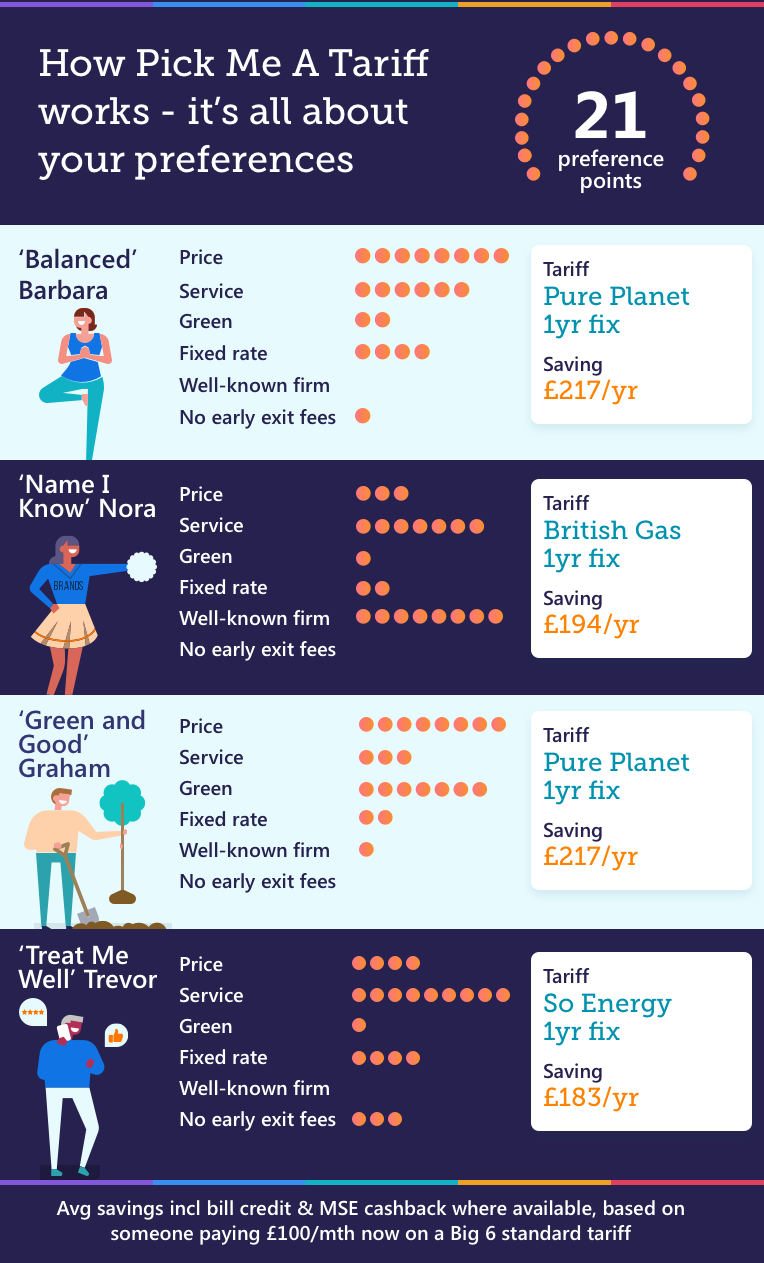

Tell MSE Autoswitch your details and priorities - price, service, name you know, green, fixed, exit penalties - and it then compares and picks YOUR top whole-of-the-market switch based on that. Tell MSE Autoswitch your details and priorities - price, service, name you know, green, fixed, exit penalties - and it then compares and picks YOUR top whole-of-the-market switch based on that.

Then annually, with just a one-click verification, it switches you to your new top deal, again based on those preferences.

| As I've learnt at my TV roadshows, when helping those who say 'comparing is difficult', the real sticking point usually turns out to be picking a winner - leaving many frozen in indecision, or worried as they've been burnt before by switching to tiddler firms with dire service. They often say: "Can't you do it for me?" MSE Autoswitch does that. The market's long relied on many firms attracting switchers with cheap year-long tariffs, knowing most stick for a good while longer, paying a much higher price. Autoswitch could be the final nail in the coffin for that. In future, we aim to ask providers to offer cheaper 'retention tariffs' via it to retain their own customers. Who can and can't use this? It works across the UK, except NI (see NI comparison). It isn't yet available for prepay tariffs (we don't want to autoswitch people to firms where they can't top up their credit, but we're working on a solution - meanwhile, do a prepay comparison), nor for a few niche tariffs such as Eco 10. To join MSE Autoswitch, currently you need to be switching tariff (we're working on a join anytime facility), so if you find you're already on a great tariff, wait and join when it ends. How does this differ from other 'autoswitch' services?

(Spoiler alert: HUGELY and, in my view, far better)

Our tool isn't the first autoswitch proposition. A few sites already try it, but I believe we're taking it on two leaps and a bound. We believe this is the first true, full, free auto-compare-and-switch tool. Many existing autoswitch tools simply switch everyone to the same tariff, or just a select few, from a limited panel of firms they've a relationship with. As Which? found, you may be overpaying with them as they can be far from the cheapest deal. I wasn't willing to put MSE's name on something that blunt. Here's how our Autoswitch differs... 1) MSE Autoswitch uses our 'Pick Me A Tariff' system to select your best tariff by doing an auto-comparison. We don't just switch everyone to the same deals - we use our unique, new Pick Me A Tariff tool. Here, after telling us your details, you're given 21 preference points (I originally called 'em balls, but decided better of it later). You then allocate them across six categories - price, service, green, fix, name you know and exit penalties - depending on your priorities. - Not sure of what's important? I put my balls preferences on show, with a 'Martin's pick' balanced tariff option you can select to start you off. Whatever you choose, our algorithm then selects your winner and the next two closest matches - aiming to mimic what you'd pick yourself if doing a comparison. So prioritise green and service, and you'd get the cheapest top service green deal.  2) Your deal is selected from the WHOLE OF THE MARKET. We don't ignore providers we can't switch you to. MSE auto-compare-and-switch includes all providers, whether we've a switching (ie, commercial) relationship with it or not. If the top pick is one we can't switch you to, it's still your top pick, but as choosing it means you can't then be on Autoswitch, we also show the alternative top autoswitchable tariff you can choose. PS: Whole of market means every available open tariff. We can't always include other comparison sites' exclusives, and very rarely small firms don't provide their rates (or have them on beta test tariffs, such as Octopus Agile), so until they do, we can't include them. 3) You stay in control, with a one-click Autoswitch verification. A year after your switch (later if you're on a longer fix), we'll contact you by email or text with your new top tariff based on your preferences. You then switch to it with just a one-click verification. If you don't want to switch, just don't click it. You can opt out of Autoswitch at any point. 4) It's not just free, we give you £25 cashback. The only autoswitch (there are no other auto-compare-and-switch) services that look across the whole of the market charge a fee. Yet with MSE, switch via the tool and as we, like other comparison sites, get paid, we don't charge a fee. Instead, we actually give you £25 dual-fuel cashback (£12.50 single-fuel) - roughly half what we get. That means in effect it costs you less than even going directly to the provider, and it covers our costs (and hopefully some profit) for providing the service. A win-win. 5) If there's a major market move, we've an editorial override. When building this, one of my concerns was: "What if there's a huge market shift, or a 'top service' provider we've switched people to suddenly has an IT meltdown causing hideous problems?" So we've built in an editorial override rule. If the worst happens, we can override the automatic 'wait a year' rule, and send you an urgent update suggesting you switch earlier. This is only for extreme circumstances, we'll try not to use it, and it'll always need signing off by me (or, in my absence, MSE Editor-in-Chief, Marcus). More info and questions answered in MSE Autoswitch FAQs. Autoswitch isn't for energy nerds or complex switches - in those cases, it's still best to use our DIY comparison

MSE Autoswitch is great if you just want to stay on a cheap energy tariff with no hassle. We've kept it simple, to encourage the many who don't like switching, and (usually) will only switch you annually. Yet there are some for whom Autoswitch isn't suitable... - Those doing complex switches (eg, EV tariffs, homes with multiple meters).

- Energy nerds, a compliment from me I assure you. They're those who know what they're doing and want to interrogate all tariffs themselves.

- Frequent switchers - those who like to constantly keep on the perfect tariff, so switch more than once a year. For all those, stick with our DIY energy comparison. Like all MSE energy tools, it's free, whole-of-market and you get the cashback. We also have a halfway house Pick Me A Tariff tool - where you still use the 21 preference point tool to select a tariff, but after that you don't sign up to Autoswitch (though can opt into it at a later date). A bravo for the team - and do let us know what you think. This has been a huge job with 10,000s of hours of work in it - we're very proud of it (and hope it's so busy it'll struggle to hold up). We also aim to continue to add more bells and whistles. I can't promise perfection on day one, but we're trying, and to help, please do send us MSE Autoswitch suggestions/comments (or, heaven forbid, glitches). -------------------------------------------------- SAVINGS IN CRISIS

The Martin Lewis Money Show LIVE, 8.30pm Thu, ITV

This week, my big briefing is on 'Savings in Crisis' and what you can do to max interest after NS&I's shock rate cut (more below). Plus a host of other important latest info to keep your finances shipshape. As we're live, you can tweet suggested questions to @MartinSLewis but you must use the show's hashtag #MartinLewis. Do tune in or set the VideoPlus. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | SAVINGS NEWS: Devastating blow as NS&I slashes rates, it'll pay virtually NOTHING on lots of accounts from Nov - what to do?

State-backed NS&I had been a bastion of hope for savers. Its deals have been best buys for months as the Govt, desperate to bring in cash, tasked it with raising £35bn this tax year, up from the normal £6bn. Monday's announcement of massive rate cuts was therefore a huge shock. Chief exec Ian Ackerley justified it with: "It is time for NS&I to return to a more normal competitive position for our products." That's terrifying for savers, as its new rates are mostly just 0.01%, ie, 10p a year per £1,000 - or to put it another way - nowt. So NS&I defines normal as nowt. | NS&I savings RATEs SLASHED | | Account (easy access unless stated) | Current rate | New rate from 24 Nov 2020 | | Income Bonds | 1.16% | 0.01% | | Direct Saver | 1% | 0.15% | | Investment Account | 0.8% | 0.01% | | Direct ISA | 0.9% | 0.1% | | Junior ISA - no access till child turns 18 | 3.25% | 1.5% | | Premium Bonds - see Are they worth it? | 1.4% (prize rate, not interest) | 1% (from 1 Dec 2020) |

There's a suspicion it may be anticipating further UK base rate cuts, even negative interest rates, and as it has to give 2mths' notice of cuts, it's trying to get in position now. Yet whatever the reason, it's likely to have a gravitational pull on other savings. So what should savers do? Full info in Top Savings, but here's a quick rundown... - Got debts or a mortgage? Overpaying often beats saving. For many, the best thing to do right now is clear debts. With costly debts this is a no-brainer - see Repay debts or save? However, with savings rates so low, many would be better off overpaying their mortgage with savings too - the link has a full explanation and calculators.

-

Worried about rate deterioration? Lock in to top fixed savings ASAP. Until NS&I announced it was pulling rates, we'd seen the top fixed rates creeping up. The worry is the NS&I move will change market momentum. So if you're worried, locking away on a fixed rate now is protection (though of course things could always move the other way - no promises). The following deals all have up to £85,000 per person savings protection. Tandem pays 1.3% AER on its 1yr fix, Aldermore* pays 1.36% for 2yrs and Tandem pays 1.45% for 3yrs (all min £1k deposit). Worried about rate deterioration? Lock in to top fixed savings ASAP. Until NS&I announced it was pulling rates, we'd seen the top fixed rates creeping up. The worry is the NS&I move will change market momentum. So if you're worried, locking away on a fixed rate now is protection (though of course things could always move the other way - no promises). The following deals all have up to £85,000 per person savings protection. Tandem pays 1.3% AER on its 1yr fix, Aldermore* pays 1.36% for 2yrs and Tandem pays 1.45% for 3yrs (all min £1k deposit).

- Need access? Top 'easy-access' savings at 1.2% - but rates are variable so could drop. As the name suggests, you can withdraw money when you want, but the best deals have some restrictions. In truth, as there's so much uncertainty here, if it's easy access you want, and you're with NS&I, you may as well wait to move your money until nearer November. Here are the best buys though...

Coventry BS pays 1.2% AER variable (min £1) - but only allows 2 penalty-free withdrawals a year - or Principality BS* pays 1.05% (min £1) with 3 withdrawals a year allowed. For true easy access, Yorkshire BS pays 0.95% (min £10k), though you can beat this rate with Cynergy Bank's cash ISA at 1% (min £1).

- Can you UP the interest? A few things to check...

- Low income? Get a 50% savings bonus. Check the Help to Save scheme to see if you qualify.

- First-time buyer? Get a 25% boost on savings via a Lifetime ISA.

- Get up to 3% interest by saving monthly. See Regular Savings.

- Pay tax on savings? See if a cash ISA is more suitable.

- Earn 2.02% on up to £1,000. See interest-paying bank accounts.

- Not sure how much to put away? An array of autosaving apps can decide for you. | Regulator wants to 'ban' insurers charging existing customers more than newbies - and only allow 'justified' renewal hikes. The FCA's set out game-changing insurance proposals, though if they come in, it won't be till next year at the earliest. Full info in Insurance loyalty penalties to be banned? 'Secret' shoe outlets, eg, £21 Puma trainers (norm £62). Some high street chains flog slightly scuffed and ex-display footwear online at huge discounts via little-known outlets, but stock's limited. Walk this way for how to find 'em 'Can I get a refund on £9,000 tuition fees if my course is now mostly online?' Martin's video answer. We've been swamped with questions such as this, so watch Martin's 10min video briefing on it. £34 for 24-piece make-up bundle (norm £150), incl 'dupes' for Urban Decay, Tarte, Ciate and more. MSE Blagged. Incl eye shadow, lipstick, gloss and contour sticks. Lottie London deal Warning. BT Sport and BT TV customers face up-to-£72/yr hike. Up to £6/mth (£72/yr) will be added to bills for anyone who signed up before Feb + some others (though you can leave and escape penalty-free). See BT price hike rights. Biggest upfront bank switch bribes, get up to £125 FREE. Last week, HSBC Advance* began paying newbies a £125 bribe within 30 days of switching (min monthly pay-in £1,750+/mth, equiv £25,600/yr salary). Ironically, that was just days before it became embroiled in a scandal around suspicious international corporate transfers. Thankfully there are other free cash options, from Club Lloyds and RBS, though they offer a lower £100 to switch, but they include other perks. Full info on all of them, including eligibility criteria, in Best Bank Accounts . | 9 new CORONAVIRUS financial need-to-knows, incl... UK returns to 'level 4' alert | Weddings reduced to 15 | Work-from-home tax back | £500 self-isolation payments | Self-employed grant deadline | Loans, car finance etc help | Tui refunds | Redundancy rights

Martin: "It's been a momentous week - bringing into stark contrast the fact, sadly, this is far from over. The UK has returned to alert level 4. I'm writing this half an hour after Boris Johnson told the Commons of the tightening restrictions. They will have a knock-on effect on lives, wellbeing and people's pockets. We will be analysing the consumer impact over the week as we hear more, and adding new information into the coronavirus guides linked below. For now though, here are the need-to-knows we know-you-need so far..." Constantly updated Covid-19 help guides: Travel | Employees | Self-employed & ltd co | Finance & bills | Benefits | Lockdown life  1) It's back to 'work from home if you can' - at least there are tax breaks. The guidance has yo-yoed again, swinging back from 'go to your workplace or risk your job' to 'work from home if you can'. If you are required to work from home, then read Martin's Claim tax back if you work from home blog. 1) It's back to 'work from home if you can' - at least there are tax breaks. The guidance has yo-yoed again, swinging back from 'go to your workplace or risk your job' to 'work from home if you can'. If you are required to work from home, then read Martin's Claim tax back if you work from home blog. 2) Weddings reduced from 30 to 15 people in Eng from Mon (funerals still 30) - your rights. If your plans have been scuppered by the tighter restrictions, see Covid wedding rights. 3) Self-employed and business now hit by Covid? You can still try to claim the grant. The 19 Oct deadline for the 2nd Self-Employed Income Support Scheme grant is fast approaching - it's worth up to a max £6,570, made up of 3mths of income, up to 70% of your average trading profits (calculated over a period of up to 3yrs - but you can't earn more than £50,000/yr to qualify). As it's a grant you NEEDN'T PAY IT BACK, though it is taxable. To claim, you need to declare your business has been adversely affected by coronavirus since 14 Jul - you can do that even if it wasn't until now. This doesn't need to mean a total disaster - it could be, say, a reduction in trade, staff illness or extra PPE costs. See Can you declare your business is affected by coronavirus?

4) If told to self-isolate and unable to work, those on low incomes will qualify for a £500 payment. From next Mon, 4m people on universal credit, working tax credit, income-based employment and support allowance/jobseeker's allowance, income support, housing benefit or pension credit can claim £500 from their local authority. This applies if they're told to self-isolate by NHS Test and Trace, are unable to work from home and will lose income as a result. Similar schemes are planned in Scot/Wal/NI. See full £500 payment help. 5) Struggling to repay loans, credit cards, car finance and more? Help's set to be extended - but additional payment hols etc WILL go on your credit report. Until 31 Oct you can request payment holidays on most regulated lending. The regulator's consulting (it's almost certainly just a formality and so will happen) that after this, 'tailored' support will be offered for those struggling, rather than a 'one size fits all' approach. And, crucially, from this point it will GO ON YOUR CREDIT REPORT. Full updates for loans, credit cards etc & car finance, plus similar plans for further overdraft help. 6) Tui promises to sort outstanding refunds by end of THIS month. It's pledged to pay out by 30 Sep, following Virgin Atlantic and Virgin Holidays' promise to clear outstanding claims by the end of Oct. See latest on Tui refunds & Virgin refunds. 7) Loveholidays and On the Beach quit ABTA to avoid paying out refunds in full. An ABTA rule says firms should pay out in full if the Foreign Office advises against non-essential travel - to avoid that, these firms have outrageously quit ABTA. In our view, if you booked when they were ABTA members those rules should still apply. Yet it'll be a fight. See Loveholidays and On the Beach ditch ABTA to avoid refunds - full help. 8) Been told about redundancy? Tool up on your rights. Redundancies are rife as employers are being asked to contribute increasingly more under the Govt's furlough scheme until it ends (unless it's changed) in Oct. Whether you've been made redundant or are worried your job's at risk, our Redundancy Help guide covers your rights to pay, notice, holidays and more. 9) IVA payment holidays and other help now avail till next Apr. Those with individual voluntary arrangements now have until 20 Apr 2021 to ask for extra flexibility if struggling with repayments. Full info in IVA help extended. | Free Tesco food - eg, bread, salad and fruit pots - via food-sharing app. The supermarket's giving away tons of surplus food via an app which also offers free food from Pret, Costa, local bakeries and more. See how to grab free grub. Hoover cordless vacuum cleaners 30% off via code, eg, £200 version now £140 delivered. MSE Blagged. Works on four models, but limited stock. Who you gonna call? Dust-busters Get £5 off when you recycle clothes, shoes and textiles at M&S, H&M etc. As it's 'Recycle Week', we've compiled a compendium of where you can save by recycling old clobber. Get paid to recycle New. Hot 64GB iPhone SE deal with 4GB data - with NOTHING to pay upfront. MSE Blagged. A new smartphone isn't MoneySaving, but if you'll get one anyway, at least get it for less. Via this link from reseller Fonehouse, EE newbies can get the iPhone SE with 64GB storage*, 4GB/mth of data (enough for most) + unlimited mins & texts for an initial £21/mth. But from Mar, EE will raise prices by a little more than inflation, as most firms do. Therefore, while we can't tell you the total cost over the 2yr contract as the hike is unknown, based on £21/mth, it's £504 over the 2yr contract - £338 less than the same deal direct (which would also rise in price). It's the cheapest we've seen for this phone/data combo and, unlike most contracts, there's no big upfront outlay. For more, see Cheap iPhones & Samsungs. How to get five free Bodyform sanitary pads + 13 more sanitary savers. See how to get free or cheap pads, tampons and reusables. | Tell your friends about us They can get this email free every week | If you can't afford to clear credit or store card debt, you can't afford NOT to try to get a 0% balance transfer

New 29mth 0% debt-shift and NOW check your chances for most top cards

We told you last week about TSB's new 29mth 0% balance transfer credit card. Sadly, then only one of the top four cards was in our Balance Transfer Eligibility Calc , but we've worked hard to add more and now three of the top four are in it (with only the TSB one missing). This is important, as the calc lets you see which cards you're most likely to get without impacting your credit score, to avoid unnecessary applications. How does a balance transfer work? You get a new card that pays off debt on other cards - so you owe it instead, but at 0%, so repayments clear the debt rather than servicing the interest, saving you £100s or £1,000s. Top 0% new-cardholder balance transfer CREDIT cards

Go for the lowest fee in the time you're sure you can repay. If unsure, play safe and go long

| | CARD | 0% LENGTH & FEE (1) | HOW GOOD IS IT? | New. TSB 29mths 0%

(apply*) - sadly not in our eligibility calc

| - Up to 29mths 0%

- 2.95% fee

| The LONGEST 0% card on the market, but an 'up to'. Some with poorer credit scores may be accepted and offered 26mths or 23mths at 0% - still pretty decent. After the 0% ends, it's 19.9% rep APR.

| M&S Bank 28mths 0%

(apply via eligibility calc) | - All accepted get 28mths 0%

- 2.85% fee (min £5) | Longest DEFINITE 0% card. Shorter 0% than TSB, but all accepted custs get the full 28mths 0%. After, it's 19.9% rep APR. | HSBC 25mths 0%

(apply via eligibility calc) | - All accepted get 25mths 0%

- 1.5% fee (min £5) | Longish DEFINITE 0% with a lower fee. This is a good mid-length card, with a much lower fee than the longest. If accepted, you're certain to get the full 25mths 0%. After, it's 21.9% rep APR.

| Santander 18mths 0% NO FEE

(eligibility calc / apply*)

| - All accepted get 18mths 0%

- NO FEE

| NO FEE and DEFINITE 0% length. The winner if you can clear debt in less than 18mths. If accepted and you clear it in time, there's no cost here. After the 0%, it's 18.9% rep APR.

| | Important: HSBC and M&S Bank have asked we direct people to our eligibility calculator, so only those more likely to be accepted will actually apply, reducing demand and enquiry calls, as they're already over capacity and need to prioritise coronavirus help for vulnerable people. (1) As a percentage of debt shifted. |

Always follow the Balance Transfer Golden Rules. Full info in Best Balance Transfers (APR Examples). a) Never miss the min monthly repayment, or you could lose the 0% deal and it'll cost far more.

b) Clear the card or balance transfer again before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate and withdrawals hit your creditworthiness.

d) You must usually balance transfer within 60 or 90 days to get the 0% - check what your card says.

e) You normally can't balance transfer between two cards from the same banking group (the case for all cards above). | SUCCESS OF THE WEEK:

"I did the cutely named MSE Academoney course and really enjoyed it. Useful content, nicely presented, a thoughtful selection of static and interactive learning elements. Learning wins all round. Thanks for getting this out there. Well done. "

(Send us yours on this or any topic.) | THIS WEEK'S POLL How do you rate your mobile network? This week, we want to find out how each firm rates both for service (how they treat you) and coverage (how strong the signal is when you need it). Tell us how you rate your mobile network. MoneySavers are more likely to have upped their pension contributions than cut them during the pandemic. Last week, we asked if you've changed your pension contributions since March, and if so, how? Just over 3,000 responded, and of those who contribute to a pension, most (66%) haven't made any change. But some 22% of you have increased contributions, with just 12% of you reducing them. See the full poll results. | B&Q - 20% off bathroom furniture

Local Heroes - 'Free' £25 Amazon vch with tradesperson booking

McDonald's - Free kids' football sessions, for ages 5-11

Pizza Hut - 50% off takeaway pizza when you spend £30

Sainsbury's - 25% off six bottles of wine | | | MARTIN'S APPEARANCES (WED 23 SEP ONWARDS) Thu 24 Sep - This Morning, phone-in, ITV, 10.55am

Thu 24 Sep - The Martin Lewis Money Show, ITV, 8.30pm MSE TEAM APPEARANCES (SUBJECTS TBC) Mon 28 Sep - BBC Radio Manchester, Drive with Phil Trow, from 2.25pm

Tue 29 Sep - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, from 12.25pm | 'THE TOOTH FAIRY IS LOADED' - YOUR KIDS' TOP MONEYSAVING TIPS That's all for this week, but before we go... we all know kids say the funniest things (and some are wise beyond their years), so this week we asked MoneySavers to ask their children for their best MoneySaving tips. While some answers were ill-advised ("pull out your teeth - the tooth fairy is loaded") or over-ambitious ("make billions on YouTube"), others were genuinely savvy, with one urging you to "sell stuff you don't want" and a very sensible five-year-old simply advising "don't spend it, save it". See more - and let us know what your little 'uns think - on our MoneySaving kids Facebook post. We hope you save some money,

The MSE team | |