| Plus... Next sale?, get PAID to recycle, crisp deal, 8GB Sim £6/mth, £300 breakdown cover saving  THE TOP TIPS IN THIS EMAIL

| |  Finally the Government and the news has caught up with what we've been telling you for months. Just a fortnight ago here, I warned you the energy market was dire. Now, sadly, it's got far worse: Finally the Government and the news has caught up with what we've been telling you for months. Just a fortnight ago here, I warned you the energy market was dire. Now, sadly, it's got far worse: - Cheapest fixes are 60% costlier than a year ago.

- 4 energy suppliers have gone bust, more to come.

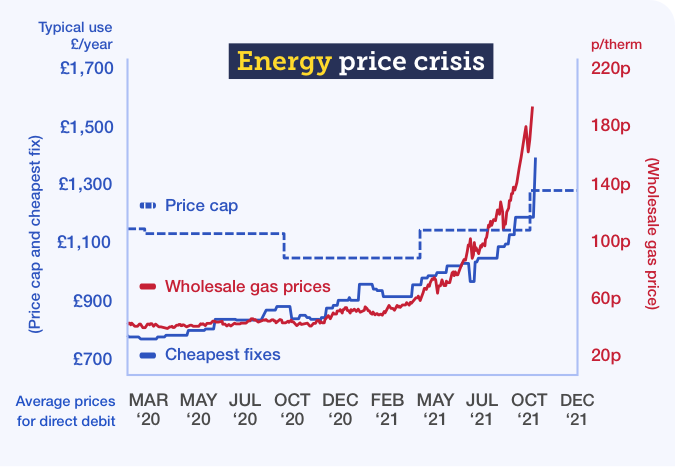

- Wholesale gas prices (those energy firms pay) UP fourfold in a year.

- As much UK electricity is gas-powered, electricity prices are hit too. While others focus on the 'why', my aim's to look at the impact on you and how to mitigate it. To see how your choices stack up, use our MSE energy comparison in conjunction with the nine need-to-knows below. PS: As my ITV series restarts on Thu at 8.30pm, I'll be taking you through it step-by-step there too, if you prefer to watch rather than to read. 1. On 1 Oct the energy price cap - that over half of all homes are on - will jump 12% to £1,277/yr (on typical use) If you've never switched, or have come off a fixed or special tariff, you're likely on your energy provider's default standard tariff. That price is dictated by regulator Ofgem's so-called price cap (except in Northern Ireland). In fact, it isn't a cap on price, it's more a cap on the rate you pay per unit, so if you use more, you'll pay more. See price cap FAQs. - The cap rises an average 12% (13% for those on prepay meters).

- For someone with 'typical use', that's up from £1,138/yr to £1,277/yr.

- All big firms' standard tariffs are within £1 of the cap.

2. From 1 Apr next year, the price cap could jump again to a stomach-churning £1,450/yr (on typical use) The price cap changes each October and April. Yet the assessment period that dictates it is far earlier. The new 1 Oct cap is based on average wholesale prices for the six months until the end of July. Yet... the wholesale price has exploded since then. As it's sensible to look at energy bills over a year, the fact we're nearly a third through the next assessment period (Aug - Jan), which determines the cap from Apr 2022, is crucial. At current rates, analysts at Cornwall Insight predict ANOTHER 14% jump then, taking it to £1,455/yr (on typical bills). In fact, for prices not to rise in April, wholesale rates for the final four months of the assessment period would need to drop to roughly the lows of the pandemic. Yet many analysts think they're staying high for now. 3. Rolling off a cheap deal? Accept the fact you WILL pay substantially more Prepare to be horrified - today's cheapest fixes are 60% more than a year ago. The idea of 'saving' compared to what you were paying has gone for now. So like others... 4. The BIG CHOICE you have to make... Whether you're on the price cap or rolling off a fix, the options are pretty stark. You can see YOUR actual cost of various options via a Cheap Energy Club comparison, but to give an indication: | Price cap (at typical use) |

| Today's cheapest (typical use) | Until 30 Sept: £1,138/yr

| Cheapest variable: £1,225/yr

| 1 Oct - 31 Mar 22: £1,277/yr

| Cheapest 1yr fix: £1,407/yr

| From 1 Apr 22: Poss £1,455/yr

| Cheapest 2yr fix: £1,392/yr

| - Option 1: Do nowt for now and stick on a price-capped / variable tariff. Best if wholesale prices drop in a few months. Energy firms are complaining the new 1 Oct price cap is lower than their cost price. So for consumers the price cap is protective right now, but it's likely to be destructive come next April.

Currently, the cap works like a six-month 'cheap' fixed rate, so you could stick with it (I can't believe I just wrote that - wow) hoping that by April wholesale prices will drop, cheaper fixes will be available, and you can lock in then.

The risk is that if you're still on it by April, and either the cheapest fixes then are more than now, or other prices have dropped and you haven't switched, you'll be massively overpaying.

Tip to shave a little off. One bigger supplier, Octopus (link takes you to a comparison), has a variable rate up to £50/yr cheaper (on typical use) than the new price cap. Crucially, it still must follow the price cap, so even if - as I suspect it may - it puts prices up, it can't go above it. This may shave down costs in the short run.

- Option 2: Grab the cheapest fix possible. Best if wholesale prices continue to rise - or if you need certainty. A fix means you lock in the rate for a year or two. Use the MSE cheapest fixed comparison to find your winner, as it depends on location and use. (New to switching? See the Switching FAQs.)

The last fix cheaper than the new price cap was pulled at lunchtime on Tuesday. So you will have to pay more than the cap to fix. Yet if the April cap rises sharply and wholesale prices continue to stay high, this could be welcome peace of mind, and a saving with hindsight.

Right now the cheapest fix on average is for two years, likely showing that the market is only factoring in high prices in the short term, then lowering after. Without a crystal ball, I can't with certainty tell you which will be best. So you have to decide based on your attitude to price versus certainty. 5. My cheap fix lasts a few more months, should I ditch it and grab a longer one? My best guess is no. Prices have risen so much that the savings you'll make by sticking with your old cheap tariff, while it lasts, will be huge (though do compare to check). So even if prices still rise, I suspect the gain of holding on to very cheap tariffs now will likely outweigh that. It is more art than science though. 6. Small providers are going bust, should I avoid them? Four suppliers covering 500,000 homes have gone under in the last fortnight. Read our People's Energy & Utility Point help (also useful to see the protections in place if you're worried about your firm) and PFP & MoneyPlus help. And certainly many more suppliers are at risk. The Govt has said it won't bail them out, saying that it is normal to see some firms fall by the wayside. Yet some business experts predict if nowt changes about 30 more may go, leaving only 10 - far from normal. It's not just about tiddler firms either, even some with well over a million customers have reported funding issues. Yet predicting which'll go and when is tough, because as soon as a firm knows it's insolvent it must declare it, so there's little pre-warning. If your supplier does go bust, the Ofgem safety net means you won't lose supply, you'll be moved to a new firm, and your credit is protected. The risk is one of delay, hassle and losing any cheap tariff you're on, instead being moved to the price cap. However, this is all a bit of a moot point for switchers right now, as there's nothing cheaper than the cap and most cheap fixes are with bigger firms. 7. Beware other comparison sites that don't automatically show deals that don't pay them... and most of the cheapest don't pay right now Energy switching sites, including our Cheap Energy Club, earn their money by getting paid by firms they can process a switch for. To protect their incomes, most sites usually by default don't show deals they don't have a commercial relationship with. I've always rejected that for MSE. By default, the Cheap Energy Club comparison includes all available tariffs (though you can filter, for example, for service rating).

Instead, my concept was to give switchers nearly half of what we earn in the form of cashback (eg, £25 per dual-fuel switch) allowing us to include the cashback in the saving, so more people switch to those that pay. A win-win for us and you. Right now, in these extraordinary times, many of the cheapest firms have pulled payments to comparison sites, so most sites, by default, show very few tariffs. It's so extreme that some comparison sites are now more prominently signposting how to opt to see the whole market. As we're always whole of market by default, we've not changed, though it does mean we're unable to switch you to most tariffs, and instead just link you to the provider. Similar is true of free auto-switch sites, which are likely to have even fewer competitive deals than usual right now. 8. Struggling to pay bills, and worried you need choose between heating and eating? There may be help available... I am very concerned about how those on lower incomes will cope with these horrific new energy prices, especially coupled with high inflation, the end of the universal credit uplift and furlough & self-employment support ending. It is the perfect price storm. Emergency measures put in place due to coronavirus are still ongoing. Your supply won't be cut off - disconnections have been suspended, while prepayment customers can get emergency credit to ensure the lights stay on. Suppliers can also offer payment reviews, breaks or reductions. This is all case-by-case, so contact your firm as soon as you can if you start to struggle, and let it know if you're vulnerable. Those on lower incomes may also be able to apply for £140 towards bills via the 2021/22 Warm Home Discount. Though that rate hasn't increased for nine years, even though cheap fixes are up by 60% compared to a year ago. I try to stay away from getting too political here, but pressure is needed on the Govt to increase this ASAP.

More help in our Home & energy grants guide. 9. It's not just about prices - use less and you pay less - obvs. Ensure you know the energy-saving myths from reality  Most people (including me sometimes) waste energy. We know wearing jumpers, lowering thermostats and not leaving electricals on standby will help. And maybe these price hikes may change behaviour. Most people (including me sometimes) waste energy. We know wearing jumpers, lowering thermostats and not leaving electricals on standby will help. And maybe these price hikes may change behaviour. There are also many questions out there, such as 'should you keep the heating on all day, or only have it on when needed?' For answers, see our 18 Energy Mythbusters guide, and also the top thrifty heat-saving tips for things like how to easily make draft excluders. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | New. Got credit or store card debt? The best balance transfer deals in 2yrs+ have launched. Get 31mths 0% (2.75% fee) or 27mths 0% 'NO-FEE' & cut your interest now

If you pay interest on credit or store card debt, you can't afford not to check if you can do a balance transfer. That's where you get a new card that pays off debts on your existing credit or store card(s) for you, so you owe it instead but at 0%. This means more of your repayments clear what you owe, so you get debt-free quicker. The offers available haven't been great for a couple of years, but things are turning around. And this can mean huge savings, as Keith emailed: "I switched to a 0% interest balance transfer card and have gone from paying £400+/mth of interest, to paying off £400+/mth [a £4,800/yr interest saving]. I can't thank you enough." - How to get the best card that will accept you. The main challenge is often getting accepted, so use our 0% Balance Transfer Eligibility Calculator, which gives you a bespoke best-buy table based on your acceptance chances for most top cards. That allows you to home in on the right one, therefore minimising applications, which protects your credit score. Here's what's available...

| TOP NEWBIES' 0% BALANCE TRANSFERS

Always go for the card with the lowest fee, in the time you're sure you can repay | | CARD | KEY 0% & FEE INFO | HOW GOOD IS IT? | New. Santander

Best to check acceptance odds first or apply*.

| - 31mths 0%.

- 2.75% fee (min £5).

| The longest 0%, so great if you need that long to clear your debt. Plus unlike some cards, all accepted get the headline 0% length, which is 31mths. After the 0%, it's 20.9% rep APR interest. | MBNA

Best to check acceptance odds first as you can be 'pre-approved' for this card, meaning you'll be told if you'll definitely get the full 27mths 0%, or apply* direct.

| - Up to 27mths 0%.

- 1% fee, but shift £1,000+ within 60 days and you get £30 cashback, which wipes the fee out for many (cashback paid within 180 days).

| Longest NO-FEE card if shifting £1,000-£3,000 (some are even paid to shift debt). Move, say, £1k and the 1% fee is £10, so you're up £20 after cashback. At £2k you're £10 up, by £3k there's no fee. On £3k+, shorter no-fee cards win.

Use our eligibility calculator to check acceptance odds to see if you're pre-approved. If not, you may be offered a shorter 0% and/or a higher fee (that cashback won't cover). After the 0%, it's 21.9% rep APR. | HSBC

Best to check acceptance odds first or apply*.

| - 20mths 0%.

- NO FEE.

| Longest definite no-fee 0%. Via our links (not available direct), all accepted get the full 0% length - so clear the debt within 20mths and there's no cost. After the 0%, it's 21.9% rep APR. | | Poorer credit score? You may be able to get this | Capital One

Best to check acceptance odds first or apply*.

| - 9mths 0%.

- 3% fee.

| Longest 'poor credit' 0%. Gives interest respite for some, even with past credit problems. But only move money you can clear in the 9mths or you'll pay a horrid 34.9% rep APR interest after. |

Getting a card? Always follow the Balance Transfer Golden Rules: a) Never miss the min monthly repayment, or you could lose the 0% deal and it'll cost far more.

b) Clear the card (or balance-transfer again) before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate and withdrawals hit your ability to get future credit.

d) The balance transfer must usually be done within 1-3mths to get the 0% and any cashback - check your card.

e) You can't balance-transfer between two cards from the same banking group. Full help and info, including more options, in Best balance transfers (and see APR examples). | £100+ off via first-timer grocery codes, including £10 off Sainsbury's, £15 off Getir (cities only). See our first-timer freebie grocery hack list. Free £130, plus get paid to pay bills via Santander's new switcher offer. Last week, the Santander 123 Lite* account added a £130 incentive for switchers - and it was already a top pick as you pay £2/mth but get 1-3% cashback on bills that you pay from it by direct debit. That makes it the sixth bank to pay switchers £100+. So just in case you missed it a week ago, here's Martin's bank-busting blockbuster taking you through all the free cash deals and how they work. Some make £100s, such as Sam who emailed: "My wife and I have switched each account three times and are about to receive our third bonus, totalling £710. Many thanks." Ending. Last chance to apply for the Govt Covid self-employment grant. There's just over a week left. To check eligibility and what you could claim, see our SEISS grant help. 50+ beauty lookalikes, including £14 No7 powder vs £35 Charlotte Tilbury. Many stores sell own-brand items mimicking designer brands, often called 'dupes'. And there are a host of new dupes from biggies including Aldi and Boots. See if you can save in our Beauty Downshift Challenge. Top easy-access savings 0.6%. This deal from Aldermore* (min £1,000) pays 0.6% AER variable, but only allows a max of two penalty-free withdrawals a year - so it's a good place to leave cash, but not to dip in and out of. Yet rates are changing all the time, so check our Top Savings guide for the latest, or if you need to save less than £1,000. Get PAID to recycle, including £5 for old clothes and free MAC lipstick for used containers. It's National Recycling Week, so it's a good time to let you know about ways to make money by going green. It's back. Thu 8.30pm ITV, The Martin Lewis Money Show LIVE. Martin's new series is back, most Thursdays from now until March (gulp). It kicks off, no surprise, with energy bills. As he normally says, do watch or set the Betamax. | Student finance ain't what you think. As the new academic year starts, here's how to survive and thrive on a student budget...

The annual rush of students going to university is underway. And if you - or your kids - are starting at or heading back to uni this autumn, you'll be swamped with tales of student debt and money misery. Some are true, some are exaggerated, and some are myths. So make sure you tool up on the reality of student finance. To help, we've loads of tips, support and tricks in our 50+ student MoneySavers. Here are some of the key ones... -

Martin's five things EVERY student and their parents should know. Student finance is a political football that's often kicked in the wrong direction. Our job is to avoid the politics and instead focus on the practical financial realities - how much university really costs. To help, take just three minutes to read Martin's five student finance must-knows 2021/22 guide. To give you a hint of what's covered... Martin's five things EVERY student and their parents should know. Student finance is a political football that's often kicked in the wrong direction. Our job is to avoid the politics and instead focus on the practical financial realities - how much university really costs. To help, take just three minutes to read Martin's five student finance must-knows 2021/22 guide. To give you a hint of what's covered...

- The student loans price tag is up to £60,000, but that's NOT what you pay.

- There is an official amount parents are meant to contribute, but it's HIDDEN.

- The amount you borrow is mostly irrelevant - it works more like a TAX.

- Interest is added, and the headline rate is 4.5%, but many WON'T pay it.

- The system can and has changed.

Plus Martin's TikTok videos this week (he joined it last week) are all on student finance too. -

Top student bank accounts 2021 - make them fight for your custom. Banks salivate over the thought of students, as once they grab a fresher's custom many stay for life. We're not a fan of such loyalty, but we do suggest all students get the max gain from their account, which this year includes a £1,500 0% overdraft, free four-year railcard and more. Full help in top student accounts. -

Those in all-student homes DON'T pay council tax, but you need to let the council know. If you're in a mixed student / non-student household you are liable, but could be due a discount. See how council tax works for students. -

Working people shouldn't spend more than they earn, students shouldn't spend more than...? Lots of parents tell their student offspring to budget, but unless you know your limits that's irrelevant. Our Student Budgeting Planner takes you through it. -

Renting? You've rights too. Students with short tenures can feel insecure as renters, so it's important to know your rights. See 50+ tips for renters, including how to save £100s on utility bills. - Student bargains, discounts and more. We've covered some of the hard stuff above, but actually being a student opens you up to a world of discounts and bargains. You'll find more in our student discounts section, including 3mths' free Spotify Premium, 6mths' free Amazon Prime, 10% off Apple, free Microsoft Office and more. Plus see if you can watch TV without a licence.

| Buy £1 Walkers crisps to get £5 off £20 at 1,000s of local restaurants. If you want to give your local high street a boost and get money off some grub, see £5 off local eats. Cheap Sim. Unlimited mins, texts and 8GB/mth for just '£6/mth'. Three's no-frills brand Smarty* charges £3.50 for the first four months, then £7/mth, averaging out at £5.84/mth over a year. Moving your number to it is easy and you can cancel at any time. While 8GB is far more than most use it only costs about £1.50/mth more than 3GB options (which match more people's use) but with a big buffer. More options in MSE's Cheap Mobiles tool. Traffic light system to be overhauled (Eng, NI & Scot) - what it means for you. The green and amber lists will be scrapped, and testing requirements relaxed for many fully-vaccinated travellers. Full info and more help in Coronavirus travel rights. TWO pairs of designer (including Levi's, Polaroid) specs from £25 delivered. MSE Blagged. Glasses Direct £40 cashback for investing £400. MSE Blagged. If you plan to 'robo-invest' - where investments are selected for you based on your attitude to risk - then this Wealthify deal is equivalent to a 10%-ish head start, provided you keep it for at least 6-7mths. The fact we've included it doesn't mean we recommend Wealthify - just that if you're going to use Wealthify anyway, get cashback. We featured this last week, but only 2,000 or so remain. Full help and explanation in Robo-investing cashback. 'I saved £300+/yr on my breakdown cover.' Laura emailed us our latest success of the week after reading the haggling tips in our Cheap Breakdown Cover guide: "I got my breakdown cover down from £30/mth to £2.99/mth by threatening to leave, so they offered me a discount. Thanks, MSE." Please send us your MoneySaving successes on this or anything else. Next 50% off sale rumour. Unconfirmed, but after some digging we're almost certain that the next Next sale is this week. | Tell your friends about us They can get this email free every week | | AT A GLANCE BEST BUYS | | Cheapest for £5k-£7.5k: AA (check eligibility / apply* ) (3.3% rep APR for AA members, 3.4% rep APR for non-members + claim a £30 Argos/ M&S/ Costa etc voucher)

Cheapest for £7.5k-£15k: M&S Bank (check eligibility / apply* ) (2.8% rep APR, plus £30 M&S gift card for accepted new loan applicants) | | THIS WEEK'S POLL Are you part of the cashless society? How often do you use cash? During the pandemic we saw a decline in the use of cash, with people favouring other methods of payment, such as contactless. With the Government planning to increase the contactless limit again next month – up to £100 – we want to find out how cashless our society is now, and how many of you still prefer using cash. Vote in this week's poll. Around half of you prefer to contact customer services by phone. Last week, we asked you how you prefer to contact customer services. Some 47% of the 6,000 people who responded said phone was their preferred method, though it varied a lot by age, with many younger people preferring live chat. See full customer services poll results. | MARTIN'S APPEARANCES (WED 22 SEP ONWARDS) Wed 22 Sep - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 23 Sep - This Morning, phone-in, ITV, 10.55am

Thu 23 Sep - The Martin Lewis Money Show Live, ITV, 8.30pm MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 22 Sep - BBC Radio Wales, Breakfast with Claire Summers, with MSE's Guy Anker on the energy crisis, from 7.40am

Mon 27 Sep - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 28 Sep - BBC Radio Berkshire, Mid-morning with Sarah Walker, with MSE's Guy Anker, from 11.35am

Tue 28 Sep - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | NIT COMBS & EMPTY SWEET TINS... WHAT'S THE MOST DISAPPOINTING PRIZE YOU'VE WON? That's all for this week, but before we go... while we all love a freebie, compers on the MSE Forum and on our social channels have been discussing their worst competition wins. An empty sweet tin, a nit comb, toilet rolls, a used candle, and an empty tube of Pringles signed by Fergie from the Black Eyed Peas all disappointed compers, as did a tube of haemorrhoid cream. See others and share your stories in our worst prize you've ever received MSE Forum thread. We hope you save some money, stay safe,

The MSE team | |