| Plus... Martin broadside at Parliament, Klarna warning, energy update, 9GB Sim £5/mth  THE TOP TIPS IN THIS EMAIL

| | Martin's mortgage heads-up 'Mortgage rates are at all-time lows - some can fix at 0.84%. Yet that may be about to end. A UK rate rise is on the cards. Can you lock-in cheaply now to save £1,000s?'

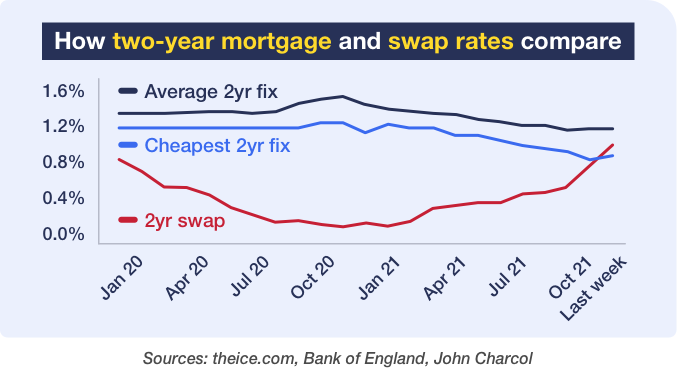

8 mortgage cost-cutting need-to-knows  Martin: "Back in April, there were no switchable mortgage deals below 1%, by June there were 10, today there are over 50 - with the cheapest fix being 0.84% (see Cheapest mortgage deals). Yet with hindsight, we may look back and say this was as good as it got. Martin: "Back in April, there were no switchable mortgage deals below 1%, by June there were 10, today there are over 50 - with the cheapest fix being 0.84% (see Cheapest mortgage deals). Yet with hindsight, we may look back and say this was as good as it got. "On Sunday, the Bank of England's Governor said it 'will have to act' over rising inflation. For Andrew Bailey, that's as subtle as chucking a brick through a window, his way of telling people interest rate rises are likely coming. On the back of that, the market's strongly predicting (it's not always right) rates will rise from today's 0.1% to 0.25% next month, then to 0.5% by February and 0.75% later next year. "If that comes true, it will almost kick-start an increase in mortgage rates. Though it's more complex than that. Take a look at this graph...

"Normally the rate of the cheapest mortgage deals tends to follow similar City 'swap rates' - basically long-term interest rate predictions. Yet over the last year, unusually they've been somewhat de-linked. This is likely due to a combination of increased competition, and banks having a glut of cash due to Quantitative Easing (ie, the Govt sort of printing money), but that's due to end by January. "Normally the rate of the cheapest mortgage deals tends to follow similar City 'swap rates' - basically long-term interest rate predictions. Yet over the last year, unusually they've been somewhat de-linked. This is likely due to a combination of increased competition, and banks having a glut of cash due to Quantitative Easing (ie, the Govt sort of printing money), but that's due to end by January. "Put this together with possible UK base rates rising and it's highly likely change is a comin' - and possible mortgage rates could go up steeply and swiftly. So EVERYONE with a mortgage should check now if your existing deal is as good as it can get - and that applies double if you're languishing on your lender's standard variable rate. "To prove the point, Louise tweeted me: '@MartinSLewis Our mortgage was £476 a month. We fixed for 5 years at 1.62%, payments went down to £248 [saving £2,700/yr].' "Now over to the team to talk you through the practicals of remortgaging (switching deal without moving home)..." 1. Find out your current mortgage details. Gathering the following info will make deciding a lot easier: - What's the rate? Plus monthly payments & outstanding debt.

- What type is it? Is it a fix, tracker, SVR? See fixes v variables.

- When's the intro deal over? When does the 2yr fix end?

- When must it all be repaid? In 10, 20, 25yrs?

- Will you be penalised to switch deals? Does your fix or tracker have an early repayment charge? If so, it isn't usually worth switching, though it can be on rare occasions. See Ditch your fix?

- What's the loan-to-value (LTV)? This is the proportion of the home's current value you borrow - for example, £270,000 borrowing on a home currently worth £300,000 is 90% LTV. Rates get cheaper the lower your LTV. See LTV help. 2. Find your existing lender's cheapest. Contact your existing lender to check what new deal it'll offer you - this is called a 'product transfer'. It didn't used to be a great option, but these days as your existing lender is allowed to forgo affordability checks if you're not borrowing more, it may work out well for some. Plus there may be lower fees and paperwork. Don't stop here though... 3. Now speedily compare it to the market's cheapest deal - to see whether big savings are possible. Spend a couple of minutes on our mortgage comparison tool to see if it's likely you can save more by going to another lender. Do note that low-rate deals can mean higher fees - so our tool factors these in to the 'MSE total cost' to make comparing easier. The biggest factor affecting rate is your LTV. Mortgages start at 95% LTV, but you'll get a cheaper deal at 90% LTV. It's cheaper again at 80%, 75%, and then bottoms out at 60% of a home's value. There can also be minor gains at each 5% in between. | Example cheap rates available today (£150,000 mortgage) | | Type (1) | Intro rate + arrangement fees | Annual cost (2) | | Typical SVR | 4% | £9,500 | | Fix, 2yrs 60% LTV | 0.84% + £995 | £7,081 | | Fix, 2yrs 80% LTV | 1.36% + £1,034 | £7,629 | | Fix, 2yrs 90% LTV | 1.89% + £1,001 | £8,003 | | Fix, 5yrs 60% LTV | 0.97% + £1,010 | £6,919 | | Fix, 5yrs 90% LTV | 2.45% + £2,001 | £8,423 | | Tracker, 2yrs 60% LTV | 0.78% + £995 | £7,071 | | (1) All links go via our Mortgage Best Buys comparison. (2) Based on monthly payment & including the fees spread across the deal (hence why a 5yr rate can look cheaper than 2yrs) on a 25yr term. |

Should you fix? The more you value certainty and being able to stick to a budget, the more you should hedge for a fix, and fix longer. If you're worried about interest rates rising, which as Martin notes above is a real concern right now, then fixing is a bit like an insurance policy against this. Trackers may be a smidgeon cheaper, and if today's rate is your prime concern and you can ride out moves, you may want to go for it. See our full fixes vs trackers analysis for more. 4. Use our range of calculators to make it easy to compare deals. To simplify the process, plug your numbers in here... - Basic mortgage calculator - including what it'll cost

- Compare two mortgages

- Compare fixed-rate mortgages

- Should you ditch your fix?

- How much can I borrow guesstimator 5. Sadly it's not about what's the best mortgage, it's about what's the best mortgage you'll be accepted for. There are two key financial checks the lender will do on you when you remortgage. Unfortunately each lender is different, so there's little point trying to second-guess it all, but there are ways you can improve your prospects. - Are you creditworthy? A poor credit history can torpedo a remortgage application, or at least mean you don't qualify for the cheapest deals. So check your credit file (for free) to ensure there are no errors, then minimise other credit applications, and pay down debts if you can. See 37 tips to boost your creditworthiness. - Can you afford it? Lenders must also do strict checks to see if you can afford mortgage repayments, not just at current rates, but stress-testing how you'd cope if they rocketed. They want evidence of income, bills, expenses and sometimes even eating out. Likely to be close to the wire? Being frugal in the months leading up to application can help. For more tips, see 18 ways to boost mortgage acceptance | Top tip: Try to go £100 beyond any LTV threshold. If you've worked hard to get enough together to reach the next LTV band, for instance, 90% or 75%, try to push to £100 beyond that. It means it no longer looks to mortgage underwriters like you're scraping to get to the limit, and can ease acceptance. |

6. A good broker can be worth their weight in gold - they can match you with lenders more likely to accept you. Lenders are loosening some mortgage acceptance criteria - for example, some will now include bonuses and commission in your income assessment, which wasn't the case during the pandemic. Yet getting the right mortgage is still complex, and even if all else looks good, acceptance is more difficult if one or more of these apply... - You're self-employed.

- You claimed financial help from the state during the pandemic.

- You've a non-standard property. In these cases, we strongly suggest you use a mortgage broker. They will do the 'finding a deal' work for you and they have details of most lenders' acceptance criteria, which aren't easily obtainable by the public, plus many deals, even some product transfers that can only be accessed via brokers. Nationwide 'fee-free' brokers (they earn via commission from lenders) include L&C Mortgages*, Habito* and Trinity Financial* (it normally charges a fee, but not via this link), though some with more complex situations may want to pay. Full help in top mortgage brokers. 250,000 mortgage prisoners are trapped on often costly deals and the cladding scandal means more are likely to join them.

"During the 2007 financial crash, the Government of the time rescued the banks. Yet many customers of firms that went under then had their mortgages sold on over the years as part of a 'debt-book' to financial companies that don't do mortgages - and they just saw it as a financial transaction. "The nature of these mortgages meant many people couldn't get deals elsewhere, and were now stuck with rump mortgage managers who didn't have any other products. Little has been done to help them, there are still an estimated 250,000 of these mortgage prisoners who are having their finances eroded and lives destroyed because of it. "To help, we've a new Mortgage prisoners guide, with a step-by-step list of what to try. Sadly it won't fix the issue for everyone, in fact it won't help the majority, but it is worth a go. "This guide is part of MSE's and my personal continued campaign on this issue. Alongside it, and lobbying, I'm currently funding a 2nd tranche of London School of Economics mortgage prisoner research to try and find solutions to put to the Govt. More mortgage prisoners due to the cladding scandal? "A whole new group of mortgage prisoners, mostly in leasehold flats, have now been created due to the cladding scandal. "They are unable to get an EWS1 safety certificate needed to be able to move property or, in some cases, remortgage (do check via a broker). This is a scandal that needs fixing by Govt. There is a little hope though that the recent cabinet reshuffle will see a renewed focus." 7. Still a while away from your current deal ending? Many lenders let you lock in a rate 3mths ahead, and a few even go to 6mths in advance, so it's wise to check within that window. However, locking in can incur a non-refundable booking fee of £100-£250. If you're worried about rates rising and missing out on the cheap deals currently available, you could see this as a form of insurance policy. Bag the rate you need now, but if things get cheaper, forego it, lose the fee and go cheaper instead. Full info in long lock-in mortgage help. 8. Use any savings to bag a better mortgage deal. If you've savings, use them to get a cheaper mortgage. As mentioned above, rates tend to improve as you move down to 90%, 80%, 75% and 60% LTV, so when you remortgage, use savings so you need to borrow less for your mortgage. It can really pay off. For example, if an extra £1,000 of savings got you to the 75% LTV band, the top 2yr fix here is 0.94%. This means you'd pay £560/mth (on a £150,000 mortgage), as opposed to 1.36% at the 80% LTV band, which costs £590/mth. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Urgent. Shift debt to 27 months 0% by Monday and it's essentially NO FEE (if you miss it, the next best is just 21 months 0%) If you can't clear your credit card debt, then you can't afford not to try to shift it to 0% A balance transfer is where you get a new card that pays off debt on old cards for you, so you owe it instead, but at 0%. Your repayments then clear the actual debt, rather than just cover the interest, so you're debt-free quicker. Most longer 0% deals charge a percentage of the debt shifted as a one-off fee, so we usually say 'go for the card with the lowest fee in the time you're sure you can repay', but right now as one of the market's longest is effectively fee-free, it makes it far easier... - Always check which deals you've the best chance of getting BEFORE you apply. Each application leaves a mark on your credit file, so instead use our 0% Balance Transfer Eligibility Calculator, which shows your acceptance odds for lots of top cards (without affecting your ability to get credit in future), so you home in on those most likely to accept you, minimising applications.

| TOP NEW CARDHOLDER 0% BALANCE TRANSFERS | | CARD | KEY 0% & ONE-OFF FEE INFO | HOW GOOD IS IT? | | 'No-fee' 0% balance transfer credit cards | Ends 11.59pm Mon. MBNA

Best to check acceptance odds first as you can be 'pre-approved' for this card, meaning you'll be told if you'll definitely get the full 27mths 0%, or apply* direct.

| - Up to 27mths 0%.

- 1% fee, but apply in time and shift £1,000+ within 60 days and you get £30 cashback (paid within 180 days), which wipes the fee out for many

- 21.9% rep APR after the 0%. | Longest 'NO-FEE' card if shifting £1,000 to £3,000 (some even get paid to shift debt). For example, for someone shifting £1,000 the 1% fee means you pay £10, but there's £30 cashback, so you're £20 up. At £2,000 you're £10 up, by £3,000 there's no fee. Above that, shorter no-fee cards may be better.

It is an 'up-to' card though, so some may get 14mths at 0% and/or a higher 3.49% fee which the cashback wouldn't cover. So use our eligibility calculator to check acceptance odds to see if you're pre-approved. | New. Sainsbury's Bank

Best to check acceptance odds first (pre-approval available), or apply* direct.

| - Up to 21mths 0%.

- NO FEE.

- 20.9% rep APR after the 0%.

| Longest NO-FEE card if shifting under £1,000 or over £3,000, but an 'up to'. Unless our eligibility calculator shows you're 'pre-approved' for this card, you could be accepted and offered just 17mths or 13mths at 0%. | HSBC

Best to check acceptance odds first, or apply* direct. | - 20mths 0%.

- NO FEE.

- 21.9% rep APR after the 0%. | Longest definite no-fee 0%. As the 0% length is definite for all accepted, if you've good odds for this in our eligibility calculator, it can be a winner. | | Longest 0% cards. Unsure how long you'll need to repay? Play safe and go long | Santander

Best to check acceptance odds first, or apply* direct. | - 31mths 0%.

- 2.75% fee, min £5.

- 20.9% rep APR after the 0%. | Longest definite 0% deal. All accepted get the headline deal, so it's a top pick if you need longer to clear your debts. | New. Sainsbury's Bank

Best to check acceptance odds first (pre-approval available), or apply* direct.

| - Up to 30mths 0%.

- 1.5% fee, min £3.

- 19.9% rep APR after the 0%. | Long, lower fee 0% - but some get less time at 0%. Slightly shorter than Santander, with a much lower fee - though you must request the transfer as you apply. Some accepted could be offered just 24mths 0%. |

Getting a card? Always follow the Balance Transfer Golden Rules: a) Never miss the min monthly repayment, or you could lose the 0% deal and it'll cost far more.

b) Clear the card (or balance-transfer again) before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate and withdrawals hit your ability to get future credit.

d) The balance transfer must usually be done within 1-3mths to get the 0% and any cashback - check your card.

e) You can't balance-transfer between two cards from the same banking group. Full help and info, including options for poorer credit scorers, in Best balance transfers (APR examples). | Beware using Klarna's new 'pay now' service - you may lose vital protections. See our Klarna MSE News story. Netflix and chill (out) about the cost: watch Squid Game, You and others for less. See our 17 Netflix hacks . Watch Martin launch scam ads broadside to Parliament - 'it's a ludicrous plan'. In a no holds barred evidence session to both Houses, Martin passionately called for SCAM ADS TO BE IN THE NEW ONLINE SAFETY BILL and for making big tech legally responsible, as a scams epidemic is damaging 100,000s of people's wealth and mental health. He said the ludicrous plan to include user-generated scams in the bill but not scam ads is an incentive for criminals to just pay to promote posts to avoid the rules. He even wished it was Boris Johnson's face scammers used not his, as then online scams would definitely be covered by the bill. £148 of Ciate nail polish for £35 via Advent calendar code. MSE Blagged. See Ciate Advent code. John Lewis' £100 voucher if you do BIG spends there is back. If you NEED a new TV, freezer etc soon, check John Lewis' prices as you may get £100 back in vouchers if you buy before 1 Nov. See our full John Lewis big spends analysis for how it compares. Big car & home insurance rule change means cheap switchers' deals may end soon. If you missed Martin's car & home insurance rule change warning last week, it's an important read, and worth acting on soon even if you're not at renewal. It resulted in our success of the week, as Steve emailed: "Great info about the potential premium increases. Have now switched and saved over £400 on home and car insurance. The car cover was mid-term, but even with the 'admin' charges it was worth changing." Please send us your successes on this or anything else. 9GB Sim from BT's Plusnet just '£5/mth'. MSE Blagged. With this 1yr deal, newbies to Plusnet* (uses EE's signal) get 9GB/mth data and unlimited calls & texts. You pay £7/mth, but are sent a £20 prepaid Mastercard - factor that in and it's equivalent to £5.34/mth over the year. Need more/less data? Use our powerful Cheap Mobile Finder tool. Morrisons 'up to 50% off' toy sale, including Paw Patrol, Peppa Pig, Mario Kart and more. See full toy sale analysis. Thu 8.30pm, ITV, The Martin Lewis Money Show LIVE - 'the end of cheap mortgages'. Over to Martin: "Well, no surprise after the Bank of England Governor effectively warned of interest rate rises, I'll be taking you through what to do to protect your mortgage rates. Plus the latest hot tips in News You Can Use. Do watch or program your VCR." | Break-down... the cost

Roadside recovery, home start & onward travel for TWO £54/yr. Or basic RAC cover £21/yr for one. Many can save £100+

Car breakdown's a nightmare at any time, but getting stuck at the side of a road when it's dark, cold and wet feels much worse. The cost of a simple tow home or to a garage can easily reach £150 - before any costs to fix your car. That's the point of breakdown cover, it's there to provide peace of mind that someone's coming to help. Do it right and it doesn't have to cost the earth. So, with winter on its way, here's our Car breakdown's a nightmare at any time, but getting stuck at the side of a road when it's dark, cold and wet feels much worse. The cost of a simple tow home or to a garage can easily reach £150 - before any costs to fix your car. That's the point of breakdown cover, it's there to provide peace of mind that someone's coming to help. Do it right and it doesn't have to cost the earth. So, with winter on its way, here's our rundown drivedown of the cheapest cover... - Full service breakdown cover for you AND your spouse £54/yr. AutoAid* has been our cheap full service breakdown pick for over a decade, and currently newbies going via our link pay £53.99 for a year's cover (it charges £59.99, then you get an automatic £6 cashback within 60 days), or £68.99 if your car's 16+yrs old. Similar cover from the big players is around £210/yr, though using a cashback site can bring that down to £140ish.

The policy covers you and your spouse / civil partner / live-in partner in any car. It includes home start, roadside recovery, and onward travel for you and your passengers if your car can't be fixed immediately. Call-out times are similar to the AA and RAC, with all three saying their average is 50mins or less, and existing customers who've used it generally give good feedback on its service. Rodney told us: "Clutch went when visiting friends so called them out, a local company turned up and took it some 25 miles to a garage. Excellent service. Thanks AutoAid."

There's also the similar Eversure Gold* at £57.50/yr, which slightly undercuts AutoAid renewals, but we've limited feedback on it, so do let us know if you use it. See full service breakdown deals.

- Trick to get basic RAC cover from £21/yr. Basic cover means if you break down away from home, they'll try to fix your car or tow it to the nearest garage. The cheapest prices are if you buy via cashback websites, for instance if you pay £50/yr for RAC cover, you get £28.80 back. The AA's prices are a touch more after cashback. See cheapest basic breakdown cover for more.

- Use Tesco Clubcard vouchers to get cheap RAC cover. If you're a Tesco shopper, you can turn vouchers into cover at around a third of the normal cost. Till Mon, you can get basic cover (including home rescue) for £20 of vouchers, or full service for £29 of vouchers.

- Or stay where you are and HAGGLE. When your renewal hits, don't simply accept it. Success rates for those who haggle with breakdown providers are high, with 88% of AA customers and 85% of RAC customers reporting success in getting money off in our latest poll. Joe emailed: "Thanks for the tips. I'd had breakdown cover with RAC for a decade. Finally got round to doing something about it - one 20-minute phone call and I saved nearly £200. Time well spent." See our Breakdown cover haggling help. Can't cut the cost? Green Flag will halve renewal prices for AA/RAC customers.

PS: If you also need travel insurance and mobile phone cover, check out the Top packaged accounts where you can get all this for the whole family from £156/yr. | Energy crisis updates: Goto goes bust | New Pure Planet supplier revealed | Should you switch? The energy market crisis continues. See our Goto energy customers help info as it became the 13th supplier to bite the dust in the last six weeks. And former Pure Planet customers should see our review of their new Shell Energy tariff. If you're trying to work out what to do with your energy bill, see our Should I switch? help. No Sweat? Get a 6mth subscription to Kayla Itsines' popular fitness app for FREE (normally £15/mth). Includes workouts & meal plans. We've got it for free for 6mths, cancel any time. Sweat for free Martin: 'The Govt's mooted student loan repayment threshold cut is a breach of natural justice - it could even threaten the nation's fertility.' Read and listen to Martin's Financial Times interview about the possibility that current students may be made to pay more each year towards their loan. 20 craft beers £24 delivered (normally £68). MSE Blagged. 10,000 boxes available. Beer52 (please be Drinkaware). Free or cheap half-term and Halloween kids' activities, including free books, comics and baking. It's never easy to keep the littl 'uns entertained, but we've put together some home half-term and Halloween activities. Greater Anglia sale, including £5 one-way London to Cambridge, Clacton and Norwich. For travel until 21 Nov, 50,000 tickets available. £5 tickets Ends today (Wed). 6% boost on Tesco shopping via its 'Christmas savings' scheme. Pay in £25-£360 by 11.59pm on Wed, and in Nov you'll get it back in Tesco vouchers with an up to 6% bonus on top. Full info on how it works, plus similar schemes at Asda, Sainsbury's, Co-op, Iceland and Morrisons, in Supermarket Christmas boost. | Tell your friends about us They can get this email free every week | THIS WEEK'S POLL When did you last switch your bank account? Competition's fierce in the current account switching market right now, with some banks offering £100+ in cash to switchers. So whether you want better service, interest on your savings or just free cash, changing your day-to-day bank account can be well worth doing. But when did you last do it? Nearly three-quarters of MoneySavers whose energy accounts are in credit have had their direct debits raised. Last week, we asked if your energy direct debit had been increased in the last two months. Over 20,000 people responded and 73% of those whose accounts were in credit said they'd seen a rise. Those in debt with their provider saw the biggest hikes - 20% said their payments had been doubled or more, compared with just 6% of those in credit. See full energy direct debit poll results. | MARTIN'S APPEARANCES (WED 20 OCT ONWARDS) Wed 20 Oct - Lorraine, ITV, 9am

Wed 20 Oct - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 21 Oct - Lorraine, ITV, 9am

Thu 21 Oct - This Morning, phone-in, ITV, 10.55am

Thu 21 Oct - The Martin Lewis Money Show Live, ITV, 8.30pm

Fri 22 Oct - Lorraine, ITV, 9am MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Fri 22 Oct - BBC Radio Stoke, Lee Blakeman, with MSE's Gary Caffell on how to save on your utility bills, from noon

Tue 26 Oct - BBC Radio Berkshire, Mid-morning with Sarah Walker, with MSE's Guy Anker, from 11.35am

Tue 26 Oct - BBC Radio Cambridgeshire, Mid-morning with Thordis Fridriksson, from 12.40pm | 'LOCKED MY KEYS IN THE CAR ON THE WAY TO THE AIRPORT'... YOUR MOST EXPENSIVE MISTAKES That's all for this week, but before we go... members of the MSE Forum have been discussing their most expensive mistakes this week. Some Forumites shared their regrets at spending money on cigarettes, taking out payday loans and even buying wardrobes full of expensive clothes and not wearing them. Spare a thought too for the holidaymaker who locked their car keys and luggage in the car when packing up for the trip back to the airport on the way home. See more costly catastrophes or add your own in the what's been your most expensive mistake? discussion in the MSE Forum. We hope you save some money, stay safe,

The MSE team | |