| | | Check NOW to see if you can take advantage and save £1,000s ditching & switching

It sounds ridiculously cheap, and indeed Atom Bank's new 1.29% 5yr fixed mortgage is - for those who can get it. Not everyone can, as you can't borrow more than 60% of your home's value (it rises to 1.99% if borrowing 90%), and it's so cheap it could be pulled at any moment. Yet it's indicative of the huge competition at every level, and is forcing others to slice rates to compete. It sounds ridiculously cheap, and indeed Atom Bank's new 1.29% 5yr fixed mortgage is - for those who can get it. Not everyone can, as you can't borrow more than 60% of your home's value (it rises to 1.99% if borrowing 90%), and it's so cheap it could be pulled at any moment. Yet it's indicative of the huge competition at every level, and is forcing others to slice rates to compete.

It's no wonder we're hearing of huge savings. JM emailed: "Read your guide, remortgaged, SAVING £200/mth [£2,400/yr]. Delighted." And MC said: "Followed your remortgaging help, will now be able to repay my mortgage 10 years early and SAVE £55,000 in repayments. Thank you."

So EVERYONE check if you can save £100s or £1,000s remortgaging. Here's the key info...

| 1. | Check your credit file (for free). A bad credit report or credit file error can kill applications. So check yours ASAP, as it can take time to improve it. Get your totally free Experian Credit Report by joining the free MSE Credit Club, which also shows your credit score and Credit Hit Rate, plus how to boost them.

More lenders use Experian than any other credit reference agency, but it's worth checking your Equifax and Callcredit reports too - for how to get 'em free, see free credit reports. | | | | | 2. | Swot up on your current deal. To see if it's worth remortgaging (ie, switching mortgage to save), you'll need to know the following...

a) What's the interest rate? Plus monthly repayments & debt outstanding.

b) What type is it? Fix, tracker, discount, standard variable rate. See Fix vs Variable help.

c) When's the intro deal over? Eg, when does the 2yr fix end?

d) How long's the full mortgage term? When must it be fully repaid? Eg, in 10, 15 years' time etc.

e) Will I be penalised? Any early repayment/exit penalties?

Critically, work out your CURRENT loan to value (LTV) - the proportion of your property's value you're borrowing. Eg, £90k on a £100k property is 90% LTV. For each 5% your LTV drops, usually until 60%, the cheaper the deal. So if your home's increased in value since you got your mortgage, you may gain. See LTV help for full info. | | | | 3. | Speedily find your top deal with a mortgage comparison. Your best may not be someone else's. So bash your info into our comparison tool (which also factors in fees) to get a benchmark for your top deal, then read on.

Mortgage Best Buys

Remortgaging Best-Buy Comparison Tool

(Alternatively, see our First-Time Buyers or Moving Home tools)

PS: We're working on getting Atom's mortgage deals into the tool, so it's not there now. If you want to get it, you'll need to go via a broker.

Typical current top deals on A £150k mortgage

Links take you to our Mortgage Best-Buy tool | | | | Deal | Rate + Fee | Cost/yr in deal term (incl application fee) (1) | | Typical SVR rate | 4% | £9,500 | | Fix 2yr at 60% LTV | 0.99% + £1,495 | £7,530 | | Fix 2yr at 90% LTV | 1.89% + £1,450 | £8,260 | | Fix 5yr at 60% LTV | 1.75% + £999 | £7,615 | | Fix 5yr at 90% LTV | 2.55% + £995 | £8,325 | | Tracker 2yr at 60% LTV | 1.1% + £999 | £7,365 | | Tracker 2yr at 90% LTV | 2.24% + £999 | £8,340 | | (1) Assumes fee paid upfront, 25yr term. Excludes cashback. | | | | | 4. | HUGE savings are on offer if you're languishing on your lender's standard variable rate (SVR). This is the rate most fixes and trackers revert to when intro deals end. They're often horribly expensive compared with shorter-term deals.

To show you the size of possible savings, here are some major lenders' current SVRs (some have cheaper versions for older customers), which now average about 4% - see SVR help for more:

Barclays 3.74% | Coventry BS 4.49% | HSBC 3.69%

Lloyds & Halifax 3.74% | Nationwide 3.74%

RBS & NatWest 3.75% | Santander 4.49% | Virgin Money 4.54%

Yorkshire BS 4.74%

So someone moving from a £150k mortgage with 25 years remaining at 4% SVR to a 2yr fix at 0.99% will save about £5,300 over 2yrs - even after taking £1,500 fees into account. See how this works for you: Compare Mortgages Calc. | | | | | 5. |  Grab a copy of our FREE 60-page Remortgaging 2017 Booklet. Your mortgage is likely your biggest expenditure, and just because you've done it once, doesn't mean it's the same this time around. So be sure you know what you're doing. Our updated guide takes you through it step by step. Grab a copy of our FREE 60-page Remortgaging 2017 Booklet. Your mortgage is likely your biggest expenditure, and just because you've done it once, doesn't mean it's the same this time around. So be sure you know what you're doing. Our updated guide takes you through it step by step.

- Remortgage Booklet 2017: Download instant PDF | Order printed

- Remortgage-help 5-min video: Sometimes it's easier to watch than read. See the short remortgage help video. | | | | 6. | Use savings to bag a better mortgage. The lower your LTV threshold, the better the deal you can get. Rates tend to fall for each 5% less you borrow from 95% to 60%, so use savings to get into a lower threshold and you can save big. For example...

If you've a £150k home, and want a £137k remortgage, that's 91% LTV, and the top 5yr fix is 3.69%. But use £2,000 of savings to reduce the borrowing & you'd be at 90% LTV - where the top 5yr fix is 2.55%, saving c. £1,100/yr in repayments alone.

See how pumping more of your savings into your mortgage can help you drop an LTV band. | | | | 7. | Midway through your mortgage? It could pay to ditch your fix. Use our Ditch your fix? tool to see if you can save by switching from a pricey fix. It won't work for all, as some will face exorbitant early repayment fees - but with rates so low, why not check, just in case?

Eg, if you've a 3.49% fix with 23mths left on a £100k mortgage, you could save if you can switch to anything better than a 1.51% fix with a £1,000 arrangement fee, even taking into account £2,800ish extra switching fees (incl early exit charge, legal & valuation fees). | | | | | 8. | You can lock in up to 7 months ahead of remortgaging. Many lenders let you fix your rate 3-7 months ahead, so you can grab the right deal now and protect against rates disappearing. But there are risks with possible advance fees, while rates could fall again. See Long lock-in mortgage help for full info. | | | | | 9. | It's often better with a broker, especially if you've unusual circumstances, eg, more than one mortgage, buying above a shop or self-employed. A good broker can match you to the right deal and have often difficult-to-find info - see Top mortgage brokers. What's more, many borrowers are frozen out of ordinary deals because they have highly individual circumstances which can make even the simplest loan application impossible. In such cases a broker would be invaluable as they know the ins and outs of a lender's ability to be flexible.

However, a few lenders, eg, First Direct, cut brokers out and only sell direct to the public. So some brokers can and do exclude them - we suggest you use a broker alongside our mortgage comparison, which has all these deals. | | | | 10. | We've calcs galore to test your options. Now you know typical rates, use our mortgage calcs to compare 'em and see what you could save:

Ultimate Mortgage Calculator

Eight tools to home in on the right answer for you, incl...

Basic Mortgage Calc | Compare Two Mortgages | Mortgage Overpay Calc | Compare Fixed Mortgages | Ditch Your Fix? | | | | 11. | First-time buyer? We've a separate guide. While much of the info remains the same, our First-Time Buyers' Guide tells you how to boost your mortgage chances, save for a deposit and use the Lifetime ISA. | | |

| | | | | | | | | | | | | | | | | | Those who struggle to be accepted may be able to cut existing credit card, overdraft or payday loan costs

If you've poor credit, new borrowing is a bad idea. And we don't want to encourage it. Yet there's a new short-lived deal right now that adds options for credit rejects to cut the interest on different types of existing debts. And doing that means more of your repayments clear the debt itself, rather than just interest, so you're debt-free quicker. Here are the options... -

Shift existing credit or store card debt to 6mths 0%. This Capital One Balance card (eligibility calc incl pre-approval / apply*) lets accepted new cardholders shift debt to it from other cards at 0% for 6mths, for a one-off 3% fee. Even some with past defaults or county court judgments (CCJs) may be accepted if they're 1+yrs ago. Always use our eligibility calc first, in case you're eligible for longer 0% deals. Full help: Capital One. Shift existing credit or store card debt to 6mths 0%. This Capital One Balance card (eligibility calc incl pre-approval / apply*) lets accepted new cardholders shift debt to it from other cards at 0% for 6mths, for a one-off 3% fee. Even some with past defaults or county court judgments (CCJs) may be accepted if they're 1+yrs ago. Always use our eligibility calc first, in case you're eligible for longer 0% deals. Full help: Capital One.

-

New. 6mths 0% spending card - good for clearing payday loans/bank charges. Until Wed 26 Apr Barclaycard Initial (eligibility calc / apply*) gives accepted new cardholders (including those with defaults over 1yr old or a settled CCJ) 6mths 0% on new spending. Again, first use our eligibility calc to see if you can get a better deal.

We're not suggesting you do new borrowing on it. We're highlighting it because if you're careful, you can use it to cut payday loan costs or avoid charges for busting your overdraft limits. To do that, instead of spending from your bank account, use the card for normal daily spending (it's not an excuse to spend more) up to the credit limit - don't go over. Then you can use unspent income built up in your bank to reduce your most expensive debt. It's like moving debt to this card, but at 0%. Only do this if you're sure the income will build up in your bank. Pls read FULL help on this in B'card Initial Tips.

-

CLEAR the debt within 6 months, + other key Credit Card Golden Rules

a) The 0% rates only last 6 mths, so clear the debt by then otherwise it jumps for both cards to a horrid 34.9% rep APR. If you can't, shift remaining debt to a new 0% balance transfer card instead.

b) Always pay at least the monthly min on time & keep within the credit limit, or it's a £12 fee & a possible credit file black-mark.

c) Only use it for its intended purpose (eg, balance transfer with Capital One, spending with Barclaycard), not anything else - that won't be at the cheap rate.

PS: If you've big debt problems and think this won't help, or isn't for you, consider getting free non-profit debt help. | | | | | £7 double duvet, £6 for 2 pillows via EXTRA 25% off code. MSE Blagged. The hugely popular Boston Duvet deal's back. Stock's up to 75% cheaper than high st shops & dept stores. Our code takes a further 25% off. £4 del. Ltd stock. 'Posh' bedding

Pssst. Wanna buy stolen goods on the cheap? Don't worry, even the police are in on it, and now we've even more ways to do it. Buy cheap stolen goods

Ends TODAY. Fast BT fibre broadband & line rent '£208' for 1yr. Until 11.59pm today (Wed) BT broadband newbies can slash standard costs by more than half. Full info: Cheap Broadband.

GENERAL ELECTION 2017: MSE Leaders' Debate - what's your question? The PM's called a snap election on Thu 8 Jun. We hope to redo our leaders' debate (see 2015 debate), so please suggest money/consumer questions to put to party leaders. Also, is the general election a good idea? Please tell us in our election poll.

Cheap post-Easter chocs, eg, 16p Creme Eggs, £1.25 Lindt bunny. Shops flogging leftovers. Cracking-value chocs

Urgent. MSE Big Energy Switch expected next week. We hope to have a super cheap deal, but rules mean we can only offer it to 'members'. So check if you're registered, and if not, simply sign up to this newsletter or join Cheap Energy Club by Monday. PLS TELL FRIENDS/FAMILY. | | | | | | | | | | | Everyone OF EVERY AGE who's got assets, consider protecting your family and yourself from costs and shocks

Die will-less and you don't choose where your assets go - not good. Yet if you lose your faculties, whether due to stroke, accident or dementia, without a Lasting Power of Attorney (LPA), your assets could be locked down - even stopping your family paying for your care. It's not an age thing either: I'm 44 and have one. Every grown-up with assets should consider an LPA, but most don't. I make no apology for pushing, especially now the cost's dropped. See Power of Attorney, but in brief... -

Relatives can't just access your cash if you lose your faculties, not even to pay for your care or mortgage. One person develops dementia every 3 minutes, others lose capacity in a variety of ways. It's often quick. And when your family are already under stress dealing with your condition, without an LPA, the only way to take charge of your finances is via the Court of Protection. People often say that's a nightmare, as Judith tweeted: "@MartinSLewis Took 12mths to go via Court of Protection for my mum. Cost £3,000." Relatives can't just access your cash if you lose your faculties, not even to pay for your care or mortgage. One person develops dementia every 3 minutes, others lose capacity in a variety of ways. It's often quick. And when your family are already under stress dealing with your condition, without an LPA, the only way to take charge of your finances is via the Court of Protection. People often say that's a nightmare, as Judith tweeted: "@MartinSLewis Took 12mths to go via Court of Protection for my mum. Cost £3,000."

With an LPA you nominate a trusted friend/relative to take control of your assets ONLY if you lose capacity. It's a bit like an insurance policy in case the worst happens.

-

Power of Attorney cost cut to £82. The cost of registering an LPA in England & Wales has just dropped from £110 to £82 - the Govt wants to encourage more people to take this step. In Scotland it remains at £75, in Northern Ireland £115. If you've simple circumstances and know what you're doing, you can DIY it online. -

New. £79 Which? Power of Attorney drafting codes. An LPA is a legal document and the DIY route can be tricky. The gold standard is to get one drafted via a solicitor, which can cost up to £500. Which? has a halfway house - you fill in a questionnaire & the LPA is populated, then checked by a paralegal. Which? normally charges £139, but we've blagged Which? codes to get it for £79 until Wed 31 May. (You'll still need to pay the Govt registration fee.) -

Sort future medical care & your (living) will. I've focused on the financial LPA, but you can also set up a health & welfare Power of Attorney to give loved ones authority over your treatment, and a living will (officially 'an advance decision'), where you can refuse certain medical treatments if you lose capacity in future. Plus, while you're at it, consider making a will if you don't have one.

| | | | | | | | | They can get this email free every week | | | | | | | | | New rules mean insurers MUST show last year's price - check yours & FIGHT THE RIP-OFF

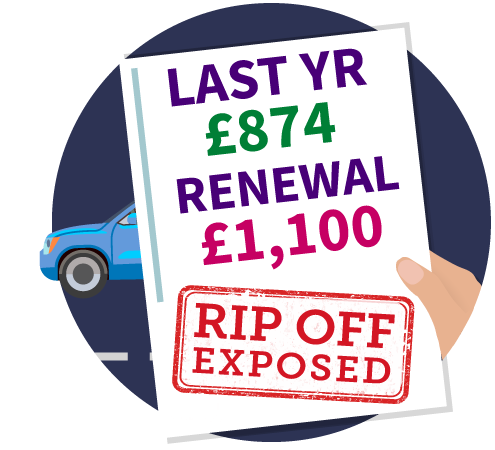

Since 1 April, when you get a renewal quote your insurer must show last year's price, making it easier to see how much it's upping your premium. As renewal's almost always pricier than new customer deals, it's another reason never to accept its quote. Instead do what Barry did: "Quoted £1,100, up from £874 last year. Compared and paid £484, yippee. Thanks MSE." Full help in Cheap Car Insurance & Young Drivers' Insurance, in brief, follow our 5 steps... -

Combine comparison sites. They don't cover the same insurers, so more sites give a wider spread. Our current order's Confused.com*, CTM, Gocompare* and MoneySupermarket* (for why, see comparison order). Combine comparison sites. They don't cover the same insurers, so more sites give a wider spread. Our current order's Confused.com*, CTM, Gocompare* and MoneySupermarket* (for why, see comparison order).

-

Check for hot deals comparisons miss, incl free £60 M&S voucher. Some deals aren't on comparisons, eg, Age UK* offers a £60 M&S vch or Co-op* a £50 food vch. Plus, big insurers Aviva* and Direct Line* are never listed on comparisons. See hot deals comparisons miss. -

Lock in a quote up to 60 days ahead. A number of insurers' quotes are valid for up to two months. So if your renewal's due soon, grab 'em now and insure yourself against a rate rise. These include Aviva*, LV* and Nationwide - see our full list of 20 insurers with lock-in quotes. As Dimuthu tweeted us: "Renewal quote was £521. I'd done it a month earlier from the same company, as you suggested, for £319 and got that." -

Try counter-logical tricks. It's all about risk averages and 'actuarial' tables, which can lead to bizarre ways to save. Use trial & error to see if comprehensive's cheaper than 3rd party & if tweaking your job description saves £££s. Adding extra drivers can cut costs too, if they're a lower risk than you. This is especially strong if you're a young driver adding a responsible older driver, but everyone should try it. More tricks in Cheap Car Insurance. -

Don't want to switch? Haggle. This works best at renewal. Simply find the best price, then ask your provider to beat or match it. Sarah emailed: "Followed MSE's tips, negotiated mine from £1,000+ to £595 with my current insurer. Thanks." See Haggling Tips. | | | | | 5 'mystery' Plain Lazy T-shirts £35 via code (norm £110). MSE Blagged. Men’s or women’s lucky-dip bundle. Ends Tue. Plain Lazy

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"Just got mum's council tax cancelled, thanks to your council tax reclaim help for people with a severe mental impairment. Saved her £1,200/yr, plus got £750 back for last year. Thanks MSE - would never have known about this if it wasn't for you."

Run 26.2 miles for a free burger... London Marathon freebies. Burger, pizza, beer & more. Fast food

Daily Mail '£15' hols. Really £44 min but still cheap for 150+ parks across UK. See '£15' Daily Mail holidays. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 20 Apr - Good Morning Britain, ITV, Deals of the Week, 7.40am. View previous

Fri 21 Apr - This Morning, ITV, Martin's Quick Deals, from 10.30am. View previous

Mon 24 Apr - This Morning, ITV, from 10.30am

Mon 24 Apr - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast | | | | Wed 19 Apr - Share Radio, 12.20pm

Wed 19 Apr - BBC Radio Cumbria, 'Money Talks', from 6pm

Thu 20 Apr - BBC Radio Tees, 10.35am

Fri 21 Apr - BBC South West stations, breakfast

Tue 25 Apr - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: I've seen a cheap flight on a travel agent's website - if I book with my credit card am I still covered by 'Section 75' should anything go wrong? Megan, via email.  MSE Nick's A: The answer is yes and no. In its simplest form, Section 75 protection means the credit card firm is jointly liable with the retailer if something goes wrong with a purchase of £100+. MSE Nick's A: The answer is yes and no. In its simplest form, Section 75 protection means the credit card firm is jointly liable with the retailer if something goes wrong with a purchase of £100+.

But this is a trickier situation. If you book via an agent or broker and something happens with the airline - eg, it goes bust - you won't be covered as your contract is with a third party, not the airline. Though if something goes wrong with the agent itself - eg, it fails to secure your seat on the flight or it runs off with your money - you will be protected. For more, see my Cheap Flights via Brokers blog and our Section 75 guide. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go, as the nation recovers from an Easter egg chocolate hangover our forumites are discussing clean eating vs the filthiest meal they've ever had. Have you ever indulged in a deep-fried pizza, or deep-fried Mars bar? What have you eaten which was so bad, it was good? Let us know your darkest food secrets in the 'Clean vs Filthy' forum thread. We hope you save some money,

The MSE team | | | | | | |

No comments:

Post a Comment