|

| - | - | - | - | - |

| |

|

|

|---|

| DON'T believe the fake ads on Facebook |

| MSE Big Energy Switch Event 10

We know many are worried about choosing a new tariff, so to help we've secured two rock-bottom deals from reliable firms as part of our latest Big Energy Switch. 13,000 have already saved, such as Fraser who tweeted: "Just used Cheap Energy Club. Goodbye British Gas, hello eco-friendly Bulb & HELLO to the extra £336. #winwin" After the hikes, a typical dual-fuel user will pay an avg £1,149/yr on a Big 6 standard tariff. Compare with prices below, but act quick - the deals won't last for long.

Switching's easy, but if you're worried about it or want more info, see our Switching FAQs. Sadly, the deals above aren't available in Northern Ireland or on prepay. PS: If you wonder if we're paid for this - we are. But we pay roughly half to you via cashback, which you don't get applying direct. The rest pays our costs, and hopefully makes us a little profit. |

| Amazon £5 off £25 for virtually EVERYONE. Many of its deals are limited - not this. How to bag £5 off Amazon. Check your tax code - MILLIONS are wrong, and it could cost you big. A new tax year means new tax codes. They affect your take-home pay, yet it's your responsibility to check. If wrong, it can mean nasty surprises. Use our Tax Code Calculator to check yours is right. Martin: 'Pls help stop people who are suicidal being harassed by creditors. People in hospital due to severe anxiety, depression and other tough mental health conditions struggle enough without heavy-handed creditors pushing them. My Money & Mental Health charity is campaigning with MPs to get them breathing space, helping their recovery and improving the chances they'll repay one day. Agree? Pls sign this letter to the Chancellor.'

|

| |

|---|

| Warning. Mortgage rates are RISING - so if you're gonna fix GO QUICK For mortgages, the only way is up, it seems. Last autumn you could get a 2yr fix for just 0.99%, in Jan the cheapest had risen to 1.09% and now it's 1.29%. It's all because the rates lenders pay to borrow have risen, largely due to expectations the base rate - the official Bank of England borrowing rate - will go up in May. Yet many can protect themselves by acting now to beat further increases. Full help in our Free Remortgage 2018 Booklet, here's our quick step-by-step plan...

|

| New. Top 1yr fixed savings - 1.85%. Fixed savings rates have started nudging up again. Wyelands Bank pays 1.85% on a £5k min. Or there's Atom's 1.8% (min £50). For a 2yr fix, Wyelands pays the top rate of 2.15% (min £5k). Full options in Fixed savings. Apple-refurbished iPads up to £80 cheaper than new. Loads of models to choose from, but stock of each is limited. All incl 12mth warranty, new battery, outer shell, accessories & packaging. Refurbished iPads EXTRA 10% off 'best before' clearance groceries, eg, 26p Pepsi. MSE Blagged. Online shop sells discounted food close to or past 'best before' dates, but still safe to eat. Our code makes it even cheaper. Min £22.50 spend + £6 del, so best for bulk-buyers. Approved Food Tube or train delayed in London? New free tool 'auto-claims' refund for you. You won't miss out if you forget to claim. Full details of routes it works on in Tube & train refunds. Naked Wines £35 for 7 bottles (norm £78) and 2 glasses. MSE Blagged. Incl prosecco. 1,500 available for Naked Wines newbies. Pls be Drinkaware. |

| AT A GLANCE BEST BUYS

|

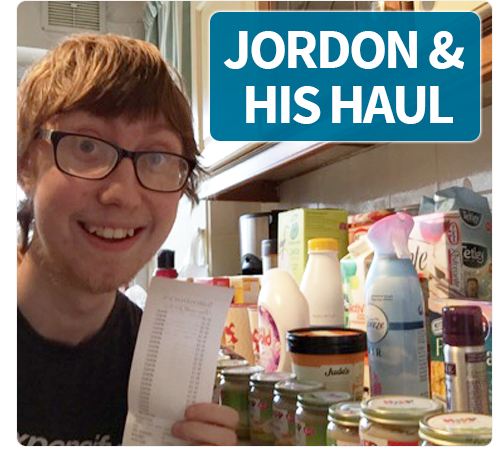

| MSE's Coupon Kid: 'I got £68 of shopping for £5' Can you beat it? We've a trolley-load of couponing tips for huge supermarket savings Our Coupon Kid Jordon has unfortunately spent most of the past few months in hospital because of his Crohn's Disease. But that didn't stop him doing what he does best - hoarding a tonne of coupons. Now thankfully out and on the mend, he's used his stash to get an incredible £68 of shopping for £5, incl nine packs of cat food for free. So can you beat Jordon? There's full help in our Extreme Couponing guide, but in brief...

Also find more top tips in our 34 Supermarket Shopping Tips guide. |

| Free tennis sessions & coaching. 1,500+ Lawn Tennis Association events across Eng, Scot and Wales. Anyone for tennis? REFUNDS GOING BACK TWO DECADES - SUCCESS OF THE WEEK "On your suggestion I queried my council tax banding as my neighbour's was lower than mine. I have just received a refund for the last 19 years as I was in a higher band than I should have been. Thanks." (Send us yours on this or any topic.) Run 26.2 miles for free food... London Marathon freebies. Burgers, pizzas, beer, sushi, free travel and more for runners and volunteers. Fast food |

| THIS WEEK'S POLL Ever asked for a pay rise? Pay is big news, with many bigger companies having to report their gender pay gap. Normally in the consumer world if you're unhappy with something, you should politely complain. We wanted to test whether this applies in the world of work too. Ever asked for a pay rise? Toiletries are the most likely items you'd take from a hotel. Last week we asked what you've taken from a hotel and got 13,000+ votes. Toiletries were the most popular choice, with about a fifth of respondents admitting to stocking up. Biscuits/chocolates were the second most popular, followed by coffee/tea/sugar sachets. Interestingly, roughly 3% would 'treat' themselves to a new towel before checking out. See other items people take from hotels. |

| MONEY MORAL DILEMMA Should I split my winnings and risk my wedding? A friend and I went to the races and he won about £50, which he split with me. On a more recent visit together I won a much larger amount - enough to pay for my forthcoming wedding. He says I should split it with him, but then I won't be able to afford my wedding. Can I get away with giving him a token amount? Enter the Money Moral Maze: Should I split my winnings? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: MoneySaving horror stories... |

|

| MARTIN'S APPEARANCES (WED 18 APR ONWARDS) Thu 19 Apr - Good Morning Britain, ITV, Deals of the Week, 7.40am MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 18 Apr - BBC Cumbria, Money Talks with Ben Maeder, from 6pm |

| QUESTION OF THE WEEK Q: When I go on holiday this summer and pay the hotel bill on my credit card, should I choose sterling or local currency? Malcolm, via email.

We always say to get a top overseas credit card, as you get near-perfect exchange rates from the card provider with no fees, so paying in local currency ensures you're doing it at the best rate. Yet even if you don't have an overseas credit card (er, why?), and have one that charges, paying in local currency is still likely a better option than risking the hotel or retailer doing the exchange for you - we've seen examples of some charging up to 10 times the best rate. For more, see pounds vs euros. Please suggest a question of the week (we can't reply to individual emails). |

| '200+ APPS HAD ACCESS TO MY FACEBOOK DATA' - INCL 'WHICH DISNEY PRINCESS ARE YOU?' That's all for this week, but before we go... after the Facebook privacy scandal, where it emerged millions unwittingly gave apps their data (see how to stop third-party apps accessing your data), MoneySavers were amazed to learn how many had access - 200+ in one case. Many were also embarrassed to learn of the wacky apps they'd given permissions to, incl 'Which Disney princess are you?' and 'Which Beyoncé song is your anthem?' Tell us your story in our Facebook privacy post. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email firstdirect.com, bank.marksandspencer.com, mbna.co.uk, santander.co.uk, moneysupermarket.com, confused.com, gocompare.com, comparethemarket.com, directline.com, aviva.co.uk, admiral.com, sainsburysbank.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Registered number: 8021764. Registered office: One Dean Street, London, W1D 2EP. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment