|

| - | - | - | - | - |

| |

|

|

|---|

| DON'T believe the fake ads on Facebook |

| Interest rates HELD... for now. What savers & borrowers need to know Got savings, a mortgage or need a loan? A rate rise this year is still likely... so check you're on the best deal NOW The Bank of England kept the base rate - the official interest rate which impacts savers and borrowers - at 0.5% last Thursday. It's been there or lower for almost a decade. Yet while savers heaved another huff of despair, and borrowers a sigh of relief, the Bank's governor, Mark Carney, said it was still likely rates would rise this year (though he's said this before without a rise). So we're in a holding pattern where it's time to get your finances in order...

|

| Can you beat sky-high airline baggage fees by POSTING your luggage? Several firms ship suitcases abroad (or home if you've shopped a lot). Eg, sending a family's bags to Spain could cost £64, vs up to £105 on a budget airline. See how it works and when it wins in Post your baggage. £32 of No7 beauty products for £12. Incl primer, nail polish, mascara etc. Boots No7 Warning. Ryanair's cutting its free check-in window AGAIN. Hits new AND existing bookings. Get it wrong and you could be charged £55/seat. Ryanair check-in help New. MOT rules are getting stricter from Sun. Full info and tricks to cut the cost in our updated Cheap MOTs guide. 20% off Family & Friends Railcard - great if you have kids. Normally £30 for 1yr - code gets it for £24. Railcard gives 1/3 off most fares for up to 4 grown-ups when travelling with 1-4 kids, who get 60% off. Family & Friends Railcard New. Shift credit card debt to 32mths 0% (1.4% fee) & get £25 cashback. A balance transfer card repays existing credit and/or store cards for you, so you owe it instead, but at 0% interest. HSBC (eligibility calc / apply*) now offers new cardholders 32mths 0% for a 1.4% fee (min £5) with £25 cashback. You'll need to transfer £300+ within 60 days, but shift up to £1,785 and the cashback cancels out the fee. Always pay at least the min each month and clear the card before the 0% ends or it's 19.9% rep APR. More options in Balance Transfers. |

| |

|---|

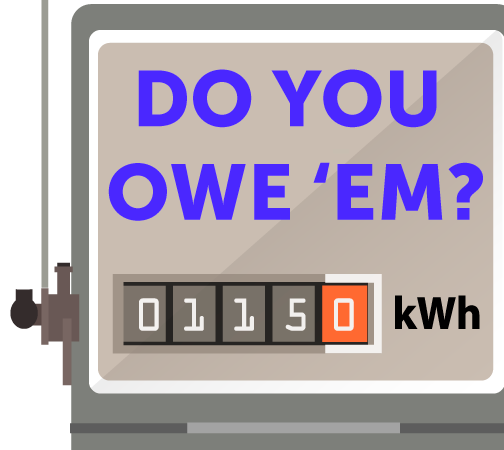

| Many in energy credit getting £100s back - but what if you owe cash? After last week's email, we were swamped with monthly direct debit payers who discovered badly-estimated bills meant they were owed cash - such as Chris, who tweeted: "@MartinSLewis, I got a £350 rebate and my energy bills lowered by £49/mth. Keep up the good work." To see if you're owed, read Martin's 'Now's the time to reclaim energy credit' blog. However, credit is, of course, the yin to debt's yang - and if you find you owe money, focus on it urgently. Here's how...

|

| FREE MSE Mental Health & Debt booklet - updated for 2018. It's Mental Health Awareness Week. Sadly those with mental health issues are 4x more likely to be in debt crisis. If you or someone you know is impacted, download our free 44-page Mental Health & Debt 2018 booklet. Virgin Mobile's raising prices. 1.6m hit from July - see if you can leave penalty-free. Virgin rights TWO pairs of glasses £17 delivered. MSE Blagged. Via code at Glasses Direct. Ends Mon. Spec-tacular £25 beauty box with contents worth £123. MSE Blagged. Incl Murad eye serum, Origins moisturiser etc. 1,000 avail Hit by TSB's IT meltdown? More customers now getting compensation - eg, 'I got £73 back'. See full help and how to claim in our TSB online banking problems guide. Tesco clothing codes - up to 25% off. Min £50 spend. Valid on everything, incl school uniform, baby clothes and sale items. Online-only, till Sun. F&F codes |

| AT A GLANCE BEST BUYS

|

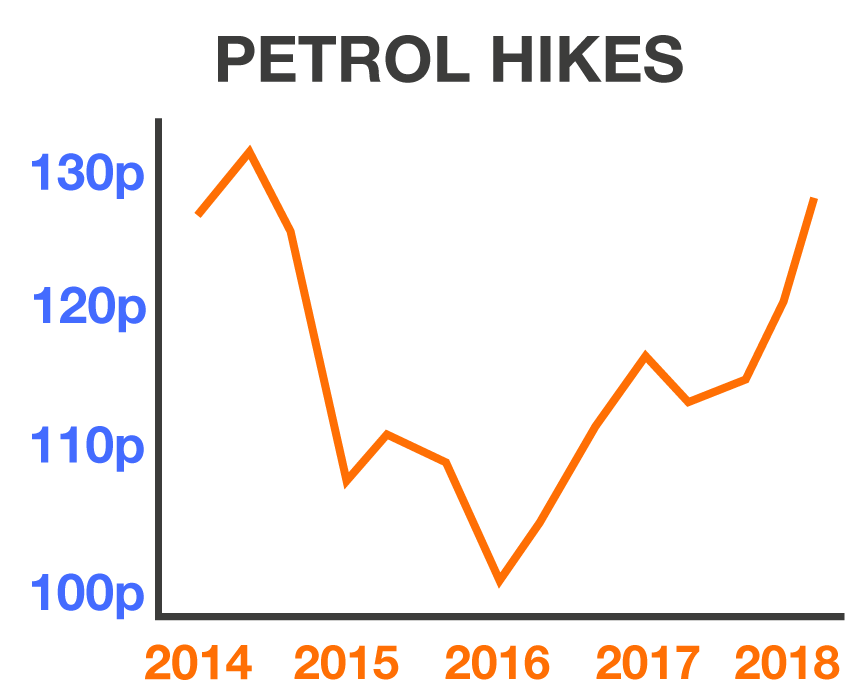

| Petrol prices nearing FOUR-YEAR high - cut costs by 30%+ Surging oil prices are pushing up what you pay at the pump. Here's how to fight back The cost of petrol and diesel is climbing. The average price of unleaded is up 3p/litre in the last month alone, and the RAC predicts that because oil prices worldwide are rising, it could hit 126.5p/litre next week - the highest average price since Oct 2014. Yet there are easy ways to drive down costs. Full help in our Cheap Petrol & Diesel guide, but in brief...

For more ways to cut driving costs, check out our guides on Motoring MoneySaving, Cheap Breakdown Cover and Cheap Car Insurance. |

| Karen Millen 25% off EVERYTHING code. MSE Blagged. Incl sale items. Online & in stores till Sun. Karen Millen £3,100 PPI WIN - SUCCESS OF THE WEEK "Thanks for badgering about PPI reclaims. I eventually followed up on three old credit cards using your free service. Got £1,600 from one, £900 from another, £600 from the third. Great result." EXTRA 25% off code for discounted, out-of-date (yet safe) health foods, eg, 50p dairy-free milk. MSE Blagged. Ltd stock. Full explanation in Love Health Hate Waste. |

| CAMPAIGN OF THE WEEK Make sure your everyday maths skills add up on National Numeracy Day. Take this quiz and then check out the recommended resources that can help you improve or challenge yourself further. |

| THIS WEEK'S POLL Is it time to revalue Britain's council tax bands? In England and Scotland your council tax band depends on your home's value in 1991 (Wales 2005), when the last valuation was done. However, redoing it would likely see widespread changes to valuations and risk some paying substantially more (others less). Should we revalue council tax bands? The vast majority of you are worth MORE than you owe. In last week's poll, we asked you to calculate your net worth (or net debt) - excluding mortgages and student loans. Over 6,700 of you responded and unsurprisingly, older groups reported a greater net worth than their younger counterparts. The 50-64 age group fared particularly well, with over a quarter claiming a net worth of £500,000+. Encouragingly, fewer than a fifth of all respondents are in debt. See full how much are you worth? poll results. |

| MONEY MORAL DILEMMA Should I ask my boss to pay up for carpooling? My boss (who doesn't drive) often asks me for a lift to work. It only adds a few miles to my journey but the cost over a year is a fair bit. He obviously earns a lot more than me and has never offered to contribute to fuel costs. Should I risk asking him? Enter the Money Moral Maze: Should I ask my boss to pay up for carpooling? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: Anyone else in the £50k+ club? |

|

| | |

|---|

| MARTIN'S APPEARANCES (WED 16 MAY ONWARDS) Thu 17 May - Good Morning Britain, ITV, 7.40am MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 16 May - BBC Cumbria, Money Talks with Ben Maeder, from 6pm |

| QUESTION OF THE WEEK Q: I'm still with British Gas because I'm nervous about switching to a smaller supplier, even if it's cheaper. How can I check if a smaller firm's customer service is up to scratch? James, via email.

To help find them, use our Cheap Energy Club's 'Superb' or 'Good or Better' customer service filters. These only show tariffs from suppliers with decent feedback in our customer service polls based on at least 50 votes. If you're still put off switching, at least make sure you're on your supplier's cheapest tariff, by using our 'My Current Supplier' filter. Please suggest a question of the week (we can't reply to individual emails). |

| HOW WILL YOU REPLACE THE WET WIPE? That's all for this week, but before we go... it seems the trusty wet wipe is set to get the chop in an attempt to limit plastic waste in the UK. We took to Facebook to find out if there are any cheaper or greener alternatives, and you had a few ideas. Biodegradable substitutes were popular and many suggested a reusable flannel - but hats off to the MoneySaver who says she crochets her own. Tell us your favourite wet wipe substitutes in ourFacebook post. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email autoaidbreakdown.co.uk, santander.co.uk, natwest.com, uk.virginmoney.com, hsbc.co.uk, americanexpress.com, nationwide.co.uk, sainsburysbank.co.uk, bank.marksandspencer.com, admiral.com, zopa.com, ratesetter.com, mbna.co.uk, moneysupermarket.com, confused.com, comparethemarket.com, gocompare.com, directline.com, aviva.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 2EP. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment