|

| - | - | - | - | - |

| |

|

|

|---|

| DON'T believe the fake ads on Facebook |

| 7 airport rips-offs to beware (and how to beat 'em) Drop-off charges, sky-high parking prices, hideous exchange rates, costly water and more... So you've packed the suitcases and dug out the passports. But if you're heading to the airport in the next few days (or weeks), watch out - it's easy to shell out much more than you need to before you even leave the tarmac. To help, here are our top 7 airport MoneySavers:

|

| £99 of No7 beauty for £30. Contains cleansers, bronzer, mascara, lip balm, nail polish etc. No7 beauty box New trick: Spend £1ish to get 2for1 at 1,000s of restaurants FOR A YEAR. This is all about manipulating the new Meerkat Meals promo - works at Zizzi, Pizza Hut, Frankie & Benny's, independents etc. Meerkat trick New. Broadband & line rental for 'just over £10/mth' from BT-owned Plusnet. Its on/off promo is back - it's one of the top-rated providers for customer service. See how the deal works in '£10.41/mth' Plusnet. Martin's drugs bust watched by 7.5m people. Martin's This Morning attack on big pharmaceutical company rip-offs went viral on Facebook last week, with huge views and 100,000+ shares. See Martin's drugs bust video and his 6 top tips for cutting medicine costs in his new blog. Ends TODAY. Get £12-off Build-A-Bear voucher - making some bears £2. It screwed up last week - to make amends, until 11.59pm today (Wed) it's offering everyone £12-off vouchers, valid until Fri 31 Aug. See how to get a bargain Build-A-Bear, plus full details of what went wrong in our Build-A-Bear stuffs up news story. 20% off Family & Friends Railcard code. Get a 1yr card for £24 (norm £30). It gives 1-4 grown-ups a third-off most fares when travelling with 1-4 kids, who get 60% off. Railcard code |

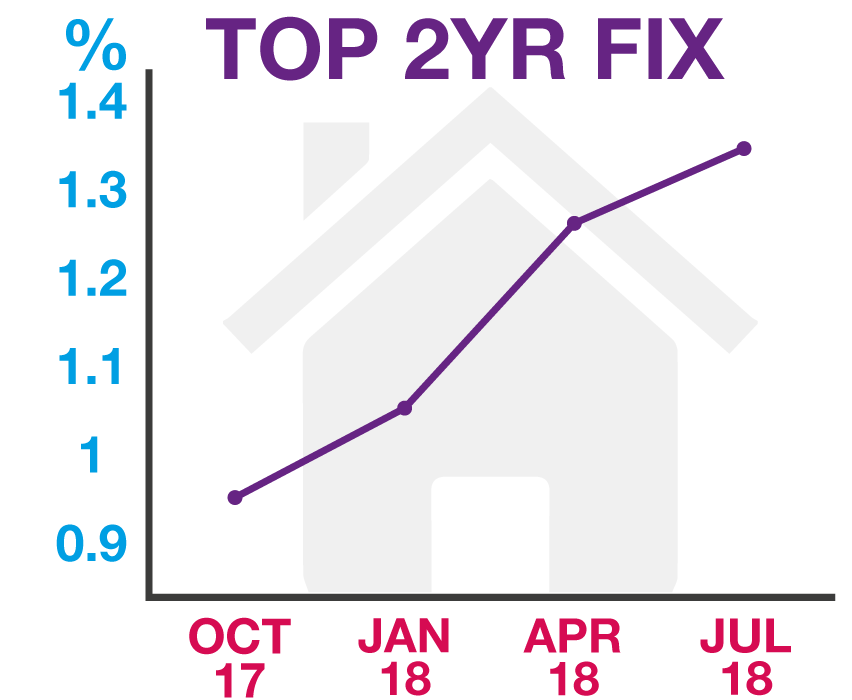

| Check your mortgage NOW as rates are rising - don't pay £1,000s extra The cheapest new mortgages (for new & existing mortgage-holders) are getting more expensive largely because there's been a growing consensus among analysts that the Bank of England will put interest rates up in August, with one poll finding 80% of economists expect a rise. That would mean repayments rise for anyone on a standard variable rate (SVR), with a 0.25 percentage-point rise equiv to £15/mth per £100,000 of outstanding mortgage. To protect yourself, check now if you can slash costs with a new deal in case they get even pricier. Some can save £1,000s, as Karen found: "I moved from a SVR to a fix. By keeping my monthly payments the same, I knocked 9 years off the mortgage term, saving £54,000. Thanks." See full help in our free Remortgage 2018 Booklet, but in brief:

|

| School's out... 100+ cheap or free summer holiday ideas. Incl £3ish cinema, 2for1 theme parks, free activities and more. Keep 'em busy Trains chaos: Gt Northern, Thameslink, Northern & TransPennine giving up to a MONTH'S fare back as compensation. Many season ticket holders will get £100s. See when and how you can claim. Cheap Sim-only deals, eg, 1.5GB data & 2,000 mins for £6/mth. We've rounded up the best deals incl two from well-rated Plusnet (uses EE's network) for big talkers. Pay £6/mth for 1.5GB* or £10/mth for 6GB*, both with a generous 2,000+ mins & unltd texts on a 30-day contract. Full info & more offers, incl cheaper with fewer mins, in Sim-only Deals. £30 of FREE drinks, incl FIVE free pints. See how MSE Becky got £30's worth of free drinks, and you can too - incl booze, soft drinks, tea and coffee - via apps and sign-ups. Free drinks (pls be Drinkaware). Special SSE tariff, cheapest Big 6 energy deal - many can save £270+/yr. There were originally 9,000 switches avail and they've gone, but we've bagged an extra 2,000 (ends Fri 20 Jul) - so use our Cheap Energy Club's 'big name' comparison before they all go to see if the tariff wins for you, or do a full comparison if you just want the cheapest across all firms. |

| AT A GLANCE BEST BUYS

|

| Renew your tax credits NOW - don't wait until the 31 July deadline If you get tax credits, you should have received a renewal pack in the post (let HMRC know NOW if you haven't). You might not need to send it back, but don't ignore it - if details are wrong, you could be forced to repay cash you've already spent. For full info, see Tax Credit Help - here's what you need to know...

|

| New. Top graduate accounts 2018 - up to £3,000 0% overdraft available. Find the best account for you post-uni. Grad accounts 2018 Extra 20% off eBay outlets code, works on 20 brands incl AO, Google & Samsung. Ends Thu. eBay code POTHOLE RECLAIM - SUCCESS OF THE WEEK: "In February my son incurred costs for pothole damage to his car. We heard today the council's offering a settlement of £1,004. Thank you for your pothole reclaim tips which we followed exactly." (Send us yours on this or any topic.) In the saddle for summer? Check if you need bike insurance. Our guide has all you need to know, incl whether home insurance is enough. See our Cheap Bicycle Insurance guide for wheelie good tips. |

| THIS WEEK'S POLL Employed or self-employed - how much do you save in a pension? In the last few years up to 10 million more people have started saving into private pensions due to auto-enrolment. So we wanted to know how much you and/or your employer (where relevant) contribute towards your pension. Employed or self-employed - how much do you save in a pension? The vast majority are UNHAPPY with Brexit negotiations. Last week, a massive 25,000 of you voiced your opinion on how you now feel about Brexit. While most stand behind their original vote to leave or remain in the EU, one in 10 who voted 'leave' now wish to remain, while only 3% of Remainers wish to leave. Tellingly, over 80% of BOTH camps say they're 'unhappy' with how negotiations are progressing. See full Brexit poll results. |

| MONEY MORAL DILEMMA Should I sell something my friend gave me for free? A friend gave me an expensive juicer as it was too complicated to use and she wanted rid of it. When I started using it I realised why, as it takes more effort and cleaning than the result is worth. Is it unreasonable to flog it and keep the money? Enter the Money Moral Maze: Should I sell something my friend gave me for free? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: Wipe out savings paying off card? |

|

| | |

|---|

| MARTIN'S APPEARANCES (WED 18 JUL ONWARDS) Thu 19 Jul - Good Morning Britain, ITV, Deals of the Week, 7.40am MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 18 Jul - BBC Cumbria, Money Talks with Ben Maeder, from 6pm |

| QUESTION OF THE WEEK Q: I've heard having multiple current accounts can damage your credit score - is that true? Gillian, via email.

Multiple applications are unlikely to make a big difference to your overall credit score. But if you're worried, it's best to space them out and hold off on opening new accounts if you're about to make a big credit application, such as a mortgage. For more info on managing and improving your score, see our Credit Scores guide. Please suggest a question of the week (we can't reply to individual emails). |

| WHAT HAPPENED WHEN A SPAM PPI FIRM COLD-CALLED MARTIN... That's all for this week, but before we go... like everyone else, Martin Lewis has had his fair share of spam texts and calls from PPI firms over the years. But what's it like to dial up the founder of MoneySavingExpert to give him the PPI sales spiel? This week a lady who cold-called Martin years ago finally 'fessed up - and shared her side of the ultimate "Don't you know who I am?" story. Read exactly what happened in Martin's new blog post. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email sainsburysbank.co.uk, mbna.co.uk, tescobank.com, zopa.com, admiral.com, paybyfinance.co.uk, santander.com, holidayextras.co.uk, looking4.com, skyparksecure.com, bookfhr.com, plus.net, confused.com, moneysupermarket.com, comparethemarket.com, gocompare.com, directline.com, aviva.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

MSE Naomi's A: Simply having multiple current accounts won't damage your credit score on its own, but your score can be negatively impacted if you frequently open new accounts. This is because every time you apply for a new account, you'll be 'hard-searched' - which temporarily marks your credit file. Also, breaching your overdraft limit or being in the red long-term may adversely affect your credit score.

MSE Naomi's A: Simply having multiple current accounts won't damage your credit score on its own, but your score can be negatively impacted if you frequently open new accounts. This is because every time you apply for a new account, you'll be 'hard-searched' - which temporarily marks your credit file. Also, breaching your overdraft limit or being in the red long-term may adversely affect your credit score.

No comments:

Post a Comment