| Hi - here are your latest deals, freebies, tricks and messages to help you save.  THE TOP TIPS IN THIS EMAIL

| | The summer holidays are over (boo) Back to school, back to work, back to saving... 18 tips, tricks and hacks Flight delay reclaiming, childcare help, free photo prints, uniform tax rebate, currency buyback & lots more Happy New (school) Year. Millions of kids are donning uniforms this week - while many in Scotland have been wearing them a while. As the holidays are over and the treadmill of work has restarted for many (if you got a break at all), we've compiled a host of ways to save to ensure that even if the heartstrings are yearning for sun, at least we're protecting the purse strings... - Was your flight delayed or cancelled this summer? You may be due £100s back. See our flight delay & cancellation rights.

- 10 school uniform hacks, incl £15 worth for 'free'. See our uniform savings.

- Putting on your uniform ready for work - are you due £100s worth of tax rebates? Claiming is easy, see uniform tax refunds (no need to pay anyone).

- Digital isn't for everyone, how to get FREE photo prints. If you've been on holiday, to a summer wedding or just want to put 'em up, see how to get FREE photo prints.

- About to pay for childcare or after-school clubs? Save 20%. If you're a single parent who works, or a couple where both parents work, check out the Govt's tax-free childcare scheme (or if you claim universal credit, you could get back up to 85% of childcare costs).

- New job? Find out what you'll take home with our income tax calc. Try the income tax calc.

-

Picking up your missed payslips? Check your tax code, it could be worth £1,000s. Holiday returnees' desks, lockers and inboxes may be full of payslips. If so, check for your tax code. It dictates how much your employer should be taking off you and MILLIONS ARE WRONG. Use our free tax code calc to find out. Hannah did: "Checked my tax code - it was wrong for years. HMRC just sent a cheque for £6,000+. Thank you for the prompt to check." By law, it's your responsibility to check. Picking up your missed payslips? Check your tax code, it could be worth £1,000s. Holiday returnees' desks, lockers and inboxes may be full of payslips. If so, check for your tax code. It dictates how much your employer should be taking off you and MILLIONS ARE WRONG. Use our free tax code calc to find out. Hannah did: "Checked my tax code - it was wrong for years. HMRC just sent a cheque for £6,000+. Thank you for the prompt to check." By law, it's your responsibility to check.

- Diarise when your annual travel insurance ends - if you've holidays booked, you need to restart cover the next day. If not, you risk being uninsured if something happens that then means you can't go away. To find the cheapest, see our guides...

- Cheap annual travel insurance

- Cheap over-65s' travel insurance

- Cheap pre-existing medical condition travel insurance

- FREE financial education textbook - for you or your kids. Last year, Martin funded 340,000 copies of the first ever curriculum-mapped textbook in schools. It's available as a free 150-page PDF download for anyone who wants it. Many grown-ups learn from it too.

- Got holiday currency left over? Use the 'friends buyback' method. Holiday currency buyback is usually at a poor rate. Instead, if you've leftover cash try and find a friend, family member or colleague who's going where you went. Then use a site such as XE.com to find the main market rate and swap at that. You get a better rate than buyback and they get a better rate than buying.

- Don't know anyone who needs your currency? Use our buyback tool. Our TravelMoneyMax buyback tool shows where to get the most bang for your buck, euro etc.

- Overdrawn? See if you can shift direct debits to a few days BEFORE you're paid. Move them towards the end of your working month (eg, if you're paid on the 25th, aim for a few days before), leaving you overdrawn for less time (or at least a lesser amount) to cut costs. Also see Cut Overdraft Costs.

- How long's left on your passport? Less than 6mths? Renew now if going to Europe shortly after Brexit. If there's a no deal, it's likely you won't be allowed into Europe if you've less than 6mths left. See passport help.

-

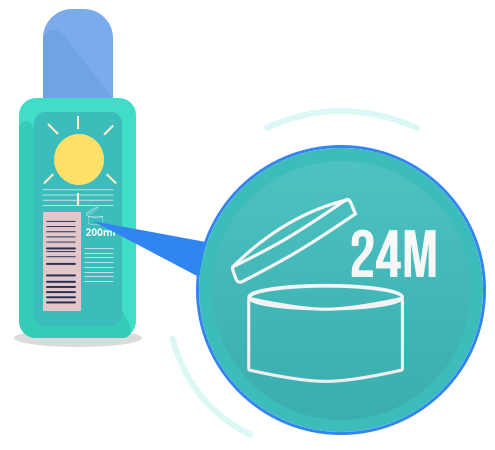

Don't throw open sun cream away - it may last two more years. There should be a number (eg, 12 or 24) on the back or underside of the bottle next to an image of a lid. The number denotes how many months since opening you can use it for (so write on it when you opened it). Don't throw open sun cream away - it may last two more years. There should be a number (eg, 12 or 24) on the back or underside of the bottle next to an image of a lid. The number denotes how many months since opening you can use it for (so write on it when you opened it).

- Heading to uni? Bag £100 and £1,000 0% overdraft with the top-pick student bank account. There are lots of bribes flying around to lure students in. Full analysis in our Student Bank Accounts guide.

- Don't get back into costly habits, it's the perfect time to kick 'em and save. If you always buy, let's say, a coffee at work, but didn't on holiday, it may be time to quit and save. Use our Demotivator to see the true cost.

- Is it worth booking a summer 2020 holiday now? It's not cut and dried, but booking a whole year ahead can be MoneySaving. See When's the best time to book your holiday?

- Time to start saving for Christmas (if you haven't already). While we like to avoid using the C-word so early, it can cost families as much as a holiday. So don't try to pay for it out of December's salary alone, start putting cash aside now which is better than being in debt after (and you could consider banning unnecessary presents too). See more saving for Christmas tips.

| | DON'T believe the fake ads on Facebook

Lots of scam ads that litter social media lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | New. Top balance transfer: 29mths 0% (2.75% fee) PLUS £20 cashback STOP paying interest on existing credit or store card debts - check now if you can shift them to slash the cost  A balance transfer is where you get a new card to pay off other credit or store cards, so you owe it instead but at 0% - you're debt-free quicker as repayments clear the debt rather than any interest. We've been telling you for months 0% lengths have been shrinking, and while that ain't changing, at least this week there's the return of a couple of decent cashback deals. So if you pay card interest, now's a good time to check what you can get. A few tips, then the best-buys... A balance transfer is where you get a new card to pay off other credit or store cards, so you owe it instead but at 0% - you're debt-free quicker as repayments clear the debt rather than any interest. We've been telling you for months 0% lengths have been shrinking, and while that ain't changing, at least this week there's the return of a couple of decent cashback deals. So if you pay card interest, now's a good time to check what you can get. A few tips, then the best-buys... - 'Up-to' cards mean you may get a shorter 0% if accepted. Others give more certainty.

- Go for the lowest fee (factor in cashback) in the time you're sure you can repay in. Unsure? Play safe and go long.

- Find cards most likely to accept you BEFORE you apply. The cards below also include a link to our Balance Transfer Eligibility Calculator. It shows your odds of being accepted before you apply, and doesn't affect your creditworthiness. | BEST 0% NEW-CARDHOLDER BALANCE TRANSFER CARDS | | CARD | 0% LENGTH (1) | FEE (2) + CASHBACK | | New. MBNA (eligibility calc / apply*) | Up to 29mths (20.9%) | From 2.75% (3) + £20 cashback if shifting £1k+ within 60 days | | Virgin Money (eligibility calc / apply*) | 29mths (21.9%) | 3% | | Barclaycard (eligibility calc / apply*) | Up to 28mths (19.9%) | 1.75% (4) | | New. MBNA (eligibility calc / apply*) | Up to 26mths (20.9%) | From 1% (3) + £20 cashback if shifting £1k+ within 60 days | | Sainsbury's Bank (eligibility calc / apply*) (5) | Up to 20mths (20.9%) | None | | (1) Rep APR after 0% deal ends in brackets. (2) As a percentage of debt shifted. (3) Sadly, it charges a higher fee for some with worse credit scores - up to a max 3.49%. There's no way to know before applying. (4) Initial 3.5% fee, half of which is refunded within a couple of days of the transfer. (5) RBS & NatWest customers can get a longer 0% fee-free card from them. |

With lots of very similar cards, which is best? Here's Martin's take: "It's complex, which is why I'd push you first to do an eligibility check, to see which card is most likely to accept you, as that trumps everything (especially with non 'up-tos'). "As for picking, it's all really close so don't overly worry, all of these will save you large compared to paying interest. Yet if you want to nerdily number crunch, let's suppose you've a great credit score so can get the best deal on all cards. If you'll repay in under 23mths go no fee, unless you're transferring £1k-£2k when the 26mth 0% MBNA card wins due to the cashback. Need longer? I'd go for the longer MBNA for £1k-£2k shifted, otherwise Barclaycard." Always follow the Balance Transfer Golden Rules. Full info in Best Balance Transfers (APR Examples). a) Never miss the min monthly repayment, or you could lose the 0% deal and it'll cost far more.

b) Clear the card or balance transfer again before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate and withdrawals hit your creditworthiness.

d) You must usually balance transfer within 60 or 90 days to get the 0%.

e) You normally can't transfer a balance between two cards from the same bank (the case for all cards above). | Boots trick - £80+ of beauty products for £20, incl L'Oreal, Maybelline & Rimmel. This is hot as it's one of its beauty box freebies, but this time you can get it for buying already DISCOUNTED cosmetics. Boots trick STOP PRESS: British Gas has just cut its cheapest price - it's now £260/yr lower than its and others' standard tariffs, and EXISTING custs can get it too. The new BG Energy Plus Protection Green Sep 2020v2 locks in the cheap rate for a year, and including the MSE £25 dual-fuel cashback, it's on average the cheapest Big 6 deal. It's available to new and existing dual-fuel customers paying by monthly direct debit (not in NI), but ONLY via comparison sites (incl via the link above), not direct. Click the link for full info and to see how it compares. Martin: 'PPI's over, but now you may be due £100s of tax back on PPI payouts.' Whether you're one of the likely 500,000 who started a reclaim via us last week before the deadline, or you've already had a payout, check whether you're going to be due tax back in Martin's PPI tax reclaim blog. £10-£25 theatre tickets for Hamilton, Harry Potter, Fleabag, Matilda etc? Big West End shows offer cheap tickets to the lucky, but go quick. For Fleabag, the last draw closes today (Wed) at 11.59am. MSE Holly got lucky: "I only entered once and got brilliant Fleabag seats for £15 each." Can you win the theatre lottery? 'Free' wills in Nov - but you should book 'em now. There's no fee, but it's hoped you leave a charity donation. Book a 'Will Aid' appointment now as the scheme fills up quickly. New. Free £150 RBS bank switch bribe + 2% cashback on bills (worth £200+ in yr 1). RBS now pays a £150 bonus to switchers on most of its current accounts - after you pay in £1,500. Its RBS Reward* account also gives 2% cashback on household bills for a £2/mth fee if you keep paying £1,500/mth, leaving an avg gain of £60/yr after the fee. Or get the £150 bonus on the fee-free RBS Select*. Full eligibility info and alternatives in Best Bank Accounts. | A whopping 11m are out of contract on broadband and line, and almost all are massively overpaying. To help, there are three hot, short-lived deals on right now, two from oil giant Shell (which bought out First Utility last year), which is no doubt trying to use its deep wells to boost market share. Yet there's no infrastructure change, as like most providers it's using BT lines. If you want even faster broadband, Vodafone has a corking deal...

Links go via our Broadband Unbundled tool to check your eligibility, as deals are postcode-dependent. Plus you can use it to find alternatives. | TOP BROADBAND AND LINE DEALS FOR NEW CUSTOMERS (1) | | DEAL | EQUIV COST (2) | HOW IT WORKS | Shell

11Mb | £10.74/mth

Ends Fri | MSE Blagged. Via our special Shell link, you pay £16.99/mth and automatically receive a £75 bill credit in late Oct, making it an equiv £10.74/mth over the 1yr contract. | Shell

35Mb fibre | £16.74/mth

Ends Fri | MSE Blagged. Via our special Shell link, you pay £22.99/mth and automatically receive a £75 bill credit in late Oct, making it an equiv £16.74/mth over the 1yr contract.

| Vodafone

63Mb fibre | £17.45/mth + 'free' Echo Dot

Ends Tue 9 Sep | You pay £23/mth for this 18mth Vodafone contract, but you can claim a £100 Amazon, Currys, John Lewis or M&S vch. If you'd have spent it anyway, the price is an equiv £17.45/mth. In addition, you can claim a 'free' Amazon Echo Dot speaker. | | (1) You're a 'new customer' if you don't have broadband with the provider now. (2) To compare, we use 'equivalent prices' - adding all fixed costs, deducting vouchers & averaging it over the contract. | - What broadband speed do you need? Standard avg 10/11Mb speed is usually fine for browsing or light streaming. Faster fibre is best for streamers, gamers or if many use it at once in your home. Yet even with fibre there are speed differences, and the faster you go, the more of a luxury it is.

- Will I get the average speed? The figures quoted are what at least 50% of customers get at peak times. Most big providers will also tell you the min speed you'll get before you sign up - see how to check your speed.

- In or around Hull? As you'll know, you can't get these as you're likely stuck with KCOM, which has an effective monopoly in your area. Sorry we can't help - it's one for your MP.

| Tell your friends about us They can get this email free every week | MARTIN'S WARNING TO ANYONE 16+ WHO'S NEVER OWNED A HOME: 'Help to Buy ISAs close in 3mths. Put £1+ in or risk missing free £1,000s'

The easiest, simplest form of help for first-time buyers to build a deposit closes to new applicants on 30 Nov - now less than 3mths away. First-time buyers saving in Help to Buy (H2B) ISAs get a 25% boost from the state, so each £1,000 saved becomes £1,250. So if you may one day want to buy a home, consider opening one now with £1+, as then the facility stays available until 2029. The H2B ISA's replacement, the Lifetime ISA (LISA), also gives a 25% boost - but other terms differ, so choosing a winner is complex... The easiest, simplest form of help for first-time buyers to build a deposit closes to new applicants on 30 Nov - now less than 3mths away. First-time buyers saving in Help to Buy (H2B) ISAs get a 25% boost from the state, so each £1,000 saved becomes £1,250. So if you may one day want to buy a home, consider opening one now with £1+, as then the facility stays available until 2029. The H2B ISA's replacement, the Lifetime ISA (LISA), also gives a 25% boost - but other terms differ, so choosing a winner is complex... -

Can you get one? To open a H2B ISA you just need to be 16 or older, but LISAs can only be opened if you're 18-39 (so those near that 40th birthday should open one ASAP). A first-time buyer is defined as someone who's never owned or part-owned a property anywhere worldwide. As ISAs are individual products, you can qualify even if you're buying with someone who's owned before. Both first timers? You can have one each (and one can be H2B, one a LISA). -

Help to Buy ISAs v LISAs. You can open both, but you can ONLY get the 25% homebuyer's bonus on one. For full info, see the full H2B ISA or LISA guides, but for now, let's get them ready to rumble... - The LISA bonus is potentially £1,000s bigger. You can save up to £4,000/tax year in LISAs. Yet with H2B ISAs you're limited to £1,200 in month one, then up to £200/mth after that. So max both out from today for just over 18mths and you'd have £4,600 in H2B (generating a £1,150 bonus), but £12,000 in a LISA (generating a £3,000 bonus).

- LISAs let you buy a property valued at up to £450,000. With a H2B, it's a lower max of £250,000 (or £450,000 in London). With both, they can only be used with a residential mortgage (ie, not buy to let).

- The H2B bonus is triggered faster. As quickly as 3mths after opening, but you can only use the bonus on the LISA if you have had it open for a year before you buy.

- H2B is no risk, as it lets you withdraw penalty-free whenever you want. Yet with LISAs, withdraw for anything other than a first home (or retirement when aged 60) and there's an effective 6.25% penalty.

- The top H2B ISAs pay higher interest. See Top H2B ISAs and Top LISAs, though if a LISA is right for you, if you've enough savings to max or near max it out, its far bigger bonus makes up for the lower interest. In summary... if you're 18-39, will definitely buy a qualifying home and won't buy within a year, go for a LISA for the bigger bonus. If you're older, need to buy quickly or aren't 100% sure you'll buy at all, a H2B ISA is safer. -

Consider putting £1 in (possibly both) now just in case. Think you'll need these but aren't sure? Just put £1 in a H2B ISA by 30 Nov or you lose the opportunity. LISAs don't have an end date, but have the 'it must have been open a year to use the bonus' rule, so £1 in now gets that clock ticking. If both are open, you can decide later which is best.

Important: If you're ready to start saving, and want a H2B ISA, then as you can save up to £1,200 in a H2B in the first month, and only £200/mth after, it's best to wait until you've the max amount to open it, as long as it's before 30 Nov. - They're a great way to save for older children. If your kids are 16+ for a H2B ISA, or 18+ for a LISA, the bonus means these are a great place to give them money to save in if you have it.

| How my yoga retreat nightmare turned into a free holiday. MSE Becky's dramatic story of sun, sea & survival - luckily, with a happy ending and a rather MoneySaving twist. See My yoga holiday from hell. SUCCESS OF THE WEEK:

"Thank you for your help online regarding renewing breakdown cover. I spoke to the AA and it took all of four minutes to reduce my cover by a whopping 50%."

(Send us yours on this or any topic.) Applications for MSE Charity grants are now open. Mon saw the start of our charity's latest grant-giving round. We're offering up to £7,500 to non-profit organisations that teach people money skills. This round is focusing on supporting people going through life-changing circumstances, eg, bereavement, homelessness or relationship breakdown. You can apply via the MSE Charity website, where you can take a quiz to see if your organisation's eligible. But be quick, as the round closes when it accepts 40 applications or on Fri 27 Sep, whichever is first. | THIS WEEK'S POLL Should the contactless spending limit be increased? Two in five debit card payments were made using contactless last year. Yet at the moment, the maximum amount you can spend using contactless is just £30 (barring some using Apple Pay), which is done to cap spending if someone takes your card. So where do you think the contactless limit should be set? The vast majority of you are worth MORE than you owe. Last week, we asked you to calculate your net worth or debt (excluding mortgages and student loans). Over 8,800 of you responded, and encouragingly only 14% said they were in overall debt. Unsurprisingly, older groups were generally better off than their younger counterparts, with a third of over-65s sitting on a net worth of £500,000 or more. See the full how much are you worth? poll results. | McDonald's - Free cheeseburger for new app users

Lego - Free £5 Lego at monthly in-store workshops

Matalan - 'Free' school uniform for Topcashback newbies

Virgin Wines - Six bottles £27 delivered (norm £56ish)

SpeckyFourEyes - £30 Ted Baker or £20 Levi specs | | | MARTIN'S APPEARANCES (WED 4 SEP ONWARDS) Thu 5 Sep - Good Morning Britain, ITV, 7.35am

Fri 6 Sep - This Morning, ITV, from 10.30am

Fri 6 Sep - The Martin Lewis Money Show roadshow at The South West Motorhome Show 2019, The Showground, Shepton Mallet, from 11.30am

Mon 9 Sep - This Morning, ITV, from 10.30am

Mon 9 Sep - BBC Radio 5 Live, Lunch Money Martin, 12.20pm MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Fri 6 Sep - BBC South West stations, Good Morning with Joe Lemer, from 5am

Mon 9 Sep - TalkRadio, Breakfast with Julia Hartley-Brewer, 9.45am

Tue 10 Sep - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, 2.20pm | QUESTION OF THE WEEK Q: My wife and I have a joint current account. Is it possible to switch to another bank as a couple, or does it have to be as individuals? Philip, via email.  MSE Rosie's A: You can indeed switch as a couple. Just open a joint account with the bank you want to move to and tell it you want to switch your old account. Note that you can't switch a joint account to an individual account, so make sure your new account's a joint one. For full info on account switching, including how you can get up to £150 in cash or up to £180 in vouchers, see Best Bank Accounts. MSE Rosie's A: You can indeed switch as a couple. Just open a joint account with the bank you want to move to and tell it you want to switch your old account. Note that you can't switch a joint account to an individual account, so make sure your new account's a joint one. For full info on account switching, including how you can get up to £150 in cash or up to £180 in vouchers, see Best Bank Accounts. A note from the MSE team: Rosie's sadly just left us after 4yrs of top work at MSE - good luck at drama school, Rosie. You'll be missed. Please suggest a question of the week (we can't reply to individual emails). | ONLY 111 SLEEPS TO GO - SO HAVE YOU STARTED CHRISTMAS SHOPPING? That's it for this week, but before we go... MSE Molly got a shock last week when she found out her parents are already doing their Christmas shopping, so we've been asking MoneySavers if they've started stocking up for stockings. Turns out many have, either doing a bit each month to spread the cost or getting in really early to pick up bargains in 2018's Boxing Day sales. Others think it's far too early though, with one insisting: "The C-word shouldn't be mentioned until after Bonfire Night". Let us know where you stand in our Christmas shopping Facebook post. We hope you save some money,

The MSE team | |

No comments:

Post a Comment