| Hi - here are your latest deals, freebies, tricks and messages to help you save.  THE TOP TIPS IN THIS EMAIL

| | Warning. Don't wait till the last min to buy car insurance. The PERFECT time is 20 to 26 days ahead, cutting typical costs by 40%

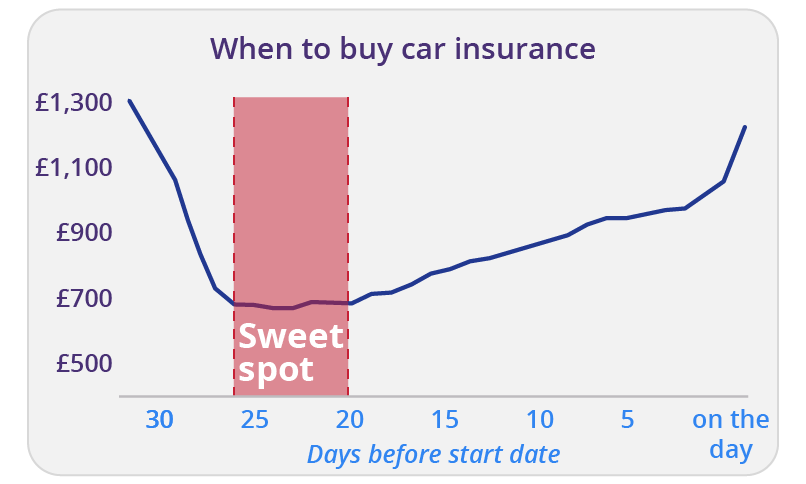

For years we've been refining our system on how to get the cheapest car insurance. In summer 2018, after analysing more than 18m car insurance quotes, we told you the perfect time to get it was 21 days before renewal. Now we've redone the analysis, with over 50m quotes (courtesy of Compare The Market, Confused.com and MoneySupermarket) and we now think you've a six-day sweet spot, from 26 to 20 days before renewal, where you'll find the cheapest price - after that, prices rise steadily. This isn't about the price from your existing insurer - that's your renewal quote (and is generally expensive and should be avoided). This is about getting quotes as a new customer. A policy that costs an avg £1,218/yr on renewal day would be just £672/yr 24 days ahead - statistically the cheapest day. That's £546 less.  And following this works in practice. We've had many people reporting successes to us, such as Hayley: "Renewed 3wks early after your tip. It's gone from a renewal price of £108/mth to £51/mth [saving £684/yr]. Checked the comparisons later and it went back to £100. Happy." Wondering why this happens? It's all about risk... One big factor in car insurance pricing is 'actuarial risk' - where insurers set prices based on the likelihood of claims, using data from millions of drivers' claims history. Some of these - car type, address, occupation - are well known. Yet the Financial Conduct Authority's recent insurance report said some firms employ more than 400 rating factors - many of which are hidden (we're working on finding them out). That's why we examined lots of data to find the pattern. When we first revealed this 'days before renewal' effect, thankfully some insurers were open about it. LV told us: "Our historic claims data shows riskier drivers get their policies nearer to renewal." And it really is as simple as that. Drivers who leave it until the last minute are statistically riskier, therefore they pay more. Of course by telling you, there's a chance we'll subvert future risk charts, as some riskier drivers may now do it earlier. But even if we did move the market so much, it'd likely take years to filter through. We'll keep redoing the analysis to be on top of it. How far away from your car's renewal are you?

- Renewal fewer than 30 days away? Aim to get a quote 3-4 weeks before, but if you've missed the sweet week, then just do it ASAP. Here's what to do...

- Combine comparison sites to speedily find your cheapest. There's no single cheapest insurer, as prices differ for all. So plonk your details into comparison sites and in seconds they check dozens of quotes each. But they don't all cover the same insurers or even give the same price per insurer, so use as many as you've time for.

Our current order's MoneySupermarket*, Confused.com*, Compare The Market* & Gocompare* (see how we rank them).

- Check hot deals comparisons miss, incl free £60 M&S voucher. Some deals aren't on them, eg, £60 M&S vch from Age Co* (vouchers come within 120 days of buying a policy).

Plus you won't find big insurers Direct Line* or Aviva* on comparison sites - they're worth a check. For full details, see hot deals comparisons miss.

- Check multicar policies if you've more than one car in your home. Some insurers offer discounts if you insure more than one motor in your household with them, but there's no hard and fast rule as to whether individual or multicar policies are cheapest. The only way is to check, see multicar discounts. - Check multicar policies if you've more than one car in your home. Some insurers offer discounts if you insure more than one motor in your household with them, but there's no hard and fast rule as to whether individual or multicar policies are cheapest. The only way is to check, see multicar discounts.

Michael emailed us: "I saved £416 breaking up with my daughter. Our 'multicar' policy wanted £1,255 to renew. Going separate ways, I got mine for £249, my daughter's for £490."

- Do the counter-logical car insurance checks. Comprehensive may be cheaper than third party, as some insurers see you as a lower risk. Plus adding a responsible second driver can cut costs - especially if you're a young driver (but never lie and say they're the main driver if they're not - that's fraud). See more cost-cutters.

Tom tweeted: "Thank you #martinlewis. Insured my elderly father on my young driver's insurance. Just instantly saved £200."

- Check for extra cashback. Once you've found your cheapest insurance, you may be able to get extra money back from cashback sites (do this at the end of the process though - and check prices, as you may get more expensive quotes). See car insurance cashback.

- Don't want to switch insurer? Haggle. This works best at renewal. Simply find the best deal using the tips above and ask your provider to beat it. See our haggling tips.

- Nowhere near renewal but unhappy with your price? You don't have to be at renewal to switch. If you haven't claimed, you can usually cancel your policy for a £50ish admin fee (factor that in) and get the rest of the year refunded. Just follow the steps above to check.

You will miss out on a year's no-claims bonus, but if it means big savings it can be a winner, as Iain tweeted: "I just saved £375 by changing car insurance MID-POLICY - thanks @MartinSLewis."

The key is to set your new policy to start 24 days after you get the quote to get the best price. Full help in switching mid-policy.

- Nowhere near renewal and can't be

ars.. bothered to check now? DON'T WAIT for them to get in touch, put 26 days before your next renewal in your diary now. ____________________________

How to HALVE your broadband costs & speed it up Martin Lewis Money Show, ITV, 8pm Mon

Over to Martin: "This week, the lead story is all about slashing broadband costs. Over 8m homes are out of contract and overpaying. So I'll take you through how to save, and in some cases this can be £500+/yr. Plus more on saving for your kids to go to uni. You can't afford to miss it." | | DON'T believe the fake ads on Facebook

Lots of scam ads that litter social media lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Martin: 'Who should you vote for in this Thu's general election...' If you don't use your vote, don't complain about what they do after. They've had their say, now it's time for yours  It's the biggest consumer decision most will make this year. Who governs impacts the money in your and everyone else's pockets - never mind the fact it can change the whole flavour of our society. Unless you're a party loyalist, the decision isn't easy - you need to factor in Brexit, your local candidates, party policies and their leaders. This time the choice is more stark than I can remember - with huge waters between the parties. It's the biggest consumer decision most will make this year. Who governs impacts the money in your and everyone else's pockets - never mind the fact it can change the whole flavour of our society. Unless you're a party loyalist, the decision isn't easy - you need to factor in Brexit, your local candidates, party policies and their leaders. This time the choice is more stark than I can remember - with huge waters between the parties. If you're undecided, let me help. While many have asked for my view, that's not right. Just like my favourite holiday may not fit your bill, my priorities may not be yours. So instead I want to help ensure your vote reflects your view... - Find out which parties' policies match your views. A few clever tools, that attempt to be independent, can help. For Eng only, (as Plaid/SNP not included) I like Who should you vote for? For speed, just answer a few questions and it maps your views to the closest major party. For Eng, Scot & Wales, try Vote for Policies, which does it by letting you pick your favourite manifesto. Of course you can read the manifestos yourself, and then look at Full Fact's fact-checked manifestos for Tory, Lab, Lib Dem & SNP policies.

- Check up on your local candidates. In our voting system you elect a local MP. To find your candidates, enter your postcode at Who can I vote for?, where you may find info on them. You can also find your most recent former MP's (none of them are MPs now) voting record at TheyWorkForYou or contact most of them via Tweet your Candidate.

- The MSE Leaders' Debate 2019 - find out what they promise to do (or not do) on housing, income, mortgage prisoners, money & mental health, rail fares, social care and more. Last Wed, we launched our own MSE Leaders' Debate - where all the major leaders (except Nigel Farage, who didn't respond to requests) answered the big questions about the pounds in your pocket. Search via party response or subject-by-subject.

- Want to vote tactically? If your preferred party has very little chance in your constituency, you may want to vote tactically to avoid your most-disliked party winning. There are a range of tactical voting online tools and sites to help you. Yet many of these have an agenda, so as we're trying to stay impartial, I'll let you find those yourself.

- Take your kids to the ballot box. A general election is a time to celebrate and educate your children about our democracy. So why not #takeyourkidstovote and show them the process? I've already posted my vote, but I got mini MSE to do it with me, explained what it meant and to pop the letter in the postbox to feel a part of it.

- You DON'T need your polling card to vote. Having it speeds up the process, but you can just give your name and address, as staff will have your details if you're registered (although in NI you need photo ID). If you don't know where your polling station is, contact your local authority.

- Can't face voting? The right for all to vote was hard fought for. As a last resort, at least go to the polling booth and spoil your ballot (ie, scrawl a line through it) to register a protest - a far stronger message than not voting.

PS: Join me at @MartinSLewis for election-night chat. | £4+ Christmas theatre - via a top secret route. A special site sells last-min unsold seats (mainly London, but at a few other places too) at dirt-cheap prices, but only if you agree to keep hush so you don't upset people who paid full whack. You normally must wait months to join, but it's instant via our link: Top-secret tix. Related: £10+ Jan/Feb West End tix Warning. Easy-access savings deals dropping like flies. Bag 1.45%... while you can? Three weeks ago, there were four truly easy-access rates above 1.4%, now there's one - Marcus* at 1.45%. After, it's Saga at 1.4% and Post Office* at 1.38% - all min £1, AER variable and they come with fixed 1yr bonuses, so rates will drop after (diarise to switch then). Full details of each account and other options in Top Savings. £30 Soap & Glory 'Sweet Tin-tations' body care set (norm £60). The set is one of the Boots 'Big Deals' (formerly 'Star Gifts') MoneySavers wait for each year. This time it includes lip gloss, mascara & body butter. Soap & Glory £156 of No7 make-up & skincare for £39. Like Soap & Glory above, the No7 set is a Boots 'Big Deal' many look out for - this year it includes day & night cream, mascara, face masks & more. No7 set 20,000+ free winter water pipe and tap protectors in Eng & Wales - could save you £1,000s in repairs. Nine of the 22 water firms are giving away free insulation for 'em (so not all can get 'em). They can be vital, as pipes can freeze and burst when it's very cold. Check if you qualify for pipe protection (100,000s of water-saving freebies avail too - full info in the link.) Alert. HSBC, First Direct & M&S Bank to hike overdraft rates to a HUGE 39.9% - how to beat 'em. For when they hit, more info and how to switch to a 0% overdraft, see hike alert. | Last chance cheap Big 6 energy this decade?

Scottish Power & SSE have killed their cheap deals - Brit Gas, EDF & E.on likely to follow - switch and save £300/yr while you still can

Energy firms have annual switching targets, so the Big 6 firms have been pumping out cheap deals in the last month to meet 'em. Yet two have just pulled their deals, so their cheapest tariffs are now up to £270/yr MORE on typical use. We think it's because we're at the final deadline for this year's targets (switches can take 21 days). If so, expect the other Big 6 firms to follow. So if you haven't switched yet, do it ASAP, or it may be the next decade (ie, January) at the earliest before they relaunch deals, meaning an extra month's higher bills at this high-use time... The savings below are compared to the £1,178/yr cost of the avg Big 6 standard tariff with typical use:

-

The cheapest deals save you £340/yr, but check their service rating. Your cheapest depends on how much you use and where you live. That's why we always suggest you do a whole of market comparison, yet among the very cheapest deals are firms with poor customer service ratings or those with little feedback, so use our good service filter to get rid of them. The cheapest deals save you £340/yr, but check their service rating. Your cheapest depends on how much you use and where you live. That's why we always suggest you do a whole of market comparison, yet among the very cheapest deals are firms with poor customer service ratings or those with little feedback, so use our good service filter to get rid of them. - Big-name cheapest - British Gas & EDF save £300/yr. EXISTING CUSTOMERS can grab 'em too. Many of you tell us you want to avoid smaller firms, and the good news is some biggies still have cheap deals, which are all 1yr fixes. Here they are below - the savings mentioned factor in the £25 MSE dual-fuel cashback you get via these comparison links (but not direct). You CAN'T get any of these deals by calling 'em, only via a comparison site.

- British Gas for NEW & EXISTING customers - save £301/yr. The British Gas Energy and Boiler Cover Jan 2021 incl 100% renewable elec (not gas) and 1yr's 'free' boiler insurance for dual-fuel customers only. Smart meters are required, though it'll install them for free if you don't have meters already.

- EDF for NEW & EXISTING customers - save £295/yr. The EDF Simply Online 1 Year Fix Dec20v5 is for dual-fuel and elec-only custs. Smart meters are required, though it'll install them for free if you don't have meters already.

- E.on for NEW customers only - save £294/yr. The E.on Fix Online Exclusive v21 comes with 100% renewable elec and is for both dual-fuel and elec-only customers. There's no smart meter required. For lots more help, see our Cheap Gas & Electricity guide. | Tell your friends about us They can get this email free every week | Pound at 2+yr high vs euro - should you buy currency before Thu's election?

Martin says: "Currently £1 buys €1.18. Being straight, it's because the markets seem to have factored in a Tory majority, and all that implies, including a likely Brexit deal. While the markets are - rightly or wrongly - generally anti-Brexit, I suspect this result is seen as a soft positive, as it'd end some uncertainty (which they don't like) and reduce the short-term chance of a no deal (which they also don't like). Martin says: "Currently £1 buys €1.18. Being straight, it's because the markets seem to have factored in a Tory majority, and all that implies, including a likely Brexit deal. While the markets are - rightly or wrongly - generally anti-Brexit, I suspect this result is seen as a soft positive, as it'd end some uncertainty (which they don't like) and reduce the short-term chance of a no deal (which they also don't like). "If they're wrong, and uncertainty increases, the pound will likely (no promises) fall. Either way, those travelling soon and worried about fluctuations (who don't have a crystal ball), may want to buy soon-needed currency now, or hedge your bets and buy half now and half when you travel. Now over to the team for how to bag the cheapest currency." If you want to lock in today's rates...

- Find top travel cash rates in seconds. Our TravelMoneyMax Holiday Money Comparison tool compares 30+ bureaux.

- A trick to buy cash now AND protect against big currency swings. A few bureaux let you book rates for collection 7-14 days ahead and let you cancel it for free or for £10. So if rates worsen, you're up; if the rate gets better, just cancel and buy at the new rate. The negative is that these generally aren't the cheapest bureaux. See currency trick for full help, incl the ones to try.

- Top prepaid cards that let you lock in today's rate. You load these cards up with cash, and then exchange to the currency and it's the rate on the day you do that counts. Revolut gives near-perfect rates on euros and dollars on weekdays and it's free for newbies via our link. For more options, see Top Prepaid Cards.

If you want near-perfect rates EVERY time you spend abroad...

Specialist overseas debit and credit cards don't add the usual 3% 'non-sterling exchange fee', so you get the near-perfect Mastercard/Visa rates - in every country. For regular travellers, this is the 'no-brainer' option. Put one in your purse/wallet and use it every time you spend overseas. Full info in Top Travel Cards, but in short: Our long-term top pick is the Halifax Clarity Mastercard (eligibility calc / apply*), which gives near-perfect rates and has low ATM costs. Santander Zero Mastercard ( apply) is another top pick, though we can't check your eligibility for it. Ensure you repay IN FULL or you pay interest at 19.9% and 18.9% rep APR, respectively, on spending. If you withdraw cash, you'll always pay a little interest at those rates until it's paid off, so try to clear it ASAP to minimise charges. Alternatively, Starling's* debit card has no fees on spending OR cash withdrawals, giving near-perfect rates on both, though you'll need to operate it via an app. It doesn't credit-check you unless you apply for an overdraft (though it will ID-check). You don't need to switch bank to get it. | THIS WEEK'S POLL How much of your Christmas shopping is now online? We've just a couple of weeks to go until the big day - but with reports of shoppers abandoning the high street in favour of online shopping, will you be buying your Christmas gifts in store or online? Medium-sized energy providers beating the Big 6 for service levels. Last week, 4,314 of you responded to our biannual energy customer service poll. Of the firms that received 100+ votes, medium-sized suppliers including Bulb, Igloo, Octopus Energy and Pure Planet largely outperformed the Big 6 for customer service. Scottish Power ranked bottom, while gas-only supplier Zog Energy once again topped the charts. See the full energy service poll results. | Brewdog - Free pint on polling day, UK-wide

Morrisons - Free bag of wonky carrots

Chiquito - £1 tacos (Thu only)

Guinness - Free pint for Apple Pay/Google Pay users

Yo Sushi - 50% off for NHS staff/emergency services | | | MARTIN'S APPEARANCES (WED 11 DEC ONWARDS) Thu 12 Dec - Good Morning Britain, ITV, 7.40am

Fri 13 Dec - This Morning, ITV, from 10.30am

Mon 16 Dec - The Martin Lewis Money Show, ITV, 8pm. See previous MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 11 Dec - BBC Radio Cumbria, Money Talks with Ben Maeder, from 6pm

Mon 16 Dec - TalkRadio, Breakfast with Julia Hartley-Brewer, 9.45am, Oli Townsend

Tue 17 Dec - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, 2.20pm | QUESTION OF THE WEEK Q: I have two bank loans, both at fairly low interest rates, and can afford the monthly repayments. I've recently come into a bit of spare cash - would it be in my best interests to pay one of the loans off in full, or to save the money and continue to pay the loans off as I am now? Caz, via email.  MSE Steve B's A: Only you can answer that question, with one of the key factors being what size an emergency cash fund you'd have left in case you run into problems. MSE Steve B's A: Only you can answer that question, with one of the key factors being what size an emergency cash fund you'd have left in case you run into problems. But we can help on the maths. If the rate you pay on your loan is higher than what you can get on savings, then it's worth you clearing the debt. With the current top easy-access savings paying 1.45%, and top fixed savings only at 2.37%, it's almost certain the loan rate will be higher given the cheapest-ever standard loan rate is 2.7%. But before paying it off, check with your lender if there are any early repayment charges - they're rare these days, but it's worth checking. We've full help in our Repay Debts or Save? guide. Please suggest a question of the week (we can't reply to individual emails). | O CHRISTMAS TREE, O CHRISTMAS TREE. HOW OLD IS YOURS? That's all for this week, but before we go... as many start to deck the halls for Christmas, MoneySavers have been lighting up the MSE Forum with tales of ancient Christmas trees and decorations. One Forumite's tree is more than 31 years old and is still going tree-mendously strong. And one MoneySaver had baubles that were more than 100 years old from their great grandma... fir real. Are your Christmas decorations and trees even older than these? Let us know in our Facebook and Twitter posts. We hope you save some money,

The MSE team | |

No comments:

Post a Comment