| Hi - here are your latest deals, freebies, tricks and messages to help you save.  THE TOP TIPS IN THIS EMAIL

| | How you doin'? 15 MoneySaving tips for couples - it's nearly Valentine's, after all Tax breaks, joint accounts, cinema tricks, diamonds and more It's Valentine's Day this Friday, an over-commercialised and sometimes forced celebration of love. Yet we're happy to use it as an excuse to share some tips to help couples. Here's where love actually can help you to be frugal... -

News. Marriage tax allowance claims to be cut in April - if you're hitched, grab £1,150 NOW. A huge 2.4m couples miss out on an easy tax break, worth £250 this tax year. Plus, you can claim back up to four tax years, as long as you were eligible during that time. As this allowance started in 2015/16, if you don't claim it by this April, you'll lose that first year. News. Marriage tax allowance claims to be cut in April - if you're hitched, grab £1,150 NOW. A huge 2.4m couples miss out on an easy tax break, worth £250 this tax year. Plus, you can claim back up to four tax years, as long as you were eligible during that time. As this allowance started in 2015/16, if you don't claim it by this April, you'll lose that first year.

The allowance applies ONLY to those who are married or civil partners, where one is a non-taxpayer and the other a basic-rate taxpayer. For more, incl how to claim, see our Marriage Tax Allowance guide.

Jonathan emailed us: "After reading your email, I applied for the marriage tax allowance and within weeks an £839 cheque landed. Took 5 mins to apply online. Thank you very much. "

- New top easy-access JOINT savings - 1.35% AER. Marcus* - part of investment giant Goldman Sachs - has been a top-pick account for 18mths. While up until now it's only been for single applicants, on Monday it started allowing joint applicants. Of course, as with all easy-access savings, it has a variable rate, so can change. There are l ots of alternatives in Top Savings incl top fixes.

This is only for new accounts. So if you already have a Marcus account, you can open a new joint one, and move money across from the single one, though some who opened it earlier may be earn ing a higher rate, which can't be transferred to the joint account.

-

Pay £1 for 2for1 cinema tickets or 2for1 at 1,000s of restaurants for a year. The 2for1 meerkat trick gets you the discount on grub from Sun-Thu (not Valentine's Day, sadly) and lets you la, la land this deal on the flicks on a Tue or Wed. Geraint did: "Just got a year's 2for1 meals & movies for £1.01. Thanks, MSE." Pay £1 for 2for1 cinema tickets or 2for1 at 1,000s of restaurants for a year. The 2for1 meerkat trick gets you the discount on grub from Sun-Thu (not Valentine's Day, sadly) and lets you la, la land this deal on the flicks on a Tue or Wed. Geraint did: "Just got a year's 2for1 meals & movies for £1.01. Thanks, MSE."

- Adding your partner to your car insurance can slash costs. If they've a good driving record it can bring the price down - especially useful when adding a responsible older driver if you're young. So better if it's someone as careful as Mary Poppins rather than someone who is fast and furious. Full info and more help, incl cheap multi-car policies, in Cheap Car Insurance.

- You can shift your partner's debt to your 0% card - but think carefully whether you should. The key weapon to cut the cost of existing credit or store card debt is a balance transfer. It's where you get a new card that pays off existing card(s) for you, so you owe it but at 0%. It means more of your repayments clear the debt, rather than just covering interest, so you're debt-free quicker, possibly saving £1,000s.

Acceptance is the problem though. So if your partner is struggling and you have a good credit score, one solution is to shift the debt to your card. Yet this needs careful consideration. Here's what to do:

a) The person with the debt should use our Balance Transfer Eligibility Calculator - which shows the 0% cards they're likely to be accepted for, if any.

b) If they've limited eligibility, then some, but not all, cards allow you to shift your partner's debt to them. So again use the eligibility calc to see what YOU may be accepted for, then look for these brands...

Barclaycard has confirmed it allows this. Virgin Money and Santander may do too - but with both, your partner needs to be added as a second cardholder, and may face a limited credit check.

c) Are you sure you want their debt in your name? Understand if you do this, it's YOUR debt, even if you split up. Please never be forced or guilt-tripped into doing this if it doesn't feel right - read Martin's Financial Abuse Risks guide - IF IN DOUBT, DON'T.

See full info in Best Balance Transfers (APR Examples).

- Plan to buy a first home together? Get TWO 25% boosts. This is a no-brainer for anyone 18-39 planning to buy their first home. With a Lifetime ISA, the state adds 25% on top of what you save, which can mean £1,000s free. If you're in a couple, you can have one each and double the bonus - even if one of you isn't a first-time buyer, the other can still get the boost.

- £60 full service breakdown cover for TWO. Breaking down may be hard to do, but this'll make it that little bit easier. Full cover incl home start and onward travel for you and your cohabiting partner costs £60 for a year with our top pick, AutoAid*. It covers any car you or they drive and can be cheaper than two single AA or RAC policies. See Cheap Breakdown Cover.

-

Make a cashback credit card your friend with benefits - net 5% cashback between you for SIX months. Cashback credit cards pay you for spending. The big payer is the Amex Platinum Everyday ( eligibility calc / apply*), which gives 5% cashback for the first 3mths (max £100) and up to 1% after. Yet couples can get 6mths at 5%. Here's how: Make a cashback credit card your friend with benefits - net 5% cashback between you for SIX months. Cashback credit cards pay you for spending. The big payer is the Amex Platinum Everyday ( eligibility calc / apply*), which gives 5% cashback for the first 3mths (max £100) and up to 1% after. Yet couples can get 6mths at 5%. Here's how:

Kim applies and makes Kanye her second cardholder, so both get 5% cashback to earn when buying clothes. Before the 5% ends, Kanye applies, making Kim his second cardholder to bag another 3mths at 5%. (They must spend £3k+/yr per card to get ANY cashback though.)

Only do this for normal, affordable spending and ensure you set up a direct debit to repay IN FULL each month to avoid the 22.9% rep APR interest, which would wipe the gain. Full help, other options and how to use them in Credit Card Rewards (APR Examples).

- A Power of Attorney is possibly more important than a will. Being blunt, if you die your assets are passed on eventually. Yet if you lose your faculties, without a Power of Attorney your finances can be locked away, unusable to pay for a mortgage, much-needed care etc. It takes a difficult and costly court order to sort it.

A Power of Attorney is an easier option as if you can no longer make decisions, be it after an accident, stroke or dementia, someone you love can take over (don't worry - you can do it so it ONLY happens in such an eventuality). Full help, plus pros and cons, in Power of Attorney.

- Cut the cost of a big, fat Greek wedding (or a small, slimline British one). If you or your partner have popped the question recently (or maybe you'll do so on Valentine's Day...), congratulations. Now see our Cheap Wedding Tips, incl how to save big on the dress, set up a free wedding website and find a reception that costs £1,000. Also, find out if you need wedding insurance.

- If you're going to put a ring on it, nab your diamond ring... with Clubcard points. You can swap Tesco points for a voucher at jewellers Goldsmiths worth three times the value, eg, bag a £600 sparkler for £200 of points. Our Forumites have long used this trick to snap up wedding rings, earrings and even a diamond eternity ring. Full help in Boost Tesco Vouchers.

- Love 'em, live with 'em, but aren't married to 'em? Then get a cohabitation agreement. There is no such thing as common law partners under UK law. If you're married or in a civil partnership you have rights. If you just live together, even if you've been together 20 years and have kids, you don't have those rights.

So if one of you owns the home and the other pays, or you do it jointly, splitting up becomes a nightmare. So formalise it, and it's more romantic to sort out what'd happen when you love each other, than to fight over it if you later no longer do. See cohabitation agreements.

- You can both get up to £400 of travel, phone and breakdown insurance for £114 with a packaged bank account. Paying a monthly account fee can be a waste, yet done right - as a cheap way to buy insurance - it can be fruitful.

Our top-pick packaged account for couples is Co-op Bank's Everyday Extra, as for £15/mth (£180/yr) you get worldwide travel insurance (up to age 79) plus smartphone insurance and UK and European breakdown cover - just add your partner as a joint account holder so they get the benefits too. A couple needing it all could pay up to £400/yr separately.

There's also a trick to get it for £9.50/mth (£114/yr) as its free Everyday Rewards scheme gives you £5.50 back if you go paperless, then each month: stay in credit or within your overdraft limit, pay in £800, log in to mobile or online banking, pay out 4+ direct debits and use your debit card 30+ times.

Full eligibility info and more options, including better cover from Nationwide for families, in Packaged Bank Accounts.

-

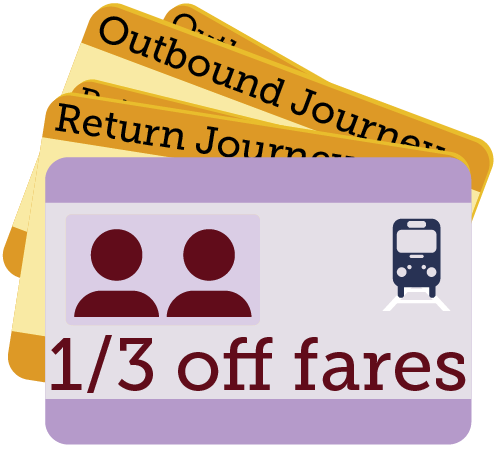

Pair up and get a 1/3 off fares on your love train(s). A Two Together Railcard gives the two named cardholders a 1/3 off most fares if travelling together. It's £30 as standard but there are a couple of tricks to cut the cost. See Cheap Train Tickets for more tips, incl for other railcards. Abi tweeted us: "Didn't know about Two Together - saved £40+ on tickets, thanks." Pair up and get a 1/3 off fares on your love train(s). A Two Together Railcard gives the two named cardholders a 1/3 off most fares if travelling together. It's £30 as standard but there are a couple of tricks to cut the cost. See Cheap Train Tickets for more tips, incl for other railcards. Abi tweeted us: "Didn't know about Two Together - saved £40+ on tickets, thanks."

- And finally... beware getting closer (financially) with a bad credit scorer. Apply for joint mortgages, loans, bank accounts and sometimes utility bills (not credit cards) and your credit files can be linked - regardless of whether you're kissing, living together or hitting your diamond wedding anniversary. So be careful getting joint products if your partner has a poor credit history. See Boost Your Credit Score.

____________________________

Cheap mortgages, how long should things last after you buy 'em & do you understand your tax code? The Martin Lewis Money Show, ITV, 8pm Mon

Over to Martin: "Next week I start with mortgages - it's a superb time to slash costs, as there's real competition out there. Plus, how long should goods last after you buy them? And do you know what your tax code means? (Spoiler: if the answer's no, it could cost you thousands.)

"Last week 3.5m watched, our highest rating of the year. If you missed it, you can watch the car insurance & pension credit show, or read our Car Insurance, Young Person's Car Ins and Pension Credit MSE guides." | | DON'T believe the fake ads on Facebook

Lots of scam ads that litter social media lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Martin: 'Want to shift all debts into one simple cheap loan? I'll tell you how, though it's far from my first suggestion'

I'm a clinical person. I like clinical solutions. Yet life isn't always binary (NB: There are 10 types of people in this world - those who understand binary and those who don't). Ease, practicality and peace of mind matter too. Recently, on my debt help TV show, Jo told me she wanted to consolidate her debt... a clinical person. I like clinical solutions. Yet life isn't always binary (NB: There are 10 types of people in this world - those who understand binary and those who don't). Ease, practicality and peace of mind matter too. Recently, on my debt help TV show, Jo told me she wanted to consolidate her debt... - Should you consolidate your debts? Jo had multiple credit card debts. My instant suggestion was to do 0% balance transfers - where you shift the debts to new cards, but at 0%, to minimise the interest. That means more of your repayment clears the actual debt.

Yet some of her cards were already at 0% and her main issue was that paying multiple minimum repayments was putting a strain on her disposable income. Jo wanted to explore getting a cheap loan over 3yrs, which in her case (not everyone's) would reduce the amount she shelled out each month. She also liked the disciplined structure of a loan's set monthly repayments, and the certain knowledge it'd be clear in 36 months.

So we checked a Loans Eligibility Calc and found a loan at 3%-ish, which cost a couple of hundred quid in interest. While 0% would've been cheaper, she made a rational choice, that she was willing to pay this price for her convenience and peace of mind. While I'm always biased towards the cheapest route, if paying a little more (and her loan was cheap) eases your fears and you've done the calculation, it's a legit choice. So here's quick help...

- Cutting credit card debt, 0% balance transfers are the cheapest route. Our Balance Transfer Eligibility Calc shows which top cards you're most likely to be accepted for. Go for the card with the lowest one-off balance transfer fee (it's a percent of the amount you transfer), within the time you're sure you can clear the debt.

- Joint longest 0%: Sainsbury's Bank eligibility calc / apply* is 'up to' 29mths 0% (2.74% fee) and Virgin Money eligibility calc / apply* is 29mths 0% (3% fee). Sainsbury's fee is slightly lower than Virgin's, yet Sainsbury 0% is an 'up to', meaning some accepted customers get a shorter 0% period, while Virgin's definitely gives all accepted the full 29mths, so if the eligibility calc shows a decent chance with Virgin, it's safer.

- Longest NO-FEE card: If you can pay off quicker, Barclaycard (eligibility calc / apply*) is 'up to 20mths' 0%.

Try to repay a fixed amount each month just like you would with a loan, ensuring you clear the debt before the 0% ends. But be warned: miss a minimum repayment or fail to clear the card within the 0% period and the rates jump to the representative APRs (19.9% for Sains, 21.9% for Virgin/B'card). More info/options: Balance Transfers guide (Rep APR Examples ).

- Cheapest loans to repay existing debts - easy repayment discipline, but not interest-free. With loans, while rates decrease the more you want to borrow, so does your chance of acceptance (as you need decent income as well as a good credit score for big loans). Use our Loans Eligibility Calc to find what your chances are before applying and how much each loan costs at its rep APR. Always minimise your borrowing and repay as quick as you can...

- Cheapest loans. Full info in our Cheap Loans guide, but in brief, for £3,000-£4,999, Admiral* is 8.2% rep APR. For £5,000-£7,499, Hastings Direct is 3.3% rep APR (not in eligibility). For £7,500-£15,000, Cahoot* is 2.8% rep APR.

- 'Rep APR' means some are charged more. All loans are representative APR (see Rep APR Examples), which sadly means only 51% of accepted applicants need to get that rate - the rest can be charged more, with no max - and you usually only find out by applying.

- Looking to shift existing loans? It can be complex - see our existing loan switching guide and calc. | Alert. £17 million worth of Tesco Clubcard vouchers EXPIRE in Feb - check yours NOW. Full help incl a trick to extend 'em in Clubcard alert . 20,000+ FREE Ideal Home Show London tickets (norm £16-£22). From 27 Mar-13 Apr, up to two per household. Note: weekend tickets go really fast. Full info on how to grab them in Free Ideal Home tix. British Gas, E.on, Octopus and more cut prices - SAVE £340+/yr (or just £17 with the price cap). On Fri, Ofgem announced it'd lower the price cap for the standard tariffs most are on from Apr, it then lasts 6mths. That will cut the cost for someone with typical use from £1,179/yr to £1,162/yr. Yet our new top picks include 1yr fixes that are up to £340+/yr cheaper on the same use. This includes picks for those who like big names, eg, there's a new British Gas 1yr fix (inc for its existing custs) that's £330+/yr less than its own standard tariff is likely to be after the cap drops. 26 Amsterdam MoneySaving tips, incl NEW Eurostar returns, bargain bikes and cheap footie tickets. As direct Amsterdam-London train tix go on sale this week, we've 26 'Dam good savers. 'We saved £54 with your new Ryanair bag trick' and 'Thanks, I saved £18 on my Dublin trip - pays for a few pints of Guinness.' We've had some great success stories in since we revealed last week how to save up to 60% on bags and seats. See Ryanair trick. Victory: UCAS stops sending debt ads (for now at least) after MSE's intervention. After a 'robust' meeting with Martin, the uni admissions service has 'paused' emails with ads from private loan firms. See UCAS U-turn. | News: Water bills to be cut slightly (for some), but many can still tap into large savings, eg, 'I'm saving £700/yr with a water meter' We're overflowing with tips, incl how to save with a meter, water freebies & tariffs if you're struggling Water bills in Eng & Wales will drop by an average of 4% from 1 Apr, it's just been announced. In Scotland they'll rise by an average 0.9%. Water is often the forgotten utility, with money dripping out of people's accounts. And because you can't switch firm to save, many think there's little they can do. Yet that's not true - and our Cut water costs guide can help you plug the gaps in your knowledge. Here are the basics... -

In Eng & Wales? Can you save £100s switching to a water meter? Water bills are based on the antiquated rates system, last evaluated in 1990. This is roughly based on how much rent your home could fetch, so the bigger your place, the more you pay. That means big homes with few people in them often overpay, and in Eng & Wales (not Scot or NI) you can get a water meter fitted for free (unless impracticable). So Martin's rule of thumb is... In Eng & Wales? Can you save £100s switching to a water meter? Water bills are based on the antiquated rates system, last evaluated in 1990. This is roughly based on how much rent your home could fetch, so the bigger your place, the more you pay. That means big homes with few people in them often overpay, and in Eng & Wales (not Scot or NI) you can get a water meter fitted for free (unless impracticable). So Martin's rule of thumb is...

If you've more bedrooms in your home than people, or the same number, check if you can switch and save.

The easy way to check is to use a water meter calculator. For some it can be huge, such as Trisha, who emailed: " I considered a water meter years ago when my kids lived at home but it didn't seem a good idea. But I saw Martin on TV talking about meters and checked again now it's just my partner and me - I went ahead and we've been more careful about saving water, with an annual saving of £700."

- Refused a meter? Some with shared pipes or in flats can't 'practicably' have a meter fitted. That isn't the end of it, as you can then ask for an 'assessed charge bill', based on likely usage, which can still save you cash.

- 250,000+ water freebies, low-income discounts, and when to flush. Lots more ways to save, incl...

- 250,000+ FREE water-saving gadgets. Many water firms offer free shower heads, tap inserts etc - they're MoneySaving if you've a meter, and of course green too. See 250,000+ water freebies.

- If it's yellow, let it mellow... That's just one of the golden nuggets (of info) in our 30+ water-saving tips.

- Struggling to pay? If you're in financial difficulty, have a medical condition, or get certain benefits you may be entitled to water bill discounts or grants.

- Can you get a sewerage rebate? If you have a way of draining/storing water such as a soakaway, cesspit, pool or big garden you may be able to claim a rebate worth an avg £35/yr. | Millions of EE mobile customers face March price rises. They'll jump by 2.2%. See EE help . Self-employed or freelance? Do you need a business bank account? Can you just use your personal account, or do you need to go full business? See Self-employed bank account help (incl the best deals). Not sorted Valentine's yet? Do you need to? If so, there are £2 roses, £10 dine-in meals for two & more. Romance is great, but over-commercialised pressure to show your love ain't. Yet if you want to spend, take advantage of the war of the roses to get the cheapest in-store bouquets, plus cheap grub. See last-min Valentine's offers. (Or to give without spending, try our Valentine's gift cheques.) FREE kids book token with a McDonald's Happy Meal, incl Bing's Splashy Story. Swap it for one of 12 free books from authors incl Anthony Horowitz, Greg James and Chris Smith; or £1 off lots of other books. Read all about it Flavourly 48 craft beers for £48 delivered. MSE Blagged. At £1 a can, this is likely to go fast. When we ran a similar deal in Nov, all boxes went in a day. 3,000 Flavourly deals avail, but please be Drinkaware. | Tell your friends about us They can get this email free every week | 'We tried for 2yrs to get flight delay compensation, then used your tool and got £2,500 that evening.' Are you due too? You could be entitled to up to £510 per person for delays in the past 6yrs. Brexit hasn't changed this Under EU rules, if your flight is delayed by 3hrs+, and it's the airline's fault, you're entitled to compensation. Some get £1,000s, such as Paul: "Thanks for recommending your Resolver tool. We tried for a couple of years to get compensation from Qantas for a 48hr delay when travelling to Sydney, but its complaints system is frustrating. So we used Resolver, and via it, Qantas responded that evening, agreeing to £2,500 which we got in a week." See our Flight Delay Compensation free tool & guide, but in brief: -

The key flight delay/cancellation compensation rules. The key flight delay/cancellation compensation rules. - You can claim dating back six years (so currently to 2014). See full claims timeline.

- You must have arrived 3hrs+ late if delayed (see how to check past delay lengths).

- Only EU or UK flights count, defined as any from EU/UK airports, or to EU/UK airports if an EU/UK airline. Which flights count?

- Compensation's fixed, based on delay and journey length. It's between £110 and £510 per person. How much am I owed?

- It must be the airline's fault - bad weather doesn't count, so you can't claim for Storm Ciara. What counts?

- Flight cancelled? You're always entitled to a full refund or alternative flight. Whether you also get compensation depends if it's the airline's fault. See flight delay cancellation rules.

- You're entitled to cash, though some airlines offer vouchers. If that happens, go back to 'em.

- Use our FREE online reclaim tool - don't pay anyone to claim. Our flight delay reclaim tool (in collaboration with complaints site Resolver) uses template letters to draft your complaint, track it and help escalate it to the relevant regulator or resolution scheme if rejected - plus you keep ALL the compensation.

- Is it fair to airlines? Not always, eg, a delay on a £20 flight can cost it £100s. So it's up to you to decide whether to complain or not. For help, see Martin's legal vs moral concerns.

- IMPORTANT. Brexit has not changed these rules. They're based on EU law 261/2004 which still applies during 2020 as we are in a transitional Brexit stage. Even after, they'll apply as they've been written into UK law, though there are questions over how these will interact with EU laws in future.

| THIS WEEK'S POLL Is it OK to use a 2for1 voucher on a first date? It's Valentine's, so time for our traditional poll. Imagine Sam asks Alex to dinner on a first date, offering to pay. When the bill comes, Sam whips out a 2for1 voucher - what advice would you give Alex? Is it OK to use a 2for1 voucher on a first date? Many MoneySavers have (lots of) cash in the bank. Last week, we asked how much you have, or how overdrawn you are, in your main current account. We got a whopping 23,000 responses - and 92% of you said you were in credit, while 28% had £5,000+. Older MoneySavers had the most in the bank, with a quarter of over-65s being £15,000+ in credit. See full bank balance poll results. | Wetherspoon - Main, dessert & drinks for two £20 (Fri only)

Frankie & Benny's - Three-course meal from £18 (Fri-Sun)

Pizza Express - Three-course meal for two £29 (Fri-Sat)

Zizzi - Three-course meal £22 per person (Thu-Sun)

Ikea - Valentine's meal for two (not all stores) | | | MARTIN'S APPEARANCES (WED 12 FEB ONWARDS) Thu 13 Feb - Good Morning Britain, ITV, 7.45am

Fri 14 Feb - This Morning, ITV, 10am

Mon 17 Feb - The Martin Lewis Money Show, ITV, 8pm MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 12 Feb - BBC Radio Cumbria, Money Talks with Ben Maeder, from 6pm; Helen Saxon, autosaving

Wed 12 Feb - BBC Radio 4, Money Box, from 3pm; Guy Anker, broadband switching

Fri 14 Feb - BBC South West stations, Good Morning with Joe Lemer, from 5am; Guy Anker, cutting water bills

Mon 17 Feb - TalkRadio, Breakfast with Julia Hartley-Brewer, 9.45am; Oli Townsend

Mon 17 Feb - BBC Radio Manchester, Drive with Phil Trow, from 5.45pm

Tue 18 Feb - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, 2.20pm | SAY IT WITH... FREE PIZZA? That's it for this week, but before we go... with Valentine's Day just around the corner, we've been asking for your romantic MoneySaving tips. For many, cheap food's the key, whether it's heart-shaped sausages from the reduced aisle or a 'free pizza when you buy a soft drink' deal. One MoneySaver regularly used Clubcard vouchers to pay for wedding anniversary hotels, while another says she uses work benefit discounts for date nights because "those who save together, stay together". Read more and share your own tips on our Romantic MoneySaving Facebook post. We hope you save some money,

The MSE team | |

No comments:

Post a Comment