| Plus... beat stamp price hikes, £143 No7 £39  THE TOP TIPS IN THIS EMAIL

| | Urgent: Act now to lock in £200+/yr savings

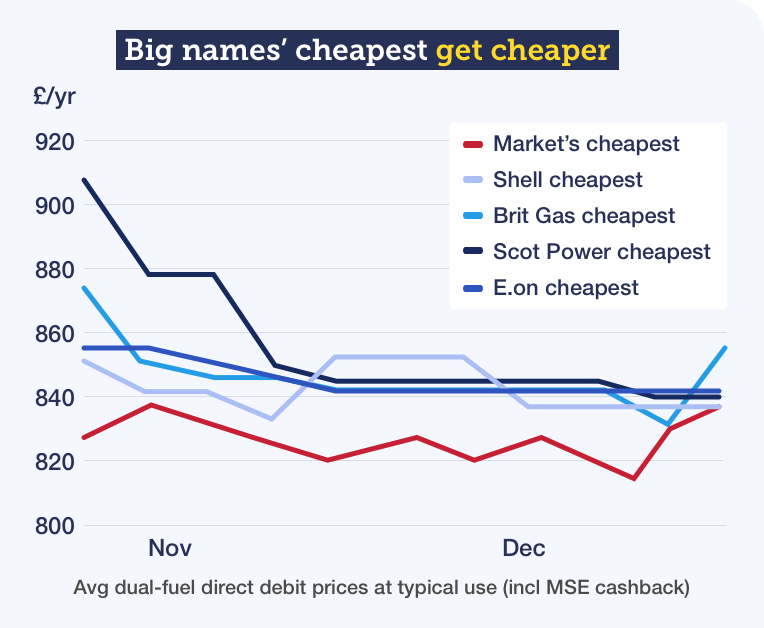

Rare moment - big energy firms now the CHEAPEST, yet top deals disappearing at speed (eg, BG's just gone) Martin: "For five weeks, we've seen some big firms repeatedly shave more and more off their cheap switcher deals, as a price war rages. It's likely this week is the CLIMAX, with Shell, Scottish Power and E.on undercutting all the small firms that normally are cheapest (once you factor in MSE cashback) - meaning big savings. "This isn't due to a drop in wholesale prices (what they pay), but likely as firms have internal customer acquisition targets to hit before the year ends. Yet as a switch typically takes 17 days, right now probably is the last few days of it.

"On Friday British Gas launched a new, even cheaper tariff, but on Tuesday it pulled it and replaced it with one £20 higher, likely as it hit its targets. And if my guess is right (no promises), others may follow suit within days. So if you haven't sorted a cheap energy deal, for safety, PULL YOUR FINGER OUT. Here's the team to take you through it." Find choosing confusing or can't be bothered with the whole shebang? Let us do it for you

Rather than doing a standard comparison, we've two tools that can help. Both look at deals across the whole market, including all those below. - Recommended: Pick Me A Tariff every year (MSE Autoswitch). For those unsure or nervous about switching, this is the best option. Tell us your energy preferences (fixed, name you know, top service, green etc) or just select Martin's default choice.

We then find your top-pick tariff, you switch, then each year when your deal ends, we'll autoswitch you to your new winner based on your preferences with just one click from you to verify.

- Pick Me A Tariff for now. Tell us your preferences the same way, but with no autoswitch after a year, just a reminder.

As prices vary depending on where you live and how much energy you use, all links go via our Cheap Energy Club comparison, so you see your exact winner and saving, which is especially important with prices changing rapidly as they are right now. Note: None of these deals are available direct with providers, they're all 'comparison site only' deals aimed at switchers. THE CHEAPEST ENERGY DEALS

All are FIXED so the rate's locked in (but what you pay varies with usage)

| WHAT MOST PAY NOW: Current energy price cap (applies to 50%+ of homes) on typical dual-fuel use

| £1,042/yr | | Shell Energy 28 Feb 2022 fix. The cheapest tariff & fixed for 14mths. New & existing dual-fuel or elec-only custs | 100% green elec (not gas) | Middling 3.3/5 service rating | £836/yr

(save £206/yr)

| Scottish Power 31 Dec 2021 fix. 1yr fix + 100% renewable elec but POOR service rating. For new dual-fuel or elec-only custs | 100% green elec (not gas) | Smart meters required where possible | Poor 2.2/5 service rating

| £840/yr

(save £202/yr) | | E.on 1yr fix. Cheap big name 1yr fix + 100% renewable elec (NEW CUSTS ONLY). For dual-fuel or elec-only custs | 100% green elec (not gas) | Smart meters required where possible | Middling 3/5 service | £842/yr

(save £200/yr)

| | Info correct at 8pm Tue 8 Dec. Prices based on average dual-fuel costs on typical use across the regions, and include MSE £25 dual-fuel cashback (which we spread across the length of the fix). | Not on direct debit or live in Northern Ireland?

If you don't pay by monthly direct debit, you either can't get the deals above or you'll pay more. Also, unfortunately you can't get these deals if you're in Northern Ireland. However, that doesn't mean you shouldn't act. - Not on monthly direct debit? If you're not on a prepay meter, the best thing to do is to switch to monthly direct debit, as the top deals are only via this payment method. If you're not happy to do that, you can still do a comparison based on your payment method.

- Are you a prepay customer? Try our prepay comparison - savings are smaller, typically £85/yr, but it could still be worth doing. For bigger savings, see if you can switch to a credit meter. See Cut prepay energy costs.

- In Northern Ireland? Our Cheap Energy Club - like all UK comparisons - doesn't include NI, but you can do a comparison via Cheap NI Electricity or the Consumer Council for Northern Ireland's tool.

Here's a quick Q&A - for more, see the full Cheap Energy Club FAQs.

Q. Is switching risky? Could I be cut off? No, as no one visits your home (unless you want a smart meter) and it's the same gas, same electricity and same safety. The only things that change are price and service. See our 'Switching is no biggie' FAQs. Q. Does MSE make money from this? Yes, as like all energy comparison sites, we're paid each time you switch through us, yet we give you roughly half as cashback (that's £25 dual-fuel, £12.50 single-fuel). This is money you wouldn't get if you went direct (not that the deals above are available directly anyway). So it's a win-win. The rest helps cover our costs and hopefully makes us some profit. More switching and energy help in the links below... Switching with smart meters | Why's my price risen when I'm fixed? | Reclaim credit | Switching-in-debt help | Switching if I've solar panels | How direct debits are set | Can I pick a switch date? | How do you compare my rates? ------------------------------------------- 8.30pm Thu, ITV - Martin's Money Show Live

Are you missing out on what you're entitled to? Benefits / tax credits

Martin: "Benefits, tax credits and the entire welfare system is complex. Millions of people, including pensioners, grandparents, parents and carers, are missing out, and the web stretches further than you think. This week, I'll be taking you through it (with the aid of a guest benefits expert). "Plus of course my news-you-can-use - too early to say what that is yet though, and as it's live you can tweet suggested questions on owt you like to @MartinSLewis, but pls use the show's hashtag #MartinLewis. Do tune in or set the VideoPlus." | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | 8 days left: Shift debt to NO FEE 18mths 0%, get a £20 Amazon vch If you can't afford to clear credit or store card debt, you can't afford NOT to try to get a 0% balance transfer With the longest no-fee balance transfer credit card deal, new applicants are sent a £20 Amazon voucher, yet that's ending imminently. A balance transfer is where you get a new card to pay off debt on other cards, so you owe it instead, but at 0%. That means all your repayments clear the debt rather than service interest, saving you £100s or £1,000s. The key is whether you'll be accepted, so go via our 0% Balance Transfer Eligibility Calc, which will show what your acceptance chances are for most top cards. That way you can home in on the right one and protect your credit score. Top 0% new-cardholder balance transfer CREDIT cardS

Go for the lowest fee in the time you're sure you can repay - if unsure, play safe and go for the longest length

| | CARD | 0% LENGTH & FEE

| HOW GOOD IS IT? | Ends Thu 17 Dec

Santander*

Recommended: Check acceptance chances first | - 18mths 0%, NO FEE + £20 Amzn

- All accepted get the 18mths 0% while the vch comes within 90 days

| An easy winner if you can clear debt within 18mths. Provided you clear the card in time, it's totally free, and you get the voucher. After the 0%, it's 18.9% rep APR.

| HSBC

(Applications via eligibility calc)

| - 25mths 0%, 1.5% fee

- All accepted get the 25mths 0%

- 1.5% one-off fee of amount shifted (min £5) | Lowish fee if you need longer to repay. After, it's 21.9% rep APR.

| TSB*

(Not in the MSE eligibility calc) | - 29mths 0%, 2.95% fee

- You get 'up to' 29mths 0%

- 2.95% one-off fee of amount shifted | The longest 0% card (by far), but an 'up to'. So some accepted get 26mths or 23mths 0% depending on credit score, which is still decent. After the 0%, it's 19.9% rep APR.

Note: If shifting large amounts (about £5k+) and you need a long 0%, this Santander card may win.

| Poor credit scorers:

Fluid

(Applications via eligibility calc)

| - 9mths 0%, 4% fee

- All accepted get 9mths 0%

- 4% one-off fee of amount shifted

| Best if no others are likely to accept you. Offers respite from interest, even if you've had a county court judgment 1yr+ ago or bankruptcy 18mths+ ago. But only shift debt to it you can clear within 9mths, as after it's a huge 34.9% rep APR (unless the card you're shifting debt from has a higher rate).

| HSBC and Fluid have asked we send people to our eligibility calc to reduce demand on them.

Full options and more cards in: Best Balance Transfers (APR Examples). |

ALWAYS follow the Balance Transfer Golden Rules. Full explanation in Best Balance Transfers. a) Never miss the min monthly repayment, or you could lose the 0% deal and it'll cost far more.

b) Clear the card (or balance-transfer again) before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate and withdrawals hit your creditworthiness.

d) The balance transfer must usually be done within 60 or 90 days to get the 0% - check your card.

e) You can't balance-transfer between two cards from the same banking group. | What a no-deal Brexit would mean for you - passports, EHICs, house prices and more... See our updated 22 Brexit need-to-knows. New. Top 1.25% easy-access savings via special MSE code. The new Chip+1 app from the autosaving firm pays 1.25% interest, smashing the top normal easy-access savings account at 0.6%. To get it you normally need to be invited, but we've an MSE code to bypass that. As this is far from a normal savings account, read our new 1.25% savings help. Stock up on stamps NOW to beat Jan's up to 14p hike. The biggest rise in 8yrs - see Stamp price help. PayPal's new £9 'inactivity fee' starts NEXT WEEK - how to avoid it. See PayPal help. New. MSE Cheap Mobile Finder: 'I found my new phone for £200 less' - Mary. Last week we launched our Cheap Mobile Finder and more than 100,000 people have already used it. It has four key tools: 1) The new phone (& Sim) finder. 2) The right phone at the cheapest price finder. 3) The best phone deal in my budget finder. 4) The Sim-only finder. As it's new we want to keep improving it, so please send us feedback and report bugs. Spend £10+ and get £5 back at 1,000s of local shops, restaurants, barbers etc via Amex Shop Small. Not everyone with an Amex card will be eligible for this offer - some users say they can't find it and Amex says it's for "targeted card-holders" - but if you can get it, you can use this 10 times for up to £50 back. Of course, ensure you repay IN FULL so there's no interest. It's also a good way to support local businesses during such a tough time. For full info, and how to check if you're eligible, see Amex 'Shop Small'. £143ish of No7 beauty products for £39. Incl mascara, lipstick, serum, cleanser and more. It's one of Boots's 'Star Gifts' and is always really popular with MoneySavers. No7 Star Gift | Martin: 'My five 5-minute reclaims - can you get £1,000s back? Are you married, working from home, a graduate, or do you wear a uniform?'

Christmas is nearing, purse strings are tightening, and people are busy. Many are searching for extra cash. So I've put together five easy ways you could be due money back at speed. There's no need to pay anyone, most are just filling in online forms. Got longer? See the MSE reclaims section for more. No time to chat, let's get on with it... Christmas is nearing, purse strings are tightening, and people are busy. Many are searching for extra cash. So I've put together five easy ways you could be due money back at speed. There's no need to pay anyone, most are just filling in online forms. Got longer? See the MSE reclaims section for more. No time to chat, let's get on with it... - Required to work from home, even for ONE DAY, since 6 Apr? Join the 1.25m who've claimed a YEAR's tax relief. Typical gain: £60 / £120. I started shouting about this here and on my show in Oct, and HM Revenue & Customs told me yesterday 1.25m have heard and claimed since. It's a doddle for most. Full info in my Working-from-home tax back blog.

- Married or in a civil partnership? 2.4m couples missing out on a tax break. Typical gain: £1,188. If one of you pays tax at the basic 20% rate, and the other doesn't earn enough to pay income tax (so less than about £12,500/yr), you're due this easy tax break, this year worth £250 for most. It's backdatable by four years, meaning a total £1,188. As Margaret emailed: "I applied - it took less than two weeks for just over £1,000 to come through. And they amended my tax code. Amazing - thanks, Martin." Full step-by-step help in our Marriage Tax Allowance guide.

PS: I'm afraid you can't get this if you're just living together. It's a Govt policy to reward marriage in the tax system.

- Urgent. Are you one of 1.3m still owed a Power of Attorney (PoA) refund? Typical gain: £45 per application. Between Apr 2013 and Mar 2017 in Eng & Wales, the fee for both health and finance PoAs was £110. Yet it should've been in proportion to underlying costs, and they'd dropped. So even if the person is now deceased, you can easily claim back up to £54 per PoA online. But you must do it by 31 Jan 2021. Full help in Reclaim Power of Attorney refunds.

- Did you start repaying your student loan too early? Typical gain: £100 - £1,000. You are only supposed to start repaying your loan from the Apr after leaving uni (so about 9mths later for most), and even then only if you earn enough. Yet 100,000s of employees had it wrongly deducted from pay packets before then. If so, you can get it back, often with just a phone call. As Franabelle tweeted: "Big @MartinSLewis delivering the money hacks again. I'm getting £530 back in overpaid student loan. Nice little Christmas (but probably not) fund." Step-by-step help in our Student Loan Overpayments guide.

- Wear a uniform to work? You're entitled to tax back. Typical gain: £60. If you have to wear a uniform for work, (even for just one day since 6 April) such as a branded T-shirt or overalls, you wash it yourself and don't wear it elsewhere, you're entitled to a tax rebate. Just fill in a Govt form online. As TTNeb tweeted: "Thanks for the tip @MartinSLewis @MoneySavingExp. We completed the online form for my partner a couple of weeks ago. Got a cheque over the weekend and a new coding notice for him. Got five years back." Full help in Uniform Tax Refund.

| Tell your friends about us They can get this email free every week | SUCCESS OF THE WEEK:

"Thanks for the advice about haggling on breakdown cover. I just told the AA I was leaving and it reduced my joint full cover from £357 to £179."

(Send us yours on this or any topic.) | THIS WEEK'S POLL How much of your Christmas shopping have you now done? There are less than three weeks to go until the big day - and, of course, this year coronavirus restrictions have changed how many of us shop. So is your Christmas in the bag, or are you leaving it until the last minute? Tell us in this week's poll. Bah humbug... most MoneySavers WOULD cancel Christmas if given the choice. Last week, we asked if you would press a CANCEL CHRISTMAS button if it would make the whole thing disappear. More than 10,000 people voted - and a massive 67% of you would like to cancel the festivities (up from 63% when we asked last year). Yet 60% of those with young kids voted to keep Christmas. See full cancel Christmas poll results. | | | Soap & Glory - £30 bath, body & make-up set at Boots

Sainsbury's - 25% off six or more bottles of wine etc

Local Heroes - Free £25 Amazon vch with tradesperson booking

Caffe Nero - Free hot or cold drink on Tue or Wed via O2 Priority

Tails - 80% off 1mth supply of tailored dog food | | MARTIN'S APPEARANCES (WED 9 DEC ONWARDS) Wed 9 Dec - Treasury Select Committee, economic impact of coronavirus, parliamentlive.tv, 2.30pm

Thu 10 Dec - This Morning, phone-in, ITV, 10.55am

Thu 10 Dec - The Martin Lewis Money Show, ITV, 8.30pm

Mon 14 Dec - Ask Martin Lewis, BBC Radio 5 Live, 12.20pm. Listen again MSE TEAM APPEARANCES (SUBJECTS TBC) Sun 13 Dec - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 10am

Mon 14 Dec - BBC Radio Manchester, Drive with Phil Trow, from 2.25pm

Tue 15 Dec - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.20pm | WHAT SORT OF CHRISTMAS TREE DO YOU PINE FOR? That's all for this week, but before we go... 'tis the season to deck the halls, and with trees popping up in homes across the country, we want to know how much you spend on yours. Many MoneySavers told us on our social channels they prefer artificial trees to save splashing the cash each year, while others pay upwards of £30 for a real tree every Christmas. Let us know how much you pay for your Christmas tree on our Facebook post. We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment