| Plus... free £264 Nectar, call 159 for your bank, 50% off Tesco toys, 31mth 0% debt shift  THE TOP TIPS IN THIS EMAIL

| | New. Broadband price war on this week

Save £350/yr on broadband with the cheapest deals we've seen in YEARS

Standard £12/mth. Fibre £15/mth. Both incl line rent

There's no antidote for the bill shock many will feel due to the hike in energy prices. Yet huge swathes of the nation, including 9 million who are out of contract, could recoup more than the extra cost by simply getting a more competitive broadband package.

And if we've said it once, we've said it a thousand times - the way to get cheap broadband is to pounce on cheap short-lived deals. And this week we're seeing cheaper deals than we have for a couple of years. - How much do you pay? Quickly add up your monthly broadband and phone line cost then multiply by 12. Many pay £350 - £500/year. Contrast that with the cheapest deals which are as cheap as £150/year. It's worth checking your current speed too (and see our 8 speed-boosters if slow).

- Use Broadband Unbundled for YOUR best buys. Not all the top deals below are available everywhere, so put your postcode into our Broadband Unbundled comparison to find your cheapest. TOP NEWBIES' BROADBAND & LINE DEALS

Links go via our postcode-driven broadband comparison.

| | DEAL & EQUIVALENT COST (1) | HOW GOOD IS IT? | Ends 11.59pm today (Wed).

Plusnet (BT-owned) broadband & line

10Mb standard '£12.25/month'

MSE Blagged | Cheapest broadband & line deal and good service. Apply via this Plusnet link and it is £18.50/mth on a one-year contract. You are then AUTOMATICALLY sent a £75 prepaid Mastercard within 45 days. Factor that in, and it's equivalent to £12.25/mth.

Service rating: 6.2/10 (good). | Ends 11.59pm Fri.

Vodafone broadband & line

35Mb fibre (fast) '£14.50/mth'

and

63Mb fibre (superfast) '£16.50/mth'

| Cheapest fast fibre deal for FOUR years. Vodafone charges £19.50/mth for 35Mb fast fibre or £21.50/mth for 63Mb superfast fibre. Both are two-year contracts and let you CLAIM (don't forget) a £120 Amazon, Tesco or M&S voucher. If you'd have spent there anyway, factor that in and they're equivalent to £14.50/mth or £16.50/mth.

Service rating: 4.7/10 (OK). | Virgin Media broadband & line

108Mb fibre (megafast) '£19.79/mth'

MSE Blagged | Cheapest megafast deal. Apply via this Virgin Media link and it's £23.95/mth over the 18-month contract, and you AUTOMATICALLY get £75 bill credit applied to your first bill. That gives you 3 months free and makes it equivalent to £19.79/mth. Service rating: 3/10 (poor). | | Deals are for new customers who have not been with that provider for 12 months. (1) To compare, we use 'equivalent costs' - adding all costs, deducting promo credits and averaging over the contract. |

- At least 50% must get the advertised speed at peak times. Plus all these providers will tell you an estimated maximum and guaranteed minimum speed before you apply, and let you cancel penalty-free if your speed doesn't meet the minimum for 3 consecutive days (and they can't fix it within 30 days).

- Switching usually only means about 2 hours of downtime. You're told the switch time in advance and it's often quick. Most won't need an engineer to visit though if joining or leaving Virgin, as it's a different system, it's more likely.

- Most can switch without contacting their old firm. Unless you're on cable, such as Virgin, most home broadband is supplied via the Openreach network (including Plusnet and Vodafone above). If so, just contact the new provider and it should do the switch for you.

It's also just been announced that from 2023 this will be the same for all switches. Regulator Ofcom has put out new supplier-led switching rules that mean all firms will have to operate this, though for now if you're switching to or from Virgin you'll need to let your old supplier know too.  Many are happy with their current service, but unhappy with the price, especially when compared to the list above. Many are happy with their current service, but unhappy with the price, especially when compared to the list above. It is possible to get the best of both worlds, though. Use the prices above as a benchmark (or better still do a comparison to see exactly what is offered in your area - including by your existing supplier if you were a new customer). Then ask it to match it. Broadband providers are easier than most to haggle with... | % OF THOSE WHO TRIED HAGGLING AND HAD SOME SUCCESS | | 1. Sky - 86% | 5. Plusnet - 71% | | 2. BT - 77% | 6. EE - 63% | | 3. Virgin Media - 77% | 7. Vodafone - 55% | | 4. TalkTalk - 77% |

| But right now, you may need patience as some providers are short-staffed due to the pandemic (and never be rude - haggling works best with politeness and charm). See our full 14 tips to haggle down the cost of your broadband. It's not just broadband firms you can save with. Try these tips to save on your TV bill... - Firstly, do you even need to pay? Freeview is, er, free. Ask yourself: "Do I really need the channels I pay for?" If the answer's "no", Freeview may be the best option. It offers 70 channels and 15 in HD. See what you get with Freeview. - If sticking with a TV package, do a channel audit. Work out what you really watch and ditch the rest. For example, are you paying for kids' channels, when yours have since grown up? Only pay for what you watch. - Now see if you can find a cheaper broadband and TV deal. Find the deals and discounts Sky and its competitors offer newbies by using our broadband, phone line and TV deals comparison . If you find one you like, switch. If not, use the prices as a benchmark to haggle with your existing provider(s)... - If you've more than one provider for your broadband, line and TV, check if you can save by combining them. Speak to each provider and see what deals it'll offer you to bring all services together in one package. Then play them off against each other and choose the cheapest. - Want to stick with your TV supplier? At least see if you can haggle a better deal. If you're out of contract or nearing the end, you're in a strong position to haggle. For example, in our Nov poll, 86% of those who tried had some success haggling with Sky, while 77% had success haggling with Virgin. Karen emailed to tell us her stellar saving: "Thanks for your advice to haggle over Sky TV. Was paying £117/mth, now £54/mth, so a saving of £756/yr and they upgraded all rooms to Sky Q." - Be warned - many firms hike prices a little during your contract. In general, firms increase prices in line with inflation each year. If the contract warns you (like Plusnet and Vodafone do), you're stuck with the rise. If not, most (including Virgin) let you leave penalty-free within 30 days. However, such rises tend to be small, often £1-£2/mth, so you won't suddenly be lumped with an expensive deal.

- Want top service? Try Zen. The deals above have good, OK or poor service scores. Yet, if service is important (and price less so), have a look at Zen as it scored 9.3/10 in our broadband service poll. Yet you'll pay extra for the top service - see fibre deals and superfast fibre deals for how Zen compares.

- TalkTalk now offers six months' free fibre broadband to many jobseekers. It's a new scheme run through Jobcentres. Find out who qualifies and how to apply.

- Talk to your provider if you're struggling to pay bills. If you can't switch to a cheap deal - for example, you're in contract - and you're struggling to pay, speak to your broadband provider as soon as possible. It may be able to help you cut costs, or work out a repayment plan.

____________________________

8.30pm Thu, ITV: Martin's Money Show LIVE

Broadband, energy collapse and more...

Over to Martin: "What a whirlwind start to the series last week. Thanks to all 2.6 million people who watched the energy crisis special, making it the most-watched show on TV at that time - sending an important message to ITV and others about how prime-time consumer journalism is needed. "This week I'll be looking at broadband bills, the new tariffs for those whose energy firms have collapsed, and more. Tweet suggested questions to me via @MartinSLewis, and if possible, please use the show's hashtag #MartinLewis. Do watch or set the VHS to record." | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Martin's 3 Energy Crisis Need-To-Knows

1. Energy firm bust (Avro, Green etc)? What now...?

2. Urgent. EVERYONE download energy bills/credit now.

3. All cheap deals pulled. Nowt beats the price cap.  Things are moving at a pace. Staggeringly, since last week's email, two energy firms have gone bust; all deals cheaper than the 1 Oct price cap have been pulled from the market; and the cost of the cheapest 1yr fix rose by typically £200/yr. To hear me talk you through it, watch back my ITV energy special, but in brief, here are this week's key need-to-knows...

1. Energy firm (Avro, Green etc) gone bust? We analyse how much you'll pay now. The regulator Ofgem has now announced the 'supplier of last resort' (which'll take over supply) for all six firms that have recently gone under. We've analysis of the new deal and customer service for Avro, Green, PFP, Utility Point and People's Energy customers.

2. Urgent. Everyone download energy bills / screenshot credit amounts. More energy firms are likely to fail. If / when that happens, customers race online to see their balances, but often fail as the websites have already been shut down. So as a precaution, grab the info now, and regularly during the crisis. While the risk is far lower with the big firms, it's still good practice. Full help in Screengrab your energy credit NOW.

3. All cheap deals have been pulled. Nowt beats the price cap. On Friday (1 Oct) the energy price cap will rise by 12% (13% prepay). For someone with typical use, that's up from £1,138/yr to £1,277/yr (use more and it'll be higher, use less and it'll be lower). This rate applies to those who've never switched, and sets the default for those coming off fixed deals. Over half of UK households are on it. Having always been crap, it's now the cheapest - cheaper than the cost price of energy. There are no switchable deals meaningfully lower. In fact, very few providers even allow switching at the price cap rate.

This new cap will last until 1 April. I would view it as a six-month fixed rate, which you have the freedom to leave whenever you want (hopefully because cheaper deals return).

On 1 April, it is likely the cap will rise substantially again. We know this as the assessment period for setting it has already started - on the current run-rate, the prediction is another 14% hike to £1,455/yr (on typical use). Yet that is still cheaper than today's cheapest fixed-rate deal, E.on's 2yr fix at a typical £1,477/yr. In fact, in this perverse market, the cheapest 1yr fix costs £100/yr more than that. If things deteriorate further, this may look a decent rate with hindsight, but right now it seems a very substantial premium to pay for certainty, and my best guess is, for most, it isn't worth it.

On a prepayment meter? You can still switch and save. The situation is very similar, except there are a few providers with variable rates that undercut the new price cap. The likelihood is they'll raise prices to the cap soon, but you could do a prepayment comparison to save in the meantime.

Struggling to pay bills? There may be help available... Emergency pandemic rules mean your supply can't be cut off and prepay customers can get emergency credit. If you're struggling, let your supplier know you're vulnerable - it may be able to offer payment reviews, breaks or reductions. Those on lower incomes may also be able to apply for £140 towards bills via the 2021/22 warm home discount . More help in our Home & energy grants guide.

Plus, most people (including me) waste energy. We know wearing jumpers, lowering thermostats and not leaving electricals on standby will help, but we don't always do it. Maybe these price hikes may change behaviour. Answers to common questions such as 'Should you keep the heating on all day, or only have it on when needed?' are in our 18 energy mythbusters guide, and there's more help in top thrifty heat-saving tips. | New. For safety, many can now dial 159 to speak to their bank. Some big banks are trialling this, to help stop scams. See how it works and which banks and phone firms are taking part .

Code gets unsold high-street coats, shoes, dresses etc for £4.50. MSE Blagged. De-tagged surplus stock and non-branded items from big high-street names (previously incl M&S, Topshop etc). Ends Sun. Everything5pounds

Best balance transfer deals since 2019 - get 31mths 0%. A reminder of last week's news that this is the best time for years to cut the cost of existing credit card debt. See our best balance transfer deals help. New. Sainsbury's shopper? New in-store Nectar rewards could save you '£200/year'. See 'My Nectar Prices'.

Martin: 'Reported Govt plans to change student loan repayments will cost you £400/yr.' The FT's reported the Govt may lower the threshold students start to repay at. Full info, help & analysis: Martin's student loan news video. Contactless card limit rising to £100 (from £45), yet many can now SET THEIR OWN limit. The rise happens on 15 Oct, but a growing number of banks are letting you set your own cap. Ends Sun. Cheapest loan deal for £7,500 to £15,000. M&S Bank's* (always check eligibility odds before applying ) 2.8% rep APR interest is the joint-cheapest rate, plus apply by 11.59pm on Sun and if you're accepted, you'll be emailed a £30 M&S gift card within 45 days. Only borrow if you need to: Ensure it's for a planned, affordable, budgeted-for one-off purchase. If in doubt, don't borrow. And remember as it - like all loans - is 'rep APR', only 51% of those accepted need get the advertised rate. Others can be charged more. Cheapest smaller loans: Full info in Cheap personal loans (APR examples). FREE solicitor-drafted wills for those aged 55+ (normally £150+). Free Wills Month is back in Oct, with many areas across Eng, Wales and NI taking part. Bookings open on Fri. See Free wills for more help and options. | New. Earn £264 in Nectar points (or a £150 Amazon voucher) just for doing your Christmas shopping...

This is the perfect time to grab a reward credit card. These pay you to spend on them - and better still, they often pay introductory bonuses in the first few months. Right now that coincides with most people's highest spending period of the year, and happily, some of these bonus offers have been boosted. Yet ONLY do this if you'll repay the card IN FULL each month, preferably by direct debit, so there's no interest.

To get the bonuses, you usually need to hit a spending trigger. Don't see that as an excuse to spend more, rather see it as a reason to put all usual spending on the card. So the key is to look at what you'll likely spend, and see which deal maximises your gain on it. More help in Credit card rewards, here are the top deals... -

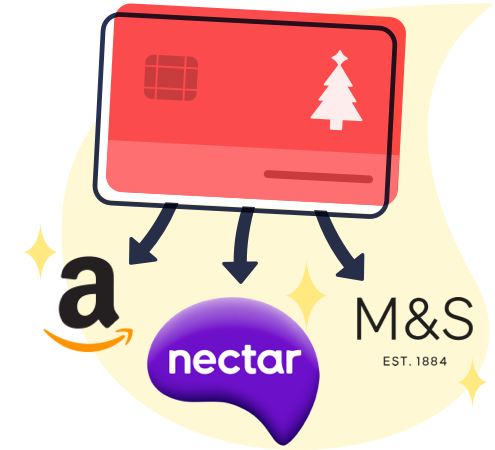

New. Earn £264 in Nectar points or £150 in vouchers if you spend £3,000 over 3 months. The American Express Preferred Rewards Gold* (always first check your odds of being accepted) has just temporarily increased its bonus from 20,000 Amex reward points to 30,000. New. Earn £264 in Nectar points or £150 in vouchers if you spend £3,000 over 3 months. The American Express Preferred Rewards Gold* (always first check your odds of being accepted) has just temporarily increased its bonus from 20,000 Amex reward points to 30,000.

To get this you need to spend £3,000 on it within the first 3 months. And as you get the usual 1 point per £1 as well, you'd have a total 33,000 points - which you can exchange for £150 in Amazon, M&S etc vouchers or convert into £264 of Sainsbury's shopping via Nectar points. So if you think you'll hit the £3,000 it's a real winner.

Important. The card is fee-free in the first year, but £140/year after, so once you've got the bonus, remember to cancel before a year if you don't want to pay it. The card has a 24.5% rep APR if you don't pay it off in full (APR examples). And you won't qualify for the intro bonus if you've had a personal Amex in the last two years.

- Spending less? Earn 5% cashback on an up-to-£2,000 spend in 3 months. The fee-free Amex Platinum Everyday* (always first check your odds of being accepted ) pays 5% cashback on up to £2,000 of spending in the first 3 months, then tiered cashback up to 1% above.

You get the cashback on the first anniversary of getting the card, provided you've spent at least £3,000 on the card in that time (if you'll spend less, don't bother). Fail to repay fully and it's 24.5% rep APR (APR examples). Again you can't get the intro bonus if you've had a personal Amex in the last two years.

Or there's a similar Amex Nectar card which gives £120 in Nectar points rather than cash.

- Had a personal Amex in the past two years? Get up to £40 in Nectar points. Other non-Amex cards include a bonus £40 in Nectar points via this Sainsbury's Bank Nectar card or a £30 Amazon voucher via this Amazon Platinum card.

- When we say pay off IN FULL, we mean IN FULL, not nearly in full. The words IN FULL are Martin's catchphrase for a reason. If you spend £1,000 in a month and clear the card entirely, there's no interest. Spend £1,000 and pay off £999, and you usually pay interest on the whole £1,000, not just the £1 left.

While we're at it, never withdraw cash on the card as you'll pay interest even if you clear it in full. And never go over your credit limit, or you'll pay a fee. | Tell your friends about us They can get this email free every week | | AT A GLANCE BEST BUYS | | Cheapest for £5k-£7.5k: AA (check eligibility / apply* ) - 3.3% rep APR for AA members, 3.4% rep APR for non-members + till Thursday, claim a £30 Argos/ M&S/ Costa etc voucher

Cheapest for £7.5k-£15k: M&S Bank (check eligibility / apply*) - 2.8% rep APR + till Sunday, £30 M&S gift card for accepted new loan applicants £130 to switch for new and existing customers: Santander

£100 to switch (or £125 for existing customers): Nationwide | | THIS WEEK'S POLL Do you use credit cards? Credit cards are like fire. Used right they're a useful tool, but get it wrong and they burn. Many use them to collect points or cashback on spending they'd do anyway, but for others they're just another debt that needs to be paid. So this week, we want to know if you have a credit card and if so, whether you've debt on it? Vote in this week's poll. More than half of you rarely or never use cash. Of the 11,800 people who responded to last week's poll, 60% said they rarely or never use cash versus just 15% who said they mostly or always use cash - with the rest using cash and card equally. Those aged 50 and over were slightly more likely to use cash more often, but even here 'rarely use cash' was the most common answer. See the full cashless society poll results. | MONEY MORAL DILEMMA Should I pursue damages for my bike? My bicycle got damaged as a motorcyclist went into me and we both came off (no injuries as it was at slow speed). He agreed it was his fault verbally at the scene and agreed to pay for damages, but he's not replied to my messages and has blocked my phone number. It's only £80 - should I pay it myself or track him down as I have his registration number? Enter the Money Moral Maze: Should I pursue damages for my bike? | Suggest an MMD | View past MMDs | MARTIN'S APPEARANCES (WED 29 SEP ONWARDS) Wed 29 Sep - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 30 Sep - Lorraine, ITV, 9am

Thu 30 Sep - The Martin Lewis Money Show Live, ITV, 8.30pm MSE TEAM APPEARANCES (SUBJECTS TBC) Sat 2 Oct - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 11am

Mon 4 Oct - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 5 Oct - BBC Radio Berkshire, Mid-morning with Sarah Walker, with MSE's Guy Anker, from 11.35am

Tue 5 Oct - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | WHAT MONEYSAVING TIP WOULD YOU SHARE? That's all for this week, but before we go... we asked on social media for the ONE big MoneySaving tip you often share with friends and family. And it's clear you're all stalwart MoneySavers, as the recommendations include paying off your credit card IN FULL every month and following Martin's Money Mantras before spending. Staple MoneySaving tips included taking your lunch to work and keeping takeaways and coffees to a minimum, but a more controversial idea was not having kids. See the full list and share your own in our MoneySaving pearls of wisdom Facebook post.

We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment