| Plus... £12 Baileys, 23mth 0% plus points, Ryanair bans chargeback customers, free car check  THE TOP TIPS IN THIS EMAIL

| | Martin's Car & Home Insurance Warning

'Rules revolution. Cheap switchers' deals may end soon. Check now if you can lock in cheaply, even if not at renewal.'

The 12 things you need to know

On 1 January 2022,  regulator the Financial Conduct Authority brings in new insurance rules. They primarily apply to vehicle insurance (car, motorbike, van) and home insurance (buildings & contents), but it's a monumental shake-up - the biggest I remember. regulator the Financial Conduct Authority brings in new insurance rules. They primarily apply to vehicle insurance (car, motorbike, van) and home insurance (buildings & contents), but it's a monumental shake-up - the biggest I remember.

The aim is to end price walking, where those who loyally renew each year are penalised by seeing their prices put up - while new customers get the best deals. There's full car insurance cost-`cutting and home insurance cost-cutting help on the site, but here's what you need to know and do about the new rules. 1. From 1 Jan, car & home insurers must charge new and existing customers the same. I can hear the cheers. The loyalty premium has long been a bone of contention. It's great news for those who don't switch, or do but don't want the hassle. The rules say insurers must prove, on aggregate, that they charge new and existing customers the same, including any vouchers or cashback.

It's 'channel specific' too. For example, an insurer must give all customers renewing who first came via MoneySupermarket the same prices as new customers via it - but these can differ from prices via Gocompare. 2. My guess is firms won't just cut renewals to match newbies' prices. They'll drop 'em somewhat, and increase new-customer rates - meeting towards the middle.

That's why we may see an end to many cheap switchers' deals. I need to be plain here - I don't know that this will happen. My guess is based on similar past changes. The easiest example is from 2012, when insurers were barred from price discrimination based on gender...

Young male drivers had paid far more than female drivers. After we tried to factor out other price moves, it looks like young women saw prices rise, while young men saw them drop by even more. Don't think savings by switching will end totally though. Different insurers will still have different prices - and new entrants will try to disrupt the market - but savings will likely be smaller.

3. Rates may change before January, so checking now, while they're still cheap, is safest - you can switch even if not at renewal.

While the new regime officially starts in January, as it's a big job, insurers will likely start to shift pricing algorithms sooner, so the clock is ticking and the cheapest prices may start to disappear within weeks or months.

The tips below will show you how to find cheap car insurance and cheap home insurance. Take a look even if renewal is six months away, to see if you can save significantly.

If you can, you'll need to cancel your existing policy, and provided you've not claimed or reported an incident this insurance year... - You should get a pro-rata refund for the rest of the year minus a £30 to £50ish one-off admin fee. Factor that in to any savings.

- You might not earn this year's no-claims bonus though. As Holly emailed us: "I'm so glad to get your emails. I wouldn't have thought to cancel my car insurance mid-year and start a new one which is £300/yr less." More help on how to save if not at renewal.

Even if you can't save now, but can match your current price, it may be worth doing in case prices rise. This is far shakier territory though, as it involves some crystal-ball gazing. So I'll leave it up to you.

4. Use more than one comparison to find your cheapest.

Comparison sites are actually technically insurance marketplaces, as insurers are allowed to, and sometimes do, offer cheaper prices on individual sites than they charge direct.

Therefore it's not just that different sites cover different firms, but that different sites can have different prices for the same insurer. So for the widest comparison use at least two, and more if you've time.

Below is our current order to try (see how we pick the order). Though checking as many as you've time for is the key rule, rather than the order, so if any perks appeal, you can select your order based on that. | CAR INSURANCE COMPARISON ORDER | Confused.com* car insurance

Official perk info: ONE of a... £20 Halfords voucher | £20 Domino's voucher | 12 IMO 'triple foam' car washes | Hello Fresh recipe box.

MSE perk analysis: The highest value is between the car washes, if you'd use them all, as they can cost £5 each elsewhere, so it's worth £60; or the recipe box, if you keep ordering it, as you also get the next three discounted, so it could be worth £70 or so. | MoneySupermarket* car insurance Official perk info: Combination of up to £150 of car repair and servicing vouchers, eg, £30 off MOTs, £5 off wheel alignment work. MSE perk analysis: Likely better for older cars that need more work. We analysed the value of these vouchers compared to the cheapest similar garages and found they could be worth up to £70 in a year. | Compare The Market* car insurance Official perk info: Meerkat Movies and Meals - a year's 2for1 on cinema tickets and meals on Tue/Wed nights.

MSE perk analysis: For those who'd use it, going to the flicks and restaurants, this perk can be worth £100s. However, instead you could grab other perks, as you can use our trick to get Meerkat Movies and Meals for £1 for a year anyway. | Gocompare* car insurance Official perk info: £250 'free' excess cover. MSE perk analysis: Gives good peace of mind, but few will use the free excess in any given year. We value it at roughly £35 as that's a typical cost for an excess policy to cover a similar amount. | | Comparison sites are best for those with straightforward circumstances. If your situation isn't mainstream, see help to get cover. |

The order for home insurance...

The principle is the same, but not all have perks. Our order here is Compare The Market* (same perk) | Confused.com* (same perk) | Gocompare* (no perk) | MoneySupermarket* (no perk). And again if comparison sites don't work for you, see help to get cover . 5. Check for deals comparison sites miss.

The big firm that's missing for car and home insurance is Direct Line* as it won't go on comparison sites (Aviva used to take this stance too, but now it's on them). It is worth checking as in some circumstances it is a winner.

There are also promotional deals that may not be on comparisons. The team have put together a list of car insurance promos - incl a £60 Amazon voucher, and home insurance promos - incl a £55 Amazon voucher. 6. Near renewal? Get quotes 23 days beforehand - leave it later and you can see prices double...

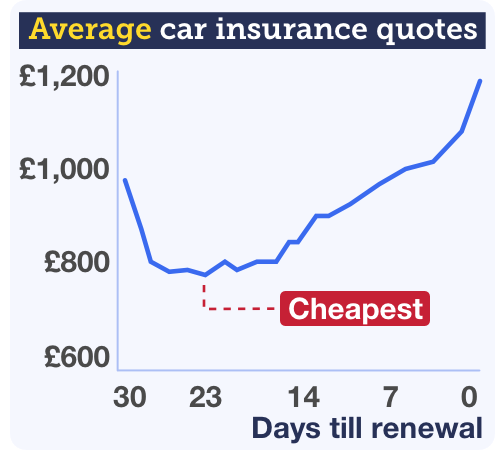

While today I'm pushing you to check if you can save regardless of timing, for those with renewals soon, timing can really help. While today I'm pushing you to check if you can save regardless of timing, for those with renewals soon, timing can really help.

We analysed over 70 million quotes, and found the optimum time to get new car insurance quotes is 23 days ahead of renewal (21 days for home), but anytime around three weeks is good. Leave it later and car insurance prices can almost double because insurers' algorithms show those who get new quotes earlier are a lower risk (the rise is far less steep with home insurance).

We get huge numbers of successes on this. Ian emailed: "Brilliant advice - best price, about 21 days before expiry date, was £340. But day before expiry: £637."

Amanda emailed too: "I read your tip... and got a quote for £600 less than the renewal quote. Saved £960 total because I could now afford to pay in one go rather than monthly instalments. Thank you."

7. More than one car in the home? Multicar policies could save or cost you £100s...

Multicar insurance policies aren't included on comparison sites, so to find out if you'll save requires digital elbow grease. Multicar insurance policies aren't included on comparison sites, so to find out if you'll save requires digital elbow grease.

My rule of thumb is first try the opposite to what you have, as insurance has always been about sucking in newbies with special deals. So if you've multicar, try standalone policies. Got standalone? Then try multicar.

The three pure multicar discount policies are from Admiral MultiCar*, Aviva* and LV*. All let you set up a policy at your 1st car's renewal, leaving the other car(s) on its existing insurer until their renewal. See multicar split-year renewals.

There are also multi-policy discounts, reducing the cost if you've two cars, or get car and home insurance together. These include More Than (15% off), Axa* (up to 15%), Esure* (10%), Privilege (varies) and Sheilas' Wheels* (10%). Plus, Direct Line* and Churchill also offer discounts for multiple cars.

Multicar worked for Kam, who told us on Facebook: "I saved £500 by sticking both my and my wife's car on a multicar policy."

But Nigel tweeted that splitting was better: "@MartinSLewis I was with multicar until at renewal they wanted over £1,300 for 3 cars. Got 3 individual policies for under £600. " 8. Cashback sites can pay up to £70 if you get a policy via them, boosting your saving. If you're a cashback site user, you'll know that if you get your car and home insurance via it, and it's paid a lead fee for sending you to the insurer, then it shares it with you as cashback.

Yet do check your quote isn't more than via a comparison site. Plus think of the cashback as a bonus rather than 100% certain, as sometimes it doesn't track or isn't paid out - focus on the right product. Full info in car insurance & cashback, but there are two routes to try... - Route 1: Use cashback site comparisons. A rebranded version of Confused's comparison is used by cashback sites Topcashback* (get £40 for car, £32 home) and Quidco* (£35 car, £28 home) - though you don't get the normal Confused perks.

What I can't say is whether you'll get exactly the same price as going to Confused direct. This week, we got a small sample, 17 people from MSE Towers, to check. Nine got the same price from both cashback site comparisons as Confused, three got it cheaper, five more costly - but that could be due to dynamic pricing.

- Route 2: Find your cheapest policy, then try for cashback. This may be more lucrative. Once you know your cheapest insurer after using a comparison site, check what cashback you'd get going to it direct via Quidco* or Topcashback* . You could get up to £70 for car insurance and £50 for home.

Yet be extra careful not to let the cashback tail wag the dog. Choose the right insurer first, then look for cashback. Don't choose the biggest cashback to make your choice of insurer. 9. Counter-logical CAR INSURANCE tricks.

Insurance pricing is about risk, and that can have some strange consequences. For example, comprehensive cover may undercut third party, as while it covers more, the mere fact that you selected it can change insurers' views of your risk profile to outweigh that.

Similar is true of tweaking your job description and, crucially, adding a responsible 2nd driver can bring down your risk average, especially for younger drivers, and mean you pay less. 10. Ensure you're insuring your HOME & contents correctly. Buildings insurance is normally only for freehold property owners - leaseholders and renters will usually be covered by that (though some leaseholders' circumstances may be different - so check). Do be careful not to overinsure buildings cover - cover the cost to rebuild it if knocked down, not to buy it. Use a rebuild cost calculator.

Everyone should consider contents insurance. An easy way to think of the difference is if you could upend your home, whatever falls (plus integrated items such as white goods) is its contents. Do beware underinsurance contents though, as you may not get a full payout. 11. Don't want to move... haggle.

If you're happy where you are, ask your insurer to match the cheapest quote / best deal - it may even be from your same existing insurer, as the new rules haven't come in yet. Full help in Car & home insurance haggling (pls remember it's about charm and politeness, not aggression).

As Paul emailed: "Did the usual searches and then contacted my insurer. Got the price down from £2,500 to just over £1,900. Pays to haggle."

12. Ensure the policy is right for you and know your rights if you're unfairly treated / your claim is rejected.

Before you sign up to a policy, spend time going through what it covers and the details to make sure you're happy with it, and check it is regulated by the Financial Conduct Authority.

If you believe your insurer has treated you unfairly, or rejected a claim it shouldn't, remember you have a right to take it to the independent, free Financial Ombudsman Service for it to adjudicate. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | New. Need to borrow? The top 0% spending cards - 23 months INTEREST-FREE and rewards galore (Nectar, M&S and Clubcard points, or just cash)

A 0% spending card allows you to make purchases and spread the repayments over a 0% period at no extra cost meaning you are borrowing, over the longer term, with no interest. We've seen a host of top deals launch over the past couple of weeks, giving the longest and best options since mid-2020. Many of them can be used two ways: as 0% cards and as reward cards (more on how to max that below)... - Warning. Don't use cards willy-nilly - only borrow if it's planned and affordable. While interest-free is great, be careful. Credit card borrowing should only be done for needed, one-off purchases, for example, replacing a broken oven or fridge. And ensure you pay it back within the 0% period or the interest rate jumps.

Never just spend willy-nilly to fill income gaps, as that creates even bigger gaps later when you're repaying. If you're already struggling with debt, avoid more borrowing. See full debt help. LONGEST 0% PURCHASE CREDIT CARDS FOR NEWBIES

RECOMMENDED: Use our 0% Cards Eligibility Calculator first to see the cards you're most likely to get | | Card | Key details | How good is it? | New. Tesco Bank

Best to check acceptance odds first. Or apply*. | - Up to 23 months 0%

- After the 0%, it's 20.9% rep APR interest

- 1 Clubcard point per £4 spent at Tesco (1 per £8 elsewhere), worth up to a 0.75% return if used on Clubcard Rewards

| LONGEST 'up to' 0% + Clubcard points. The fact it's an 'up to' card means some accepted will be offered just 18 or 14 months at 0%, depending on Tesco Bank's credit assessment. | M&S Bank

Best to check acceptance odds first. Or apply*.

| - 22 months 0%

- After the 0%, it's 21.9% rep APR

- 1 M&S point per £1 spent at M&S (1 per £5 elsewhere), worth up to a 1% return as M&S vouchers

| Longest 'definite' 0% + M&S points. Here, all who are accepted get the full 22 months at 0%, so if our eligibility calc shows you've good odds, it's a strong option as you can be sure you'll get the full 0% length if M&S says yes.

| New. Sainsbury's Bank

Best to check acceptance odds first. Or apply*. | - Up to 22 months 0%

- After the 0%, it's 20.9% rep APR

- Max £25 Nectar bonus points. You get 500 points (worth £2.50) per £35 Sainsbury's spend, up to 10 times in the first 2 months, on top of the standard 2 points per £1 there (1 per £5 elsewhere) - worth up to a 1% ongoing return

| Long 'up to' 0% + bonus Nectar points. The fact it's an 'up to' card means some accepted will be offered just 14 months at 0%, depending on Sainsbury's Bank's credit assessment. If you are a Nectar user though, the rewards are strong. | New. HSBC

Best to check acceptance odds first. Or apply*. | - 18 months 0%

- After the 0%, it's 22.9% rep APR

- £25 cashback. If you spend £100+ in the first 60 days (it then comes within another 60 days)

| 'Definite' 0% length if accepted + £25 cashback. If you can clear what you borrow in 18 months then the straight £25 cash here is a winner. | - All these cards give rewards too - feel free to max them out, but with care. By offering reward points and 0% interest, providers are tempting you to spend on their cards, in the hope you build up debt you can't repay in the 0% period. If you're only in it for the rewards, it's easy - just pay off IN FULL each month, and you'll never pay the interest.

But for those who have a planned purchase you need to borrow for, and want rewards, tread carefully. Put the purchase on the card (for example, £1,000), then add your normal spending (say £400) to it each month. Each month ensure you clear ALL the new spending (£400) and enough on top to clear the planned debt within the 0% period (for example, £80).

- Follow the 0% Card Golden Rules. Full info in 0% credit cards (APR examples), but in brief...

a) Always repay at least the set monthly minimum and stick within the credit limit, or you can LOSE the 0% offer.

b) These cards are usually only top picks for spending - AVOID cash withdrawals or shifting debt to them.

c) Plan to clear the card (or balance-transfer away) before the 0% period ends, or the rate jumps to the rep APR.

d) Can't use a credit card for your purchase? Credit limit not big enough? A cheap loan (from 2.8%) may be better. | On FRIDAY the contactless card limit rises to £100 - but can you set your own limit? See whether you can set your own cap - not all providers will allow this from Friday. Extra 15% off 'secret' Office shoe outlet, eg, £64 Ugg boots (normally £155). MSE Blagged. The high-street chain flogs slightly scuffed footwear online at its little-known outlet at huge discounts, and we've got it to give you a further 15% off, though stock's limited. Ends Sunday. 'Secret' shoe outlets Can you make £1,000+ in time for Christmas? Including get £130 for switching bank. 8 tips to bring in easy money at speed - see cash for Christmas. Ends Fri. £40 cashback for investing £400. MSE Blagged. If you plan to 'robo-invest' - where investments are selected for you based on your attitude to risk - this Wealthify deal is equivalent to about a 10% head start, provided you keep it for at least 6-7 months. The fact we've included it doesn't mean we recommend Wealthify - just if you're going to use Wealthify anyway, get cashback. It ends at 11.59pm Fri unless 1,800 go first. Full help in Robo-investing cashback. £184 of No7 for £47 via beauty Advent calendar. Sign up to its waiting list by the end of Wednesday for early access on Friday. See our full beauty calendars round-up, including Body Shop and Holland & Barrett versions out now, with M&S coming soon. Ends Fri. Fibre broadband & line '£14.30/month' - cheapest since 2017. Via this link Vodafone broadband newbies can get 35Mb speeds for £19.50/mth and can CLAIM a £125 Amazon, Tesco or M&S voucher. Factor that in and it's equivalent to £14.30/mth over the 24-month contract. Its faster 67Mb speed deal - at £21.50/mth - comes with the same vouchers so is an equivalent £16.30/mth. Both were due to end last week, but were extended due to sign-up difficulties. For loads more deals, see our broadband comparison. Warning. Ryanair bans passengers who got Covid chargeback refunds. The MSE team has diligently uncovered that those who used the chargeback purchase protection to force the airline to give them refunds when they couldn't travel may face having to pay that back if they want to fly with it again. Ryanair chargeback ban Thu 8.30pm, ITV, The Martin Lewis Money Show LIVE - car insurance crackdown. Over to Martin: "No surprise if you've read my car and home insurance warning above, that's what I'll be taking you through. Plus the latest hot tips in News You Can Use. Do watch or program your VCR." | 'DO NOTHING. Don't switch energy firm. Inaction is the best action... unless they're trying to double your direct debit' Martin's energy bills crisis Q&A...  The energy market is in crisis. Firms are failing. Bills are rocketing. The cheapest fixed deals are double the price of a year ago. The energy price cap rose 12% (13% prepay) on 1 Oct. It's all on the back of an explosion in the cost of wholesale gas. No surprise many are worried, and we're swamped with questions. So we've put the most common to MSE founder Martin Lewis - you can read them here or if you prefer to watch, see Martin's ITV energy bills crisis special... The energy market is in crisis. Firms are failing. Bills are rocketing. The cheapest fixed deals are double the price of a year ago. The energy price cap rose 12% (13% prepay) on 1 Oct. It's all on the back of an explosion in the cost of wholesale gas. No surprise many are worried, and we're swamped with questions. So we've put the most common to MSE founder Martin Lewis - you can read them here or if you prefer to watch, see Martin's ITV energy bills crisis special... Q. With prices rocketing, should I try to bag a cheaper deal?

Martin: No. DO NOTHING - the energy price cap is the cheapest deal. The price cap limits what providers can charge on their standard variable (default) tariffs. There are no meaningfully cheaper switches available right now. The cheapest fixed deal is 35% higher (around £450/year more for someone on typical bills), and my best guess is that gap makes it too big a premium to make it worth moving right now, but check for yourself by doing a Cheap Energy Club comparison.

As you'll be on the price cap, or AUTO-moved to it, if: 1) You've never switched. 2) Your cheap fix ends. 3) Your provider goes bust and you're moved to a new firm - that means do nowt and you'll be on, or moved to, today's cheapest deal.

Q. The price cap is £1,277/yr, does that mean it's the most I can pay?

Martin: No. 'Price cap' is a stupid name - it's more of a rate cap. There's no maximum you can pay for your domestic energy. The £1,277/yr rate is just what the cap would be for someone on the regulator's defined 'typical use'. The best way to think of it is as a cap on the rate you pay for each unit of energy you use. So use more, and you pay more.

Q. I'm comfortably in credit, but my firm's hugely hiked my direct debit, is this fair?

Martin: It's not fair if it's out of proportion to the cost rise, and it's worrying. I'm hearing this a lot - some have seen their direct debit (DD) double. The DD is designed to smooth out your energy costs across a year. Going into winter, it's normal to be a month or so in credit. So as the price cap has risen 12%, if you're on it, expect a similar DD hike. If you're coming off a cheap fix and paying 30-40% more, expect that too.

Yet if you're in credit and your DD is rising way above the rate rise, there's an issue. Do read our full Energy DD help, but in brief, f irst, do a meter reading, so any DD estimate is based on up-to-date usage. Once that's processed, call and politely ask the firm to justify the hike. You've a right to a 'fair direct debit' under energy firm licence conditions. If it can't, ask for the DD to be lowered. My concern is some firms are hiking DDs right now to help their cash flow, even when it isn't justified.

Has your energy direct debit been increased? Please vote.

Q. Is it true the price cap will rise again in April?

Martin: Almost certainly yes, possibly by 30%+. Each cap lasts six months - the current one finishes on 31 March. It's best to think of it as a six-month fixed tariff you can leave at any time if, and hopefully when, other tariffs get cheaper.

Come April, sadly, we expect the cap to rise hugely again based on its current run-rate (yet that'll still be less than today's cheapest fixes). We know this as the assessment period to set the level of the April cap started in August, just as wholesale rates exploded. See how the price cap is set for more.

Q. I'm on a cheap fix, should I leave it as I'm worried my firm may go bust?

Martin: No, do nothing, relish the cheapness while you can. If your firm goes bust you'll almost certainly be moved to a new provider at the price cap - the cheapest you can get now anyway - and all your credit is protected (though do screenshot now how much credit you have). So you may as well stick with your low rate for as long as you can.

Q. My energy firm (Igloo, Avro, Green etc) has gone bust. How much more will I pay?

Martin: For most on cheap fixes, it'll be 10-40% more than you were paying. We've full analysis of the new deals for Avro, Green, Igloo, PFP, People's, Symbio Energy and Utility Point customers. Q. I'm really worried I can't afford to pay my bills - what do I do?

Martin: Speak to your supplier as soon as possible. Emergency pandemic rules mean your supply can't be cut off and prepay customers can get emergency credit. Yet communicate and let your supplier know you're vulnerable. It may be able to offer payment reviews, breaks or reductions. Also check our 2021/22 warm home discount and home & energy grants help. And review all your finances too, including doing a 10-min benefits check-up and a money makeover.

PS: For help to use less energy, see our 18 energy mythbusters guide, and top thrifty heat-saving tips. | £12 for 1 litre of Baileys. The cheapest we've seen it outside the festive period - it's normally £20. Baileys (please be Drinkaware). Has your energy direct debit been increased in the last two months? We want to see which firms are increasing direct debits, and by how much. So please vote in this week's poll. 'We received a £6,600 council tax refund.' Our latest success of the week comes from Tony and Vivien who got top tips to challenge their council tax band after watching Martin on TV. They emailed: "It wasn't easy and took dogged determination to keep insisting on our rightful appeal as we were unable to provide the council with the required evidence. It was well worth it to get £6,585 back. Many thanks." Please send us your MoneySaving successes on this or anything else. Cheap 5GB Sim - '£5/month' from Lebara (uses Vodafone's signal). MSE Blagged. Lebara newbies* can get 5GB/mth of data plus unlimited minutes and texts for £2.95/mth for the first four months, then £5.90/mth, so it's equivalent to £4.92/mth over a year. As it's a one-month contract, you can cancel anytime. Want a different network / handset / more data? Use our powerful Cheap Mobile Finder tool. Barista & Co 700 grams of fresh coffee for £14 delivered (normally £24). MSE Blagged. Choice of three blends including dark espresso, lighter filter and decaf roasts. Barista & Co Free £15 Halfords winter car check, including tyres, battery, wipers, oil & lights. At 750 locations. See how to get your free car check-up. | Tell your friends about us They can get this email free every week | THIS WEEK'S POLL Has your energy direct debit been increased in the last two months? Energy bills are rocketing, as the UK is in an energy crisis. We want to see which firms are increasing direct debits, and by how much. Please vote in this week's poll. Amazon Prime members are much less likely to shop elsewhere when buying online. Last week, we asked whether you compare prices when shopping online or mostly head straight to Amazon - more than 6,000 people responded. Overall, around a quarter defaulted to Amazon (a smaller proportion than last year), but Prime membership remained a big factor - 47% of those with Prime go straight to Amazon, compared with just 10% of those without. See full online shopping poll results. | MARTIN'S APPEARANCES (WED 13 OCT ONWARDS) Wed 13 Oct - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 14 Oct - This Morning, phone-in, ITV, 10.45am

Thu 14 Oct - The Martin Lewis Money Show Live, ITV, 8.30pm

Mon 18 Oct - Lorraine, ITV, 9am

Tue 19 Oct - Lorraine, ITV, 9am MSE TEAM APPEARANCES (SUBJECTS TBC) Tue 19 Oct - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | FROM WEARING EXTRA LAYERS TO FAKING DOING THE WASHING... HOW YOU CUT ENERGY USE That's all for this week, but before we go... with energy prices rocketing and the weather cooling, you've been sharing on our social channels how you cut energy use. Using draught excluders, wearing extra layers and making sure no lights are on unnecessarily are all tried and tested methods. But the craftiest was the lady whose husband insists on washing his jeans after every wear. To save on the washing machine and tumble dryer costs, she simply gives them a shake and hides them for a few days before putting the jeans back in his wardrobe pretending they've been cleaned. Share your suggestions or be inspired in our how you cut down on your energy use Facebook post.

We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment