|

|

|

|

|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Martin's warning: For anyone paying interest on credit card debt

Quick balance transfer FAQs (click links for Martin's answers) | |||||||||||||||

| Amazon £5 off £15. Not for all, but only takes a one-click check to see if you're eligible. Amazon Ends Mon. Last chance to use non-barcoded 1st and 2nd class stamps. You can't post stamps with the late Queen's profile on after Monday 31 July - so use 'em or swap 'em. FREE National Trust family day pass (normally £25 to £35). Excludes NT Scotland sites. Family days out

Free £10 to autosave. MSE Blagged. Autosave apps use tech to figure out what you can afford to save, then automatically move that from your current account to savings (or investments). It's an easy way to get into the savings habit. Currently via this Plum link*, newbies get £10 if they save at least 1p by day 90. See the full Plum review in our Autosave apps guide. Cheapest ad-free Netflix now £48/yr more as 'Basic' plan axed - but we've tips to cut costs. See Netflix. Urgent. Tax Credits deadline is MONDAY - check renewals NOW or risk payments stopping. Check and renew online or by app before 11.59pm on Monday 31 July. See Tax Credits renewals. Martin: Are cash ISAs ni-sa? Will lower inflation mean cheaper mortgages? All in the new The Martin Lewis Podcast - listen through BBC Sounds | Apple | Spotify & more. |

| |

|---|

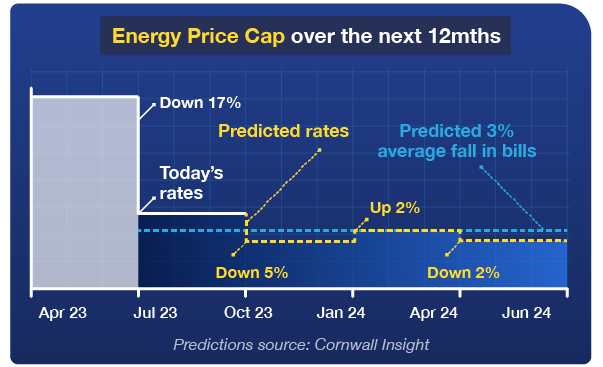

| Stick, switch or fix? Energy retailers are the firms that we buy our gas and electricity from. Over 20 of them have gone bust in the last couple of years due to the energy crisis. It killed competition - switching died while prices rocketed. Now we've the first small sparks of a recovery. Newcomer Fuse Energy has just launched an electricity-only variable tariff that undercuts the Price Cap. So now there are four key options, which is right for you? (Separately, see Northern Ireland energy help, as it works differently.)

|

| If a cold-caller says they're from MoneySavingExpert or Martin, BEWARE - we don't do this. Once again, we've had a number of MoneySavers tell us of doorstep cold-callers claiming to be from MSE. See Cold-call warning. New. Top 5.1% notice savings account. RCI Bank* pays 5.1% AER variable (min £1,000), but you must give it 95 days' notice to withdraw money. This is higher than the 4.5% top easy-access savings, and is best for those who want to be able to withdraw and will know ahead of time when they need the cash. The top 6.13% one-year fix pays more but your money is locked away (though with fixed cash ISAs you can withdraw early but pay a penalty to do so). What's going to happen to energy bills this winter? Martin grilled Energy Sec Grant Schapps... Plus what the Govt plans to do on standing charges and social energy tariffs. Watch the 5min Good Morning Britain clip. 'I've cleared £20,000 of debt thanks to support from the MSE Forum.' Our success of the week is from befree93, a Debt-free wannabe Forumite who shared their inspiring tale: "I joined this forum with over £20,000 of debt age 25. Through your support, I took a leap to get started with a debt management plan, and after hard work, saving and maximising my budget I'm making my last payment tomorrow - 2 years early! I don't know how I ever could have done it without the advice and posts. Thank you MoneySavingExpert and everyone who posts on this site. Your stories seriously inspired me when my morale was low, and I now look forward to entering my 30s debt-free." If we've helped you get out of debt or save money elsewhere, please send us your MoneySaving successes. Whodunnit, romance or sci-fi... grab free holiday books, whatever your taste. How to bag a bookish bargain. Martin wrote to Children's Minister Claire Coutinho to ask her to do more to help 80,000 teens with special ed needs to unlock their Child Trust Fund money. She's written back... and effectively said no. Read Martin's letter and what the minister said. Urgent. Check if you can get a school uniform grant of up to £200. Means-tested grants are available across Scot, Wales, NI and parts of England. Yet deadlines start from next week. See our council-by-council round-up. Three months' free access to 7,000+ magazines, including Good Housekeeping, Gardeners' World, Vogue. MSE Blagged. For Readly newbies. Mag-nificent |

| AT A GLANCE BEST BUYS

|

| THIS WEEK'S POLL At what age should children get their own mobile? Deciding when to give your child a mobile phone can be a difficult decision. On the one hand, they're a great way to encourage independence, on the other, screen-time can be addictive. So this week, we're asking what age you think is appropriate for children to get their first mobile phone. Nearly half of MoneySavers have checked their credit report in the last three months. Last week, we asked you to tell us when you last checked your credit report, and about 3,000 of you responded. The vote showed a big split - while nearly half had checked their credit report in the last three months with at least one credit reference agency, over a third hadn't checked AT ALL in the past 10 years (or ever!). See the full results. |

| MONEY MORAL DILEMMA Should I buy my family gifts when I go on holiday as they do for me? When my parents or my sister go on holiday, they usually bring me back a small gift, though I always tell them they shouldn't, as it's often something I don't need. I'm going away soon for the first time in a while and I'm wondering if I should buy them gifts - I feel that whatever I buy will be a waste of money, but I know I'll feel guilty if I don't bring something back like they always do for me. Enter the Money Moral Maze: Should I buy my family gifts when I go on holiday? | Suggest a Money Moral Dilemma |

| |

| MENTAL ARITHMETIC & FINANCIAL INDEPENDENCE - WHAT DID YOUR FIRST JOB TEACH YOU ABOUT MONEY? That's all for this week, but before we go... our social media followers have been recalling the money lessons they took from their first jobs. For several, working on fruit and veg market stalls taught them speedy mental arithmetic skills. Others were inspired to save for the things they wanted, including holidays and cars, while one poster learnt how to earn bigger tips as a waitress by working harder on their customer service skills. And a one-time pet shop worker learnt jobs can offer temptation - they recall buying a rabbit, fish and accessories during their shifts. But the most common theme throughout was learning about financial independence and the sense of achievement gained by buying things with your own money. Add your own first-job lessons in our Facebook and Twitter discussions. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email autoaidbreakdown.co.uk, skyscanner.net, kayak.co.uk, travelsupermarket.com, carrentals.co.uk, natwest.com, rbs.co.uk, barclaycard.co.uk, bank.marksandspencer.com, firstdirect.com, tsb.co.uk, withplum.com, sainsburysbank.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment