|

|

|

|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Warning. In just two days, many top balance transfers have been pulled Balance transfer cards are the key weapon to cut existing credit card debt costs. That means you get a new card that pays off debt on existing cards for you, but at a cheaper rate so it's interest-free and repayments clear the actual debt rather than paying off the interest. Yet this week, we've seen top deal after top deal being pulled. On Mon, Barclaycard shortened its longest deal by a month, today (Tue) Santander cut one deal by two months, and HSBC pulled its top fee free deal. Overall, there seems to be a downward spiral and we suspect more deals may go. So sorting sooner is safer.

| ||||||||||||

| Urgent. Ends 11.59pm tonight (Tue). Top 5.2% easy-access savings. The huge top-paying easy-access saver, ie, you can put money in and take it out when you want, Santander's 5.2% AER account (min £1) will see its rate cut to a paltry 2.5% at 11.59pm. Apply before (you can put money in later) and you should earn its full rate for 12mths. More info in our news story, inc. video from Martin. PS: If you can lock money away, last week NS&I launched a 6.2% 1yr fix. It's a higher rate than every other fix and is totally safe. We don't know how long it'll last, though if you've £10,000 to £25,000 Ahli United 6.1% + £25 cashback* can beat it. Supermarket coupons: free £2 popcorn, 'free' £1 KitKat, 'free' £6 Strongbow (Eng). Scan through our updated list for September of 50+ supermarket coupons to see what you can get. Fuse Energy offers electricity tariff 13% cheaper than the Price Cap. Small supplier Fuse has cut its prices a month ahead of the 1 Oct planned Price Cap reduction, making it 13% cheaper than the current Cap, and 6% lower than the Cap when it falls in October - it's hoping to bag new customers (you can switch to it, but if you've gas you'd have to keep that elsewhere). See our Fuse Energy analysis. £93 of Kiehl's, Liz Earle, Origins, MAC and more skincare for £32. Nine-item set, including lotion, face wash, mask and facial oil. See Boots beauty set (in light of Christmas chat above, not bad to buy and split up as gifts). Ends Mon. Unlimited data Sim just '£11/mth' - cheapest we've ever seen. This Three Sim is £19/mth, but you can CLAIM a £95 Amazon, Tesco, Asda or Sainsbury's voucher within 6mths. Factor that in over the 12mth contract and it's equivalent to £11.09/mth. Want less data or a different network? Use Cheap Mobile Finder. 3 months' Disney+ for £6 (normally £24). A Minnie reprieve from the Nov price hike. See 6 Disney+ deals. The Martin Lewis Podcast is back. A must listen if you've had a flight delayed/cancelled this summer. Martin's big topic is the £100s per person 'don't ask, don't get' compensation many are due on top of flight refunds. Plus lots more on savings, childhood spending & steps in The Martin Lewis Podcast - listen via BBC Sounds | Apple | Spotify & more. |

| Martin's 8 STUDENT SQUEEZE easers! Millions of undergraduates across the UK are preparing to start or return to university. A good chunk though will see significant financial changes that won't make easy reading. This is especially true for English students, where the squeeze looks tightest. Perversely while over the long term new starters will need to repay up to 50% more than their predecessors, right now for them the biggest practical issue may be that the loan's too small... 1. English student maintenance (living) loans are rising far less than inflation. Most English students get a maintenance loan to live off, to cover rents, transport, books, clothes, food and more. This is added to the tuition fee loan and repaid after leaving university. In the other UK nations, available support is a mix of loan and non-repayable grant.

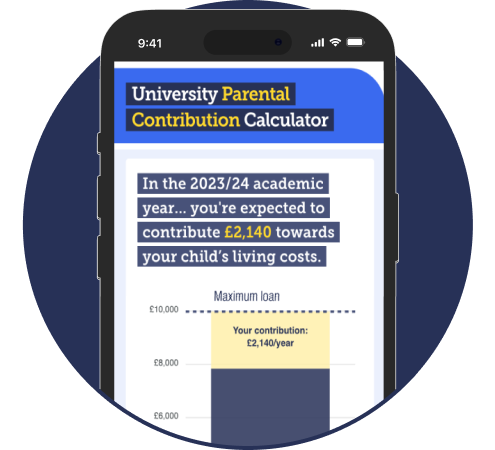

2. Of course, parents can't be forced to fill the gap, but it's crucial to have a discussion on it now, understand there's a gap and work out how it'll be filled. Use our Eng, Scot & N Irish Parental Contribution Calc to see how much it is and more on how it works. Welsh? Students get a fixed amount of total support (the means-test dictates the proportion that's a grant not loan). 3. New English starter this year? 5 things you and your parents should know. You're the first on the new 'Plan 5' student loans explained in my speedy 5 things you should know blog or detailed Plan 5 explained in full guide. Incl... - The student loan price tag can be £60,000, but that's NOT the cost, see what you really repay. 4. Started uni in or before 2022, or new Welsh, Scots or N Irish student? Your system isn't substantially changing. How it works depends on when you started and which country you live in - see Which student loan am I on? for help. 5. Top student accounts 2023 - make banks fight for your custom. Banks salivate over students, hoping to pay once to buy their customer for life. Not a good idea (shift later) but do get the max gain now. This year's top pick includes a guaranteed £1,500 0% overdraft, free four-year railcard and more. Full help in top student accounts. 6. Working people shouldn't spend more than they... earn (obvs), students shouldn't spend more than...? Lots of parents rightly tell their student offspring to budget - but don't define their 'income'. I'd say that's your student living loan, any grant, money from parents, and working (don't include 0% overdrafts). See our Student budgeting planner. 7. Sort your student household - renting, TV licence and insurance. It's worth knowing how it all works: - Home insurance. You may already be covered under your parents' policies. Read about student contents insurance. 8. Student bargains, discounts and more. Being a student opens you up to a world of discounts and bargains. You'll find more in our Student discounts section, including 6mths' free Amazon Prime | Ikea £10 off £75 | 10% off Apple | free Microsoft Office plus tips on how to get books for cheap (or free) | learn to cook | find a quirky part-time job. | ||||||||

| £37 Ted Baker prescription specs or sunnies (normally £135). MSE Blagged. Via SpeckyFourEyes code. The MSE Forum's had a lick of paint and a supercharge... We're very proud of our MSE Forum, a community of two million members discussing every possible way to save, financial products, and motivating each other. Over the last few weeks, our iconic 20-year-old community got a new look and some new features, including an enhanced homepage showcasing its best content. It's become more customisable, easier to follow, and even has a 'random thread generator'. Do check it out. Wetherspoon pubs 7.5% off for ONE DAY only. This week, there's a one-day discount on all food & drink at 800+ pubs (excluding booze in Scotland). See Wetherspoon discount. Please be Drinkaware. 'You helped us save £230 a year on standing charges.' Our success of the week comes from Aileen, who made a big saving for herself and her neighbours after reading Martin's blog on NO STANDING CHARGE tariff: "Thanks to your weekly email alerting me to the zero standing charge tariff, you saved our tenement block of flats from paying £38/yr each. As the entry phone is on a separate meter and uses virtually no electricity, the recent hike in standing charges meant that our bill would have been £230/yr for using less than one unit. Switching brings that down to 62p... every little helps." If we've helped you save (on this, or owt else), please send us your successes. FREE £15 Cake & Bake Show tickets for London, 22 to 26 November. 7,500 pairs available. Cake & Bake |

| AT A GLANCE BEST BUYS

|

| CAMPAIGN OF THE WEEK Are you a 'non-domestic' energy customer - for example, you're on a heat network, in a park home or have bills included in rent? The Government is asking people who don't have a direct relationship with their energy supplier to share their experiences of paying for energy - including the prices you face. It'll use this info to help determine what protection might be needed for these groups. If you're not sure whether you fit the description, you can check here and take the survey before it closes (on Mon 18 Sept). |

| THIS WEEK'S POLL Have you used a parking app before? More UK car-park operators are now opting for 'app only' payments (using RingGo, JustPark, and others). So we want to know if you've used a parking app before, and how you prefer to pay. Vote in this week's poll. Over 80% of MoneySavers have moved their savings in the last year. With interest rates rising rapidly, we wanted to know how many of you had ditched and switched to get a better rate. Of the 2,800 or so who voted, almost 60% had moved their savings in the last three months, and 8 in 10 had done so in the last year. Yet a not-insignificant 5% had NEVER moved their savings. See full poll results. |

| MONEY MORAL DILEMMA Should we return to the restaurant to pay our bill after being evacuated from it? My husband and I were having lunch at a restaurant that's part of a small chain when the fire alarm went off. The staff asked everyone to evacuate, then to vacate the area so the fire brigade had access. We later learned it was a false alarm, and I said we should return to pay our bill. My husband thinks there's no need, as we weren't asked to do so at the time, we didn't get to finish our food and drinks, and the service was poor, so the staff wouldn't be missing out on a tip. Who's right? Enter the Money Moral Maze: Should we return to the evacuated restaurant to pay our bill? | Suggest a Money Moral Dilemma |

| MARTIN'S APPEARANCES (WED 13 SEPT ONWARDS) Wed 13 Sept - Ask Martin Lewis, BBC Radio 5 Live, 1pm |

| SCHOOL BAGS, 48p ICE CREAM & CARD-SWALLOWING ATMs... WHAT'S YOUR EARLIEST FINANCIAL MEMORY? That's all for this week, but before we go... MSE Forumites have been sharing their earliest financial memories. One recalled the early '80s, when they were taken to open a Midland Bank account and got a free school bag... then found every kid in school had opened the account and got the same bag. Another recounts using their weekly 50p pocket money to buy a two-litre tub of ice cream... and still getting 2p change. And in a real blast from the past, another remembered the excitement of their dad getting one of the first ATM cards. He'd go into his bank, insert it into the machine and retrieve his money, then the machine would retain the card, and it would be posted back to him! Add your own nuggets of nostalgia in the What's your earliest financial memory? MSE Forum discussion. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email firstdirect.com, chase.com, barclaycard.co.uk, bank.marksandspencer.com, raisin.co.uk, natwest.com Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment