|

|

| ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Ends 5pm Thu: MSE exclusive cheaper than the cheapest fix. Many can pay £100s less on elec & gas and be protected from price rises Over 80% of homes in England, Scotland and Wales are overpaying on their energy bills because they're on a Price Capped tariff - we've listed the main ones below. But until Thursday we've an exclusive tariff which is the cheapest fix possible, saving you 7% on average over the Price Cap. It also locks in that rate so it can't rise for 16mths - unlike the Price Cap which is expected to rise again soon, as Martin's 'What'll happen to energy prices?' video explains.

| |||||||||||||

| Martin: Is being married worth it? The nine big financial benefits... If you're married, in a civil partnership (or considering it), don't miss Martin's new blog - the financial benefits of marriage & how to use them to your advantage - including Inheritance Tax, Marriage Tax Allowance, ISAs and more. Totally free National Trust family day pass (normally £30ish). Go quick, as there's a limited number available - though once they're gone, the pass is available with a £1.10 newspaper. Excludes Scotland sites. Days out New. Top 5.1% easy-access savings. Since last week, competition's pushed easy-access cash ISA rates up again (a cash ISA's just a savings account you never pay tax on). And the current top rates beat top normal easy-access savings, so for those who haven't used this year's £20,000 ISA allowance, Trading 212's 5.1% AER* (min £1, unlimited withdrawals) is the top rate. That's 4.9% variable standard interest, plus a year's 0.2% boost for newbies. It has a slightly complex structure, so see full info in Top cash ISAs. 20,000 FREE (normally £18ish) Ideal Home Show London tickets, including a chance to see Martin live. From 21 March to 6 April. For how to get your tickets and what days Martin's on, see Ideal Home Show. Ends 11.59pm Thu. 132Mb Virgin broadband-ONLY '£23/mth'. MSE Blagged. Newbies can get this Virgin 132Mb broadband only (no line) deal for £25/mth - but you also get an automatic £100 bill credit, making it equivalent to £22.95/mth over the 18mth contract. The monthly cost increases by £3.50 every April - our tool now factors in these price hikes to the equivalent costs shown. Can't get Virgin? Find other deals using our broadband comparison tool. 161 summer flowering bulbs for £10. MSE Blagged. 10,000 bundles available, excludes Northern Ireland/parts of Scotland. Plant soon for summer. Thompson & Morgan Puma 30% off code, eg, £55 trainers £15.40. MSE Blagged. On full-price & sale items. Puma

|

| |

|---|

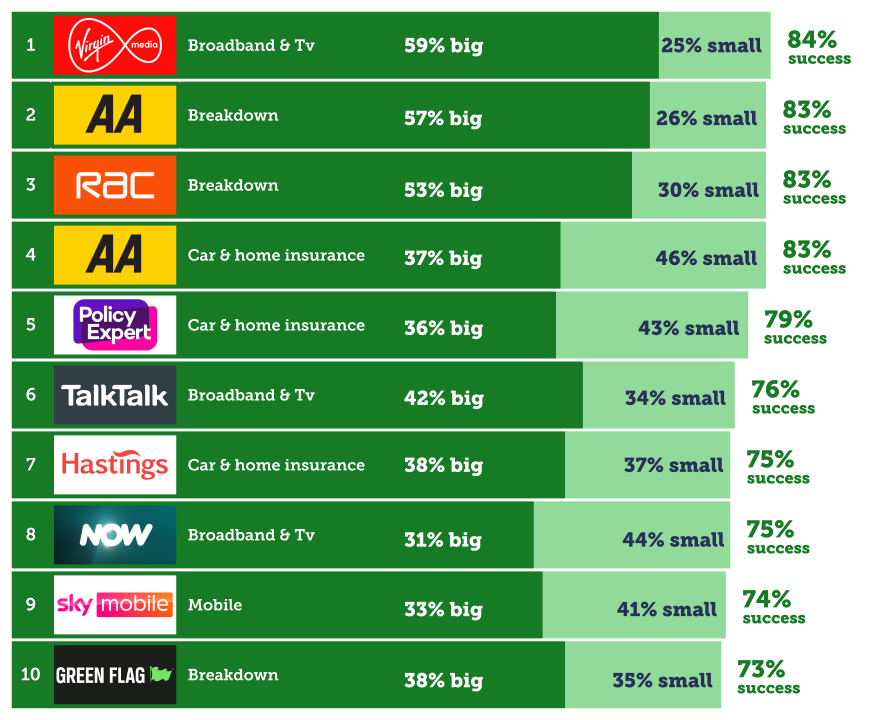

| The top 10 firms to haggle with 2025 If you think haggling is just for trips abroad, market stalls and car boots, think again. The big savings come from haggling with service firms - especially those in mature markets, where everyone already has the product. That means firms must aim to keep existing customers and, as Martin says: "When you're at or past the end of your contract, you're holstering a huge weapon... loyalty - make 'em pay for it." Our full haggling help guide has all you need, but for you, and only you, we'll do it speedily here. 1. Know where to haggle & speedily benchmark the best deals available to you. In December we polled 14,900 hagglers to find out how often they'd succeeded when haggling. Four sectors stood out. However, with all of them, it's not enough to just quote prices and ask them to match them. You first need to ensure it's as realistic a quote as possible, eg, broadband is postcode-specific. Our tools can show you the best prices available to you, so here are the top sectors and how to get the info:

3. Do this when you're near or out of contract & don't want to move provider. Haggling here is all about sticking with what you've got but paying less for it. You may pay less elsewhere, but may not be happy with what you get. Saying "I like your service but you're putting the price up and it costs too much - can you reduce it?", is perfectly legit. You can do this on the phone or, in some cases, by webchat. 4. Know your 'haggle reason' before you call. Before you get in touch, think about what you want and how you're going to get it. To help, try our phrases that pay, such as, "I don't want to lose your service but I've worked out my budget, and the very most I can pay is £[insert price here] a month", or "I've seen [insert name of rival firm here] are doing it for far less". 5. BIG RULE: Always be polite & charming, never rude - win 'em over. Channel your charm, holster hostility. You've no right to a better deal, only to leave, so ALWAYS be amiable - think of it as financial flirtation. Anecdotal evidence suggests some firms have discount quotas, so if the person likes you, they might be more likely to give you one of their discounts. 6. No joy? Ask to cancel (disconnections = customer retentions). The powerhouse move is to ask to cancel... because what firms refer to as their 'disconnection departments' are usually internally known as 'customer retentions'. It's their job to persuade you to stay - and they have more power and discretion to achieve that. As Maureen emailed last week: "I read your haggling guide and rang Sky. I told them I couldn't afford the £83/mth I was paying for broadband and TV. First guy said he could reduce it to £79 so I said I'd have to cancel. A lady in retentions got it down to £39/mth, a huge saving of £522/yr. Thank you." 7. Don't feel you have to cancel. If they call your bluff after you say you're going to leave, don't panic. Buy yourself time to think simply by saying: "I need to check with my husband/girlfriend/guinea pig first - I'll call you back." 8. If you fail, try again. There are no guarantees, but if you don't get anywhere on your first go, don't be deterred. Give it a couple of days and go again. The call centre may have hit its quota of discounts for that day/week, or the agent might just have been having a hard day. For more on this, see our 22 call-centre secrets. 9. If it doesn't work, why not ditch & switch? If they won't deliver and you're overpaying and can get it cheaper elsewhere, why not ditch and switch and try someone else? (Go back to point 1 above for the key links.) |

| Martin's must-listen new pod: Done nowt with your energy bills in the last 6mths? Beat the rip-off | Are joint accounts worth it & what are the best? | Flight delay compensation. Plus electric-vehicle tariffs, Octopus Tracker, standing charges and more, all in The Martin Lewis Pod. Listen via BBC Sounds | Apple Podcasts | Spotify or wherever you get your Martin fix. 20+ FREE ways to learn something new in 2025, such as languages, first aid, or how to use AI. If you want to boost your skills this year, see our round-up of ways to learn skills for free. 'I got £520 compensation for my cancelled flight after reading your email.' If a flight is cancelled/delayed over 3hrs and it's the airline's fault, you may be due compensation, as our success of the week from ahmurray on the MSE Forum shows: "My trip to Orlando was cancelled the night before. The next available flight was a day later, so I cancelled and booked with another airline. As I got a full refund from British Airways and didn't take the flight, I didn't think any cancellation compensation was due, until I saw Martin's email. I claimed and received £520 compensation. Money's tight right now, so I'm hugely grateful." If we've helped you save (on this, or owt else), send us your successes. Want an MSE Charity grant? You can apply for one NOW. Know of a non-profit group that could benefit from a cash boost? Our charity's winter funding round is now open, offering grants of up to £10,000 to organisations that help people to improve their money skills. Check whether your group qualifies and see how to apply - it closes on Fri 31 Jan, so go quick. |

| AT A GLANCE BEST BUYS

|

| THIS WEEK'S POLL How do you rate your bank account's service? Every six months, we ask for your help to track the quality of banks' customer service, allowing us to see which have got better or worse. Considering customer service for your main current account over the last six months, vote in this week's poll. |

| |

|---|

| MONEY MORAL DILEMMA Am I short-changing myself by letting my stepmother live in my house for free? I bought our family home from my father, who - before he died - said he wanted my stepmother to live in the three-bed property for the rest of her days. My stepmother, who I'm friendly with but not close to, is retired and lives there rent-free (I live and work abroad or else stay with my fiancé). I pay for home insurance, boiler servicing and any repairs, and I'm responsible for maintenance and upkeep, and my stepmother is quite insistent when she wants things done. I want to honour my father's wishes, but am I being naive letting her live there at my expense, when instead I could generate income by renting the house out? Enter the Money Moral Maze: Should my stepmother live rent-free? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

| MARTIN'S APPEARANCES (TUE 21 JAN ONWARDS) Tue 21 Jan - The Martin Lewis Money Show Live, ITV1, 8pm |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email firstdirect.com, trading212.com Financial Conduct Authority (FCA) Note MONY Group Financial Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MONY Group Financial Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment