|

|

|

|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Do you pay interest on credit card debt? Save £100s or £1,000s A 0% balance transfer is where you get a new card that pays off debts on existing cards, so you now owe it, but there's no interest for a set period. Anyone paying credit card interest should check NOW to see whether they can do this to cut costs. It means more of your repayments clear the actual debt, rather than servicing the interest - getting you debt-free quicker. And the good news is deals are improving. Sorting this can have a massive impact, as Mike emailed: "Hi Martin. A huge thank you. I started following your advice in Sept to build my credit score and chisel away £5,000 in credit card debt. I've halved that following your advice over need vs want, and have increased my credit score by highlighting errors and paying off debt faster. I now have a 0% balance transfer to clear the remaining £2,500; I'll be completely debt-free in four months and I'm now getting on the property ladder. Thank you!" Before we get to the best buys, four need-to-knows...

Quick balance transfer FAQs (click links for Martin's answers) | ||||||||||||||||||

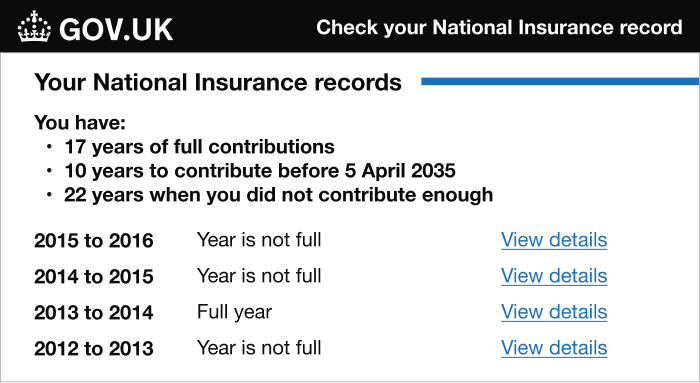

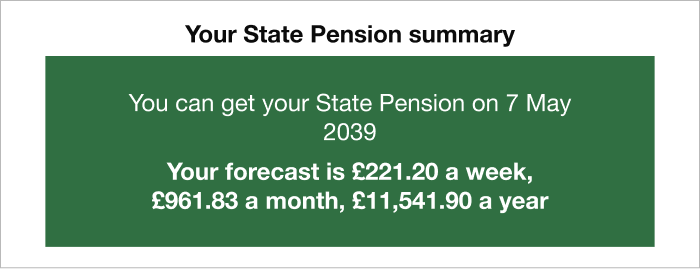

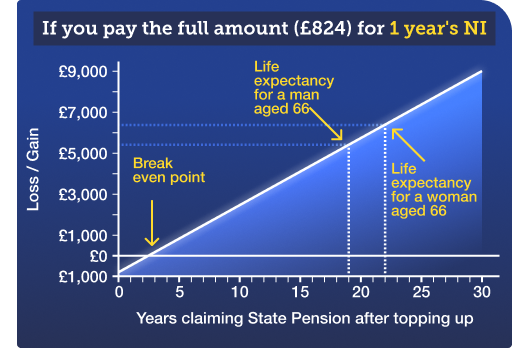

| FREE WILLS for over-55s. It's Free Wills Month, which lets those aged 55+ get a free solicitor-drafted (or updated) will, in the hope they'll leave something to a partner charity (Age UK, Marie Curie, NSPCC etc). It happens twice a year, with different locations each time - this one includes London, Cardiff, Edinburgh, Bristol & Birmingham. See the link for full info (if your area isn't there, it should be in October). Not 55+? Help & options in our Cheap & free wills guide. Wed ONLY. FREE £6ish Burger King Whopper (also plant-based). See how to claim your free Whopper. Energy Price Cap to rise 6.4% in April, but what next? The NO-RISK fix... The Energy Price Cap, which two-thirds of homes in England, Scotland & Wales are on, moves every 3mths - and we know it'll rise 6.4% in April. As the current cheapest fixes are 7% below today's Price Cap, they're massively cheaper than April's price, so use our cheapest fixes comparison to find your cheapest and ditch the Price Cap. What happens for the July Cap and beyond? Analysts' current predictions are the Cap will remain materially higher for the next 12mths. Yet if there's peace in Ukraine, prices could plummet. Some have said they're not fixing due to this - if so, consider... The no-risk fix: You're always free to ditch a fix, though you sometimes need to pay early exit fees of £25 to £75 per fuel. Yet this cheap EDF NO EXIT FEE 'Simply Fixed Direct' tariff* is 4.8% below the current Cap (10.5% below April's), and if prices do fall, you can leave penalty-free whenever. Martin tells MPs: 'Serious holes in Lifetime ISAs need to be fixed.' He called for action on "unfair" and "off-putting" first-time buyer fines, plus indexing of the max property price. Watch what Martin told a Treasury Committee on LISAs. £120 Kärcher window vac £58 with code. MSE Blagged. It's the WV 6 Plus N model, with 4,000 available. Kärcher Ends Fri. Cheapest 50GB monthly data Sim '£2.59/mth'. With unlimited mins & texts, this 50GB iD Mobile Sim (uses Three's network) is £8/mth, but you can claim (don't forget) a £65 Amazon/Currys voucher. If you'd have spent there anyway, factor it in and the cost's equivalent to £2.59/mth over the 12mth contract. Want more/less data? See Cheap Mobile Finder. New Pod: Beat energy price rise + a prof on why we pay more than Europe + do green subsidies help/hinder? We get a lot of questions on energy pricing outside of our consumer focus, so Martin brought in a specialist to help on his podcast this week. All this, plus childcare costs, Council Tax debt collection and more, in the new Martin Lewis Podcast. Listen via BBC Sounds | Apple | Spotify or wherever you get your Martin fix. Cinema Deals: 5 Vue tickets £22, Cineworld £5 IMAX movies (1 day only) & more. The Oscars are over, but the films are still out there - see a range of blockbusters for less with our 29 cinema savers. How to boost your State Pension - The Martin Lewis Money Show Live, ITV1, 8pm tonight (Tue). Martin: "I've mentioned it above, but this is a must-watch for anyone aged 40 to 73. If you don't, you may miss out on £10,000s in retirement. So do watch or at least set the Betamax." |

| |

|---|

| Savings rates are dropping while mortgage rates stay high Top savings rates are still sliding after last month's UK base rate cut, yet the cost of new fixed-rate mortgages remains stubbornly high (as lenders had already priced in the expected cut). For many mortgage holders, including the 1.8 million with a fix ending this year, your mortgage rate is likely already higher than that of top savings, or will soon be. This means unless you have more expensive debt elsewhere (if so, see Should I overpay cards & loans?), there's a crucial question to ask yourself: "Should I save or overpay my mortgage?" We've six key need-to-knows to help... 1. If your mortgage rate is higher than the interest you can earn in savings, overpaying adds up. Here's a simplified example: £10,000 saved at 4% earns £400 interest (£320 if basic-rate tax is taken off), yet use it to overpay a 5% mortgage and it saves you £500 interest. So using the savings to overpay is a winner - it's a bit like saving, tax-free, at the mortgage rate. The best thing to do is use our Mortgage Overpayment Calculator, which shows both your absolute gain from overpaying and the relative gain compared to putting money in savings.

2. To do this right, compare YOUR best possible mortgage against YOUR best possible savings... We're MoneySavingExpert, we don't do bog standard. If your mortgage could be better, that's the starting point. Use our Mortgage Best Buys comparison and free Remortgage guide for step-by-step help. The same's true with savings. If your accounts pay a paltry rate, as too many do, it's easy to ditch and switch (unless they're locked away in a fix). You can earn up to 5% in top easy-access savings and up to 4.63% in top fixed savings right now, so that's what you should be comparing with. 3. If it does add up... TWO KEY CHECKS before you do it. It's not solely about the financial mathematics...

4. Even in some cases where the maths does not add up, it may still pay to overpay. If you can save at a higher rate than your mortgage, use our Mortgage Overpay vs Savings Calc to see the pound-for-pound difference. If savings are substantially better, save. Yet if they're only marginally better, there are two things to consider...

5. Ensure your overpayments reduce your TOTAL MORTGAGE BALANCE (ie, reducing the term). Overpay and some lenders just reduce your next or future monthly repayments. That may help your cash flow later, but you won't make the big savings. The real reduction from making an overpayment is by letting it reduce your mortgage balance and keeping the same monthly repayment simultaneously. This has the practical effect of helping you clear your mortgage sooner, resulting in an interest (and time-saving) gain. So when you overpay, tell the lender you want it to reduce the capital owed and/or the mortgage term and keep your monthly repayment the same. To be clear, we're NOT saying you should ask to reduce your term, that'll often need an affordability test. The priority is that what you repay reduces your mortgage balance and you keep up the same contractual repayments, so in practice, you'll be mortgage-free quicker (see Martin's old Decrease term or overpay? blog). If your lender makes this difficult by recalculating your monthly repayments, then just ensure you keep paying what you were or more (so effectively overpaying each time) and it'll have the same impact. 6. Still on a very cheap mortgage rate? Save the right way. If your mortgage rate is still low, then you'll likely be better off in top savings. Yet if you're doing that, ensure the money is in easy-access savings when the deal/fix ends, so it can then be used to reduce the borrowing if needed. You could use fixed savings that mature just before you need the cash. PS: We've focused on overpaying vs saving. There is also overpaying vs investing, yet that's impossible to give any definites on, as it's comparing a certain outcome with an uncertain one (and investing is outside of our expertise). | |||||||||||||||

| M&S up to 50% off clothes & home sale. Online & in store on White Stuff, Sweaty Betty & Joules, plus some own-brand items. Read our full M&S sale analysis. Yay! Now 2 million have downloaded the MSE App - try it today. It's the MSE site in app-form, plus MoneySaving alerts, easy Credit Club access & more. Download free for Apple or Android. Martin's money and mental health charity given super-complainant powers. It's only the 7th organisation to gain these powers since they were introduced in 2002. See what this means in MMHPI super-complaints. £120 of beauty for £25: Clarins, Eve Lom, Emma Hardie & more. Seven-item Next beauty box. £58 Grüum home fragrance set £18 delivered. MSE Blagged. Includes two candles, a diffuser, a room spray & two wax melts. 8,000 available. Grüum |

| AT A GLANCE BEST BUYS

|

| |

|---|

| MONEY MORAL DILEMMA Should we offer to pay towards my in-laws' flights from Australia? Each summer, my retired in-laws come over from Australia to spend a couple of months with our two sons while they're on school holidays. As we put them up the whole time, we don't have to pay for any childcare or summer camps. In previous years, we've also paid for their flights, but we really can't afford to this year. Should we tell them that and hope they'll pay for themselves, or offer to pay at least something towards their flights given what we'll save on childcare if they do come? Enter the Money Moral Maze: Should we pay towards my in-laws' flights? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

|

| MARTIN'S APPEARANCES (TUE 4 MAR ONWARDS) Tue 4 Mar - The Martin Lewis Money Show Live, ITV1, 8pm |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email edfenergy.com Financial Conduct Authority (FCA) Note MONY Group Financial Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MONY Group Financial Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment