|

|

| |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Martin: Cash ISA reprieve! Limit won't be cut (for now)

Yet, cash ISAs are in the news, as the Govt thinks many, especially younger people, should prioritise investment ISAs where you, usually, put money in funds (made up of a spread of shares or bonds), which will hopefully grow faster, but with a risk you may lose some money. They're not wrong - a wide spread of global investments will usually outperform savings over the long run. So, protecting yourself from tax on investment gains is a strong ISA use too. Let me take you through what's happening, top cash ISAs, and a little more on investment ISAs too.

Cash ISAs can beat normal savings, even before looking at the tax benefit Interest from cash ISAs is never taxed, and once money is in there, it stays tax-free year after year. Plus the interest DOESN'T count towards your Personal Savings Allowance (the amount of interest you can earn tax-free each tax-year from any form of savings) - it's an extra allowance on top. For more, see my how savings are taxed video. And just like normal savings, ISAs can be easy-access or fixed. Here are best-buys (rates can change rapidly so click the links at the top of the columns to check for updates)...

Stocks & shares ISAs may outperform savings over the long run Most people use investment ISAs to buy shares or bonds, via a collective investment fund. The way you gain from this is if a) the underlying investment performs well so people are willing to buy them off you in future for more than you paid for them; and/or b) firms that are profitable may pay out income to shareholders each year in the form of dividends. Both these would contribute to the growth in the price of a fund you have. Of course, investments can drop in value too, and that is the risk vs reward balance. As for investing in an ISA, there are two main benefits:

Now at this point I need to explain. Other than the basics, I don't cover investing as part of my work, nor does MSE, I'm not regulated to do so and it's not my bag. I worry that people read the fact that I focus on savings as me being anti-investing, I'm not. I do it personally, it's just not my professional expertise. If you're putting money away in a global spread of assets over five or more years, then on the balance of probability, investing will likely substantially outperform saving, and so if you've got money to save, you should have a portion of your assets invested. This is especially important for younger people who have time to ride out the vagaries of the market. I am thinking very carefully about what I can do to try and play a role in helping people understand the importance of investing without crossing the line. More basic help in our Stocks & shares ISAs guide. | |||||||||||||

| New. Barclays launches a rare bank switchers' FREE £175, making it the fifth that pays. Many are likely eligible for the new Barclays FREE £175* as it rarely offers switch bonuses, so fewer will be excluded for having had it before. It joins the top payer, Santander's FREE £180 + £25 Amazon* (via this special link) - while you pay £3/mth for it, you get 1% cashback on bills paid via Direct Debit (max £10/mth), which more than covers it for most. See all FIVE get paid to switch banking offers in our guide, which also includes full pros, cons and eligibility criteria. Top Tesco Trick! Turn £5 of vouchers into 1,000pts (£10) and get £10 of rewards too. See Top Tesco Trick. New. Pay just '£11/mth' for 158Mb broadband - the cheapest we've seen in 3yrs. Limited locations. This Hyperoptic 158Mb broadband only (no phone line) deal is a straight £10/mth now (rising to £13/mth from April 2026), making it an average £11/mth over the 1yr contract. While Hyperoptic's well rated, it's mainly only available in some cities and very big towns - click the link, enter your postcode and see whether you can get it. Can't get it? Do a broadband comparison. Heads up. Super-cheap Easyjet summer 2026 flights are about to land... See Easyjet summer '26 seats. Martin vid: Beware car finance reclaiming ads while we await the Supreme Court's decision. You could give away 30% and get NOTHING in return. Watch Martin's car finance warning. £248 of Pixi, Prai, Philip Kingsley & more beauty £30. MSE Blagged. 2,200 available. 9-item make-up/skincare set, with face cream, cleanser, eyeliner and more. Plus a year's free Good Housekeeping digital mag. Beauty box NHS, care or emergency worker? New discounts: 20% off Wagamama and 15% off Oliver Bonas in July, 15% off new Clarks school shoes & more. See 30+ NHS deals. Related: Teacher discounts. Summer holiday kids' freebies and cheapies. Lots going on. £1 kids' and adults' Cineworld tix for some family favourites. There's also free pet workshops, gardening, emoji making & more free learning. And free football, tennis, Zumba, yoga and more sport & fitness. And, while not as cheap, there's Kids Week West End theatre deals. Martin: The secret to haggling... Watch Martin's 1min video, a snippet of his 'Haggle £100s off your costs', and avoid consumer rights rip-offs in a new episode of The Martin Lewis Podcast (listen on BBC Sounds | Apple Podcasts | Spotify & elsewhere). Plus an update on car finance reclaims. Related: See Martin's haggling help from last week's email. |

| Are you (or do you know) a disabled or ill STATE PENSIONER? Martin: "For many older people who are ill or start to face mental or physical disability, life doesn't just get tougher, it gets costlier too. Add to that the fact people's conditions can make it more difficult to spend the time and energy needed to research possible help. That's why 18 months ago we launched our Attendance Allowance (AA) guide and awareness campaign, and successes have flooded in since. Yet it still remains massively underclaimed, with potentially a million eligible pensioners missing out (source: Policy in Practice). "So whether it's you or someone close to you who may qualify, take 2mins to read what the team and I have put below, starting with some inspiration on the domino effect Attendance Allowance can have (in this case for lower-income pensioners)." Dawn emailed last month: "Dear Martin, after watching numerous shows I have successfully claimed Attendance Allowance for both of my parents worth £10,598/yr and Pension Credit worth £1,233/yr. This opened doorways to Housing Benefit worth £9,207/yr, Council Tax reduction of £1,534/yr, a free TV licence saving £169/yr and swapping their phone to BT saving £420/yr. They also received rebates of £3,449 for Housing Benefit and £604 for Council Tax. All in all, they are better off by more than £20,000/yr thanks to you and obviously me for completing the necessary applications! Thank you for everything you do."

|

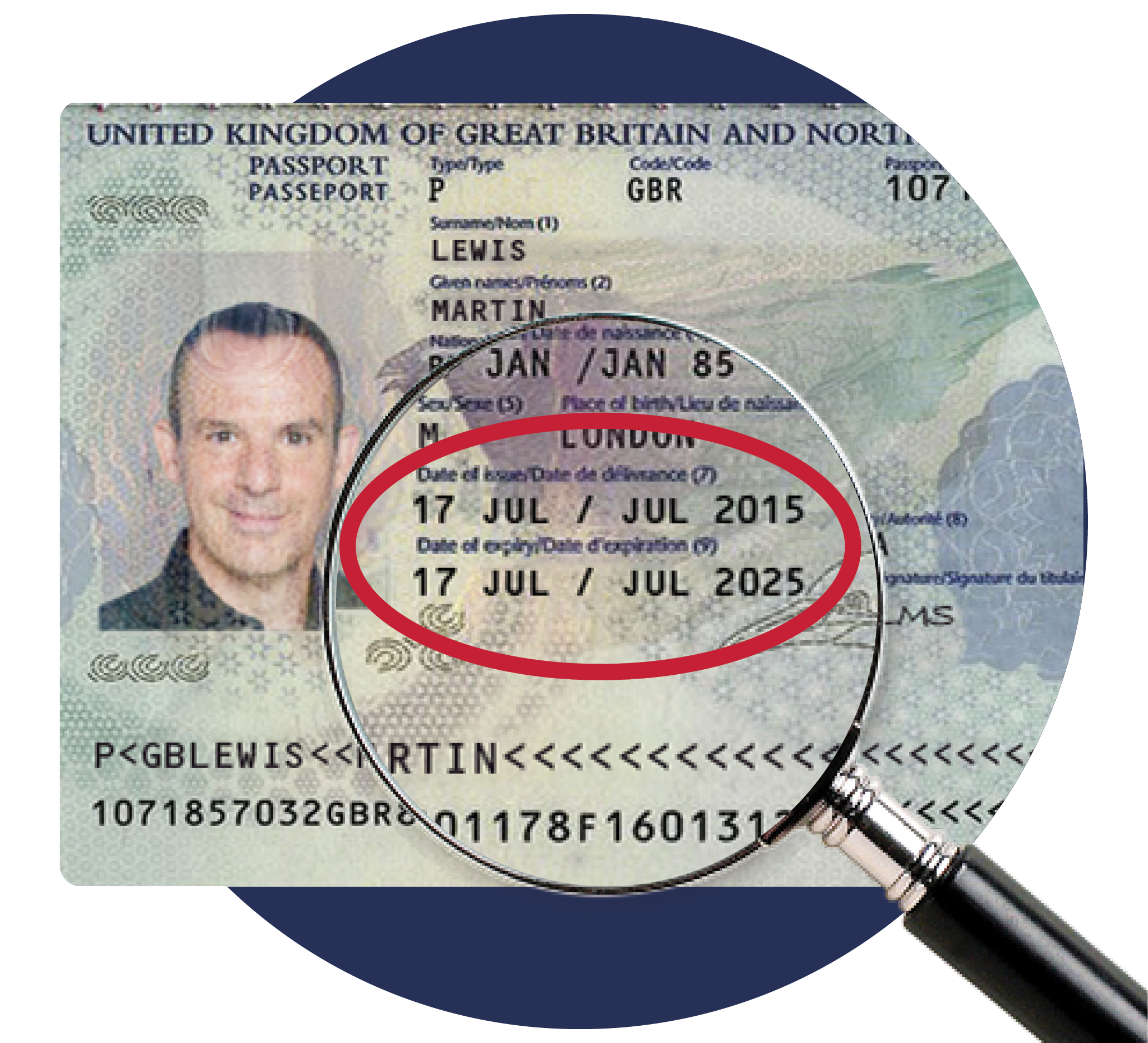

| Sat only. FREE Lego mini panda. Build and take home from The Entertainer stores. Limited stock. Free Lego Updated: Got a 'do not drive' order from Citroen or DS? Your rights explained. We've added more info to our 'What are your rights?' MSE News story. See Citroen recall. Urgent. Does your child get free school meals? Apply for holiday support now. The Holiday Activity and Food Programme (HAF) in England gives children aged 4+ at least one meal a day, plus free activities, for at least six weeks a year during the main school hols. Access to the programme isn't automatic, and some councils have deadlines which are getting close, so get more info & apply now. There's also a scheme available in Scotland. 'We got a £2,500 Council Tax refund and a 50% reduction on future bills - thank you.' Success of the week. 100,000s of people considered to be 'severely mentally impaired' (SMI) could be missing out on a Council Tax discount worth £100s - and backdated payments worth £1,000s. As Abraham emailed last week: "When my father passed and it was just my mother and my brother, who has an SMI, living together, I helped them to apply for an SMI discount on their Council Tax bill, and they received a 25% reduction. But after reading your 3 June email, I realised that - as my mother is my brother's carer - they should be receiving a 50% discount. I helped them to apply and have just had confirmation of a whopping refund of £2,571 backdated to my father's passing. Thank you for your amazing work." If we've helped you save (on this or owt else), send us your successes. Can you get a school uniform grant of up to £200? If you claim an eligible benefit (eg, Universal Credit) & qualify for means-tested free school meals, check if you can get one. We've council-by-council help for Eng, plus info on NI, Scot & Wal. Used an eSim on holiday? How did you find it? Give us your eSim feedback. |

| AT A GLANCE BEST BUYS

|

| MONEY MORAL DILEMMA How do I tell my neighbours I can't afford to pay towards replacing our garden fence? My back garden is separated from my neighbours by a fence that blew over in a storm a few months back. It's a shared fence, but my neighbours paid for it before I bought my house five years ago. They've asked me to pay for half of the replacement fence, but I can't afford to - even food is a bit of a luxury for me right now. I told them this, and they offered to pay for it and said I can owe them, but that would be yet another debt to add to my existing debts. Is there a way to say that I simply can't afford to pay for it without causing friction? Enter the Money Moral Maze: How do I say I can't afford to replace a garden fence? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

| MARTIN'S APPEARANCES (TUE 15 JUL ONWARDS) Thu 17 Jul - Ask Martin Lewis, BBC Radio 5 Live, podcast only, from 4pm-ish |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email coverwise.co.uk, admiral.com, urbanjungle.com, saga.co.uk, chase.co.uk, firstdirect.com, bookfhr.com, holidayextras.com, skyparksecure.com, aph.com, trading212.com, leedsbuildingsociety.co.uk, atombank.co.uk, skipton.co.uk, airalo.com, amigosim.com, breezesim.com, easysim.global, firsty.com, saily.com, vodafone.co.uk, barclays.co.uk, santander.co.uk, skyscanner.net, kayak.co.uk, carrentals.co.uk, trivago.co.uk, hl.co.uk Financial Conduct Authority (FCA) Note MONY Group Financial Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MONY Group Financial Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment