|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| New. Today, five banks pay switchers at least a FREE £225. We've never seen that before! Grab some cash Two accounts have souped-up their switcher deals this week. Both the bill-buster Santander Edge account - which pays you cashback on bills you pay from it by Direct Debit - and the service standout from First Direct - which has number one rated feedback - now give switchers a total of £225. So unless your bank treats you beautifully, grab cash to go elsewhere, especially as we can't find a single time in the last twenty years we've had this many paying £200+, never mind £225+. Switching's usually quick & easy. To get the free cash (usually paid within 3mths), you need to use the bank's seven-working-day switch service (so roughly 10 real days). This closes your old account and moves all your money, Direct Debits & standing orders for you. All payments to the old account are auto-forwarded. You'll need to pass a not-too-harsh credit check.

| ||||||||||||||

| Top easy-access cash ISA upped three times... now 4.4%. A cash ISA's just a savings account you never pay tax on and, with the 5 Apr tax year deadline inching closer, providers are fighting for your custom to use your £20k/yr allowance. Trading 212's 4.4% AER* variable (max £20k) has raised its rate three times in the last fortnight. The underlying rate is 3.6%, with 0.8% on top for newbies (previous tax year transfers get 3.6%). This beats all top normal easy-access savings except Chase's (part of JP Morgan) 4.5% AER* variable, also newbies only. Full help & options in Top Cash ISAs & Top Savings. £250 Ninja air fryer £140 via code. MSE Blagged. 3,000 available. 6 functions, eg, air fry, grill, roast. Ninja 'Chancellor, what you're doing on Plan 2 student loans isn't moral, it needs a rethink.' Martin called out the coming Plan 2 student loan repayment freeze on BBC Newsnight, and things have escalated since. You can hear that full interview and, most importantly, his explanation of what it means in practice in Martin's new Plan 2 loans special podcast (available on BBC, Apple, Spotify etc) - and then get step-by-step help and an AI tool in his new Plan 2 loans detailed help blog. Puma 30% off almost EVERYTHING code incl sale items, eg, £28 kids' trousers £10. MSE Blagged. Puma

'I reclaimed £12,000 in backdated holiday pay after reading your tips - a godsend, thank you!' Success of the Week. After reading an MSE article on claiming holiday backpay for former part-time and contract jobs, Joanne wrote in: "Imagine my absolute shock and surprise when it was confirmed that I was owed just over £12,000 in backdated holiday pay. It was an absolute godsend as I'd been diagnosed as having severe arthritis earlier in the year and been told I needed a hip replacement. In my area, that's a three-year wait, so I'd bitten the bullet and gone private, using my retirement savings. This money has really helped! So thank you for posting such useful advice." If we've helped you save or reclaim (on anything), please tell us about it. News. On a solar Feed-in Tariff to generate and export electricity? It'll get worse from 1 April. It's not good news for the 800,000+ households on the scheme, but it could have been far worse. See what's changing. Valentine's deals: £25 couriered roses, £10-£20 dine-in meals, £176 of beauty for £50 & more. Romance is great; over-commercialised pressure to show it ain't. But if you're going to spend, we've a round-up of Valentine's deals, or maybe use our free Valentine's cheques.

|

| |

|---|

| Six ways you may be able to save £100s on water bills Regulator Ofwat last week announced water bills across England & Wales will go up again this April. This is on top of last year's huge increase (which averaged 26%) - and sadly increases are expected to continue for at least three more years. However the 5% is an average - there's huge variance across firms with rises from 0% up to 13% - so check your water firm's hike. Yet just because the water world is a perverse one with privatisation and no competition, don't assume there aren't ways to save. We've six main ones for you to look at...

|

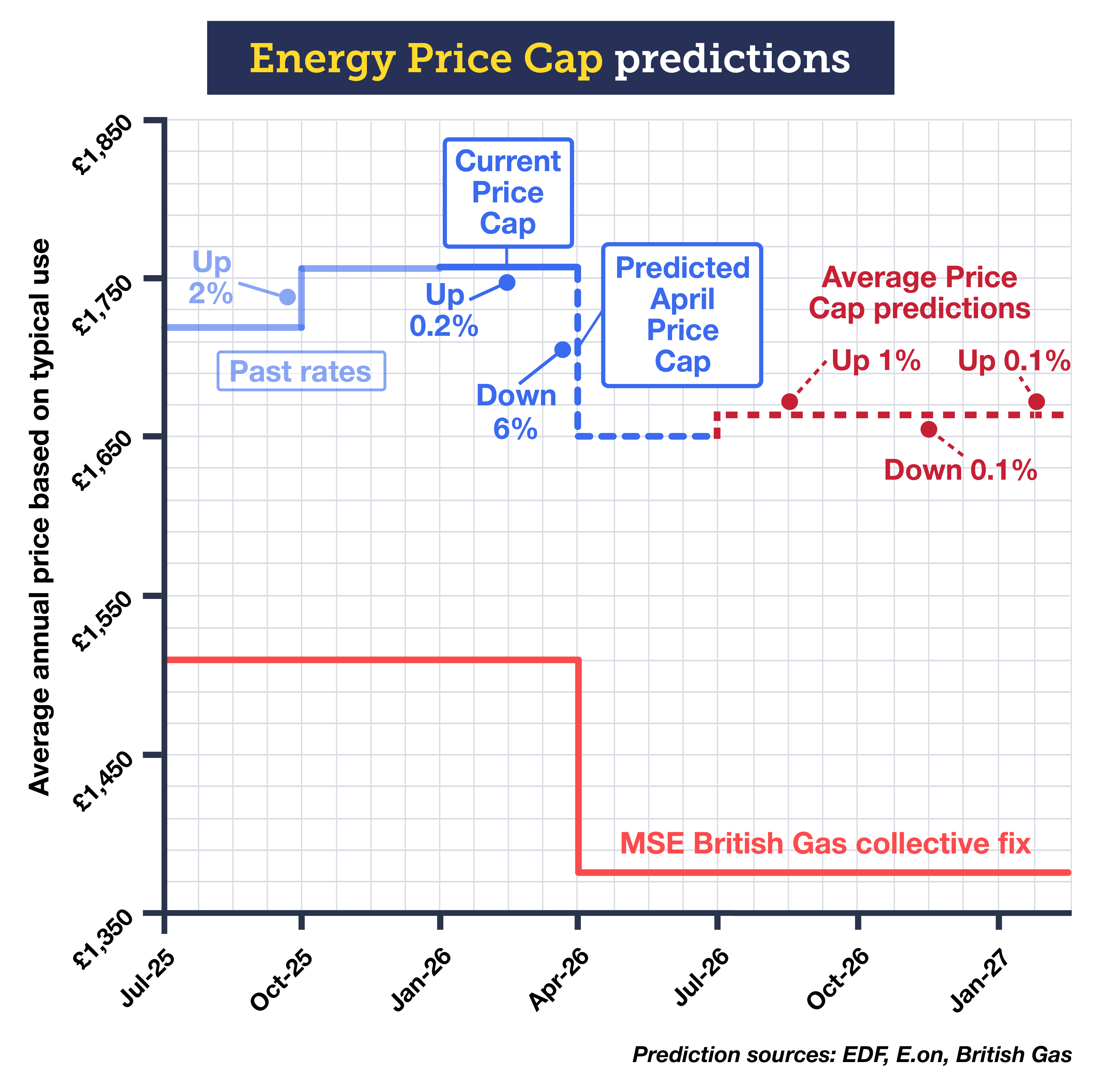

| Martin: 'Ofgem's failed to deliver promised "low or no Standing Charge" tariffs by January.' And he says plans have been diluted more than a shot of Vimto in a bath... What's happened to no Standing Charge tariffs? Ends Sun. Double Morrisons More points. At 1,600+ Daily stores. See our new Morrisons More tips & tricks guide. How to get a FREE pizza for National Pizza Day. At Pizza Express. Or get 50% off pizzas at Bella Italia. 100 days' free access to 8,000+ digital mags, eg, Hello!, Good Food, Tech Advisor. MSE Blagged. For Readly newbies & those who cancelled 6mths+ ago. Mag-nificent |

| AT A GLANCE BEST BUYS

|

| MONEY MORAL DILEMMA What should I do with the money I've inherited that I feel guilty about spending? I've recently inherited some money. It's enough to buy a new car, something I do need. But I feel too guilty to spend it - I would much rather have the person I inherited it from still here, and it breaks my heart even thinking about spending it, as doing so would almost feel like losing them again. Any suggestions on what I should do would be gratefully received... Enter the Money Moral Maze: What should I do with the inheritance I feel guilty about spending? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

|

| MARTIN'S APPEARANCES (WED 4 FEB ONWARDS) Thu 5 Feb - Ask Martin Lewis, BBC Radio 5 Live, midday |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email santander.co.uk, firstdirect.com, tsb.co.uk, trading212.com, chase.co.uk Financial Conduct Authority (FCA) Note MONY Group Financial Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MONY Group Financial Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment