| | | Incl all the BEST BUYS for over-65s, pre-existing conditions, annual policies and single trip

Summer holidays are looming, budgie smugglers and bikinis are being dusted off, but dreams of sun could turn to financial nightmares if you don't spot the loopholes in your travel insurance. Summer holidays are looming, budgie smugglers and bikinis are being dusted off, but dreams of sun could turn to financial nightmares if you don't spot the loopholes in your travel insurance.

Our Cheap Travel Insurance guide has all the key info but, for ease, here's a quick masterclass to help you sizzle in the sun, safe in the knowledge you're fully protected. | 1. | Hols booked but no insurance? You need to sort it NOW. Travel insurance doesn't just cover you while you're away, it'll also cover you for cancellation or anything else that might go wrong before you leave. So if you don't have it and you need to cancel, you've no protection. See Cheap Travel Insurance for full info. | | | | 2. | Beware the insurance Breathalyser - one drink and you could be out. Many insurers make your average headmaster seem lenient. In some cases, even if you've had one drink and you lose something or have an accident, they may say NO if you claim. Insurers have even been known to test blood samples for alcohol.

We're not saying you shouldn't enjoy yourself, but just be aware. Full info on what to check and what's covered in Holiday drinking warning. | | | | 3. | Annual policies win if you jet off at least 2x a year. Our analysis shows that in every scenario we tested, an annual policy is cheaper than two single-trip policies.

We compared 18 different insurers based on the cheapest deals that meet our minimum criteria (which include at least £1,500 for cancellation and £2m for medical cover - for a full list see Min level cover). Here are our top picks:

| Annual travel insurance best buys For individuals Holidaysafe Lite* wins for almost every age group up to 65. Eg, a year's cover for a 35yr-old in Europe is around £9, and £19 worldwide. If you're 55-60ish though you might want to try Coverwise (Bronze)*. For families Holidaysafe Lite* currently wins with annual Europe cover from £17 and worldwide costing from £37, depending on the age of the oldest member. If you want one with good claims feedback, higher limits and cover for up to 90 days per trip, our top-value pick is LV Premier*. It offers individual insurance from £67 in Europe and £111 worldwide, or for a family it's £113 in Europe and £187 worldwide. You can also do a full comparison via MoneySupermarket*, Confused*, Gocompare* and Comparethemarket, which sometimes have exclusive deals that beat these. | | | | | 4. | Over 65? Don't pay through the nose - you can get insurance from £25. It's a sad fact of life that as you get older, travel insurers see you as a bigger risk, and costs rise accordingly. Yet there are still good deals to be had.

- Europe: Our current winner is Holidaysafe Lite* which offers cover from £25/yr for a 66-74yr old. Aged 80+? Try Insure and Go (Silver) from £252/yr.

- Worldwide: Leisure Guard* usually wins at £50 for a solo traveller aged 66-74.

For more options see Over-65s' Travel Insurance. | | | | | 5. | Get family travel insurance + mobile phone/breakdown cover (can be worth up to £600) for £120. Many bank accounts with a monthly fee include different types of insurance, including travel. So if you pay for yours you may already be covered. Check the terms to see if it's appropriate for your trip, eg, does it cover extreme sports?

- Nationwide's FlexPlus* is a cracking deal for £120/yr - you get worldwide family travel insurance up to age 74 (which can cost more than the account charges alone), UK and European breakdown cover for all account holders and family mobile phone insurance. All this bought separately can cost £600/yr. For more see Best Packaged Current Accounts.

- Do NOT confuse this with a credit card benefit called travel accident insurance, which only covers accidents on a train, plane or in a hire car paid for on the card. NEVER think this means you're completely covered. | | | | 6. | With valid annual insurance you're covered if an incident happens now, even if you're due to travel AFTER your insurance runs out. We get this sort of question a lot: "My annual policy runs out in October, but I'm going away for Christmas - am I covered?"

If you need to cancel your trip now, the answer is "yes", as insurers base decisions on the date you cancel, NOT the date of the trip. Yet ensure you renew (if it's cheap) or get new cover immediately after it expires so you're continuously protected for cancellation and when on holiday. | | | | 7. | Some 'European' policies don't cover Spain, while others cover North Africa. European cover is generally defined geographically, and not just for the EU. But bizarrely some don't automatically cover Spain (and the Balearic/Canary Islands) in their, er, European insurance. You may have to select 'Europe with Spain' and pay extra. All our best buys cover Spain automatically.

Many insurers also cover a handful of non-European countries on a European policy. So if you're off to Egypt, Morocco, Turkey or Tunisia, it's worth getting a quote for European cover first and then checking the policy's geographical area definition to see if the country's included. Full info in Insurance in Europe. | | | | 8. | Going away once a year? Grab cover from £5. If you only plan one trip, cover can be seriously cheap.

| Single-trip insurance best buys For individuals and families Leisure Guard Lite* generally wins, with cover from £5 for a single, one-week trip in Europe for an individual or £10 for a family. But try Holidaysafe Lite* to compare, as prices vary depending on age, location and family size. As above, you can also do a full comparison via MoneySupermarket*, Confused*, Gocompare* and Comparethemarket, which sometimes have exclusive deals that beat these. | | | | | 9. | Your claim could fail if you haven't declared all medical conditions (for you, your family or a travelling companion) before you travel. No matter how minor you think it is, tell them EVERYTHING. This applies to you, anyone you're travelling with or a family member at home (who you'd fly back for if they got ill).

Many mainstream insurers will charge high prices to cover pre-existing conditions. So specialists to try are Staysure* (which accepts an extensive range of medical conditions, and some at no extra cost), Insurancewith, Avanti*, MIA Online, Orbis, Good to Go Insurance and Global Travel Insurance*. There is no one winner - it depends on a number of factors incl medication, illness and age.

See Pre-Existing Medical Conditions for help and best buys. | | | | 10. | Check your EHIC - 5.3m are out of date. Everyone (including children) should have a valid European Health Insurance Card if travelling in the EU (and a few more countries). It gives you state-run medical treatment in EU countries (+ Iceland, Norway, Liechtenstein and Switzerland) for the same price as a local. So if it's free for them, it's free for you. Never pay a shyster site for one though - see how to get a free EHIC. | | | | 11. | You still need insurance even if you have your EHIC. Travel insurance does MUCH more than cover medical emergencies. You're also covered for theft, lost luggage and repatriation, which an EHIC doesn't do. But having an EHIC means you don't have to pay the excess on your policy if you show your EHIC when getting treatment. See EHIC vs insurance. | | | | 12. | Beware if taken to a private hospital in Europe - you may not be covered. Many insurers don't cover private treatment unless it's an emergency, and there's no state-run hospital nearby. If you get it wrong you could end up with a bill of £1,000s - or worse. Check with your insurer before you go. For example, some insurers might want you to call them first if it's not a life or death situation. See Private hospital warning. | | | | | 13. | You can cut costs by insuring granny separately if she's part of a family trip. If you buy family or other types of group cover, the price is based on the oldest traveller or the person deemed to be the highest risk. Anyone over 65 usually pays more, and this could push up the price for everyone else, so check if buying a separate policy for them is cheaper. See Over-65s' Travel Insurance for help. | | | | | 14. | Lose your mobile/e-reader/laptop and you're probably not covered. Many travel insurance policies won't automatically include gadget cover. If you need it, select it as an add-on extension to your travel insurance, check your home insurance cover or consider a specialist gadget policy. | | | | | 15. | You normally only get basic cover on cruises. Most travel insurance policies cover medical treatment, theft or loss, but you usually need to buy an add-on from your insurer for anything else, such as cancelled excursions. See Cruise travel insurance help for what's covered and how to get it cheapest. | | | | | 16. | You're never covered in dangerous destinations. If you visit a country the Foreign Office warns against travel to, you won't be covered for any claims as you're deemed to have ignored Govt advice. Check the foreign travel advice site before you go.

Similarly, if you're worried about terrorism in your holiday destination and decide not to go, you won't normally be covered for cancellations. Standard travel policies don't tend to include cover for any terrorism-related threats or incidents. | | | | | | PS: According to reports, UK police are investigating growing incidents of fraudulent claims made when abroad. Don't ever lie, and beware claims firms that get you to embellish the truth. | | | |

| | | | | | | | | | | | | | | | | | If you don't vote, you've no right to complain about what they do. Have your say, and it's time for us to have ours...

It's the biggest consumer decision most will make this year. Who governs has a big impact on the money in your and everyone else's pockets - never mind the fact it can change the flavour of our society. Unless you're a party loyalist the decision isn't easy, factoring in your local candidates, party policies and the party leaders. I don't intend to decide for you, but I do intend to help you decide... It's the biggest consumer decision most will make this year. Who governs has a big impact on the money in your and everyone else's pockets - never mind the fact it can change the flavour of our society. Unless you're a party loyalist the decision isn't easy, factoring in your local candidates, party policies and the party leaders. I don't intend to decide for you, but I do intend to help you decide...

-

Who'll do what for the pound in your pocket. With so much political spittle, we rarely hear real detail on what they'll do, especially on consumer issues. So last Wed we launched our own MSE Leaders' Debate with May, Corbyn, Sturgeon, Farron, Wood & Bartley (Nuttall agreed but didn't send anything). Names linked also sent videos.

What the party leaders say they'll do about...

Affordable housing | Benefits & disability payments | Brexit consumer rights | Energy prices | Financial education | Income tax | Mental health & debt | Mortgage prisoners | Renting | Savings rates | Social care | State pensions & WASPI | Student finance

-

Go election speed-dating. A few clever independent web tools help match you up with the party that best reflects your view. But don't put out too early - I'd use at least two to make your mind up. Quickies: GE2017 & Who Should You Vote For? Detailed: Vote for Policies. Also, you can read fact-checked manifestos of each party. -

Your location, location, location. Where you live matters, as in our voting system you elect a local MP. To find your local candidates, enter your postcode at Who Can I Vote For?, find your sitting MP's voting record (if there is one) at TheyWorkForYou or contact them via Tweet your Candidate. -

Is tactical voting worth it? Poll reliability is questionable, but the brilliant Electoral Calculus does the maths and is a fascinating way to see the probability of different scenarios. If you're willing to vote tactically, Swap my Vote can help. Plus students, as you can often qualify to vote in two seats (but only actually vote in one), find where your vote'll have most impact. -

Take your kids to the ballot box. A general election is a time to celebrate and educate about our democracy. So why not #takeyourkidstovote and show them the process? I'll be taking 4yr-old mini-MSE, and trying to explain to her what it all means (she'll want to play hide-and-seek in the booths no doubt). You DON'T need your polling card to vote. Having it speeds up the process, but you can just turn up at the right polling station and give your name and address. Staff there will have your details if you're registered. If you don't know where your polling station is, contact your local authority. Can't face voting? The right for all to vote was hard fought for. As a last resort, at least go to the polling booth and spoil your ballot (ie, scrawl a line through it) to register a protest, a far stronger message than not voting. PS: Join me at @MartinSLewis for election-night tweet commentary (though I'm filming on Fri so not sure how long I'll last). | | | | | STOP PRESS. Finally a CASH Lifetime ISA launches - get up to £1,000/yr free. Tomorrow (Thu) Skipton Building Society launches the first cash LISA. Under-40s can put £4,000 a year in towards a first home or retirement and get £1,000 a year added. Full info/help in our updated Top Lifetime ISAs guide.

Free West End shows for kids (incl Aladdin & Wicked) with paying grown-up. It starts next Tuesday but last year 80,000 went in the first 24 hours, so go quick. Aug-only, for those 16 and under. Kids go free

It's back. FREE £200 to switch bank. Switching's easy - it takes just 7 days and the bank does everything for you. Newbies switching to the HSBC Advance* account get £150, plus another £50 if still with it after 12mths. You need to pay in £1,750+/mth, fully switch your account incl 2+ direct debits/standing orders within 30 days of opening and register for online or mobile banking within 60 days. Important: Say you want to switch when applying online and HSBC will call within two working days to arrange. Full info & eligibility plus more options in Top Bank Accounts.

Spend £12 on No7 beauty products and get a £23 gift set. Incl mascara, lip gloss & eye pencil. Ltd stock. Boots

Warning - Ryanair may make you sit apart, unless you pay. One MSE'er even had an empty seat next to him, while his girlfriend was forced to sit 14 rows behind. Full info and how to cut seat costs in Ryanair warning.

New. Longest-ever NO-FEE debt shift - up to 29mths 0%. Accepted new cardholders can transfer credit/store card debt to Halifax's (eligibility calc incl pre-approval / apply*) no-fee balance transfer credit card, and pay no interest for up to 29mths. It's the longest such deal we've seen. Need longer? MBNA (eligibility calc incl pre-approval / apply*) is up to 42mths 0% for a 2.79% fee. Always pay at least the monthly min and clear before the 0% ends or they're 18.9% or 20.9% rep APR. Full info: Top Balance Transfers (APR Examples). | | | | | - Hunter wellies 30% off code Ends Sun - £8 for 90 garden-ready plants (norm £19) 3,000 avail - 20% off Thorntons code Ends Sun - 3 personalised photo magnets for £3 all-in 9,000 available | | - £1 sun cream, factors 15-50 - Pay £1, get 25p off most Costa, Pret drinks EVERY time - 5GB (4G) data, 2,000 mins, 5,000 texts Sim, £10/mth - £30 free-range BBQ & roasting-meat hamper - 50+ FREE festivals - see Razorlight, Corinne Bailey Rae etc | | | | | | | Two deals, both from the BT group, similar price - yet one's disguised, letting existing BT custs take advantage

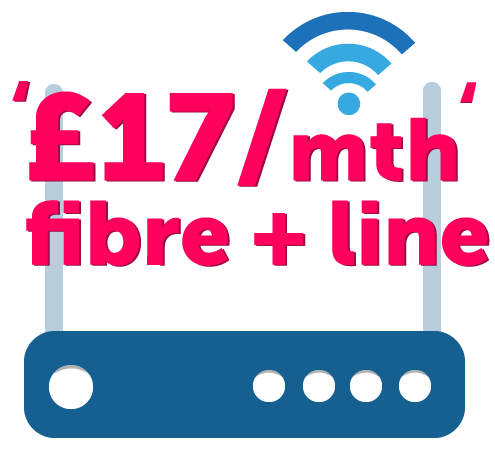

Fibre broadband's big sell is it's much faster than standard, and it's usually much costlier too. The trick is to pounce on short-lived offers, yet they normally exclude existing customers. But with these two similarly-priced deals, anyone can take advantage of at least one (if you're in one of the 83% of homes that can get this fibre line) as long as you're not tied in to a contract. -

Ends Thu. First, the BT deal (so not for existing BT b'band custs). It's only just launched and not around for long, but go via this BT fibre link* before 11.59pm Thu to get line rent & up-to-52Mb unlimited broadband (about 3x normal speed) for 1yr. This deal is all about the cashback, so only go for it if you're sure you'll claim. Here's how it works... Ends Thu. First, the BT deal (so not for existing BT b'band custs). It's only just launched and not around for long, but go via this BT fibre link* before 11.59pm Thu to get line rent & up-to-52Mb unlimited broadband (about 3x normal speed) for 1yr. This deal is all about the cashback, so only go for it if you're sure you'll claim. Here's how it works...

-

Line rental's £18.99/mth. Line fitting's free if you haven't got one. Weekend calls to UK landlines are included, for others see BT call costs. -

Fibre's discounted to £10/mth for 12mths. After it's £28.50/mth. Plus you pay £59.99 set-up, incl activation and p&p for the 'free' router. -

CLAIM £50 cashback and a £150 prepaid Mastercard after activation. Annoyingly BT won't remind you, so diarise to do it via these cashback and Mastercard claim links. You've up to three months after activation to claim - they come separately and may take 45 days. Warning: some people have had issues claiming the cashback on past deals. We've asked BT to fix this, and are monitoring its response. -

Ends Tue 20 Jun. And a deal from BT-owned Plusnet (which existing BT users can get). Plusnet is part of the BT group, yet in our poll it had better customer service than the main brand with 55% voting it great vs 26% for BT. Use this Plusnet fibre link* and get 1yr's line rent & up-to-38Mb unlimited broadband (slightly slower than BT). You can get it as long as you haven't had Plusnet broadband in the past month or are one of the few not in a low-cost area... -

Pay line rent upfront, if you can afford to. It's £185.88 for a year; otherwise £18.99/mth. Calls aren't included, and you'll pay £49.99 if you need a new line. See Plusnet call costs. -

Broadband's discounted to £6.01/mth for a year. Then £14.99/mth. Router & activation are 'free' (usually £25). CLAIM £50 cashback after activation. You're sent an email within 10 days of activation explaining how, and you MUST do it within two months. You then get a cheque within 30 days. - Cost analysis: They're both super-cheap, and as long as you claim the perks the prices are equivalent to just over £17.30/mth. Here's how: Assuming you pay line rental upfront Plusnet's £258/yr before calls and new line costs (if charged), but with £50 cashback it's equiv to £17.33/mth all-in. BT costs £407.87 over the year before calls, but claim the incentives worth £200 and it's equiv £17.32/mth all-in. Regular cashback site users may see bigger cashback elsewhere, though it can change daily, so check. -

Don't need fibre? Get standard speed and line from £12/mth equiv. See Cheap Broadband for top deals. | | | | | | | | | They can get this email free every week | | | | | | | | | If you struggle to get a balance transfer card you have three new options to help get debt-free quicker

If you're paying high interest on card debt we always tell you to do a 0% balance transfer. That's where a new card pays off your existing debts, so you owe it instead but at 0%. More of your repayments clear the debt rather than the interest - and you're debt-free quicker. Yet many who struggle with debt get rejected, so now three specialist cards let you transfer debt to 6mths 0% even if you have poor credit history. -

First check for free what your best deal is. Before you go for a specialist card for people with credit issues, use our free 0% Balance Transfer Eligibility Calculator, which will show your odds of getting all the top cards. It includes the specialist cards too, so you'll see how likely you are to get those. And as (unlike applying) doing this check doesn't impact your creditworthiness, it lets you home in on your best deal with minimum impact. -

New. Shift existing credit or store card debt to 6mths 0%. These new Aqua* and Marbles* cards - issued by the same provider - join Capital One* in letting accepted new cardholders shift debt to them from other cards at 0% for 6 months. All come with a one-off 3% fee (min £3 for Aqua/Marbles), and may accept you even if you've past defaults or county court judgments as long as they're 1+yrs old. New. Shift existing credit or store card debt to 6mths 0%. These new Aqua* and Marbles* cards - issued by the same provider - join Capital One* in letting accepted new cardholders shift debt to them from other cards at 0% for 6 months. All come with a one-off 3% fee (min £3 for Aqua/Marbles), and may accept you even if you've past defaults or county court judgments as long as they're 1+yrs old.

If you can't shift all your debt to one, wait until you've been accepted, and transferred as much as you can, before using our eligibility calc to see if you can apply for another. All above offer pre-approval, meaning for some you'll know if you can definitely get them (subject to ID checks) before applying. -

How much should I shift if I can't pay it all off within 6 months? As much as you can. Because it's interest-free, more of your cash repays the debt not just interest. If you've debt left at the end of the 0% period, do another balance transfer. If you can't, and the card you shifted the debt from has a cheaper rate (these are a horrid 34.9% rep APR vs standard 19%-ish), just shift what's left back there by asking to do a balance transfer. -

Other Credit Card Golden Rules

a) Always pay at least the monthly min on time & keep within the credit limit, or it's a £12 fee & a possible credit file black mark.

b) Don't spend or withdraw cash on these - it's not at 0%, and cash withdrawals hit your credit file. PS. Debt problems keeping you awake at night? This may not help. Consider getting free non-profit debt help. | | | | | 20% off Thorntons code. MSE Blagged. When you spend £10+ online, incl existing offers. Ends Sun - so don't be choco-late. Thorntons

3 'free' photo magnets - just pay £3 delivery (norm £13). MSE Blagged. Good for Father's Day (Sun 18 Jun). 9,000 avail. Attracted?

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"My 18-year-old son's car insurance renewal was £1,500. On a comparison site it came up as £950 - then a multi-car discount brought it to £720, less than half the renewal. #whatabargain." See Young Drivers' Insurance for how to do it yourself.

Free entry to 300+ farms this Sunday - meet the animals, ride a tractor & wang your welly. We gave you a heads-up last week - here's a reminder to get moo-ving. Open Farm Sunday | | | | | | | | | Have you been scammed into transferring money? Increasingly sophisticated scams mean people are losing huge sums by being tricked into transferring money from their bank accounts. But unlike when they've paid by credit or debit card, those affected currently have no legal right to get their money back from their bank. If you, or someone you know, has been a victim of this type of scam, share your story with Which? to help get the message across that more needs to be done. | | | | | | Which of these 50 old TV shows should be brought back? With the return of Baywatch as a film (and recent revivals of Porridge, Open All Hours, Danger Mouse and more), we wanted to know which other old-school TV shows you’d like to see brought back. Have your say in our TV show poll. Brexit and the NHS are influencing your vote. Last week's poll asked for the driving force behind your choice in tomorrow's general election. Across all ages and genders, the NHS and Brexit are big factors. For those under 31 it was also affordable housing and for those aged 31 to 50 it was also education, while for those aged 51+ immigration and the economy were also important. See full election poll results. | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 8 Jun - Good Morning Britain, ITV, Deals of the Week, 7.40am. View previous

Fri 9 Jun - This Morning, ITV, Martin's Quick Deals, time TBC. View previous

Fri 9 Jun - Ideal Home Show, Manchester, 4pm

Mon 12 Jun - This Morning, ITV, time TBC

Mon 12 Jun - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast | | | | Wed 7 Jun - Facebook Live Q&A on medicine, 1pm

Wed 7 Jun - BBC Radio Cumbria, 'Money Talks', from 6pm

Thu 8 Jun - BBC Radio Tees, 10.35am

Fri 9 Jun - BBC South West stations, breakfast, wedding tips

Mon 12 Jun - London Live, 12.20pm

Tue 13 Jun - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: I'm looking to change my bank account and the one I've selected has a minimum monthly pay-in of £1,000. Does the minimum payment have to be made as a lump sum? Anna, via email.  MSE Rosie's A: No, the pay-in can be via multiple payments throughout the month, according to the major providers we spoke to. But it's important to know what counts as a month for your bank or building society to meet the minimum. MSE Rosie's A: No, the pay-in can be via multiple payments throughout the month, according to the major providers we spoke to. But it's important to know what counts as a month for your bank or building society to meet the minimum.

Many, including Bank of Scotland, Barclays, Halifax, Lloyds and Nationwide, count it as a calendar month, but some such as Santander and Tesco Bank count it as a statement month. It's also usually possible to 'game' the pay-in by adding say £500, then withdrawing it and paying it back in, though some banks are wising up to this. For more, and the best buys, see our Best Bank Accounts guide. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week but before we go, after we asked for your best complaint stories last week, one user recalled an amazing 15-year-old letter to a big DIY store. Penned entirely in rhyme, it earned the MoneySaving poet compensation after a can of paint spilt all over her son. More recently, our own Coupon Kid got £10 for a love poem to Innocent Drinks - so have you had success getting redress (in verse)? Let us know in our Facebook post: When poetry pays. We hope you save some money,

The MSE team | | | | | | |