| Hi - here are your latest deals, freebies, tricks and messages to help you save.  THE TOP TIPS IN THIS EMAIL

| | Martin's 20 ways to be more attractive... (financially) Who better to help you don your fiscal glad rags than our Martin, with tips to boost your credit score so lenders will look on with lust  It's late at night. You're alone in your pyjamas in front of the computer, about to make contact. You press the button, but the lender takes one look at you and your credit file and says: "Sorry, you're not my type". It's late at night. You're alone in your pyjamas in front of the computer, about to make contact. You press the button, but the lender takes one look at you and your credit file and says: "Sorry, you're not my type". Catching a financial firm's eye is more art than science. Each lender scores you differently, for each product, based on its own wish-list of what makes a profitable customer as they're all turned on by different things.

So whether for a mortgage, credit card, loan, mobile contract, monthly car insurance or more - there's no one single solution to boost your credit attractiveness. Yet with a blend of knowledge and action, there are things you can learn which work for most... 1. Don't think your credit score is everything. Years ago some bright spark at a credit reference firm realised that instead of just selling data to lenders, they could sell it to consumers too - calling it a 'credit score'... even though in the UK you DON'T HAVE one uniform single credit score.

What credit reference agencies give you is just their rough indication of how a typical lender might see you - even though all lenders score differently. It also misses out crucial earnings and affordability info, often the single biggest factor in lenders' criteria. I'd still suggest you take a gander at your score, as you can do it for FREE via our MSE Credit Club (Experian score), and get free Equifax & TransUnion scores too. But focus on your overall ranking and don't obsess if your score moves a few points up or down, as some smaller actions (eg, cancelling old credit cards) are viewed by some as positive, others as negative. 2. Use the same mobile number and job title on each credit application. Inconsistencies from application to application (even with different firms) can trigger a fraud fail - another form of rejection. I'm not saying it's a problem if your mobile or job changes... more, try to be consistent if it hasn't changed. See fraud scoring. 3. Understand they're trying to predict future behaviour. Lenders use your past behaviour to try to predict future actions. Take these scenarios and think about what you'd do...

A man walks into a pub. He's forgotten his wallet and asks if you'll lend him £20, which he'll repay tomorrow (and buy you a drink to say thanks)...

a) You know him. He does this often, has always remembered to pay back and has a decent income.

b) You know him. He does this often, has always remembered to pay back, but he's lost his job and now has no income.

c) You know him. He does this often, and usually forgets to pay back.

d) He seems decent... but neither you nor any of your friends have ever met him before.

My guess is you answered "yes, probably not, no and no". This is pretty much how credit scoring works: a good income and borrowing track record is best - a bad track record or low income makes lending less likely (or most costly). Equally, not having a credit history means lenders can't predict your future behaviour, so you'll likely be scored out too... 4. Get paid to (re)build your credit history. If you've a poor history, or no history, the way to improve your credit attractiveness is to be a good credit citizen. To do that you need credit, but for many that's a catch-22. Special credit (re)build cards are designed to overcome this. They're easier to get. So get one, do £50-£100/mth of normal spending on it (never withdraw cash) and repay IN FULL each month, preferably by direct debit, so there's no interest. After up to a year, provided you never miss a payment (or have issues elsewhere) your creditworthiness should improve.

Use our Poor Credit Eligibility Calc to see which top cards you're most likely to be accepted for. This includes Aqua Reward (eligibility calc / apply* ) which gives 0.5% cashback on all spending, but sadly doesn't currently include the Amazon Classic which pays new customers a £25 voucher. These have a horrid 34.9% and 29.9% rep APR respectively if you don't repay in full, so please - always pay in full. 5. Check your files every year - small errors kill big applications. I once did a TV money makeover for a woman looking to buy a house who couldn't work out why she'd been rejected for a mortgage. It turned out she had an old (technically active) but unused mobile still registered to her old home. That was the final straw killing her application. So check every line on your files is up to date and correct, annually and before any major application. You can get your Experian credit file for free via our Credit Club, and check other files for free too. 6. 'I was hounded by bailiffs, denied a mortgage and had my career prospects threatened because of my credit doppelganger'

Have a read of this same name credit nightmare as a reason why you should always check your credit file.

|

7. Checking your credit file does NOT impact your creditworthiness. The fact you have checked your credit file (or used an eligibility calculator) will usually appear on the credit file YOU see, but as it's a soft search, lenders DON'T see it. So unlike applying for most products, it doesn't impact your future ability to get credit. 8. Don't try finessing your income on applications. Lenders may verify your income and if it's wrong, you may be auto-declined. Plus a quick tip, always click the '?' that's by the income box on forms. Some firms want household income, others single, some want bonuses or investment income included. Check it so you get it right. 9. Find out if they fancy you - it doesn't just affect acceptance; it affects rate. A credit score is a loose indication of your history. Yet, as noted, it misses out key info about whether you can afford to borrow - and each lender's attitude.

When you apply, lenders don't use it alone to decide acceptance or rejection. For mortgages, loans and credit cards, many also do 'rate for risk'. So the better your risk, the better the deal you get.

The best way to do this is just to ask: "Will I be accepted for the product?" An easy way to do that is using our eligibility calculators which show your odds of getting top deals - and unlike applying this doesn't negatively impact your future credit. So see how well you do using 'em... Eligibility calculators...

Cheap Loans | 0% Balance Transfer Cards | Cashback Credit Cards | 0% Spending Cards | Cheap Spending Abroad Cards 10. Ensure you're on the electoral roll (without any junk mail). If you're not on it, getting credit's tougher, as it can cause ID and tracing issues. If you're worried about junk mail, opt out of the 'open' register, and then your details can't be used for marketing. See full electoral roll help (including what to do if you're not eligible for the electoral roll). 11. Get rid of unsightly unfair defaults. If there's one on your file (eg, you didn't pay a catalogue loan as the firm failed to deliver the goods), get it removed or it can torpedo your chances. See remove unfair defaults help, and even if it's fair, see how to mitigate the damage from defaults. 12. Space out credit applications. Applications (regardless of whether or not you get the product) stay on your file for a year. It's not just the obvious products - it can be mobile phone contracts, monthly car insurance, even gas & electricity direct debits. Too many, especially in quick succession, can harm your creditworthiness, even if you're rejected. So do the most important first, then spread the rest.  13. Public displays of affection are fine, but beware joint mortgages, loans & bank accounts. If your credit file is linked to someone else, lenders can see their history when you're assessed, so if your partner has a bad credit history, be careful about being linked. 13. Public displays of affection are fine, but beware joint mortgages, loans & bank accounts. If your credit file is linked to someone else, lenders can see their history when you're assessed, so if your partner has a bad credit history, be careful about being linked. Linking is nothing to do with marriage, holding hands or sharing a bed - it's about whether you've a joint mortgage, loan, bank account and sometimes utility bill (not credit cards, they're always single accounts with a second cardholder).

- Wrongly linked or separating? See de-link your finances.

- Bad debts from ex-partner? See my Financial abuse and joint account worries blog. 14. Time it right - when you apply can have a big impact. Applications stay on files for a year - bad stuff (such as defaults and county court judgments), six years. So if these will soon lapse, wait until they do to apply and your file's clear. 15. Ensure existing credit card debts are as cheap as possible. In itself, cutting existing debt interest doesn't boost your credit score (though it does boost your coffers). Yet it means more of your repayments clear the debt - and less existing debt boosts acceptance chances. So if you're paying interest, check out doing a balance transfer. 16. Don't be scared to apply for a new product in case it "drops my credit score". I'm often surprised by people asking me whether they should apply to cut debt costs because "it may impact my credit score". This is a somewhat twisted logic.

The point of being creditworthy is so you'll be accepted for credit when needed - there's no point in protecting your credit score for its own sake. 17. NEVER miss or be late on repayments. Always use a direct debit to be sure, even if you just set it up to make the minimum repayment (then call up to pay more each month manually). 18. Withdrawing cash on credit cards ain't attractive. It's expensive for starters, plus lenders see it as evidence of poor money management. See Is it different for overseas cards? 19. Pay your rent on time and boost your credit score. The Rental Exchange Initiative launched in 2016, and records your rental payments (like mortgage payments are recorded), which are then added to your Experian credit file. To see how to access the scheme, read let your rent boost your credit score. 20. Payday loans are just plain ugly - but you may be able to remove them. Payday loans are not only hideously expensive, but some mortgage firms have been known to say openly that they'll simply reject anyone who's had a payday loan - as it's a sign of poor money management.

If you've had one it's worth checking if you were mis-sold it - as if so, you may be able to ask for it to be wiped from your file. And these tips are just the start. For the full set, see my 37 Credit Boosting Tips guide. | | DON'T believe the fake ads on Facebook

Lots of scam ads that litter social media lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | It's the summer holiday 'lates' period - now's the time to grab cheap getaways if you're flexible, eg, 7nts' self-catering in Malaga, £174pp

The 'lates' period usually starts 6-8 weeks before the date of travel. So right now, it covers the entire school holidays. That means if there's still stock left, package holidays especially can be heavily discounted. Of course, choice is limited, so you have to be open to various whens & wheres, but there are deals to be had, eg, 7 nights in Malaga, Spain, in late August, for £174pp (3-star, self-catering, based on four sharing). Here's what you need to know. - For package holidays, booking late means bargains. Tour operators create packages including flights, hotels and usually transfers, for an all-in-one price. These can be very competitive for traditional tourist destinations at this time of year. To find them online punch your details into comparison sites Kayak* and TravelSupermarket* and flash-deal sites such as Holiday Pirates for a planeload of deals. Or speak to your local travel agent face-to-face.

They also have the advantage of ATOL or ABTA protection, which means if the travel company fulfilling your booking goes bust, you'll be refunded if you're yet to travel, or you'll get alternative accommodation and flights home if you're abroad.

-

Like good comedy, timing is everything. We may not be funny, but we're good at holiday research, and have been trying to find a sweet spot for anyone who hasn't yet booked. Like good comedy, timing is everything. We may not be funny, but we're good at holiday research, and have been trying to find a sweet spot for anyone who hasn't yet booked.

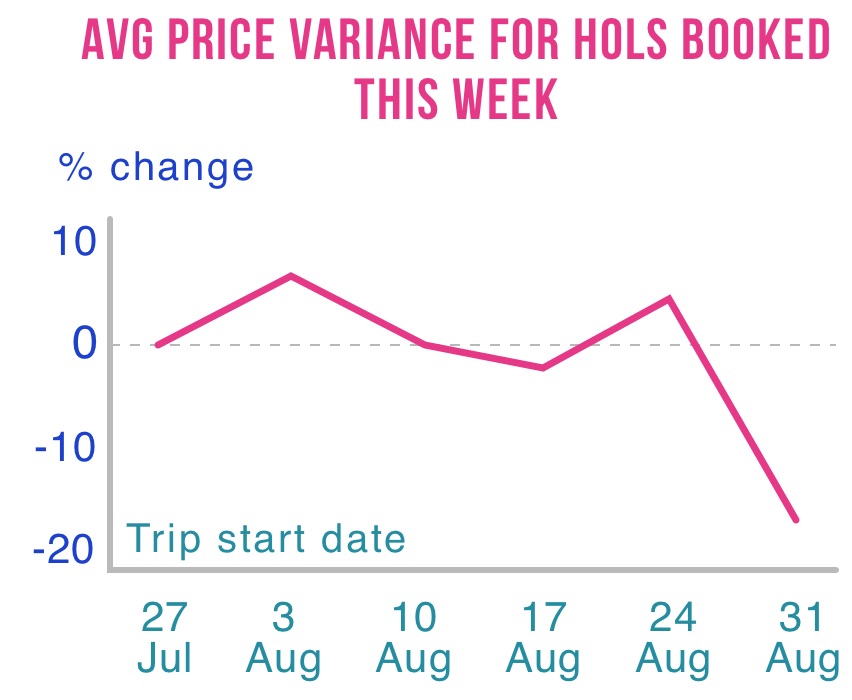

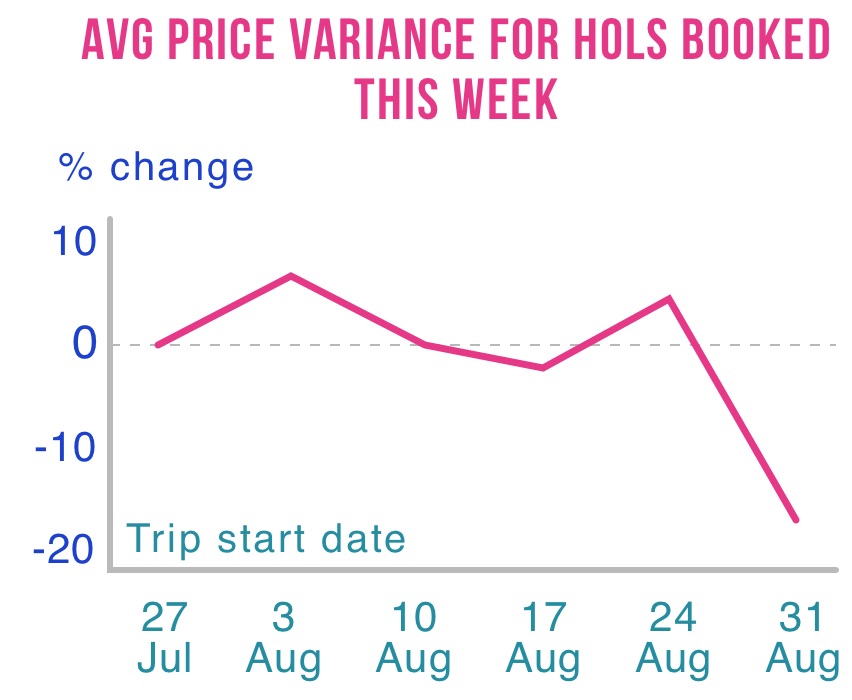

- Want to book today? Flexibility is key. We checked the prices of 20 different package & DIY holidays for a variety of dates, all booking this week. As the graph shows, average prices fell sharply after school hols end in September, as expected. But before that, there was no clear pattern as to when's cheapest to go.

Yet these average prices mask big differences for individual holidays, showing just how important it is to be flexible over when you go if you can. Eg, one 7-day hol to Greece for a family of four was £753 cheaper booking in the cheapest week - so try not to be rigid over dates.

- Happy to wait before booking? Prices may fall further - but you'll have less choice. Apart from the obvious point about avoiding school hols, there are two different tactics which can affect prices...

a) Book very late (ie, a day or two before flying). This can be super-cheap, but super-limits your choice too.

b) Travel later in summer. Generally within the summer holidays the last weeks of Aug are cheaper than earlier.

The complexity is how those two interact, which is why there's no simple pattern in the graph. We suspect that if you were to wait until 20 Aug to book a departure on 24th, prices will be rock bottom (we'll be testing it to build our data for next year). However you're likely to have much less choice - so if you're set on a particular holiday or destination, we'd suggest checking now.

- With scheduled flights later isn't usually cheaper, but check comparison sites (which also include charters). Scheduled flights (the normal ones by airlines) tend to increase prices nearer the day when there are fewer seats, likely as business travellers who need to travel will often pay more. Yet also be aware of charter flights - these are spare seats on special flights tour operators put on for their customers. If they've seats left, they may be cheap and should show up in the sites below.

To check for cheap flights use comparison sites Kayak*, Skyscanner* and Momondo*. Also see our full How to bag cheap flights guide.

And of course, if you're booking flights only, there are also hotel comparisons to check, including Skyscanner*, Kayak* and TripAdvisor*. See our full Cheap hotels guide.

- In England? Beat school hols price hikes by flying from Scotland instead. Most Scottish schools go back in mid-Aug, so exactly the same package hol flying from Scotland can sometimes be much cheaper in late Aug. This is particularly useful if you live in the north of England, but others use this trick even if they live further away. Wendy told us: "Although we live within spitting distance of Heathrow, we saved £2,000+ by flying out of Glasgow. Definitely worth the drive up the M6." See more tricks in our Beat the school hols price hikes blog.

| Tesco cuts loan rates to join the cheapest at 2.9% Now FIVE lenders offer ultra-low rates for larger loans - meaning decent acceptance chances if you need to borrow There's big competition among a string of lenders right now. Usually just a couple fight to be cheapest but now Tesco Bank has dropped rates and there are five at the top of the best-buy tables for larger amounts - with their rates close to all-time lows. Intuitively, with more choice, you've more chance of being accepted, so long as you've a decent credit score and income, though that's impossible to validate. Use our Loans Eligibility Calc to home in on the ones you're most likely to be accepted for, without damaging your credit score. -

Should I get a loan? We're not suggesting you rush in. Only apply if you NEED one (eg, your car for commuting has packed in), and it's budgeted for and affordable. If in doubt, don't risk it. If struggling with debt, ignore all of this and read our Debt Help guide. Should I get a loan? We're not suggesting you rush in. Only apply if you NEED one (eg, your car for commuting has packed in), and it's budgeted for and affordable. If in doubt, don't risk it. If struggling with debt, ignore all of this and read our Debt Help guide.

- Lowest loan rates - from 2.9%. Here are all the top picks (ALL are 'representative APR' - see explanation below). Most are for 1-5 years, a few have slightly different terms:

- £7,500-£15,000: 2.9% at Admiral*, John Lewis*, M&S*, Tesco* (new), and ONLY if you've got its Nectar card, Sainsbury's

- £5,000-£7,499: 3.3% at Yorkshire Bank* / Clydesdale Bank*, 3.4% at Admiral*

- £3,000-£4,999: 8.2% at Admiral*, 8.5% at Hitachi*

- £2,000-£2,999: 13.2% at Admiral*, 13.4% at Ikano Bank*

- £1,000-£1,999: 13.2% at Admiral*, 13.5% at Santander

- Borrowing less than £5,000? A 0% money transfer credit card may be cheaper. A few specialist cards allow money transfers. You can use one to pay cash into your bank, so you owe it instead. And if you can get one with a big enough credit limit, you can in effect use it to get a loan at 0% for up to 28mths (for a 3-4% fee) - a lot cheaper than paying loan interest. Just make sure you repay before the end of the 0% period. Full info and top picks in 0% Money Transfers.

- Beware - 'representative rates' mean you may NOT get the advertised rate. Sadly, ONLY 51% of those accepted need to get the advertised rate - others can pay more, and there's no limit. So a '2.9% loan' could cost 20%. Unfortunately there's no way to know this without applying (although we're urgently working on that), as even if you're using our eligibility calc , high chances of acceptance don't automatically mean you'll get the cheap rate. So ALWAYS check the rate you've been given once you apply.

- Loan Golden Rules. Full info and options in Cheap Personal Loans (APR Examples).

a) Minimise the amount and repay as quickly as possible.

b) Pay on time (preferably by direct debit) or you may get a charge and credit black mark.

c) If you're applying to pay off credit cards, a balance transfer may be cheaper. | Tell your friends about us They can get this email free every week | Cheap over-65s' travel insurance from £50/yr: solving an age-old problem For too long some insurers have seen older people as a cash cow to boost profits by over-inflating prices The prohibitive insurance quotes some older travellers receive can leave many angrily overpaying, and others sadly stuck at home when they dreamed of heading off to party. Last week we looked at cheap cover for those with pre-existing conditions, previously we've done straight cheap travel insurance - this week we're focusing on age-based policies. Increased age does statistically mean increased risk, so you'll pay more than younger folk, but there are ways to cut costs. Full info in our Cheap Over-65s' Travel Insurance guide - here's a quick trip through the key info. (And of course, if you're travelling in the EU ensure you have a free EHIC that's still in date.) -

Annual vs single-trip policies - which wins? The answer's different here... For those 65 and under our rule of thumb is go away 2+ times/yr and annual policies are worth it, and that same logic can usually work up to age 75. Above that, annual policies get relatively more expensive, so then they usually only win if you go away 3 or 4+ times/yr or more - but it's worth doing the maths yourself as it varies. Annual vs single-trip policies - which wins? The answer's different here... For those 65 and under our rule of thumb is go away 2+ times/yr and annual policies are worth it, and that same logic can usually work up to age 75. Above that, annual policies get relatively more expensive, so then they usually only win if you go away 3 or 4+ times/yr or more - but it's worth doing the maths yourself as it varies.

- Annual travel insurance from £50/yr. These no-frills options meet our minimum cover criteria and are ranked purely on price, not factoring in payout record or service. So we're not saying these are the best all-singing all-dancing policies, these are just for people who want basic cover. Full options in Over-65s' annual policies.

- 66-75: Leisure Guard* - £50 in Europe (£70 for a couple), £72 world (£95 couple).

- 76-85: Insure and Go (Silver) - £169-£252 Europe (£339-£377 couple), £253-£377 world (£507-£754 couple).

- Over 85: Here it gets tricky. Try Age UK, Staysure*, All Clear Travel & Benenden (all have a wide age range).

If you want more protection, eg, for gadgets & delays it's worth doing a full check using comparison sites such as MoneySupermarket*, Confused*, Gocompare* and Compare The Market*.

PS: If you travel independently on a couples' policy, speak to them to check it's allowed first.

- Or single trip policies from £11. Again we're focusing on no-frills options that meet our minimum cover criteria but don't factor in payout record or service. See Single-trip over-65s' travel insurance.

- 66-75: Coverwise* - £11-£18 Europe (£17-£29 couple), £26-£38 world (£67-£91 couple)

- 76-85: Planet Earth* - £46-£74 Europe (£111-£149 couple), £93-£158 world (£185-£315 couple)

- Over 85: The choice is less but try Age UK, Staysure*, All Clear Travel & Benenden (all have a wide age range).

For more protection, eg, for gadgets & delays do a full check using comparison sites such as MoneySupermarket*, Confused*, Gocompare* and Compare The Market*.

- Going away as a family? You may be best insuring yourself alone. If you're the oldie in a group with younger travellers it can work out cheaper for you to get a policy for yourself and them to get a single, couples or family policy to cover the rest of them - as the price is usually dictated based on the oldest traveller in the group. So check.

- Will a packaged bank account help? With these you pay a monthly fee and get a range of insurances included. Our top pick for over-65s is Nationwide FlexPlus* at £13/mth as it gives worldwide annual travel insurance for family members under 70 registered at the same address, which is great for those aged 66-69 who pay no surcharge. Even if you're older there's only a £65/yr surcharge per policy which isn't too bad. It also comes with family phone and breakdown cover - for you, a partner and kids. See Packaged Bank Accounts for full info.

- Will these insurance policies cover me whatever happens? No. Sadly that's impossible to say. Insurance protects against unexpected eventualities which is tough to check in advance. No one checked to see if they were covered for an Icelandic volcanic ash cloud before it hit in 2010, for instance. So check the policy details for the basics, ensure insurers are FCA-regulated, and if they unfairly reject a claim, take them to the free Financial Ombudsman.

| THIS WEEK'S POLL What should be means-tested? Free bus passes, the NHS, student loans? Which allowances and entitlements do you think should be means-tested based on your income/wealth (in other words, the richest don't get it or they get less)? And which should everyone get regardless? What should be means-tested? Younger MoneySavers are more likely to keep quiet about being scammed. Last week we asked if you've been scammed and if so, whether or not you told anyone. Thankfully the majority of the more than 2,000 MoneySavers who responded haven't been scammed. Of those who have, 17% of those aged under 40 didn't tell anyone about it, compared with 13% of those aged 40-60 and 9% of those aged 60+. See full poll results. | Ikea hacks - incl £5 off voucher, free drinks & more

Ciaté - £75ish lip gloss collection for £25 delivered

Swagbucks - £20 M&S/Amazon voucher for doing surveys

Lego - 20-30% off, incl Harry Potter and Star Wars

FREE drinks - incl beer, cider, G&T, J2O etc Co-op - £5 for two pizzas and four Budweiser beers

Ted Baker - £30 glasses via SpeckyFourEyes code

Halfords - free summer car check, incl screenwash top-up

KFC - £1.99 mini fillet burger, two wings & fries

Cheap BBQs - incl £1 disposable, £5 reusable | | | MARTIN'S APPEARANCES (WED 24 JUL ONWARDS) Thu 25 Jul - Good Morning Britain, ITV, 7.35am

Fri 26 Jul - This Morning, ITV, 10.30am MSE TEAM APPEARANCES (SUBJECTS TBC) Fri 26 Jul - Good Morning with Joe Lemer, BBC South West stations, from 5am

Mon 29 Jul - Breakfast with Julia Hartley-Brewer, TalkRadio, 9.45am

Tue 30 Jul - Lunchtime Live with Jeremy Sallis, BBC Radio Cambridgeshire, 2.20pm | QUESTION OF THE WEEK Q: Can I switch bank account if I use the overdraft facility every month? Shirley, via email.  MSE Karl's A: You can indeed but whether you get an overdraft with your new account and, if so, whether that limit is high enough to cover the debt, will depend on the new bank. MSE Karl's A: You can indeed but whether you get an overdraft with your new account and, if so, whether that limit is high enough to cover the debt, will depend on the new bank. If you're overdrawn when you switch and the new bank accepts you but won't match your existing overdraft limit, it's worth bearing in mind you'll have to repay what you owe to your old bank - so weigh that up before switching. For more help and the best banks to switch to, see Best Bank Accounts. Please suggest a question of the week (we can't reply to individual emails). | TO RECLINE OR NOT TO RECLINE? That's it for this week, but before we go... many are jetting off on holiday in the next few weeks, but one question has prompted massive debate among MoneySavers - is it bad plane etiquette to recline your seat? One spoke for many, arguing that reclining is "selfish and shows no consideration for others". Another was unapologetic: "My money, my seat. Once the meals are finished my seat will be going back." Or is it, as one traveller argued, "bad etiquette to design and build the seats so close together"? Let us know where you sit on the subject in our Recline your seat? Facebook post. We hope you save some money,

The MSE team | |