| Plus... £15 fibre b'band ends, free pizzas, free £40 card trick and more  THE TOP TIPS IN THIS EMAIL

| | News. Energy prices hiked by £96/yr from 1 Apr. Don't take it. We've a cheaper than the cheapest deal. Ditch, switch, save £100s

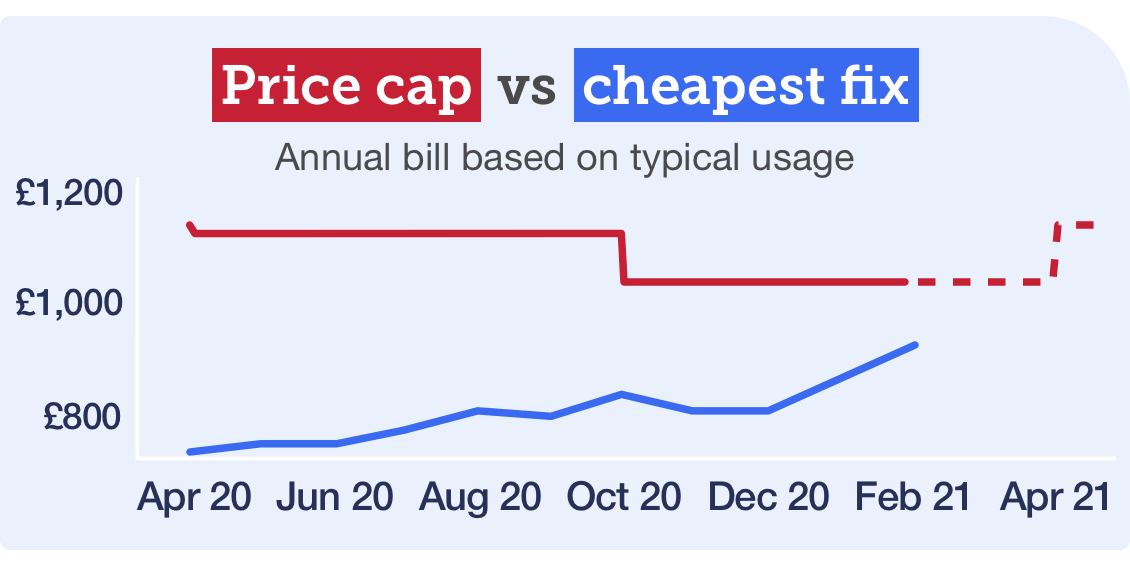

Intro from Martin: "If you've ignored your energy bills - stop. This freezing week's the time to check if you're on the right deal. To help, we've negotiated a deal for our Cheap Energy Club that undercuts the market's cheapest, and agrees to MSE's enhanced customer service request. "The reason for this call to action is that on Friday, the regulator Ofgem announced the price cap for standard direct debit tariffs will rise by a huge 9% on 1 April (prepay 8%). For someone with typical usage, that's up from £1,042/yr to £1,138/yr. As more than half of Britain's homes are on tariffs within a quid or two of the cap, millions will be hit.  "The rise isn't a surprise, we've long been predicting it. The cap is mostly based on wholesale prices (which energy firms pay) and they've jumped. It's also why prices of the cheapest deals have jumped too. "If you find watching easier than reading, I've also done a video explanation. Now for the key switching info from the team..." Important: Currently savings results are UNDERESTIMATED

Energy firms won't publish their new, costlier tariffs on the back of the price cap rise, likely for weeks. Until then, if you're on a standard tariff, when you compare, your savings must be worked out against current prices. So they won't include the typical extra £96/yr you'll save from avoiding the price cap hike. Find choosing confusing? Let us pick you a tariff

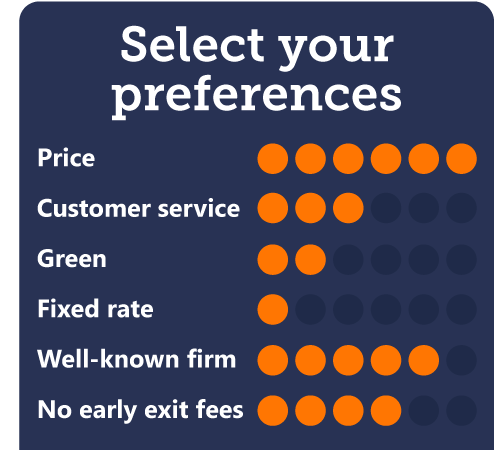

Before we run though the top deals, most people actually prefer to let us help them through it. The MSE Pick Me A Tariff tools are perfect for those unsure or nervous about switching or choosing.

- Step 1: Quickly tell us your energy preferences (fixed rate, name you know, top service, green etc) or just select Martin's default choice. - Step 1: Quickly tell us your energy preferences (fixed rate, name you know, top service, green etc) or just select Martin's default choice.

- Step 2: We then use that to find your top-pick tariff for you to switch to.

- Step 3 (optional): Each year when your deal ends, you can choose for us to email you your new winner based on your preferences, with just one click from you to verify and then switch. And to prove that even if you're nervous about switching it can pay, here's an email we got from Hilary this week: "Thank you Martin Lewis, you made an OAP very happy with a £570 saving. It's the first time I had the confidence to switch energy suppliers." The prices below are based on averages - yet prices are regional and your winner depends on your usage. All links go via our Cheap Energy Club full market comparison, so you can see your exact winner and price, as well as more details on each tariff. cheap energy FIXED RATE deals

Where the rate is locked in (what you pay varies with use)

Based on typical direct-debit use, average of regional prices | | Most non-switchers are on the direct debit standard-tariff price cap. We've averaged the cap over the next 12mths. | £1,122/yr

(£1,042 now; £1,138 from Apr) | E.on 1yr fix. MSE Blagged. Cheaper fix than the cheapest deal + MSE enhanced service. New custs only | 100% green elec (not gas) | 3.0/5 MSE service rating | Smart meters required (will fit for free if you don't already have them)

Lower service rating, but for this specific deal, E.on has agreed to 'MSE enhanced service', meaning if it doesn't sort it for you, we can escalate issues directly. | £923/yr

Save £199/yr (though comparison will only show £119) | Utility Point 1yr fix. Cheap fix. New custs only | 100% green elec (not gas) | Only avail via comparison sites, you can't get this direct via Utility Point

Normally good for service, but with many recent service complaints (mainly over getting credit back). It says it's facing a challenge due to coronavirus staffing levels and meeting coronavirus help needs, so we've temporarily removed its rating. | £924/yr

Save £198/yr (though comparison will only show £118) | | Pure Planet 1yr fix. Cheap 'greener' fix, decent service rating. New custs only | 100% green elec & unlike the others it is also 100% carbon-offset gas | Decent 3.8/5 MSE service rating | £946/yr

Save £176/yr (though comparison will only show £96) | British Gas 28 Feb 2022 fix. Cheap fix that includes 'free' £138 heating insurance. New custs only | 100% green elec (not gas) | 3.5/5 MSE service rating | Only avail via comparison sites, you can't get this direct via BG | Smart meters required (will fit for free if you don't already have them)

This tariff also gives a year's free heating insurance that normally costs £11.50/mth. After a year, if you don't want to pay, remember to cancel. | £955/yr

Save £167/yr (though comparison will only show £87) | | Prices include £25 MSE dual-fuel cashback. Savings compared with the price cap averaged over the next year. |

Is it worth switching now or waiting until April? Many have asked us this. Well, this is the heaviest use time of the year, so do a comparison now. If it shows you can save (and you like the service rating), then switch and cut your rate while usage is highest. Yet if you'll pay more by switching - which is possible, as prices have risen - then stick where you are. Those on cheap fixes are unaffected for now by the price cap rise, though the price your tariff jumps to when the fix ends may be high. So again, unless you can save by switching now (factoring in any exit fees) or are in the last days of the fix, stay where you are until it ends. If you don't pay by monthly direct debit, you either can't get the deals above or will pay a higher rate. However, that doesn't mean you shouldn't compare. - Not on monthly direct debit? If you're not on a prepay meter, the cheapest thing to do is to switch to monthly direct debit, as the top deals are only via this payment method. If you're not happy to do that, you can still do a comparison based on your payment method.

- Are you a prepay customer? Those on prepay sadly have a less competitive market to choose from, and usually pay more. The prepay cap is also increasing, so try our prepay comparison - savings are smaller, but still possible.

If you're willing to, it is likely you would make far bigger savings in the long run by switching to a credit meter. For help on that, see Cut prepay energy costs.

- In Northern Ireland? Our Cheap Energy Club - like all UK comparisons - doesn't include NI, but you can get more info in Cheap NI Electricity or do a comparison via the Consumer Council for Northern Ireland's tool.

Here's a quick Q&A - for more, see the full Cheap Energy Club FAQs.

Q. Is switching risky? Could I be cut off? No, as no one visits your home (unless you want/need a smart meter), and it's the same gas, same electricity and same safety. The only things that change are price and service. See our How switching works FAQ. Q. Does MSE make money from this? That depends on the tariff. If it's one we can switch you to, like all energy comparison sites, we're paid (though unlike others we don't hide tariffs that don't pay), and we give you roughly half as cashback (£25 dual fuel, £12.50 single fuel). You wouldn't get this going direct (not that all the top deals above are available directly anyway), so it's a win-win. The rest helps cover our costs and hopefully makes us some profit. More switching and energy help in the links below... Switching with smart meters | Why's my bill risen when I've fixed? | Reclaim credit | Switching-in-debt help | Switching if I've solar panels | How direct debits are set | Can I pick a switch date? | How do you compare my rates? ____________________________

The battle of the banks is back - and they'll PAY you for custom 8.30pm Thu, ITV: Martin's Money Show Live

Over to Martin: "Banks are finally paying £100+ if you switch to them again. Should you grab it, and if so which is best? What if you're overdrawn? And are you owed £1,000s from your old bank account? Plus a quick check-up to ensure you're not leaking money from hidden regular payments. And all that's before we get to my News-You-Can-Use and more. "And of course, as it's live you can tweet suggested questions to me via @MartinSLewis, and if possible, please use the show's hashtag #MartinLewis. Do tune in or get a stenographer to transcribe. It pays to watch." | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | New. Finally, FREE £125 cash for switching bank returns

Ends Sun. Yet the FREE '£180' (15 bottles) of wine deal's closing

January is usually the month where banks pump out (legal) free cash bribes to get you to switch. Yet this year the cupboard was bare, as the only major switching freebie was Virgin Money's wine. Finally, in the 2nd week of February, there's a deal where you're paid to switch. To get any of the freebies, you need to use the banks' official switching services. The switch takes 7 working days, all direct debits and standing orders will be moved for you, your old account will be closed and any payments to it auto-forwarded. You also need to pass a credit check, but it's usually not too harsh. -

New. HSBC free £125 + 1% fixed savings. Provided you haven't held an HSBC bank account since Jan 2018, switch to the HSBC Advance account* and you can get £125 roughly 20 days after the switch completes. You'll also get access to its 1% fixed regular saver, where you can save up to £250/mth. New. HSBC free £125 + 1% fixed savings. Provided you haven't held an HSBC bank account since Jan 2018, switch to the HSBC Advance account* and you can get £125 roughly 20 days after the switch completes. You'll also get access to its 1% fixed regular saver, where you can save up to £250/mth.

How to get it: You'll need to pay in a min £1,750/mth, which is just its way of saying "pay your salary/salaries in" (equiv to £25,600+/yr). Plus you need to switch 2+ direct debits/standing orders across.

You can still get the offer if you have an account at its sister banks First Direct and M&S Bank, as long as they were opened before 2018.

- Ends 11.59pm Sun. Free '£180' wine + 2% savings + top overseas spending card. New Virgin Money* switchers can get 15 bottles of wine (it says they're worth £180; we can't verify this as they're Virgin Wines exclusives) sent within 36 days of you meeting the switch criteria (pls be Drinkaware). You'll also get 2.02% AER variable interest (only on up to £1,000), and its debit card is a top pick for use overseas, as it has fee-free spending and cash withdrawals.

How to get it: Switch 2+ direct debits across, register for its app, and put £1,000 in its linked 0.5% easy-access savings account (a best buy in its own right). If you've no other savings, you could move it to the main account once you've got the wine code to get the 2%. For full info on both, plus accounts with cashback, interest, cheap overdrafts or insurance, see Best Bank Accounts. | £4.50 coats, shoes, dresses & more that are unsold from Next, Topshop, New Look etc. MSE Blagged. A discount retailer sells de-tagged surplus stock and non-branded items that might otherwise end up in landfill. Normally items are £5 each, but our code gets them for £4.50 until Sun (though factor in delivery from £3.95 too). Everything5Pounds Ends 11.59pm Mon. Cheapest FIBRE b'band & line we've seen in FOUR YRS - '£14.66/mth'. MSE Blagged. Shell Energy newbies can get this 35Mb deal for £22.99/mth. Yet you automatically get £100 bill credit within 3mths (essentially 4mths' free), so it's a £176 outlay over the 1yr contract, equiv to £14.66/mth - see the link for full info. For more deals, use our Broadband Comparison tool . 60,000 FREE Morrisons pizza ingredient kits for struggling families. It's dishing out the kits - which serve two - via schools in Scot this week, and in Eng and Wales next week. See free pizza kits. Ends 11.59pm Thu. FREE £40 via credit card trick. Newbies to M&S Bank's credit card* (best to check acceptance odds first ) get: A) £25 cashback on £100+ spent within 90 days; B) £5 of M&S pts if you spend 1p+ at M&S; C) £10 of M&S pts if you sign up for paperless statements by 5 Mar. So do that and put £100 of normal spending on the card (if not at M&S, then buy, say, a banana there) and pay it off IN FULL, and you're £40 up. Is it a good card apart from the trick? It's a near best-buy 18mths 0% on spending, so if you need 0% (only use for planned, budgeted, one-off spending) it's good, but ensure you clear the card before the 0% ends or it's 19.9% rep APR. Full help in Credit Card Rewards ( APR Examples). TV licence fee to rise to £159/yr (up £1.50) on 1 Apr - but who needs to pay? See TV licence help. Ends Mon. Shift debt to 15mths 0% NO FEE plus get £20 cashback. If you pay credit or store card interest, a balance transfer card can help you slash debt costs, and Barclaycard* (do check acceptance odds first) gives 15mths at 0% interest with no fee to transfer. Plus if you apply by Mon and shift £2,500 to the card within 60 days, you'll get £20 cashback. Golden rules: 1) Pay at least the monthly min. 2) Pay it off within the 0% or transfer again, or it's 21.9% rep APR. 3) Don't spend/withdraw cash. Need longer to pay off? More info and deals, incl up to 29mths 0%, in Top Balance Transfers (APR Examples).

90% off 1mth's 'tailored' dog food (eg, £23 worth for just £2). MSE Blagged. Add info about your dog (eg, breed, age, dietary requirements) and it creates a recipe especially for your furry friend. Tails dog food | Martin: 'Council tax to increase by 5% for millions in April. I've 10 ways you may be able to cut £100s or £1,000s off your bill'

According to the Local Govt Chronicle, just over half (53%) of councils propose putting up bills by the max 5% from 1 Apr. Councils offer crucial public services, and during the pandemic, have been a lifeline for many. Yet council tax bills - especially if they increase - are a stretch for some, and while people need to pay their dues, it's worth checking if you're missing out on legitimate reductions. Full help in Council tax - can you cut the cost? Here's a key summary: According to the Local Govt Chronicle, just over half (53%) of councils propose putting up bills by the max 5% from 1 Apr. Councils offer crucial public services, and during the pandemic, have been a lifeline for many. Yet council tax bills - especially if they increase - are a stretch for some, and while people need to pay their dues, it's worth checking if you're missing out on legitimate reductions. Full help in Council tax - can you cut the cost? Here's a key summary: 1. Up to 400,000 homes are in too high a band. Are you? In Eng, Scot and Wales since 1993, homes have been ranked from band A, the least expensive; to band H (I in Wales), the most. To assign bands in 1991, a stopgap 'second-gear' valuation was done, often literally by people in cars with a clipboard. In Eng and Scot that stopgap's never been updated, so many are in the wrong band. I first came up with the council tax check & challenge in 2007 - it can get bands lowered, and backdated reductions. Successes still flood in, such as Kevin: "After watching your show, we got a £5,500 refund. Thanks, it had never have occurred to us." 2. Live alone or with under-18s / students? There's a single-person reduction of 25%. Those aged under 18 and full-time students are disregarded for council tax purposes, so a single parent would be entitled to the single person's discount. Live-in carers in some circumstances are disregarded too. Paula tweeted: "I applied for a single-person reduction - £350 saving for the current year and £620/yr going forward. Thank you." 3. On pension credit? You could get a reduction. See pension credit help. 4. Full-time students are disregarded for council tax purposes. Homes with all students don't pay council tax at all. Patricia emailed: "Having watched one of your TV shows, I claimed for my 3yrs of study. I wasn't expecting success, but the council cleared my remaining amount and reimbursed me £2,600+." See student council tax. 5. Those with a 'severe mental impairment' (SMI) may be missing £1,000s in discounts. If someone has a diagnosed SMI, which includes some with Alzheimer's, Parkinson's, strokes and more, and are eligible for (not necessarily claiming) some benefits, eg, disablement allowance, they may be disregarded for council tax purposes, ie, no council tax if they live alone, and get 25% off if they live with one other grown-up. Our Severe mental impairment guide will take you through it. This is wildly under-publicised - we've been raising awareness for years, and many have heard, including Tom who tweeted: "@MartinSLewis Thanks. After a brief battle, I've claimed back £9,649.65 for my dad who suffered a stroke in 1999 and has lived alone since 2005. This will make a big difference." 6. Had your home adapted due to disabilities? You may be able to get your council tax band lowered. 7. On benefits or a low income? Can you get up to 100% off? Claim ASAP, as it may not be backdate-able. What, if anything, is available varies by council. See council tax benefits. 8. Struggling financially due to coronavirus? You may be able to get a council tax payment plan. There's no one-size-fits-all rule here, and it varies widely from council to council and case-by-case. So while there's no certainty, it's definitely worth a conversation. More info in Covid-19 council tax help. 9. Moved home since 1993? Especially if you didn't pay by direct debit, there's a chance you may be owed money. Read Claim back council tax overpayments. 10. In Eng? You can ask to pay over 12mths, not 10mths. It may help some with budgeting. See spread payments. | BT and EE to hike mobile, b'band, TV and phone prices. See your BT and EE price rise rights. Green Network Energy customer? We now know your new tariffs. GNE is in administration, its 360,000 custs are moving to EDF, and we now have the full rate details for the six new tariffs. See Are EDF's new GNE tariffs any good? analysis. Related: Simplicity's custs move to British Gas. 20+ free (or very cheap) ways to sprinkle joy for kids over half term, eg, stargazing and painted-rock treasure hunts. See MSE Jenny's Free or cheap half-term fun blog. Bounce back loans - new rules include delaying your first repayment for an extra 6mths. The Government has confirmed and tweaked the rules. See Bounce back loans help for a full rundown on how they work. Not sorted Valentine's? Do you need to? If so, find £4 roses, £15 dine-in meals + ideas to celebrate for free. Romance is great, but over-commercialised pressure to show your love ain't. Don't feel you need to spend. Yet if you're going to, we've last-min Valentine's offers (incl MSE Jules's Free ways to celebrate blog). Virgin launches 'Red' loyalty scheme - is it any good? You can earn pts at Virgin brands plus retailers such as Boots and M&S, but you're more limited in where you can spend them. See Virgin Red analysis. | Tell your friends about us They can get this email free every week | | AT A GLANCE BEST BUYS | | New. Free £125 for switching + 1% regular saver: HSBC

Ends Sun. Free wine for switchers + 2% interest: Virgin Money | | SUCCESS OF THE WEEK:

"I have followed MSE for many years and spent today with my partner doing a money makeover. We saved £6,712. It's the best-paid day this year, and I even cut a year off my mortgage."

(Send us yours on this or any topic.) | THIS WEEK'S POLL Will you spend on Valentine's? If so, how much? Valentine's Day is on Sunday and while some love the romance, others see it as an over-commercialised day with added pressure to spend. And, of course, this year the coronavirus pandemic means Valentine's could be very different, and with many having lost loved ones, feel free to skip past this. Yet if you're OK with answering, we want to know how much you're planning to spend. Starling Bank takes the banking service crown. Last week, we asked you to vote in our biannual banking customer service poll - more than 4,000 people responded. Of the banks that received 100+ votes, app-based Starling came top with 93% of its customers rating it 'great' and just 3% 'poor'. First Direct was a close second with 91% 'great' ratings, while TSB took the wooden spoon with 41% rating it 'poor'. See full bank service poll results. | MARTIN'S APPEARANCES (WED 10 FEB ONWARDS) Wed 10 Feb - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 11 Feb - This Morning, phone-in, ITV, 10.45am

Thu 11 Feb - The Martin Lewis Money Show Live, ITV, 8.30pm MSE TEAM APPEARANCES (SUBJECTS TBC) Sun 14 Feb - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 10am

Mon 15 Feb - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 16 Feb - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | £5.25 SMOKED SALMON FOR 10p - CAN YOU BEAT THIS YELLOW-STICKER SAVING? That's all for this week, but before we go... MSE James made the yellow-sticker saving of a lifetime the other day when he got a pack of Waitrose smoked salmon for 10p, just 2% of its normal price. It got us thinking whether such a saving could be beaten and, as ever, you MoneySavers did us proud, out-(yellow)-stickering James with your 50p lobster, your 5p custard and your 9p steak. But top prize goes to the couple who paid £3.38 for a week's shopping. Let us know your bargains in our yellow sticker Facebook post. We hope you save some money, stay safe,

The MSE team | |