| Plus... £116 No7 £30, CLAIM pension credit, avoid Disney+ price rise and more  THE TOP TIPS IN THIS EMAIL

| | New. First Direct joins HSBC in the revitalised bank switch battle - bag up to £125 Plus other perks, eg, 3% cashback, 2% savings & 0% overdrafts Typical... you wait three months for a free cash bribe to switch bank, then two come along almost at once. Last week, we told you HSBC had launched a free £125 bonus - the first cash bribe to switch since Nov. This week it's been joined by sister brand and top service bank First Direct with a £100 sweetener.  Meanwhile, Virgin Money has revamped the only other switching bonus of note. It's no longer offering 15 bottles of wine, instead it's giving fewer bottles but adding a charity donation. Other accounts have ongoing perks such as bills cashback, savings interest and 0% overdrafts - here's the full suite (all do a credit check when you apply - which usually isn't too harsh). Meanwhile, Virgin Money has revamped the only other switching bonus of note. It's no longer offering 15 bottles of wine, instead it's giving fewer bottles but adding a charity donation. Other accounts have ongoing perks such as bills cashback, savings interest and 0% overdrafts - here's the full suite (all do a credit check when you apply - which usually isn't too harsh). Bag up to £125 to switch bank

There are three standout bribes to tempt you to switch - you need to be a new customer, and use the banks' official switching services to qualify. The switch takes seven working days, all direct debits and standing orders are moved for you, your old account is closed and all payments auto-forwarded. Full eligibility and when/how the perks come in Best Bank Accounts , but in brief... FREE BANK SWITCH BONUSES FOR NEWBIES

| ACCOUNT

Min pay-in for all perks | PERKS | HSBC Advance* (1)

Min pay-in £1,750/mth - equiv £25,600/yr salary | - FREE £125

- Linked 1% regular saver

- 42% 'great' service rating | New. First Direct* (2)

No monthly min, but pay in £1k within 3mths | - FREE £100

- TOP service - 91% 'great' rating

- Many get a £250 0% overdraft

- Linked 1% regular saver | New. Virgin Money*

No monthly min, but you need to put £1k in linked easy-access savings paying 0.5% (0.35% from 27 Apr) & register for its app | - FREE '£138' wine - 12-bottles (pls be Drinkaware)

- FREE £50 charity donation via Virgin Giving (choice of 13,000 charities)

- 2.02% variable interest on up to £1,000

- No fees for overseas use

| (1) You're ineligible for the cash if you've had a bank account with HSBC, or opened one with First Direct or M&S Bank since 2018. (2) You're ineligible for the cash if you've ever had any account with First Direct or opened a bank account with HSBC or M&S Bank since 2018.

| - Some banks require you to switch direct debits and standing orders to get the perks. With the HSBC deal, you need to switch 2+ of either to qualify. With Virgin, it's 2+ direct debits.

- Don't earn enough to meet HSBC's minimum pay-in? First, remember if you've a joint account it's the combined pay-in that matters. If not, it's possible to cheat it. Say you only have £1,500 coming in, then just pay that in, withdraw £250 to an account at another bank (or in cash) and then pay it back in, and BINGO - you'd qualify. Though there is a chance those on lower salaries may not be accepted in the first place.

If the deals above aren't for you, you can still make or save money simply by opening one of these accounts without going through the switching process. And they can be great not just as primary accounts, but as secondary ones too. 1) Get PAID to pay your bills. Santander 123 Lite* pays you cashback on bills you pay from it via direct debit, incl 1% on council tax, 2% on energy, 3% on water. It has a £2/mth fee, but those with mid-to-large household bills can still make about £40-£80/yr from this account after the fee. You must also pay in £500/mth to qualify. For other cashback options, see Best Bank Accounts. 2) Current accounts that pay more interest than top savings. Top easy-access savings now pay just 0.5% interest. Yet you can earn more in a bank account, though only on smaller sums. Our top picks... - Virgin Money* pays 2.02% AER variable on up to £1,000. You don't need to switch to it, though you can get the wine and charity donation if you do (see above).

- Nationwide* pays 2% AER fixed on up to £1,500 in year 1, 0.25% after. Yet you need to pay in £1,000+/mth to get the interest. If you put in more than the max, the extra won't earn any interest. More options and full eligibility criteria in interest-paying current accounts. 3) £500+ of annual mobile, breakdown and travel insurance for £156 with a packaged bank account. These accounts can be big winners - though with travel currently suppressed, think carefully about whether you need all the cover now, or if it's cheaper to buy what you need separately. Our top pick is Nationwide FlexPlus* at £13/mth. Its biggest perk for many is covering all the family's mobiles, which could be £100/yr per phone done separately, plus it gives worldwide family travel insurance and UK & Europe breakdown cover for all account holders. Full info and more deals in Packaged Bank Accounts . Debit cards are debt cards if overdrawn. And now almost all major banks charge about 40% interest for overdrafts - double even a high street credit card - they're a serious danger debt. Full help in 10 Ways to Cut Overdraft Costs, here are the key cost-cutters... - Struggling financially due to Covid? Santander still offers up to £500 for 3mths at 0% if you request it, while others provide tailored support. Speak to your bank to see what it can do. See Covid overdraft help. - Owe less than £350? Switch to a 0% overdraft. As we say above, First Direct* offers switchers £100 and many get a £250 0% overdraft (39.9% EAR variable above). So if your overdraft's up to £350, the £100 pays some off and the rest is at no interest. Full info: First Direct. - Switch to get a potentially bigger 0% overdraft, but only for a year. Alternatively, Nationwide FlexDirect* can offer a far bigger 0% overdraft, though the limit depends on your credit history. But the 0% only lasts a year (39.9% EAR variable after), so see it as a respite and aim to clear it before then. Full info: Nationwide. - Do a 0% 'money transfer'. These specialist credit cards pay cash into your bank account so you owe the card instead, and you can get up to 18mths at 0%. See our Money Transfers guide for the top deals. ____________________________

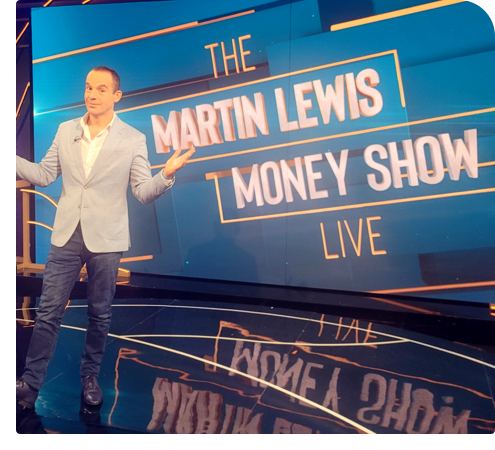

Pension special - what to get, what to do with it 8.30pm Thu, ITV: Martin's Money Show Live

Over to Martin: "I'm off work having family time this week, but popping back for an important live show on Thursday. It's the first time we've ever dedicated an entire show to pensions. As it's a regulated area, I'll have two specialists in to help me answer questions. We'll be covering both when and how to get a pension - and then what you can do with the money once you're near retirement. Over to Martin: "I'm off work having family time this week, but popping back for an important live show on Thursday. It's the first time we've ever dedicated an entire show to pensions. As it's a regulated area, I'll have two specialists in to help me answer questions. We'll be covering both when and how to get a pension - and then what you can do with the money once you're near retirement. "And of course, as it's live you can tweet suggested questions to me via @MartinSLewis, and if possible, please use the show's hashtag #MartinLewis. Do tune in or set the Betamax. It pays to watch." | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | New. Free £184 to spend at Sainsbury's via Amex card trick You can get it via normal spending and then manipulating the British Airways and Nectar partnership We often shout about the American Express Gold card as its sign-up bonus gets you £100 in shopping vouchers, or airline/hotel points. But we've spotted a new trick to get a huge £184 of Nectar pts instead, which can be used at Sainsbury's, Argos, eBay etc. You must spend £3,000 in the first 3mths to trigger this, although don't use it as an excuse to overspend. You'll also need to navigate a few loyalty schemes, but we walk you through it here (note you won't get the bonus below if you've held a personal Amex in the past 2yrs). -

New. Get a free £184 in Nectar pts (to use at Sainsbury's etc). Accepted Amex Rewards Gold* custs (best to check acceptance odds first) can follow these steps to play the system - something none of the firms mentioned here shout about... New. Get a free £184 in Nectar pts (to use at Sainsbury's etc). Accepted Amex Rewards Gold* custs (best to check acceptance odds first) can follow these steps to play the system - something none of the firms mentioned here shout about...

- Step 1: Spend £3k in the first 3mths (please only do normal or budgeted-for spending). An existing benefit of the card is that if you do this you'll get 20,000 bonus Amex Membership Reward pts, plus the usual 1pt per £1 spent, so 23,000 in total. Amex says the pts come within a month of hitting the trigger, but it often only takes a couple of days.

- Step 2: Swap your 23,000 Amex pts for BA 'Avios' pts. Amex pts can be used for many things via the Amex Rewards site, such as shopping vchs and airline/hotel pts. But for this trick, sign up to the free BA Executive Club and swap them for BA pts (known as Avios), even if you won't use them for travel. As 1 Amex pt gets 1 Avios, you'd have 23,000 Avios - the swap usually takes up to three working days.

- Step 3: Swap your 23,000 Avios for Nectar pts. This is the clever bit. Since Jan, you've been able to swap Avios for Nectar pts and vice versa. As 1 Avios gets you a generous 1.6 Nectar pts under the new scheme, swap 23,000 Avios for 36,800 Nectar pts via the BA site and, hey presto, they're worth £184 to spend at Nectar partners like Sainsbury's - much more than converting Amex pts straight to Nectar pts or shopping vchs. The points are usually available to spend within two days.

Note, this trick has only just become possible, and as it takes a few weeks to complete, hardly anyone will have done so yet, but the new bit (Avios to Nectar) works based on the published exchange rates and Ts&Cs.

- Or get other shopping vchs, or airline/hotel miles. If you don't want Nectar pts, you can instead follow step 1 above and then swap 23,000 Amex pts to rewards such as a £100 vch from retailers such as M&S and Amazon (you'll have 3,000 Amex pts left over), or into airline miles or hotel pts.

- Never forget the reward card golden rules. Repay IN FULL every month, preferably by direct debit, to avoid the 56.6% rep APR. Plus, never bust your limit and don't take out cash as it won't earn you points and can hit your credit score.

- Warning - there's a £140 annual fee from year two. So diarise to cancel before if you don't want it then.

You also get two free airport lounge visits a year, which may be useful when travel reopens - full help in Amex Gold analysis. And see Credit Card Rewards for more deals, eg, 5% cashback and £50-worth of Nectar pts (via a non-Amex). It also explains why it's unwise to get one of these cards if you're about to make a major credit application. | Free Muller Light yogurt, Lindt choc, Dentalife dog chew & more via this month's top supermarket coupons. See our updated round-up of 40+ coupons to save on your weekly online or in-store shop. Save £200/yr switching energy to beat Apr hikes via E.on and Brit Gas etc. Energy prices will rocket for millions in Apr as the price cap for standard tariffs rises by a typical £96/yr then. To help, we've blagged a deal that's cheapest in market, a 1yr fix from E.on which saves a typical home an avg £199/yr. E.on has also agreed to 'MSE enhanced service' if you sign up. Meanwhile, the price of another hot deal, British Gas's April 2022 fix, dropped on Fri so it's now only an avg £10/yr pricier than E.on on typical use, plus you can lock in the cheap rate for longer and it has 1yr's 'free' heating cover. Both are for newbies only. Important: if on a standard tariff, YOUR SAVINGS MAY BE UNDERESTIMATED in comparisons as not all providers have yet released exact post-Apr standard prices. Find choosing confusing? Use our Pick Me A Tariff tools. Warning. Sky to hike b'band, phone & TV prices by up to £72/yr from Apr - your rights. See Sky help . Trick gets £116 of No7 for £30. MSE Rhiannon shows how to stack 3x Boots offers to get skincare, make-up etc. No7 trick Shopped in-store at Tesco in recent days? Thousands may have been double-charged - full help. See Tesco overcharging . New. Cheapest 5GB Sim we've seen - '£5.24/mth' from Lebara. MSE Blagged. With this 1mth deal, newbies to Lebara* (uses Vodafone's signal) get 5GB/mth data + unlimited calls & texts. It's £2.99/mth for the first 3mths, then £5.99/mth, so it's equiv to £5.24/mth over a year, though you can cancel anytime. For more Sim-only deals, see our Cheap Mobile Finder. Disney+ is raising prices by up to £24/yr - but many can beat the hike if quick. See Disney+ help. | 1m households fail to claim pension credit, yet it's worth £1,000s, and entitles many to a free TV licence, council tax discounts & more. Check NOW to see if you're eligible

Many of the UK's poorest fail to claim pension credit , even though it's worth an average of £60/week in its own right. We're reminding you (again) as claiming also makes you eligible for other discounts on many bills, some of which will rise in Apr. Plus it entitles you to heating help when it's very cold, which 300,000 pensioners got during this month's cold snap. But pension credit is not automatic and about 1m who are eligible don't claim. So please use our latest nag to check and PLS SPREAD THE WORD, as many who could get it won't see this - so if you think you know someone eligible, tell 'em. - Pension credit can be worth £3,000/yr on average. If you're over state pension age, live in the UK, and earn less than £173.75/wk as a single person or £265.20/wk as a couple - including pensions, savings income and work - then the main element of pension credit tops up your income to those amounts. If you've additional income or you've saved for retirement you could get more via the 'savings credit' element. See how much pension credit can I get?

Note: if you've been financially impacted by coronavirus, you may be entitled to claim where previously you weren't, or you could get more, so check.

- Pension credit is also a gateway to FREE TV licences and MUCH MORE. Most of these extras are for those who get the main element of pension credit, rather than those who only get savings credit. See what extras you're entitled to with pension credit, but to whet your appetite...

- Free TV licence for over-75s - worth up to £157.50/yr (rising to £159 from Apr).

- Council tax reduction - worth about £1,000/yr typically (and many councils are expected to raise rates in Apr).

- Cold weather payments - worth £25/wk when it's really cold (like it was in many places earlier in Feb).

- Warm home discount - worth £140/yr.

- Free dental care - worth £100s/yr for some.

- Voucher for glasses/contact lenses - worth £39-£215 a time depending on your prescription.

- Housing benefit - worth £1,000s/yr for some.

- Importantly, pension credit is not automatic so you MUST claim - here's how. You can apply via Gov.uk if you've already claimed your state pension, but otherwise you'll need to phone the Pension Service on 0800 99 1234 (or the NI Pension Centre on 0808 100 6165). They will fill in the form for you, though you can also request it to be posted to you, whether for yourself or someone else. While you can backdate your claim, you can only do it for the last 3mths, so if you think you're eligible, the quicker you check, the quicker you'll benefit.

| 5 Creme Eggs for £1 with a Tesco Clubcard (norm £2). Excludes Express stores. Cracking Creme Egg deal 18 FREE ways to relax and feel good, incl meditation, virtual yoga and a live stream of puppies. It's a stressful and unsettling time, so MSE Becky has updated tips from her and the team to help look after yourself for free. Green Homes Grant funding slashed - check NOW if you can get up to £5k for home improvements. The Govt scheme gives some homeowners in Eng vchs to make homes more energy efficient (eg, insulation and double-glazing). Yet the original £2bn set aside for it will not roll over to the new tax year, with only £320m available from Apr till it all ends in Mar 2022 - so don't delay if you're interested. See Green Homes Grant help. £30 HelloFresh ingredients box for £15 - gets you six meals (three different meals for two people). MSE Blagged. It's a subscription where you sign up for a weekly box, and can actually get five (over five weeks) for £15 each. But as you can cancel any time, you could just use it the once. Newbies only, 5,000 avail. HelloFresh Ratesetter to close all investor accounts and move all loans to Metro Bank. If you've cash invested you'll get penalty-free access from Apr, while loan rates will stay the same. See Ratesetter help. Former Yorkshire Energy customers STILL waiting for credit refunds - full help. Scottish Power's taking on Yorkshire Energy's custs after it stopped trading, but many are furious about delays. See Yorkshire Energy latest. Want to work at MSE? Three jobs available: forum & community editor, senior news reporter and energy & utilities writer. To work in our London office (when we can go back). See MSE Job Opportunities. | Tell your friends about us They can get this email free every week | | AT A GLANCE BEST BUYS | | Free £125 for switching + 1% regular saver: HSBC

New. Free £100 for switchers + top service: First Direct | | SUCCESS OF THE WEEK:

"Hello Martin, I took your advice about not wasting money on Valentine's Day. So the week before, I bought my wife 14 red roses. I told her I loved her so much I couldn't wait for Valentine's Day and saved money buying them the week before."

(Send us yours on this or any topic.) | THIS WEEK'S POLL How do you rate your broadband provider? We can tell you which are the cheapest broadband providers, but to keep our customer service ratings updated, we need your help. How do you rate your broadband provider? Younger MoneySavers were most likely to spend on Valentine's. Last week, we asked how much you planned to spend on Valentine's Day. Some 4,000 people responded, and 38% told us they weren't celebrating it, while a further 12% said they'd celebrate without spending anything. Younger MoneySavers were most likely to spend, with 47% of under-35s budgeting £10+, compared to just 21% of the over-65s. See full Valentine's poll results. | MARTIN'S APPEARANCES (WED 17 FEB ONWARDS) Thu 18 Feb - The Martin Lewis Money Show Live, ITV, 8.30pm MSE TEAM APPEARANCES (SUBJECTS TBC) Sun 21 Feb - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 10am

Mon 22 Feb - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 23 Feb - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | 'I REUSE MY TEABAGS - ONE BAG DOES ME ALL DAY' That's all for this week, but before we go... MoneySaving is a way of life for many, but there may be that one thing you do that others don't and you just can't understand why. When we asked you for your MoneySaving hacks, many of you told us you do the standard stuff: making your own coffee, comparing insurance deals, using cashback cards, using your local library and planning meals. But some take it further, such as the MoneySaver who reuses their teabag multiple times a day. Let us know your tricks and perhaps learn from others in our MoneySaving hacks Facebook post. We hope you save some money, stay safe,

The MSE team | |