| Plus... SUPERFAST b'band £18/mth, Office outlet 15% code, Amex £5 off, £1k marriage tax reclaim  THE TOP TIPS IN THIS EMAIL

| | A HUGE car and home insurance shake-up is coming

Prices for switchers likely to rise as insurers to be banned from charging existing customers more than newbies - check NOW if you can save, even if not at renewal

The regulator the Financial Conduct Authority confirmed last week that from January car and home insurers must charge renewing and new customers the same. While a popular move, it could push up prices even sooner for switchers, who currently tend to pay far less. So this is our clarion call for EVERYONE to check if they can save. Martin's analysis explains why, followed by our cost-cutting tips (lots more in Cheap Car Insurance and Cheap Home Insurance). |  Prices will meet in the middle, but act now and you may beat the system.

Martin says: "With firms forced to offer new and existing customers the same prices, the new structure will likely meet somewhere a little above halfway between them. "It's good news for those who never switch, as renewals will be cheaper. But it's bad news for those who actively seek the best deals. While they should still be able to save due to competition, differences will fall, and they'll pay more overall. "The move is popular. In a Twitter poll I did last week, 86% of 11,360 voters were in favour, including most who switch regularly. "Admittedly it's likely big insurers are working on innovative pricing structures. Perhaps they'll launch cheap sub-brands to draw people in, without large legacy customer bases they'd need to cut prices for. "Yet let me stop crystal balling, and focus on what matters now. It's possible today is a sweet spot to check car insurance and home insurance prices. While the new regime starts in January, insurers will likely start to shift algorithms before - there are even signs now (but the data isn't conclusive). "This likely means the cheapest prices will disappear rapidly for those who compare and switch. So I suggest everyone check ASAP to see if you can cut costs by grabbing cheaper switchers' deals. "Even if not at renewal, if savings are big, it can be worth moving now to lock in cheaper prices. If you've not claimed, you can usually cancel existing policies for a £50ish fee, and get a pro-rata refund for the remainder (but you won't gain this year's no-claims bonus)." | Prices dived during the lockdowns to reach a seven-year low, though there are already signs they're creeping up as more people on the roads has led to more claims. Combine this with predicted higher switchers' prices due to the clampdown, and this might be the optimal time to lock in a cheap price. Full help in Cheap Car Insurance, but in brief ... - Check if you can save even if months from renewal. Follow the tips below to check new policy prices. If savings are big, you can cancel your policy, and provided you've not claimed, you'll get a pro-rata refund if you paid upfront, minus a £50ish fee. However, you won't earn the year's no-claims bonus. See save if not at renewal help.

As MrsD tweeted last week, shortly after Martin warned that everyone should check, even if not at renewal: "Blimey. My quote is £300 cheaper than it was in January. Thank you. Husband is next."

- NEVER auto-renew - instead, combine comparison sites for 100s of quotes in minutes. They don't cover the same insurers, nor give the same price for the same insurer, so use a few. Our current order is: 1) MoneySupermarket* 2) Confused.com* 3) Compare The Market* 4) Gocompare*. (Why? See comparison order.)

We base our order on which comparison site is likely to be cheapest for most people, which is the best way to choose. Yet comparisons also have sweeteners:

- MoneySupermarket offers up to £150 of car repair vouchers.

- Confused gives a choice, eg, £20 Halfords/Domino's/car wash vch.

- Compare The Market offers 2for1 meals and movies.

- Gocompare gives a free £250 excess and a £10 MOT vch.

- Then check for deals not on comparison sites. Check if biggie Direct Line* can beat your top quote, and see our list of offers that comparisons miss, eg, a £60 Amazon vch.

-

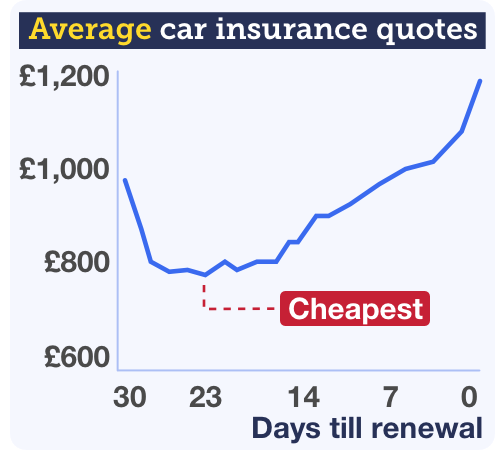

Get new quotes three weeks before the policy start date, which can HALVE costs. Our analysis last month found the optimum time to get a car insurance quote is 23 days ahead of renewal or the new start date. If you leave it later, prices can almost double because insurers' algorithms show those who get new quotes earlier are a lower risk. Get new quotes three weeks before the policy start date, which can HALVE costs. Our analysis last month found the optimum time to get a car insurance quote is 23 days ahead of renewal or the new start date. If you leave it later, prices can almost double because insurers' algorithms show those who get new quotes earlier are a lower risk.

Ian emailed: "Brilliant advice - best price, about 21 days before expiry date, was £340. But day before expiry: £637."

- If you've more than one car, check if you can save with a multicar policy. Often, multicar newbies get hot offers to suck 'em in, but that advantage can disappear at renewal, so our rule of thumb is: "If you're on a multicar policy, check separate policies to see if you can save; if you're on separate, check multicar."

For full info, including how to compare if your cars have different renewal dates, see our Multicar Insurance guide.

- Then try these counter-logical tricks to up your savings...

- Use trial and error to see if comprehensive beats third party.

- See if legitimately tweaking your job description cuts costs.

- Adding a responsible additional driver can get you a lower price.

- Once you've got a cheap quote, check if you can get cashback.

Home insurance prices are at a two-year low so if you've not switched in a while, savings can be huge, as Forumite Rhid80 found: "I'd not realised I'd been overpaying for years. Using MSE's simple steps, I saved £639 compared with my renewal quote. Very happy." Our Cheap Home Insurance guide has full help, but here are the foundations... - Check if you can save even if not at renewal. If you find big savings (eg, if like Rhid80 you've been auto-renewing for years), then for about a £35ish admin fee you can often cancel a policy and get a pro-rata refund if you've not claimed, though you won't earn that year's no-claims discount. See switching if not at renewal help.

-

Combine comparison sites to get 100s of quotes in minutes. They zip your details to dozens of insurers and brokers at once. Yet as they don't cover the same insurers, and can even have different prices for the same firm, use a few. Our current order's Confused.com*, MoneySupermarket*, Compare The Market* and Gocompare* (see full comparison order for why). Combine comparison sites to get 100s of quotes in minutes. They zip your details to dozens of insurers and brokers at once. Yet as they don't cover the same insurers, and can even have different prices for the same firm, use a few. Our current order's Confused.com*, MoneySupermarket*, Compare The Market* and Gocompare* (see full comparison order for why).

We base our order on which is likely to be the cheapest for the most people most often, which is the best way to choose. But some comparisons add freebies:

- Confused gives a choice, eg, £20 Halfords/Domino's/car wash vch.

- Compare The Market offers 2for1 meals and movies.

- Then check for deals not on comparison sites. Try Direct Line* and also see special offers comparisons miss, eg, a £55 Amazon vch.

- Check quotes three to four weeks before the policy start date for the best rates. For home insurance, the sweet spot is 17-30 days before renewal or the start date to get the best prices, according to our research. Any later and you're seen as a bigger risk by insurers, and prices can soar.

- More home insurance must-knows to help you save...

- Buildings insurance is usually only for freeholders to sort, contents insurance is for all.

- Don't overinsure your building - use a rebuild cost calculator.

- Don't underinsure contents - you may not get a full payout.

- Comparisons don't work for all. Get help if struggling to find cover.

- Once you've got a cheap quote, check if you can get cashback.

It's possible, but it's trial and error whether it's cheaper than getting 2+ standalone policies. Use the tips above to benchmark the lowest prices for your car and home cover, then see if Admiral's MultiCover* policy beats it. Via that link you can also get a £90 Amazon, M&S or Love2Shop vch (you're sent an email within 90 days with details of how to claim).

Even if you have different renewal dates, this can still work as you start by insuring one car (or your home), then add the others when they're due to renew. Alternatively, Direct Line*, Aviva* and Churchill offer multi-policy discounts - ie, if you already have home insurance, you get a discount on a new car policy (and vice versa). It's trial and error whether it beats policies with different providers. See combining home and car insurance. Don't want to move? HAGGLE

Many are shocked that the quote from their own insurer is often far cheaper in comparison site results than their renewal price - hence why the Financial Conduct Authority is cracking down. So even if you don't want to move, always follow the process above to see what's out there.

Then when you know your new cheapest quote, take it to your insurer (even if it's from your existing insurer) and ask it to match it. Though we think insurers may be less inclined to play ball if you're switching mid year - let us know if you try it.

Haggling often works, as Giulia emailed: "I always haggle for my car insurance. This year my renewal quote came in at £750, got it down to £530 by mentioning the cheapest price from a competitor I could find. Thanks for all your help."

Full help in car insurance haggling and home insurance haggling. As with any insurance, check the policy details and make sure that insurers are regulated by the Financial Conduct Authority before you buy. If a claim is unfairly rejected, take 'em to the free Financial Ombudsman. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | New. Get 18mths 0% on spending + earn £25 cashback to pay back some of the debt - via HSBC credit card deal

There's no cheaper way to borrow than at zero interest and, used right, a 0% credit card can be your secret weapon - if you can buy what you need on plastic and you've a high enough credit limit. While some can get a longer 21mths at 0%, the advantage of the new HSBC deal is it's not that much shorter, you definitely get the full 18mths if accepted and you can get the £25. See how it compares below... - Only borrow if it's needed, planned & affordable - not just to bag cashback. See any freebies as a bonus if you have to borrow but NOT a reason to borrow in itself. Only do it for a one-off reason (eg, replacing a broken fridge) - never borrow to fill income gaps and don't spend willy-nilly. And if you're already struggling with debt, further borrowing won't help - instead read our Debt Help guide.

LONGEST 0% PURCHASE CREDIT CARDS FOR NEWBIES

RECOMMENDED: Use our 0% Cards Eligibility Calc first to see which cards you're most likely to get | | CARD | KEY DETAILS & HOW GOOD IS IT? | Sainsbury's Bank - must have had Nectar card for 6mths+

Best to check acceptance odds first. Or apply*. | Joint-longest 0% length - but some accepted will get a shorter 0% period.

- Up to 21mths 0% but some poorer credit scorers get 13mths (20.9% rep APR after).

| Lloyds Bank

Best to check acceptance odds first. Or apply*. | Joint-longest 0% length - but again, some get fewer months at 0%.

- Up to 21mths 0% but some poorer credit scorers get 12mths (21.9% rep APR after). | M&S Bank

Best to check acceptance odds first. Or apply*. | You DEFINITELY get the full 0% length if accepted, so if your eligibility chances are good, it's a decent bet as it's just a month shorter than the duo above.

- 20mths 0% (21.9% rep APR after). | New. HSBC

Best to check acceptance odds first. Or apply*. | Clear winner if you can pay it back in 18mths - as all accepted DEFINITELY get the full 0% length + you can earn £25 cashback which wipes some of the debt.

- 18mths 0% (22.9% rep APR after).

- £25 cashback paid into the account if you spend £100+ in the first 60 days. | - Store won't take credit card? Or the item costs £5,000+? 0% money transfers pay cash into your bank account, so can be used where purchase cards can't. And if what you're buying costs £5,000+, you may not get the required credit limit - so a cheap loan from 2.8% may be a better option.

- Follow the 0% Card Golden Rules. Full info in 0% Credit Cards (APR Examples), but in brief...

a) Always pay at least the set monthly minimum and stick within the credit limit, or you can lose the 0% offer.

b) These cards are usually only top picks for spending - avoid cash withdrawals or shifting debt to them.

c) Plan to clear the card (or balance-transfer away) before the 0% period ends, or the rates jump to the rep APR. | Ends Mon. Cheapest SUPERFAST 63Mb fibre broadband & line we've seen this year - '£17.79/mth'. Apply for this Vodafone deal by 11.59pm on Mon 7 Jun and Vodafone broadband newbies pay £21.95/mth for 63Mb speed broadband & line. As you can also CLAIM a £100 Amazon voucher, if you'd have spent that anyway, factor that in and it's equiv to £17.79/mth over the 2yr contract. For more deals, use our broadband comparison tool. £117 of beauty products for £27 delivered. MSE Blagged. 11-piece set incl eyeliner, highlighter palette, hand cream, nail polish and more from brands such as Nip+Fab and Yardley. 1,500 available from Latest in Beauty. Bag £100 to switch to top service bank First Direct. We're in a quiet period for big bank-switch bonuses, but the mega-popular First Direct free £100 to switch* offer is still alive and kicking - the only big cash bribe left. Many also get a £250 0% overdraft, while 91% rated First Direct 'great' for service in our last poll. To get it, open the account and pay in £1,000 within 3mths. You won't qualify if you've ever had any account with First Direct before, or if you've opened a current account with sister bank HSBC since Jan 2018. Full help in Best Bank Accounts. Updated Stamp Duty Calculator - check what you'll owe if you make (or miss) the stamp duty hol deadline. The holiday is ending on 30 Jun in Eng, NI & Wales in its current form - our updated Stamp Duty Calc lets you input your estimated completion date, which determines the all-important rate. New. McDonald's £5 off £15, plus 10 more tasty hacks. For the lowdown, see 11 McHacks. Please eat responsibly.

EXTRA 15% off 'secret' Office shoe outlet, eg, £30 Adidas trainers (norm £75). The high street chain flogs slightly scuffed footwear online at its little-known outlet at huge discounts, and we've blagged a further 15% off, though stock's limited. 'Secret' shoe outlets Check your driving licence renewal date - DON'T risk a fine of up to £1,000. Last year the DVLA gave an extra 11mths to renew many licences due to the pandemic, but it means 100,000s more than usual are now due. Full driving licence renewal help. | Warning. Water and energy firms are hiking direct debits based on abnormally high lockdown use. Check NOW to avoid overpaying

High use by millions stuck at home in lockdown is leading to higher direct debit demands for many on water meters and many who pay for energy by monthly direct debit (and don't have smart meters). Such demands for future use are mostly estimates based on recent use, so if you consume more, they can rise when your bill is reviewed. Some hikes may be to recoup money owed, which shouldn't add too much. But incredibly, we've seen some demands double. So if you were a high user in lockdown, but expect that to change as things slowly return to normal, check now. -

Check and challenge water payments if they've incorrectly soared. Some 15 of the 20 water companies in Eng & Wales told us they have raised direct debit demands for customers on water meters whose payments they've recently reviewed who've used more. Check and challenge water payments if they've incorrectly soared. Some 15 of the 20 water companies in Eng & Wales told us they have raised direct debit demands for customers on water meters whose payments they've recently reviewed who've used more.

So check if your direct debits have risen (firms should tell you) and if you think you'll use less than estimated (you may need to ask how it's calculated your bill), it's best to exercise your right to ask for lower direct debits. See water bill hike help.

We've seen lots of successes on this. Susi emailed: "Welsh Water wanted to increase payments from £36.50/mth to £44/mth. I phoned and it stayed at £36.50." Sharon told us on Facebook: "My firm doubled mine. I rang and said 'no thanks' and it put it back down." MSE Guy said: "My bill went from £26/mth-£45/mth, but I called and got it to £30."

- It's less clear-cut with energy due to seasonal variations - but it's worth checking. To set direct debits, most firms take the expected annual cost (often based on past use) and divide it by 12 to smooth it out in different seasons. We asked a cross-section of major firms if - after reviewing a customer's use - they're raising demands where usage has been high over recent months. Of the five that replied, all confirmed they will do so.

Of course, a hike may be because you were previously underpaying, or you had your heating on more during the cold spell. But if you believe your firm is overestimating what you'll use (you may need to ask how it's been calculated), you've a right to get your direct debit lowered. So check if your supplier has written to you to raise your direct debit - see energy bill hike help. Also see how the energy direct debit cycle works in Martin's How to reclaim £100s from your energy firm blog.

MSE Helen S successfully challenged her supplier: "My energy firm wanted to hike my monthly direct debit from £77 to £98. I politely told it to get lost as I'll use way less, and it kept it at £77."

Of course, also check you're not - like many - overpaying by £100s on your energy bills. It just takes a few minutes via our Cheap Energy Club.

- If you're affected, it's actually more of a cash-flow problem - you won't pay any extra overall. This is a nerdy but important point. If you don't take action you'll likely end up in credit, which may lead to lower direct debits in future, or you may have to claim it back. So while you won't lose out in the long-run, why not have the money in your pocket now?

| Co-op £4 off a £15+ shop. For new loyalty card members - see Co-op discount. 'We claimed £1,000 in tax back for being married.' Can you do too? Success of the week. Barbara claimed the marriage tax allowance not just for this year, but the past three: "I made a claim & I'm awaiting a £738 cheque + we'll pay £252 less this year. So pleased, thanks." ( Send us your MoneySaving success on this or anything else.) Amex £5 cashback on £15+ spends at 1,000s of LOCAL stores. We're often unable to mention deals from smaller shops as our email goes out UK-wide, so we're delighted to include this Amex £5 off deal. It's on from Sat but you need to register first - and pay the card off IN FULL to avoid interest. 80% off 1mth's 'tailored' dog food (eg, £25 worth for just £5). MSE Blagged. Add info about your dog (eg, breed, age, dietary requirements) and it creates a recipe especially for your furry friend. Tails dog food Rental evictions are now allowed again in Eng - full help if you're a tenant. See evictions latest. 36 craft beers for £36 all-in. MSE Blagged. Newbies only, 2,000 boxes available but not in NI. Flavourly (please be Drinkaware). | Tell your friends about us They can get this email free every week | THIS WEEK'S POLL How important is protecting the environment to you? Being more environmentally friendly can save you money on some things, but cost you elsewhere. We'd like to gauge your level of commitment to being more environmentally friendly - both in the consumer world and beyond. How important is protecting the environment to you? Garden centres, supermarkets and hairdressers top the list of places MoneySavers feel comfortable going to. Last week, we asked which places you're comfortable going to as lockdown eases, and which you'd still rather avoid. More than 5,300 people responded, and 90% said they'd already been (or were happy going) to a garden centre, 88% said the same for supermarkets and 79% for hairdressers. But 81% would still avoid going to tattoo studios, 68% gyms and 66% spas. See full poll results. | MSE TEAM APPEARANCES (SUBJECTS TBC) Thu 3 Jun - BBC Radio Leicester, Mid-morning with Ben Jackson, from 11.35am

Sat 5 Jun - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 11am

Mon 7 Jun - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 8 Jun - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | 'SHOWER LESS - SAVE WATER AND MONEY'... WHAT MONEYSAVING TIP WOULD MAKE YOU LEAVE A DATE? That's all for this week, but before we go... last week we asked MoneySavers what tip a first date could give them that would make them walk out there and then. Many suggested that tips on reusing underwear and avoiding showers to save on water bills would be their cue to leave, while others would make their exit if a penny-pinching date said they watered down ketchup to make it last longer (a real-life example) or collected mayo sachets from pubs to avoid buying it. If you fancy a chuckle, or want to add your own, head over to our MoneySaving turn-offs Facebook post. We hope you save some money, stay safe,

The MSE team | |