Martin: 'The UK base rate hit 1.25% last week, a fifth increase in six months. Further rises are almost certain. How high can it go? And what should you do now with MORTGAGE & SAVINGS?'

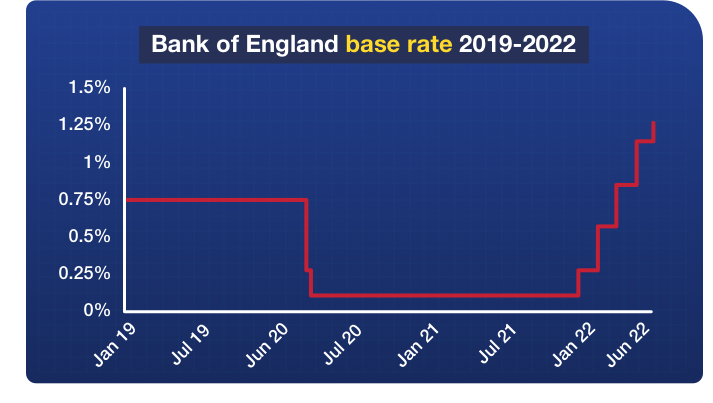

The economic situation is moving at speed. Inflation is rampant. Stagflation (inflation coupled with recession) is a concern. After the Bank of England's committee voted last Thursday to increase it to 1.25%, the UK base rate is twelve times higher than it was just six months ago, at 0.1%. The highest it's been since 2009.

That meeting's minutes show a 6 to 3 vote, with the three opponents arguing for a bigger rise to 1.5% - a strong signal that, rightly or wrongly, unless there's radical change more hikes are coming.

Forecasting consultancy Capital Economics predicts the base rate will be at 2.25% by the end of this year, 3% next. Few under age 35 will remember rates this high, yet it's the last fifteen years of super-low interest rates that are the anomaly.

Many with grey hair (like me) or even white hair (unlike me, cheeky so-and-sos) will remember interest rates over 10% - whether we're at the start of that only time will tell, but unless the world economy crashes, a general upward trajectory seems likely.

So it is important to review your mortgage and savings. Here are my key need-to-knows first for mortgages, or jump to savings...

The instant impact of last week's rise depends on your mortgage type.

- On a variable or tracker mortgage: You will soon see costs increase by roughly £12/mth per £100,000 of mortgage debt. See how & when your rate will change with our lender-by-lender list, then plug that into our Mortgage Calculator to see your rise.

- On a fixed rate: You won't see any change until your current fix ends (check you know when that is). Then you'll move by default to your lender's standard variable rate (SVR), likely to be 4.5% to 5.5% - a huge increase for most. See lender-by-lender SVR rates.

Yet most people will instead, rightly, aim to grab a new fix/deal when the current one ends. Sadly, today's cheapest fixes are three times higher than last October's when they bottomed out, though that's still far less than the SVR, so go quick...

The cheapest mortgage deals are disappearing...

For those on variable rates, or with fixes soon ending (some can even lock in a deal up to six months ahead), action now to check if you can save is a must. Lenders are repricing new deals weekly, meaning today's rates may disappear tomorrow, so delay may be costly.

The days of sub-1% fixes are gone. Today's cheapest fixes are as low as 2.49% over two years, 2.74% over five, and 2.73% over 10 years.

As you can see, right now (unusually) the premium for fixing longer is very low, especially for 10 years. With further base rate rises predicted, today's longer-term fixes may (I don't have a crystal ball) in hindsight look incredible deals.

Though be mindful of early exit charges, you must either be confident you won't move, or ensure the deal is 'portable' (ie, it can move with you).

How to find YOUR best mortgage deal

The full need-to-knows are in my free 62-page PDF Remortgage guide, but here's a speedy summary of key actions...

- Ask for your existing lender's current deals. Switching with your existing lender is called a 'product transfer'. It didn't used to be a great option, but these days, as your existing lender may forego affordability checks if you're not borrowing more, it can work out well. Plus there'll likely be less paperwork and lower fees.

Savings can be huge, as Adam tweeted me: "@MartinSLewis Just went for a new deal with my existing provider at the end of a five-year fix, was able to save £175/month [£2,100/year] - same terms. I used the mortgage tool on MSE."

- Compare the cheapest deals. It takes 2 mins to use our Mortgage Best Buys comparison to get a benchmark of the best deal on the wider market you could get. As Lee tweeted me: "@MartinSLewis We remortgaged in April and our monthly payment dropped from £900 to £750. Was our first remortgage as we bought our first house 2 years ago. Really happy. Your guide really helped me understand everything."

- Compare it to your current deal. Check how the cost of your current mortgage compares to new ones via our Ultimate Mortgage Calculators. As a rough example, for a 25-year term mortgage at 2%...

| Mortgage size | £100,000 | £250,000 | £500,000 |

| Each 1% extra interest costs | £600/yr | £1,500/yr | £3,000/yr |

- Use a mortgage broker to aid acceptance. Lenders do both credit and affordability checks (likely to be tougher to pass for some now due to the rising cost of living) that can kibosh applications. It's tough to know who'll accept you and how much you'll be able to borrow. Find a good mortgage broker and they'll have information on this that's very difficult for you to get yourself.

PS: Mortgage prisoners. For the up to 200,000 homeowners trapped since 2007 with mortgages from closed-book providers - rate rises are a nightmare. Our Mortgage prisoner guide may help some, but far from all. I am still campaigning on this in the background, and hope to announce next steps when I can.

It's never been more important to maximise every penny of savings interest. With inflation roaring, in real terms money in savings is shrinking. To mitigate the impact, you need as high a rate as possible.

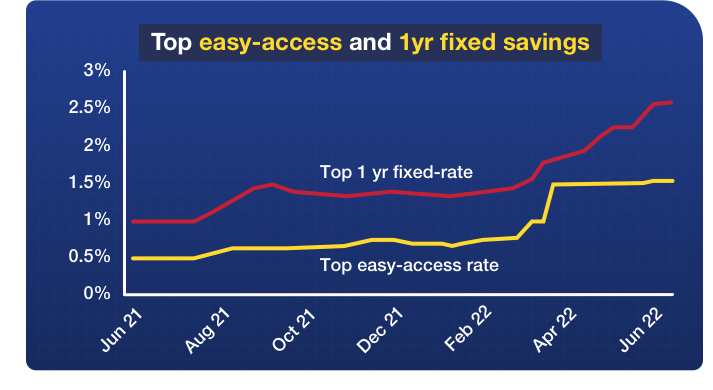

Rates for the top deals are increasing, with some longer fixes closing in on 3%, but funnily enough [sarcasm] savings rates tend not to bounce up with the same alacrity as mortgage rates. Even after five base rate rises, some still pay 0.01%. So check what you get ASAP.

All savings listed have the full £85,000 UK savings safety protection.

The very least you should be earning is 1.5%

Easy-access savings are accounts where you can put money in and take it out when you want. They're the entry level, so the top rate here is the minimum you should earn.

- Top easy-access savings 1.56%. Two accounts vie for top place here, both are actually savings linked to bank accounts. But as you can open them for free WITHOUT needing to switch account, just to get the savings, they're easy and winners.

- Chase 1.5% AER* on up to £250,000. App-only, but just wins it as my top pick for pure savings, as it only does an ID check, so applying doesn't impact your creditworthiness. Its debit card is also top for cashback at 1% for the first year and for spending overseas. Though it's so popular there's a backlog of 3-5 weeks.

As Laura emailed us: "On your advice, I opened Chase mid-April. On 1 June I received my first full month's interest of £90.64. Thank you so much. I had only received pennies annually from TSB. I have also received £29.60 for the 1% cashback."

- Virgin Money's M Plus 1.56% AER* on up to £25,000. A tad higher rate (60p/yr more per £1,000), but its credit check goes on your credit file, not a biggie, but best not if you've important credit applications soon. If you do choose to switch bank to it, you can get enough loyalty points for 12 free bottles of wine (though switches elsewhere pay up to £170 free cash). It also has a top debit card overseas.

- Atom Bank and Aldermore* pay 1.35% AER and are the top standard (not linked to a bank account) easy-access savings accounts. Atom is app-only, but has no minimum opening balance, while Aldermore is available online, but needs £1,000 to open it.

Easy-access rates are 'variable rate', so do watch that it doesn't change. See Top easy-access savings for more options.

Double the interest by locking cash away in a fix

The top fixed-rate savings, also known as savings bonds (be careful, there are lots of different, riskier things called 'bonds' too), pay more and the rate is locked in, but so is your money, as you can't withdraw it during the period. So fix what you can afford to lock away and leave the rest in easy access.

- Top 6mth fix: Shawbrook Bank 1.75% AER (min £1,000).

- Top 1yr fix: Atom Bank 2.6% AER (min £50) though it's app-only, or for online access Ford Money 2.45% AER (min £500).

- Top 2yr fix: DF Capital 2.95% AER (min £1,000).

- Top notice account: Oxbury Bank 1.9% AER (min £1,000) is variable, not fixed, and needs 120 days' notice to withdraw cash. Yet as it pays more than a 6mth fix, if you can plan ahead it's a decent alternative.

The top fixed rates have risen strongly recently and may continue to rise, so there is a question of how long you should lock away for - as you can't withdraw the cash during the term to shift to a higher-paying account.

Of course, banks are just as aware as we are that UK rates are rising, so that potential will have been factored into today's fixed-rate prices, which is one reason why they're far above the base rate.

You could play safe and just go for 6mth fixes or a notice account, as they beat easy access. Balanced against that is that you'll forgo the extra interest available in one or two-year fixes and need to move money more frequently. It's such a close call, don't worry too much, there's no wrong decision.

Three and five-year fixes are available too, but the top rate there is 3%, which for me isn't enough of a premium to lock in for longer in a rising rate environment. If you think different, or you would like to see more options than those above, see all top fixed savings rates.

Can you boost your interest by up to 50%?

Easy access and fixes are the two main routes for larger savings, yet there are other options that pay more. Here's my checklist to see what you can do, and answer some key questions...

1. Are you on universal credit or tax credits? You may be eligible for an unbeatable 50% savings bonus via Help to Save.

2. Are you a wannabe first-time buyer aged 18-39? There's a whopping 25% bonus possible via Top Lifetime ISAs.

3. Do you have existing expensive debt? Paying off debt is usually more lucrative than saving. For help, see the Should I pay off my debt? guide. It's more complex with mortgages, but can work for many. See Should I overpay my mortgage?

4. Save regularly each month? Earn 3.5% in Top regular savings.

5. Are Premium Bonds worth it? The prize rate went up to 1.4% this month, yet that's still less than top easy access, and someone with typical luck wins less anyway. Full pros & cons in Are Premium Bonds worth it?

6. With savings rates so low, should you invest? With investing, you aim for higher returns, but accept the risk you could lose some or all of your initial investment. I don't talk about it, not because I'm against it, just because it's not my expertise. For many over the longer run, investing is the right call. For an introduction, see Stocks & shares ISAs, but you'll need more specialised websites for help on what to invest in.