|

|

|

| |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Beat April's broadband price hikes 'Hold your horses. I thought they'd banned inflation-linked mid-contract broadband price hikes? Why are you saying bills are going up by 7.5%?!?' You're right... but... while for recent new contracts, they've had to tell you the pounds & pence rises before you sign up (see compare top broadband deals), most people are still on old contracts and will face percentage type rises until they sign up to a new deal. Here are the big firms' typical rises... BT, EE & Plusnet 6.4% or £3/mth (31 March) | Sky avg 6.2% (1 April) | TalkTalk 6.2% or £3/mth (1 April) | Virgin Media 7.5% or £3.50/mth (1 April) | Vodafone 6.4% or £3/mth (1 April). See detailed firm-by-firm rises list. The solution is to grab a new contract. Not only will the price often be less than half of what you pay now, you'll usually know if and when it'll rise, and by exactly how much. A whopping SEVEN MILLION households are currently out of contract and free to switch. As always, the best deals are via short-lived promo deals via comparison sites (which we collate via our broadband comparison tool). Here are some of the headlines...

Broadband-switching need-to-knows

| ||||||||||||||

| Martin: 'Phone theft's UP 40%. Five ways to secure your mobile so they can't access your banking.' Watch Martin's 2-min mobile security tips video, then if you've more time, read our full guide for details. New. FREE '£40' if you invest £1. 30,000 available. If you've never opened a Trading 212 account before, you can open its stocks & shares ISA* using code MSE40 to get £40 shares in a randomly selected popular company for free, if you deposit £1+. You can sell them immediately (likely still worth about £40) & the cash will be added to your account, which you can withdraw after 30 days. Or you can wait & see how they perform. Though you'll need to be able to use this year's £20,000 ISA allowance, so can't do it if you've maxed that out. Full info on the £40 for £1 offer in our Stocks & shares ISA guide. Coupons: free £2 energy drink, £2.50 off teabags, £1.40 off Sharwood's curry kits. See March coupons. Now the longest 0% balance transfer gives all accepted 32mths 0%. A 0% balance transfer's where you get a new card that pays off old cards for you, so you owe it instead, but interest-free for a set period. Normally the longest deals are 'up-tos', where not everyone gets the full length, but today's longest is Tesco's 32mth 0% (3.19% fee), which gives ALL accepted the full time at 0% - a winner if you've decent acceptance odds (to be clear, it's top now as a slightly longer up to 0% was pulled). Golden rules: Repay at least the monthly minimum & clear the card before the 0% ends, or it jumps to 24.9% rep APR interest. Full help in top balance transfers. Don't put bananas in the fridge! It's Food Waste Action Week, so see our updated 14 ways to stop food & drink waste. Max your chances of getting a free £100 from Nationwide. Its Fairer Share scheme, to reward 'loyal' customers, looks likely to return this year - but go quick to boost your chances. Related: Nationwide to pay £50 bonus to 12 million in April. Martin: 'Do you have Power of Attorney? Arguably it's more important than a will.' Watch Martin's Power of Attorney video briefing for how it works, and how to get one. The side hustle tax-reporting rules are changing (eg, selling goods online, dog walking). See side hustle reporting changes. Tesco Clubcard holder? FREE 3mths' Disney+ for some via 2-click check. Can you get free Disney+? Urgent Pod. Can you boost State Pension by £10,000s? A must-listen if you're aged 40 to 73. It's about missing National Insurance years - step-by-step help including contracting out, Pension Credit, free years & more, all in the new Martin Lewis Podcast. Listen via BBC Sounds | Apple | Spotify or wherever you get your Martin fix. |

| |

|---|

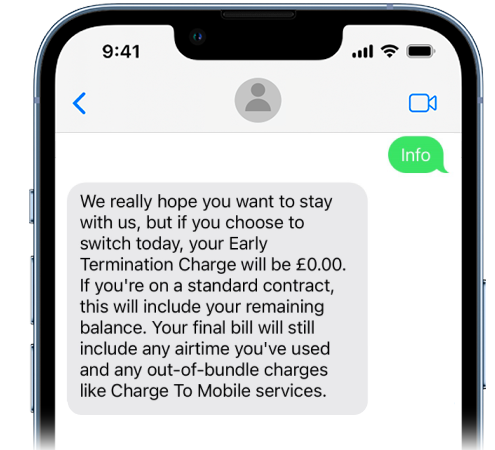

| Beat April's mobile phone price hikes Let's make this as plain as possible... - Switchers' deals have plummeted in price: Four years ago, 50GB data would've cost £12/mth. Now, it's less than £3/mth. And we're about to see further 6.4% rises next month for many on mobile contracts (see firm-by-firm price hike info). Yet many can avoid them by acting NOW. Heather emailed Martin after using our Cheap Mobile Sim Finder to tell him: "Following your show, I contacted my provider, which couldn't give me any reduction on my £12/mth. I compared new Sims, and the following day received one at £3/mth over 12mths [saving £110/yr]. Thank you."

Hot handset deals, including cheapest-ever iPhone 16 & Galaxy S25 Our main focus today is on Sims, but as we're talking mobiles, it's worth mentioning a raft of cheap handset contract deals have just launched. Of course, it's far cheaper to stick with your current phone and just change Sim, but if you're looking for a new handset, the deals include the cheapest we've seen for an iPhone 16e with 128GB storage and 10GB/mth data, an iPhone 16 with 128GB storage & 100GB/mth data, a Samsung Galaxy S25 with 128GB storage & 100GB/mth data and a Google Pixel 8 with 128GB & 300GB/mth data. The links explain all. Use our Cheap Mobile Handset Finder for top deals on other mobiles. | ||||||||||||||||||||||||

| What you need to do before April: savings, bill hikes, tax deadlines & more... The Martin Lewis Money Show LIVE, ITV1, 8pm tonight (Tue). Martin: "This is the last show in our current run, and I'm going to try and jam-pack it with everything you need to know before I go. April is a big month - it's all go with the tax-year end and a wrath of tax hikes (that's my collective noun). Do watch, or at least set the VHS." Mother's Day deals: 50% off cards, £28 delivered flowers, free gift cheques. It's a week on Sunday (30 March) - see lots more in our full Mother's Day deals round-up. Related: Free/cheap ways to treat mum. FREE gym passes, eg, 3 days' Nuffield Health till end of March. Plus 3-day Anytime Fitness pass. Free gyms Hot Diamonds 40% off full-price code AND 50% off reduced-outlet-items code. MSE Blagged. Alongside free delivery code - and yes, you can stack all three codes together. Hot Diamonds Martin: 'What happened to my 2012 pledge to give £10m to charity?' In summary... the £10m became £20m+ & the total donated so far is £12.5m direct & £5m indirect. The top three recipients are MMHPI, Martin's Covid Poverty Fund & financial education (including free textbooks for all schools). Left to donate: £8.5m. Martin's charity fund 2025 update gives all the details. He does this annually for transparency, as it was his public pledge when he sold MSE (though he's still the boss!). MSE is on WhatsApp - follow us there too. A new way to get the latest from MSE. WhatsApp-ening? |

| AT A GLANCE BEST BUYS

|

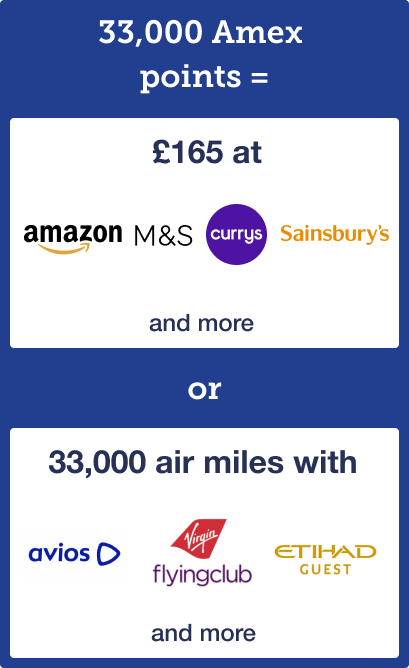

| New. Triple reward credit card: how to grab it at max gain, no cost, to get... There's no doubt this Amex card is targeted squarely at higher-spending middle Britain, with rewards at Amazon, M&S, Deliveroo & airports. Yet that doesn't make it a bad thing, as for some, do it right and it's an easy way to grab lucrative freebies. Providers want you to spend on credit cards, so much so that some pay you to do it. They hope they'll earn it back and more in interest, but to stop that, just neuter their interest-charging ability by ALWAYS setting up a Direct Debit to repay the card IN FULL each month. Then it's interest-free and you can reap the rewards. Just ensure you only use it for regular spending, never withdraw cash on it, bust your credit limit, or see it as an excuse to overspend.

|

| MONEY MORAL DILEMMA Should I stop paying for my irresponsible friend when we go out? My friend and her partner are irresponsible with money, wasting it on takeaways and other treats. She often asks us to collect them when we go out as they've no fuel in their car, and readily accepts if we offer to pay for meals and drinks, which we do knowing that they're often short of money. Yet I'm sure that they earn more than us. I don't want to damage our relationship and would miss going out with them, but why should we keep paying for their irresponsible behaviour? Enter the Money Moral Maze: Should I stop paying for my friend to go out? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

|

| |

|---|

| MARTIN'S APPEARANCES (TUE 18 MAR ONWARDS) Tue 18 Mar - The Martin Lewis Money Show Live, ITV1, 8pm |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email trading212.com, postoffice.co.uk, edfenergy.com Financial Conduct Authority (FCA) Note MONY Group Financial Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MONY Group Financial Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |