| Plus... MSE Academoney, free Kindle books, Ted Baker extra 20% off and more  THE TOP TIPS IN THIS EMAIL

| | Gas & electricity bills alert

Prices up. Cheap deals disappearing. Even the price cap's due to rise £90/yr. Yet it's the heaviest time for energy use, so everyone check NOW if you can save £200+/yr Wholesale energy prices (which energy firms pay) have soared recently - eg, wholesale gas prices are up 30% since November. As a result, the cheapest energy deals are up £50/yr too. As it's mid-winter, this is the worst time to be overpaying, so everyone should check NOW if they're on the best possible tariff (and the top deals are below).

Even if prices drop in future, worst case is that you pay the small exit penalty to switch again. It's better to be safe and pay less now. Don't let small savings put you off. Over half of UK homes are on a big energy firm's standard tariff. If that's you, your price is governed by the energy price cap. This moves every 6mths, with the next change being on 1 Apr, based on wholesale prices in the 6mths to 31 Jan. That means we've a good idea what it'll be. Analysts at Cornwall Insight predict the price cap will rise by a whopping £87/yr on typical use. Yet comparisons (incl our energy club) have to show savings against the current rate - in reality, likely a huge underestimate right now. We'll run through top deals below, but we've two tools that most people now prefer to use instead of doing a comparison themselves. Both look at tariffs from the whole market. -

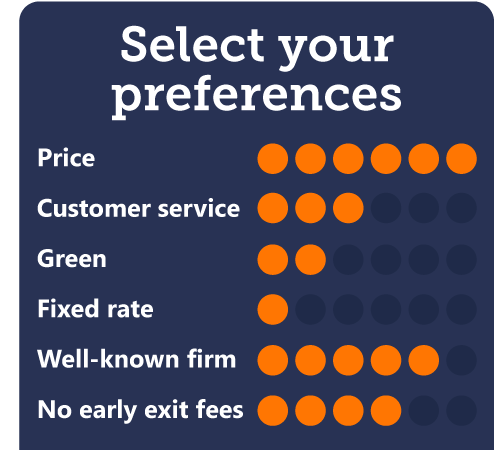

Recommended: Pick Me A Tariff every year (MSE Autoswitch). For those unsure or nervous about switching or choosing, this is best. Tell us your energy preferences (fixed, name you know, top service, green etc) or you can just select Martin's default choice.  We then find your top-pick tariff, you switch, then each year when your deal ends, we'll autoswitch you to your new winner based on your preferences, with just one click from you to verify. We then find your top-pick tariff, you switch, then each year when your deal ends, we'll autoswitch you to your new winner based on your preferences, with just one click from you to verify. -

Pick Me A Tariff for now. Tell us your preferences as above, but here there's no autoswitch after a year, just a reminder (though you can opt in to autoswitch later if you choose). The table below of the winners for each category (eg, top service, big name) is based on averages. Yet prices are regional and your winner depends on your usage. So all links go via our Cheap Energy Club comparison, so you see your exact winner and price, especially important right now while things are changing rapidly. More details on each tariff via the links. The Cheapest Energy deals

All are FIXED so the rate's locked in (what you pay varies with use)

Based on typical direct-debit use, average regional prices | | What most non-switchers pay (direct debit standard-tariff price cap): Over 50% of homes are on this. We've averaged the estimated cap over the next 12mths. | £1,114/yr

(£1,042 currently; after 1 Apr likely £1,129) | | Simplicity Energy 1yr fix. Cheapest. Small firm so we've limited service feedback, but Citizens Advice rates it just 2.2/5. Not green | £888/yr

(save £226/yr) | | Utility Point 1yr fix. Cheap fix (newbies only), but significant recent service issues. Normally good for service, but we've recently had many service complaints (mainly over getting credit back). It says it's facing a challenge due to coronavirus staffing levels, and meeting coronavirus help needs, so we've temporarily removed its rating. | Not green | £896/yr

(save £218/yr) | | E.on 1yr fix. Cheapest big-name fix (newbies only). 100% green elec (not gas) | 3/5 MSE service rating | £925/yr

(save £189/yr) | | So Energy 1yr fix. Cheapest top-service fix (newbies only). 100% green elec (not gas) | 4.5/5 MSE service rating | £950/yr

(save £164/yr) | | British Gas 28 Feb 2022 fix. Cheap big-name fix (newbies only) & a year's 'free' heating insurance. 100% green elec (not gas) | 3.5/5 MSE service rating | Heating ins costs £11.50/mth after yr1, can be cancelled any time | £955/yr

(save £159/yr) | | Prices include £25 MSE dual-fuel cashback & any bill credit (where paid). Savings compared with the estimated price cap over the next year. | If you don't pay by monthly direct debit, you either can't get the deals above or you'll pay more. Also, unfortunately you can't get these deals if you're in Northern Ireland. However, that doesn't mean you shouldn't compare. - Not on monthly direct debit? If you're not on a prepay meter, the best action is to switch to monthly direct debit, as the top deals are only via this payment method. If you're not happy to do that, you can still do a comparison based on your payment method.

- Are you a prepay customer? Try our prepay comparison - savings are smaller, typically £85/yr, but it could still be worth doing. For bigger savings, see if you can switch to a credit meter. See Cut prepay energy costs.

- In Northern Ireland? Our Cheap Energy Club - like all UK comparisons - doesn't include NI, but you can do a comparison via Cheap NI Electricity or the Consumer Council for Northern Ireland's tool.

Here's a quick Q&A - for more, see the full Cheap Energy Club FAQs.

Q. Is switching risky? Could I be cut off? No, as no one visits your home (unless you want / need a smart meter) and it's the same gas, same electricity and same safety. The only things that change are price and service. See our 'Switching is no biggie' FAQ. Q. Does MSE make money from this? That depends on the tariffs. If it's one we can switch you to, like all energy comparison sites, we're paid (though unlike others we don't hide tariffs that don't pay), and we give you roughly half as cashback (£25 dual fuel, £12.50 single fuel).

You wouldn't get this going direct (not that the top deals above are available directly anyway). So it's a win-win. The rest helps cover our costs and hopefully makes us some profit. More switching and energy help in the links below... Switching with smart meters | Why's my bill risen when I've fixed? | Reclaim credit | Switching-in-debt help | Switching if I've solar panels | How direct debits are set | Can I pick a switch date? | How do you compare my rates? ------------------------------------------- How to slash debt costs to 0% - get yourself debt-free

8.30pm Thu, ITV: Martin's Money Show Live

If you've any debts, in this week's show I'll show you how to cut the cost, and get yourself debt-free quicker. Plus as always the latest news you can use, including why your energy firm may owe you £100s. And of course, as it's live you can tweet suggested questions to @MartinSLewis, but you must use the show's hashtag #MartinLewis. Do tune in or VideoPlus it. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | No 'free cash' bank switches, but you can get a FREE £180 case of wine, plus 2% interest - yet go quick, as we doubt it'll be around for long

January is normally bank switch month, where firms flex their financial muscle to pay you to switch to them. Yet this year the cupboard is bare - in fact, we know of two deals that were due to launch that've been pulled due to the pandemic. We could w(h)ine, but at least one bank is still willing to 'pay' you to switch - however, this deal isn't likely to last much longer, so speed is of the essence. All accounts require you to pass a not-too-harsh credit check to open 'em. -

Free ('£180') 15-bottle case of wine for switching + 2% easy-access savings. New Virgin Money* switchers get the wine (Virgin says they're worth £180, though this is hard to verify as they're Virgin Wines exclusives), plus 2.02% AER variable interest, although only on up to £1,000 in the account. It also has a top debit card for use overseas (giving fee-free spending and cash withdrawals). Free ('£180') 15-bottle case of wine for switching + 2% easy-access savings. New Virgin Money* switchers get the wine (Virgin says they're worth £180, though this is hard to verify as they're Virgin Wines exclusives), plus 2.02% AER variable interest, although only on up to £1,000 in the account. It also has a top debit card for use overseas (giving fee-free spending and cash withdrawals).

To get the wine (pls be Drinkaware), within 31 days of opening you need to switch - incl 2+ direct debits - via Virgin Money's official service, register for its app, and put £1,000 in its linked 0.5% savings account (which is a best-buy easy access account anyway). If you've no other savings you could move it to the main account once you've got the wine code to get the 2%. -

Top accounts for 0% overdrafts. First Direct offers many customers an ongoing £250 0% overdraft, though some can get a much bigger 1yr 0% overdraft with Nationwide FlexDirect, depending on credit score (useful if you need respite from charges, but the rate jumps to 39.9% from year 2, so try to clear it before then). Plus do remember if you're struggling with your overdraft due to the impact of the pandemic, Lloyds, Halifax, Bank of Scot (until 31 Jan) and Santander let customers apply for 3mth-long up-to-£500 0% overdrafts - see full Covid overdraft help. -

Top accounts for cashback, service and insurance. While there are no other accounts offering big upfront switching incentives, there are plenty of ongoing perks. Here are our top picks, each of which links you to more details in our Best Bank Accounts guide...

- Top for bills. Santander 123 Lite pays 1-3% cashback if you pay bills from it by direct debit. Even after the £2/mth fee, many can earn £50+/yr. It's good as a shared bills account.

- Top for service. If service is key, First Direct's won almost all service polls we've done.

- Top for cheap insurance. Pay £156/yr for family mobile, travel and breakdown cover with Nationwide's FlexPlus. | Martin: 'Warning. Are/were you a customer of HSBC, First Direct or M&S Bank? Watch your mail - you may get a cheque. It isn't a scam - one man nearly chucked it.' Full info in Martin's HSBC warning. Ends Thu. 108Mb fibre (ie, MEGA-FAST) b'band AND line from Virgin - '£18.40/mth'. MSE Blagged. This deal for Virgin Media newbies is £23.95/mth, but as you get a £100 AUTO credit on your first bill, you pay nothing for 4mths, making it an equiv £18.40 over the 18mth contract. It also comes with 'free' weekend calls. Only 52% of homes can get Virgin, so the link takes you via our broadband comparison to check your eligibility, and from it you can find other deals. 'Martin, should I buy Bitcoin?' Everyone's asking this, so take a look at how he answered: Martin on Bitcoin. New. Cheapest ever iPhone 11 contract we've seen, incl 25GB/mth EE data. MSE Blagged. The iPhone 11's got far cheaper since the 12 launched. Now EE newbies (via this Affordable Mobiles link) can get a 64GB iPhone 11* with unltd mins, texts and 25GB/mth data for £79 upfront, then £26/mth. The £703 cost over the 2yr contract is £135 less than buying the handset outright with a similar data Sim. More help in Cheap iPhones. Find the cheapest handset or Sim for you: New MSE Cheap Mobile Finder tool. Is M&S's £5 top-up on £15 school meal vouchers in England worth it? The £15 Govt vouchers for those on low incomes can be used at many supermarkets. M&S is pricier but adds £5 on top, so we've investigated if you get more at M&S with the £5 added. Also, free mobile data for online schooling at home: Many on lower incomes can get allowances from EE, Three, O2, Vodafone etc. We've rounded it up in school mobile data help. Ends today (Wed). Ted Baker EXTRA 20% off its 'up to 50% off' sale. MSE Blagged. It's the strongest discount we've seen it offer on a sale - just use our code to get it. Ready teddy go Updated. 20 ways to get free or cheap books, incl free Kindle titles for writing reviews. See 20 free book tricks . | Hurrah. 30,000 have enrolled in the free MSE Academoney - making it the OU's most popular course (since we launched it). Why don't you? Our six-part financial education course with the Open University has rave reviews Last May, we launched our joint initiative with the Open University, the MSE Academoney (or more formally the MSE Academy of Money), and since then it's been the OU's most popular free course with 30,000 people enrolling. It's a great way to use your time, especially in lockdown... - There are six Academoney sessions - take as many as you like. Each takes about two hours, with a mix of info, exercises, Martin's explanatory videos, and animations. Completing all six earns you an OU badge, which you can use as evidence of ongoing professional development. See Academoney explained. The six are:

1) Making good spending decisions. Explores behavioural and marketing pressures to help you manage your money.

2) Budgeting & taxation. Calculate net income, how national insurance and tax work, and how to budget.

3) Borrowing money. How different debts work, the differences between them and the dangers.

4) Understanding mortgages. Incl interest rates, repayments and how mobile bills etc may kibosh applications.

5) Saving & investing. How they differ, savings options and investment basics (eg, how shares/funds work).

6) Planning for retirement. Pension help and more, for those retiring imminently or with years to go.

- Those who have taken the course are raving about it. Here are just a couple of testimonials...

- MoneySaver Alison said on Facebook: "Would recommend it to young and old. It helped me to successfully retire at 55."

- Footballer Sam Tierney (who plays for Leicester City Women) tweeted a picture of her statement of participation for completing the course last year, without any prompt from us - and she said this:  | Kids' baking ingredients kit for £1.99 (norm £13ish) - makes cakes for 12 people. MSE Blagged. Little Cooks Co is a monthly subscription box for little 'uns. 1,500 kits avail. Little Cooks Co 25% off designer glasses, eg, £45 Calvin Klein specs. MSE Blagged. See glasses code. Shift debt to 15mths 0% NO FEE plus get £20 cashback. If you pay credit or store card interest, a balance transfer card can help you slash debt costs, and Barclaycard* (do check acceptance odds first) gives 15mths at 0% interest for no fee. Plus you get £20 if shifting £2,500 to it within 60 days. There's a raft of other top deals now too - full help in Balance Transfers ( APR Examples). Golden rules: 1) Pay at least the monthly min. 2) Pay it off within the 0% or transfer again, or Barclaycard is 21.9% rep APR. 3) Don't spend/withdraw cash. The MSE Forum's '1p Savings Challenge' - can you save £665+ in 2021? See how it works in 1p Savings Challenge. Tesco fuel station card payments taken MONTHS late. Full info and help in Tesco delays. Want an MSE Charity grant of up to £7,500 for a project to help support the under-26s? Non-profit organisations can apply for a cash boost in our charity's latest grant-giving round, which this time is for projects for the under-26s, to teach and develop financial life skills. Check if your project qualifies now and apply via the charity's website from 9am on 1 Feb. The round closes once it accepts 40 applications, or on 26 Feb at the latest. | Tell your friends about us They can get this email free every week | SUCCESS OF THE WEEK:

"Boiler stopped working and would cost £200 to fix. I thought my only option would be a payday loan but I visited your website and read about credit union loans. I'm a GMB union member - I contacted its credit union and the loan was approved. Boiler fixed and no higher APR payday loan. Thank you so much."

(Send us yours on this or any topic.) | THIS WEEK'S POLL What financial support have you accessed during the pandemic? The coronavirus crisis has hit the UK economy hard, with millions struggling financially. The Government, councils and financial firms have put a variety of support schemes in place, though sadly not everyone's been able to access help. So this week, we want to know if you've had any Covid-related financial support. Two-thirds of MoneySavers now use less than 2GB of mobile data each month. Last week, we asked how much mobile data you use - 4,400 of you responded. Overall, 67% said they use less than 2GB/mth, up from 55% when we last asked in Jan 2020. Younger MoneySavers were more data-hungry, with 31% of under-35s using 5GB+ each month. See full mobile data poll results. | MONEY MORAL DILEMMA Should I return the 'free' sawhorse that arrived after I cancelled the order? I ordered a sawhorse from a well-known DIY retailer and it qualified for free next-day delivery. After two weeks it hadn't arrived, so I contacted the retailer which said it had problems with the courier and gave me a refund. I reordered it and collected the item from its local store, but two days later the original order arrived, meaning I had two but had only paid for one. I'm annoyed it arrived so late and I had to go to the store, so was going to give the second sawhorse away, but should I return it? Enter the Money Moral Maze: Should I return the sawhorse? | Suggest an MMD | View past MMDs | MARTIN'S APPEARANCES (WED 20 JAN ONWARDS) Wed 20 Jan - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 21 Jan - This Morning, phone-in, ITV, 10.55am

Thu 21 Jan - The Martin Lewis Money Show Live, ITV, 8.30pm MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Fri 22 Jan - BBC Radio Shropshire, Mid-morning with Jim Hawkins, from 11am, Guy Anker with MoneySaving shopping tips

Sun 24 Jan - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 10am

Mon 25 Jan - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 26 Jan - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.25pm | 'I WAS THE NO. 1 BUYER OF 2L BOTTLES OF CAFFEINE-FREE DIET PEPSI' That's all for this week, but before we go... Sainsbury's Nectar app users last week got their '2020 in review' Sainsbury's shopping summaries. One fun feature showed where you ranked for frequent purchases at your local store. After we revealed MSE Kit had bought the most chocolate digestives at his nearest shop, you flooded our social channels with stories of where you too ranked top. MoneySavers led the way on items including Diet Pepsi, Chicago Town pepperoni pizzas and even balsamic vinegar & caramelised onion Walkers Sensations. One healthy MoneySaver also 'won' on fresh tomatoes. Let us know your 2020 shopping 'victories' in our Facebook post. We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment