| Plus... Free £100+, cheap petrol, 18mth 0% + £20 Amzn  THE TOP TIPS IN THIS EMAIL

| | 18 Motoring MoneySavers

NEW best time to buy car insurance, £1 MOTs, cheap petrol, £54 full service breakdown cover, pothole help & more Stay-at-home rules are being eased across much of Britain this week (though there are still restrictions), which means longer or more regular car journeys are back for some. Yet rising fuel prices, added to the many other unavoidable motoring costs, can put your finances in a jam. So we've 54 Motoring Tips to help slow accelerating costs - here are 18 of 'em to give you a steer... - Six simple checks to get your car in gear if you've hardly driven recently. We've compiled top tips from the AA and Green Flag on how to do some quick checks (eg, to ensure your brakes work) that can help you get back on the road safely. Plus it's worth a scout around to check if your car's now providing a home for local wildlife. See the full checklist.

-

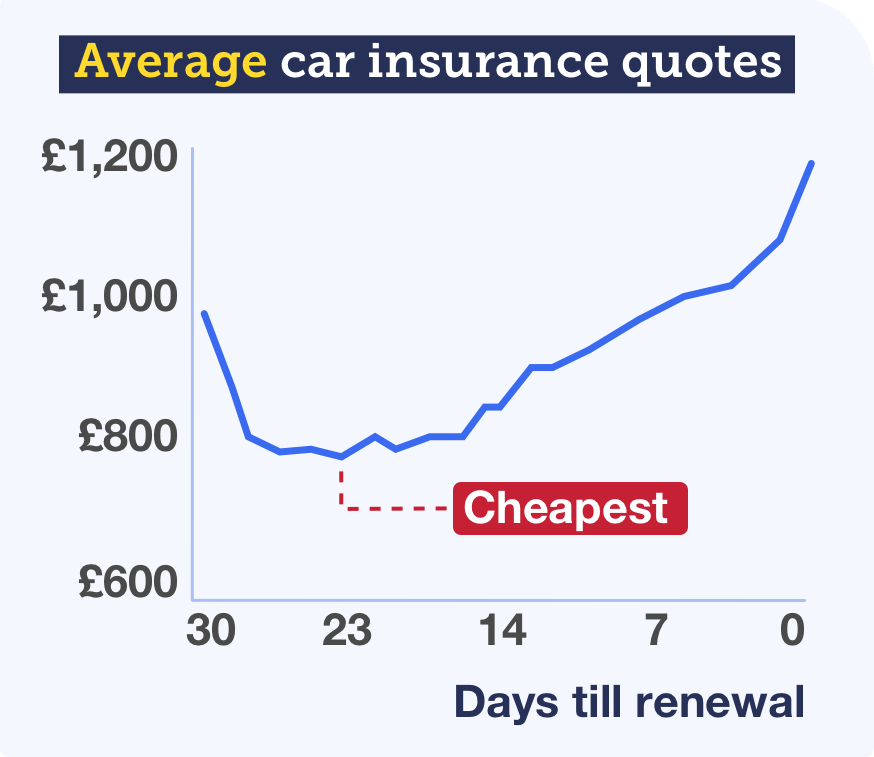

The BIG car insurance secret - compare quotes 23 days before renewal to potentially HALVE costs. We've told you this for years, so it might not sound like a secret, but we still class it that way as millions DON'T do it. But getting quotes at the last minute before renewal means you're actually deemed a higher risk - insurers say such drivers are statistically more likely to claim, so they often pay £100s more. To be clear, this is not about getting a renewal quote from an existing insurer, it's about getting cheaper quotes elsewhere. The BIG car insurance secret - compare quotes 23 days before renewal to potentially HALVE costs. We've told you this for years, so it might not sound like a secret, but we still class it that way as millions DON'T do it. But getting quotes at the last minute before renewal means you're actually deemed a higher risk - insurers say such drivers are statistically more likely to claim, so they often pay £100s more. To be clear, this is not about getting a renewal quote from an existing insurer, it's about getting cheaper quotes elsewhere.

We've just redone our "when's best to buy car insurance" analysis for the third time. We looked at 70m+ quotes from the four big comparison sites and found the optimum time to get a quote is now 23 days ahead (previously, 24 days), though it's still similarly cheap a few days either side.

If you've less time, hurry, as prices tend to rise the closer you get to renewal. Buying early worked for Nicola, who emailed: "Tried your method 24 days prior to renewal and slashed insurance on my Fiesta from £329 to £199. Thanks." And we've more tips to find cheap car insurance below.

- Ends Mon. Bag a £1 MOT vch valid till Nov. Buy anything, eg a £1 sponge, at Halfords by Mon (19 Apr) and you'll get a 'free' MOT vch. You then need to book the MOT by 21 May and get it done by 21 Nov.

A warning, though - £1 MOTs are great if you're sure your car will pass everything, eg, if it's fairly new. Yet if minor fails are likely, it's worth looking at 'hidden' MOT centres. These generally only do tests - they don't fix your car, so there's no chance of you having to shell out for needless repairs.

However, if your car's likely to need major work, you're actually best off finding a reasonably priced garage that can do both testing and repairs, as you may not be able to drive away from the test centre if it fails. See how to choose the right MOT centre.

- Not sure when your MOT's due? Use a simple tool to help avoid a fine of up to £1,000 for driving without one. See MOT checker.

-

Petrol's up 20p/L since May 2020, so use a clever tool to find the cheapest fuel near you in seconds. The difference between the cheapest and priciest local forecourts can be sizeable, eg, in Leeds on Tue we found it ranged from 117.7p/L to 126.9p/L. See how to find cheap petrol near you. Petrol's up 20p/L since May 2020, so use a clever tool to find the cheapest fuel near you in seconds. The difference between the cheapest and priciest local forecourts can be sizeable, eg, in Leeds on Tue we found it ranged from 117.7p/L to 126.9p/L. See how to find cheap petrol near you.

- Get up to 5% cashback when you fill up. The Amex Platinum Everyday card gives a massive 5% introductory cashback for 3mths (max £100), then up to 1% - and works everywhere Amex is accepted, not just for fuel.

- Urgent - check if your photo licence is valid NOW, as the renewal amnesty has ended and you could be fined. Many whose licences were due to renew last year got an 11mth extension. But if that's ended for you, or your licence expired after Dec 2020, you MUST renew it or you could face a fine. See how to check your driving licence is valid (and what to do if it's not) .

- Never auto-renew your car insurance - loyalty is expensive. Premiums are at their lowest for four years, but that doesn't mean you'll get a cheap renewal quote. Nothing better illustrates this than Ken's cautionary tale: "Renewal premium was £1,215, but following the tips in your email, I managed to get a quote of £436, saving £779". See how to cut your costs in Cheap Car Insurance.

- Find YOUR cheapest car insurance quote. Here's how...

- Try comparison sites in order to speedily find your cheapest cover. They don't cover the same insurers, nor give the same price for the same insurer. Our current order is: 1) MoneySupermarket* 2) Confused.com* 3) Compare The Market* 4) Gocompare*. (Why? See comparison order.)

- Try insurers & hot deals comparisons miss. Check if biggie Direct Line* can beat your top quote, as it isn't listed on comparisons and can be competitive for some. Also see deals comparisons miss.

- Stop using your brake... and save up to 30% on fuel. Don't worry, we're not suggesting you drive Fast (or even Furious) - it's actually the opposite. By thinking about road positioning, rather than slamming on the brakes and burning all the energy you've pumped into the car, you'll be able to slow down gradually, making your driving more efficient, thus using less fuel. Combine this with our 12 other tips to drive more efficiently and use less fuel .

- DIY checks to help you pass your MOT. Many fail needlessly with broken lights, bald tyres etc. A simple 5min check can help to fix that. See our 9 pre-MOT checks.

- Sometimes to save on car insurance, it's best not to be logical. Sometimes things that don't make sense can save you cash. Our Cheap Car Insurance guide has 'em all, incl:

- Comprehensive cover can beat 3rd party, so always check both.

- Insuring extra, responsible drivers on your policy can slash costs.

- Legitimately tweaking your job description can also cut the price.

-

Full breakdown cover, incl home start and onward travel, for you and your partner for £54/yr. Newbies can get an AutoAid* policy and pay £59.99 for 1yr, but it then gives £6 automatic cashback. In contrast, an equivalent AA or RAC policy is £100+. More options, incl basic policies from £24, in Cheap Breakdown Cover. Full breakdown cover, incl home start and onward travel, for you and your partner for £54/yr. Newbies can get an AutoAid* policy and pay £59.99 for 1yr, but it then gives £6 automatic cashback. In contrast, an equivalent AA or RAC policy is £100+. More options, incl basic policies from £24, in Cheap Breakdown Cover.

- If you're sticking with the AA or RAC for breakdown cover, never renew policies without haggling. In our poll, 83% of hagglers had success with RAC, and 82% with the AA. It worked for Barrie: "Thanks for the advice about haggling, told the AA I was leaving and it reduced my joint full cover from £357 to £179." See our Breakdown Haggling Tips.

- Car pranged by a pothole? You could be due £100s. Use our Pothole Claims guide to see if you're owed.

- Cut parking costs by renting a driveway. Whether you're back commuting or just taking a day trip into town to get a long-awaited haircut, see if you can rent a private space for less. We found £8.50/day in London, compared with National Car Parks' £16/day.

- Could you pass the driving theory test? The official mock version is free online. Driving lessons have resumed in Eng and Wales, with tests restarting next week. Whether you're a learner or just want to prove you could still pass it, check out the Driver and Vehicle Standards Agency's free mock theory test.

- 634,000 drivers haven't paid vehicle tax - risking a fine or having their car towed. You no longer need to display a paper tax disc, but you DO still have to tax your car. This is especially important if you declared your car off-road during lockdown. See how to check if you've paid vehicle tax.

- Buying a new or used car? The right finance deal can save you £100s. Whatever car you have your eye on, the cheapest way to get it is to buy it outright. If that's impossible, the next cheapest route is usually via a standard bank loan, as rates tend to be lower than those on specialised car finance packages. See our best buys below or full info & options in Cheap Car Loans.

However, specialised car finance packages can be more flexible, and can work well if you're planning to regularly trade up to newer models. See Cheap Personal Contract Purchase, and our other dealer finance guides for full pros & cons of each. PS: If you're getting on your bike instead, we've 13 MoneySaving cycling tips to help cut costs. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | The cheapest loans, at just 2.8%, are DISAPPEARING. If you need to borrow, now's the time to examine your options

A month ago, five lenders offered loans for larger amounts at rock-bottom 2.8% rates. Now, only three do for all loan terms. Historically that's still incredibly cheap, close to the cheapest-ever rates, yet these rate rises may be an indication that the mood music is turning, and borrowing's starting to get more expensive. Once you get a loan, the rate's fixed so if you do need to borrow, it may be worth acting sooner. Here's what you need to know... - Only borrow if it's NEEDED and AFFORDABLE. For example, your car's a wreck and it's a must for work, and even then, only do it if you've budgeted for it and you can make the repayments. If in doubt, DON'T borrow. If you get a loan, minimise the amount and the repayment time if you can, as that cuts the interest you pay. And if already struggling with debt, further borrowing won't help - instead read our Debt Help guide.

THE UK's CHEAPEST PERSONAL LOANS RECOMMENDED: Use our Loans Eligibility Calc first to see which loans you're most likely to get | | £7,500 to £15,000 | Cahoot*, MBNA* and Ratesetter* 2.8% rep APR. Or £7,500 - £15,000 eligibility calc | | £5,000 to £7,499 | Ratesetter* 2.8% rep APR; Virgin*, Tesco* (1-3yrs) 3.4% rep APR. Or £5,000 - £7,499 eligibility calc | | £3,000 to £4,999 | Hastings Direct* 5.9% rep APR; Ratesetter* 7.8% rep APR. Or £3,000 - £4,999 eligibility calc | | Under £3,000 | A money transfer credit card loan is likely cheaper. It pays cash into your bank, so you owe it instead, but at 0% for up to 18mths, for a 3%-ish fee. Though if you prefer the structured repayments of a loan, use our under £3,000 loans eligibility calc to find your cheapest. | | All loans are for 1 to 5 years unless stated. | - Beware: ALL rates above are 'representative APRs'. As with all loans, that sadly means just 51% of those accepted need to get the stated rate - others may pay more - and worse, you're usually only told after application. So check. Even our eligibility calc mostly has to work with rep APRs, so high acceptance odds don't always mean cheap rates. Though we're working to change that and now have a few lenders that give certainty - look out for the green boxes in your results.

- Loan Golden Rules. Full info & options in Cheap Personal Loans (APR Examples).

a) Minimise the amount you borrow and repay as quickly as possible.

b) Pay on time (ideally by direct debit) or you may be charged a late fee and have a missed payment on your credit report.

c) If you're getting a loan to pay off credit cards, a balance transfer may be cheaper. | Martin's update: 'Required to work from home even for just the odd day? Now claim TWO years' tax relief (worth up to £280)'. We found out just minutes before last week's email went out, so added it as a stop press. Now Martin's fully updated his WFH blog with step-by-step help for the new tax year as well as the old. ANY hot drink 50p at Costa Coffee. It's offering this rare discount till Thu, via its app (not in NI). Doesn't Costa lot Ends Mon. Shift debt to 18mths 0% for NO FEE, and get a £20 Amazon vch. Accepted applicants can balance-transfer credit card debt to this Santander card at 18mths 0% with NO FEE* and claim a £20 Amazon vch (RECOMMENDED: apply via our eligibility calc , which shows if you're likely to be accepted). This card wins for those who can clear the shifted debt within the time, as it's no fee, plus you get the vch. Golden rules: 1) Pay at least the monthly min. 2) Clear within 18mths or it's 20.9% rep APR. 3) Don't spend/withdraw cash on it. Full help & options in Top Balance Transfers (APR Examples). Top deals for takeaway/delivery, eg, 20% off McDonald's. Restaurants are packed, so they aren't generally offering dine-in deals, but offers abound if you don't want to eat out (or can't yet), eg, see how to get 20% off at McDonald's (+ 11 other McD's hacks). Plus we've 10 more takeaway & delivery tips, incl Uber Eats/Deliveroo cashback. Married woman over 67? You may be one of 100,000s due up to £82,000 in state pension. We started shouting about this last June, and have heard from scores of women who've claimed money and boosted their pension, incl Gill, who got £82,000 back after watching Martin's show and reclaiming 12 years of payments. So we had a somewhat wry smile when we saw the BBC headlining this news last week, coupled of course with delight the message is getting out there to more people. See our full State pension boosts guide. Now THREE banks offer switchers £100+. Top for service: First Direct*, rated 91% 'great', offers switchers a free £100 and many get a £250 overdraft. Top for upfront cash: HSBC offers switchers to its Advance account a free £125. New. Top for possible monthly cash. Halifax now pays switchers to its Reward account a free £100, plus each month you spend £500 on its debit card or keep £5,000 in the account (but no interest) you get either £5, 2 movie rents or 1 cinema ticket. Full details for each account, incl crucial bonus ELIGIBILITY info, in Best Bank Accounts. Free £13 seeds + 2for1 garden visits card (eg, for Kew & Eden Project) via £7 mag. Save on visiting big gardens when they reopen and grow seeds in your garden at home. Gardeners' World | Martin: 'REVEALED: Self-Employment Income Support Scheme 4 applications start 22 April - but everyone gets their own date'

I wish I'd been writing this a month ago. Finally, the Self-Employment Income Support Scheme 4 (SEISS 4) grant, worth up to £7,500, is on its way - welcome relief for those with incomes savaged by Covid, who've eked out the last grant for up to five months. The good news (and something we campaigned hard about) is for the first time up to 600,000 recent starter self-employed are due grants too. Here are my need-to-knows, while there's more detail in the full MSE Self-Employed & Small Ltd Co Help guide: - SEISS 4 is the first grant that will look at 2019/20 tax returns. Eligibility criteria for this grant are largely unchanged (leaving many still excluded), with one big exception - 2019/20 tax returns will be included, so many who started businesses after around Oct 2018, who were previously excluded, may get one. It works like this...

- Eligibility: Self-employment trading profits for the 2019/20 tax year must be £50,000 or under, and at least equal to other income. If not, it'll average the tax years 2016/17, 2017/18, 2018/19 and 2019/20 to see if you qualify.

- Amount: It pays 80% of average trading profits up to £7,500 for 1 Feb to 30 Apr. The average is based on those four tax years up to & incl 2019/20. If you've a gap in the years traded, it only uses the tax returns after the gap.

- I believe the first applications open on 22 Apr, but HM Revenue & Customs (HMRC) isn't confirming. To stop the system being clogged up, HMRC isn't announcing a specific date applications open. Instead, since Mon it has been sending those eligible a personalised 'earliest application' date via text, email or letter (see how to spot fake HMRC messages). The money is usually paid about six working days after application.

I asked people to feed back their 'earliest application' dates on social media, and the range is 22 to 29 Apr. HMRC does have a non-publicised find your date link, which seems to work for some, though it's saying it's still a work in progress, and won't officially launch something with all the data until next Mon. If you check then and don't get a date, and think you should have, contact HMRC if you think there's been a mistake.

- Due your first SEISS grant as a recent starter self-employed? Some newly eligible may have already had a letter from HMRC asking them to verify their ID, but that's separate from notification of your application date. If you're not sure what to do, see our newly eligible for SEISS help.

- Some who were eligible before WON'T be now and payouts may change. The change needed to include 600,000 new starters does slightly shift the maths, because of (as detailed above) the inclusion of the 2019/20 tax year. Bigger earnings in that year could mean a bigger payout or may push a few over the cliff edge of £50,000/yr max, leaving them ineligible. Lower earnings then could reduce payouts or exclude you if non self-employed income was high. See more info on how the SEISS 4 time change may impact you.

- To claim, you must declare that you've had a 'significant reduction' in profits. Your business must have been hit by Covid between the beginning of Feb and end of Apr. Use our detailed Can I claim the fourth grant? guide for full help and case studies. And remember, the payment is binary - if you're due it, you're due the entire amount.

- SEISS 5 will cover May to Sept and is worth up to £7,500, but it's turnover dependent. Those whose turnover fell by 30%+ in the year to Apr 2021 will get 80% of profits; those whose turnover fell by less than 30% will get just 30% of profits. Exact eligibility criteria and application dates haven't yet been announced - for what we know so far, see SEISS 5 help.

| Extra 35% off code for 'past best-before' health food, tea bags, protein powder etc. MSE Blagged. Save on already-reduced prices, eg, 80 Pukka tea bags £5 (norm £12). Love Health Hate Waste New. FREE guide to teach kids about spending money safely online. It's from online-safety body Internet Matters and covers scams, in-app purchases, data privacy and more. Get the free guide. Related: Download Martin's free financial education textbook. Returning pre-lockdown purchases? Many stores have extended rights (but hurry with M&S/New Look). Most retailers have started the clock again from when they reopened. See retailer-by-retailer returns policies. Warning - new passport applications and renewals may take 10 weeks. If you're chancing a summer trip, then act urgently if you need to apply. Passport warning 30% off online at Savile Row Company. MSE Blagged. While it's not strictly MoneySaving, if you're going back to the office and would be buying anyway, our code will bag you a saving, eg, £40 shirt for £28. Savile Row Co | Tell your friends about us They can get this email free every week | | AT A GLANCE BEST BUYS | | Free £125 for switching + 1% regular saver: HSBC

Free £100 for switchers + top service: First Direct | | THIS WEEK'S POLL How many passwords do you have? With scams on the rise during the pandemic and several high-profile data leaks reported recently, it's more important than ever for all of us to ensure we're cyber-safe - for example, by having different passwords for different accounts. So this week, we want to know how you use passwords. Most MoneySavers spend more than £300 on monthly bills. Last week, we asked how much you spend on your monthly bills (eg, council tax, utilities, TV etc) - some 5,600 people responded. Overall, 68% said they spend more than £300/mth. But it varied by living situation, eg, 90% of those living with a partner and kids pay more than £300/mth, but only 30% of those who live alone said the same. See full monthly bills poll results. | MARTIN'S APPEARANCES (WED 14 APR ONWARDS) Wed 14 Apr - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 15 Apr - This Morning, ITV, 10.30am, then phone-in from 10.55am MSE TEAM APPEARANCES (SOME SUBJECTS TBC) Wed 14 Apr - BBC Radio Tees, Lates with Steffen Peddie, Katie Watts on scams from 10pm

Thu 15 Apr - TalkRadio, Early Breakfast with James Max, personal finance news review with Helen Knapman from 5.35am

Fri 16 Apr - Cash Chats podcast with Andy Webb, personal finance news review with Helen Knapman, avail from Fri

Sat 17 Apr - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 11am

Mon 19 Apr - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 20 Apr - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | 'A MORTGAGE? I THOUGHT YOU ONLY BOUGHT HOMES OUTRIGHT' - MONEY MYTHS YOU BELIEVED AS A KID That's all for this week, but before we go... after MSE Becca revealed that as a child she thought there was always someone in a cash machine, last week we asked our colleagues at MSE (Virtual) Towers what money myths they believed when they were little. While she's an expert now, MSE Helen K thought people just bought homes outright without a mortgage. And MSE Laura B thought any price that ended in .99 was automatically cheap - luckily, as a deals guru, she now knows better. Inspired by all that, we asked our users on social media for similar stories, so if you fancy a giggle or want to add your tale, check out our Money myths as a kid Facebook post. We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment