A masterclass in borrowing... if you need to

How to borrow at NO COST (0% interest) & maximise your protection

Cheapest routes whether it's a new fridge, kitchen, car & more

Lockdown's easing, retail's opening, and spending's likely to restart. Some will be able to draw on savings but others will be thinking about taking on new debt. So if you're going to borrow, we want to ensure you do it the cheapest and safest way.

It's worth being aware that the lending landscape has changed during the pandemic. Buy now, pay later options from Klarna, Clearpay and others have exploded - pushing many, sometimes inadvertently, into debt when they pay online.

That's dangerous. Borrowing should always be conscious, via the right method, and never done willy-nilly...

Don't borrow unless you NEED to. If you do need to, ensure it's a planned purchase, you can afford repayments and you'll repay as quickly as possible. If you can't afford it, don't do it.

So let's take you through the pros, cons and cheapest options product-by-product.

Done right, credit cards are the cheapest way to borrow at no cost for a decent time, though that's provided you can pay for what you need on a card (eg, replacing a broken fridge or washing machine). Yet it takes discipline not to overspend on it.

Done right, credit cards are the cheapest way to borrow at no cost for a decent time, though that's provided you can pay for what you need on a card (eg, replacing a broken fridge or washing machine). Yet it takes discipline not to overspend on it.

✔️ Pros: Interest-free for a decent time | Gives Section 75 protection - so card provider jointly liable for purchases | Regulated - so can complain to the ombudsman if you've problems | Can check eligibility without applying

❌ Cons: Easy to overspend and overborrow | Repayments aren't fixed, so easy to underpay | Not everyone can get one

Top deals right now: What really counts is what you'll be accepted for, so ALWAYS check which 0% spending cards you're most likely to get first. Current top deals are:

- Longest 0% deal: Lloyds Bank 'up to' 21mths 0% card*.

- Longest non-up to 0%, with rewards: M&S Bank's 20mths 0%*. Unlike Lloyds, all accepted get the full length plus M&S points on spending (though don't let that encourage you to spend too much).

Only use these cards for a planned purchase(s) - NOTHING ELSE - then ensure you repay it within the 0% period. It's best to set up a direct debit repayment for a fixed amount, like with a loan, to ensure you clear it (and never miss a payment). After the 0%, both cards jump to 21.9% rep APR.

Full info and more top picks in Top 0% Cards (APR Examples).

This is your only prime route for most borrowing of £3,000 and above. So while a card might be good to use to replace a broken fridge, a loan is a better option if you need to replace the whole kitchen. You'll pay interest, but rates are currently close to all-time lows.

✔️ Pros: Allows bigger borrowing & longer to repay | Fixed repayments - so easier to repay in set time | Can check eligibility without applying | Harder to borrow more | Regulated - so can complain to the ombudsman if you've problems

❌ Cons: Allows bigger borrowing | Not interest-free | No Section 75 protection | Not everyone can get one

It's also worth being aware acceptance is not just on credit score; the more you borrow, the bigger an impact your income has. As always, if you do need to borrow, try to minimise both the amount and the term (ie, repay as quickly as possible).

Top deals right now: What really counts is what you'll be accepted for, so ALWAYS check which loans you're most likely to get first. Current top deals are...

- For £3,000-£4,999: Ratesetter 7.8%*, AA 8.3%*

- For £5,000-£7,499: Ratesetter 2.8%*; Virgin Money 3.4%*, Tesco Bank 3.4%*

- For £7,500-£15,000: Cahoot 2.8%*, MBNA 2.8%*, Ratesetter 2.8%*

Important: All these loans are 'representative APR', which means sadly only 51% of accepted applicants need to get the rate shown. Full help and more deals in our Cheap Loans guide. Also see Rep APR Examples.

PS: Struggling for acceptance at a decent rate? It's always worth finding your local credit union, as often these local savings & loan co-operatives will give you far better options than high-cost credit.

Buy now, pay later (BNPL) does exactly what it says on the tin. Usually, you get offered it at the checkout when you're buying something - pushing you to get the item now and to spread the cost over a few weeks or months. Our new Should I buy now, pay later? guide takes you through it.

Buy now, pay later (BNPL) does exactly what it says on the tin. Usually, you get offered it at the checkout when you're buying something - pushing you to get the item now and to spread the cost over a few weeks or months. Our new Should I buy now, pay later? guide takes you through it.

✔️ Pros: Interest-free | Easy to get | Repayments are fixed

❌ Cons: Many borrow when they don't need to | It's (currently) unregulated - no recourse to the ombudsman if things go wrong | No Section 75 protection on purchases | Short-term only

The biggest problem with BNPL is people get it when they don't need it. They attempt to seduce people in at online checkouts as "an easy way to spread the cost", but if you weren't originally planning to borrow for what you're buying, don't.

However, if you do need short-term borrowing on items you need for up to a couple of hundred quid, provided you can afford to repay, it's easy and interest-free. There are no top picks here as it's linked to your shopping.

The only major concern is if things go wrong - hitting your credit file, no delivery of items and more. There's little recourse, as it's not yet covered by the Financial Ombudsman. Plus the Section 75 rules don't apply, so it's best avoided for anything larger.

If you want a cash loan (eg, you're buying something you can't pay for on a credit card), then for less than £3,000, a 0% money transfer credit card may be a way to effectively get one far more cheaply than traditional loans.

Here, for a one-off fee of 3-4% of the amount shifted, you transfer money from the card to your bank account, then owe the card firm instead.

✔️ Pros: Interest-free for a decent time | Can check eligibility without applying | Regulated - so can go to the ombudsman if there are problems

❌ Cons: One-off fee | No Section 75 protection | Easy to overspend and overborrow | Repayments aren't fixed, so easy to underpay | Not everyone can get one

Like with 0% spending cards, money transfer cards are best for those who trust themselves to use them only for a one-off purchase and to clear the card before the 0% ends. These cards are complicated, so please read our 0% Money Transfers guide to ensure you get it right.

Top deals right now: What really counts is what you will be accepted for, so ALWAYS check which 0% money transfers you're most likely to get first. The current top pick is MBNA's up to 18mths 0% (2.99% fee)*, though some poorer credit-scorers may get a 3.49% fee. After the 0% ends, it's 22.9% rep APR (APR Examples).

Once you have a card, do the transfer ASAP. Then ensure you repay it within the 0% period - the best route is to set up a direct debit repayment for a fixed amount, a bit like if you had a loan, to ensure you clear it (and never miss a payment).

If you're looking for new borrowing, we've run through the main options that are worth doing, yet they're not the only borrowing fish in the debt sea. And there are specific loans that may be better (or worse) in some cases. So let's just briefly whizz through those...

-

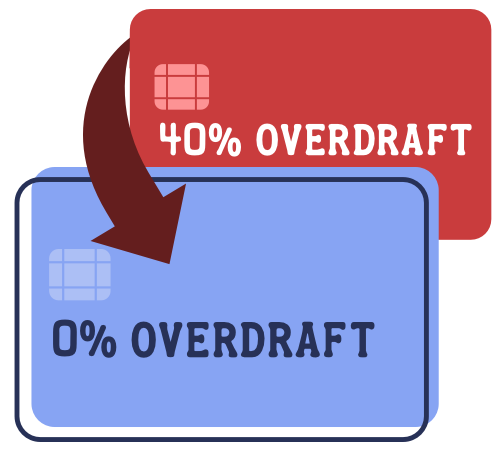

Overdrafts are a new debt danger (cut yours to 0% and get paid £100). Overdrafts are a costly form of debt for most, they now average a hideous 40% APR and are best avoided. If you're already overdrawn, one option worth looking at is shifting to First Direct, as it has a £250 0% overdraft for most, and pays you £100 which will help clear it further. More help in Slash your overdraft costs.

Overdrafts are a new debt danger (cut yours to 0% and get paid £100). Overdrafts are a costly form of debt for most, they now average a hideous 40% APR and are best avoided. If you're already overdrawn, one option worth looking at is shifting to First Direct, as it has a £250 0% overdraft for most, and pays you £100 which will help clear it further. More help in Slash your overdraft costs.

- Mortgages are a whole other category. If you're planning to buy a new home, or are getting a new mortgage on your current home, that's a different story and is too much to put in here. There's a huge amount of help in our mortgage MoneySaving section.

- Is your car a wreck and you need a new one to get to work? The cheapest way to borrow to buy a new car is usually with a cheap personal loan. However, specialised car finance packages can be more flexible. Our car finance guides have full pros and cons of each.

- Student finance works more like a tax than a loan. Many people get what's called borrowing to go to uni, whether that's for tuition fees, living costs or both. Yet in practice what (if anything) you repay and the interest depends on what you earn afterwards, so it's actually a bit like tax - the more you earn, the more you pay. Find out how they really work in Student Loans Mythbusting.

- And finally... don't touch payday loans or high-cost credit with a bargepole. They're an interest and financial nightmare. If you've got one, check out our Payday Loan Help guide. If you previously had one, you may also be able to reclaim mis-sold payday loans.

The options above are for new, planned borrowing. Yet some try to borrow their way out of debt. It doesn't work, so don't try it. Martin has three questions that are worth asking about your debts...

- Do you struggle to meet minimum monthly payments?

- Does your total debt (excl mortgage and student loan) exceed a year's salary?

- Do you have sleepless nights or depression/anxiety over debt?

If you've said yes to any of these, don't borrow more - instead get free, one-to-one debt counselling help from Citizens Advice, StepChange or National Debtline. And if you need emotional support, try CAP.

They're there to help, not judge. The most common thing we hear after is: "I finally got a good night's sleep." Read inspiring stories in our Debt-Free Wannabe forum and see our Mental Health & Debt and Debt Crisis Help guides.

No comments:

Post a Comment