| Plus... Barclaycard limit help, water-saving freebies, energy switch help  THE TOP TIPS IN THIS EMAIL

| | New. Biggest bank switch cash bribe for a year. Get £125 & a £20 Uber Eats voucher The market's hotting up as FOUR banks now pay switchers For years, we've said if your bank isn't giving you decent service, stop bitching and start switching... especially as many banks pay you to join them. Sadly the pandemic put a hold on that, as for long periods bank switch bonuses disappeared entirely.

But things are turning round. This week's new HSBC deal is the best in 'cash' terms since March 2020 (though Virgin's wine deal has a higher listed value). Now FOUR banks pay newbies to switch...

Switching is simple. For all deals below you go through the banks' official switching services, which...

- Switch you in 7 working days

- Move all standing orders and direct debits for you

- Close your old account and auto-forward payments

All do a not-too-harsh credit check. Full eligibility criteria and more details in Best Bank Accounts, but here's the key info... -

TOP FOR UPFRONT CASH: New. HSBC free £125 + £20 Uber Eats. Switch to the fee-free HSBC Advance* account and newbies get a free £125, and can now claim a £20 no-min spend Uber Eats takeaway / delivery voucher on top. You also get access to a linked 1% regular saver. TOP FOR UPFRONT CASH: New. HSBC free £125 + £20 Uber Eats. Switch to the fee-free HSBC Advance* account and newbies get a free £125, and can now claim a £20 no-min spend Uber Eats takeaway / delivery voucher on top. You also get access to a linked 1% regular saver.

- Min monthly pay-in: £1,750/mth (its way of trying to get you to pay your salary / salaries in - equivalent to earning £25,600+/yr).

- Min direct debits/standing orders you need to switch: 2

- Who counts as a newbie? If you've not had an HSBC current account, or opened one from sister bank First Direct, since Jan '18.

- TOP SERVICE: First Direct free £100 + 0% overdraft. First Direct* scores highly for service with a whopping 91% rating it 'great' in our latest poll. It pays newbies £100 to switch, plus gives access to a linked 1% saver. Many also get a 0% £250 overdraft (39.9% EAR interest above).

- Min monthly pay-in: None, but you must deposit £1,000 within 3mths (though you can withdraw it the next day).

- Who counts as a newbie? If you've never had any account with First Direct, or opened a current account with sister bank HSBC since Jan '18.

- TOP OVERALL VALUE: Virgin Money free £140 wine + £50 to charity + 2% savings. No cash here, but new Virgin Money switchers get 12 bottles of wine it says are worth £138. Plus it'll pay £50 to one of your choice from 13,000 charities.

You also get 2.02% AER variable interest, though only on up to £1,000, plus you get its debit card which is a top pick for overseas use as it offers fee-free spending and cash withdrawals.

- Min monthly pay-in: None, but you must register for its app and put £1,000 in its linked 0.35% savings account until you've been sent the wine code. PS: Pls be Drinkaware.

- Min direct debits/standing orders you need to switch: 2 DDs

- Who counts as a newbie? If you've not had a current account with Virgin, Clydesdale or Yorkshire Bank since Nov '20.

- TOP (POSSIBLE) MONTHLY CASH: Halifax free £100 + some get freebies eg, £5/mth or movie tickets. Halifax Reward currently offers newbies a free £100 to switch. Plus some can choose a monthly reward of £5 cash, 3 digital magazine subscriptions, 2 movie rentals or 1 cinema ticket.

To get those you must meet the min pay-in below, stay in credit and either spend £500/mth on your debit card OR keep £5,000+ in the account at all times (there's no interest). You must specify in advance which you'll do.

- Min monthly pay-in: £1,500/mth (equiv to £21,500/yr) - if not, you pay a £3/mth fee, so best to avoid if you can't meet the pay-in.

- Who counts as a newbie? You can't have an existing Halifax Reward account, or have had a Halifax switch bonus since Apr '20. Other existing Halifax customers can get it if they are switching an account with another bank to a new Reward account. PS: A trick to 'jemmy' the minimum pay-ins. The rules usually say you need to pay in a set amount from external sources. So let's say you're required to pay in £1,500 but only have £1,000 coming in. Get that paid in, then withdraw £500 as cash or to another bank, then pay it back in, and BINGO, you've qualified. If you need a bills account, Santander 123 Lite* pays cashback on bills you pay from it via direct debit, incl 1% on council tax, 2% on energy and 3% on water. You don't need to switch to it, so you can keep any existing accounts too if you want. There's a £2/mth fee but those with mid-to-large household bills can still make about £40-£80/yr from this account after that. It also has a £500/mth minimum pay-in.

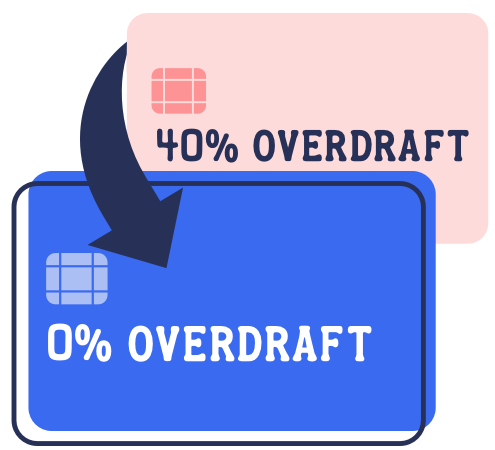

Santander 123 Lite also works well as a shared secondary account - many couples find it especially useful as a joint bills account. For other cashback options, see Best Bank Accounts. Again, you don't need to switch to these accounts - you just open them and pay the fee. They can be big winners - though with travel currently still suppressed, think carefully about whether you need all the cover now, or if it's cheaper to buy what you need separately. Our top pick is Nationwide FlexPlus*, at £13/mth. Its biggest perk for many is covering all the family's mobiles, which could be £70+/yr per phone done separately. Plus it gives worldwide family travel insurance and UK and Europe breakdown cover for all account holders. Full info and more deals in Packaged Bank Accounts.  Debit cards are debt cards if you're overdrawn. And now almost all major banks charge about 40% interest for overdrafts - double the rate of even a high street credit card - so they're a serious danger debt. We've full help in 10 ways to cut overdraft costs, but here are the key cost-cutters... Debit cards are debt cards if you're overdrawn. And now almost all major banks charge about 40% interest for overdrafts - double the rate of even a high street credit card - so they're a serious danger debt. We've full help in 10 ways to cut overdraft costs, but here are the key cost-cutters...

- Struggling financially due to Covid? Santander still offers up to £500 for 3mths at 0% if you request it (though you must apply by 4 May), while others provide tailored support. Speak to your bank to see what it can do. See Covid overdraft help. - Owe less than £350? Switch to a 0% overdraft. As we say above, First Direct* offers switchers £100 and many get a £250 0% overdraft (39.9% EAR variable interest above). So if your overdraft's up to £350, the £100 pays some off and the rest is at no interest. Full info: First Direct. - Switch to get a potentially bigger 0% overdraft, but only for a year. Alternatively, Nationwide FlexDirect* can offer a far bigger 0% overdraft, though the limit depends on your credit history. But the 0% only lasts a year (39.9% EAR variable after), so see it as a respite and aim to clear it before then. Full info: Nationwide. - Do a 0% money transfer. These specialist credit cards pay cash in to your bank account so you owe the card instead, and you can get up to 18mths at 0%. See our Money Transfers guide for the top deals. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Martin: 'The new Govt 5% deposit mortgage scheme started on Monday - but that doesn't automatically mean you should get one...'  The Govt push to stimulate our overheating housing market continues. Help to Buy equity loans and stamp duty cuts are driving new price extremes. Now it's 5% deposit mortgages. Whether in the long run this all helps or hinders is complex, but it is odd that while we bemoan most price rises, many celebrate them when it's housing.

Yet house price inflation is often just a paper gain, and can cleave away many dreams of home ownership, as well as making upgrading hard. I'll leave that thought there... on to this week's news. - The new Govt mortgage scheme means more 95% loan-to-value (5% deposit) mortgages. Lenders tightened pandemic-borrowing criteria which meant the supply of low deposit mortgages was throttled right back. Since Monday, under the mortgage guarantee scheme (MGS) , the Govt covers a portion of the mortgage risk on properties up to £600,000 (excluding new-builds), so lenders can offer more up-to-95% loan-to-value (LTV) mortgages. The LTV is the proportion of a home's value you borrow, eg, 95% means first-time buyers only need a 5% deposit.

- Seven major lenders are taking part, but DON'T think these mortgages are special. Big names such as Barclays, HSBC, Lloyds, NatWest, Halifax and Santander are offering loans under the MGS for first-time buyers and home movers, but there is also now a growing number of 95% mortgages that aren't part of the scheme.

Many lenders offering MGS mortgages are hyping it up. But don't favour a mortgage just as it's part of the scheme. The MGS offers lenders surety so they can offer more mortgages, but they aren't any better for borrowers - so pick solely based on which offers the best terms. Full help in our Free First-Time Buyers' Booklet and Remortgage Booklet.

- Better still, push for a bigger deposit if you can. Just because 95% LTV mortgages are available again doesn't mean they're the bee's knees. They are far more expensive than if you can push to a bigger deposit, even just getting to a 10% down payment. As a rough rule, for each 5 percentage-point extra deposit you have, mortgages get cheaper, until you've a 40% deposit (60% LTV).

As an example, the table below, sourced from our Mortgage Comparison Tool, shows the impact on 2yr deals (though some of the saving is because with a bigger deposit, you've a smaller mortgage). So check the top deal for you via the comparison, then use our Ultimate Mortgage Calculator to check out the costs.

| Cheap deals | 95% LTV

(5% deposit) | 90% LTV

(10% deposit) | 60% LTV

(40% deposit) | | | On £150k property = £9,050/yr | On £150k property = £8,200/yr | 1.13% + £1,000 fee On £150k property = £4,625/yr | | | 3.99% + £35 fee On £150k property = £9,025/yr | On £150k property = £8,475/yr | 1.39% + £1,000 fee On £150k property = £4,775/yr | | We've found mortgages with roughly similar fees to try to ease comparison. To work out the annual cost, we've spread the fee over the 2yr deal (based on a total 25yr term). |

- Get a £1,000-a-year free boost to your mortgage deposit. Anyone aged 18-39 can open a top Lifetime ISA and get a 25% boost, worth up to £1,000/yr, on top of savings made towards a first home of up to £450,000, once the LISA's been open a year. If you already have the similar Help to Buy ISA and want to know which is best, it's complex... so see my Should I move my Help to Buy ISA into a Lifetime ISA? blog.

- Need more help to prepare to get a mortgage? There's lots to look at. One big problem is being accepted, especially with a low deposit. For help, read how to boost your mortgage acceptance chances, part of which is the need to check your credit file (for free) . If you're struggling through this, I'm a fan of getting help - see our find a mortgage broker section.

| 30+ supermarket coupons, incl FREE Lindt choc, FREE Alpro soya milk & £5 off Persil, Dettol etc. Some really hot coupons in our April round-up, to save on your weekly online and in-store shops. Martin: 'How to legally force your employer to give you a pay rise, if you're EITHER earning under £10,000 OR aged under 22 / over 66.' See Martin's NEW Hidden pay rise blog. Want help changing energy supplier? We can Pick You A Tariff in 5mins. Savings are typically £250/yr right now. Try our easy-to-use Pick Me A Tariff tool, which finds YOUR top pick from the whole of the market. 500,000+ water-saving FREEBIES, eg, £20 shower heads & £5 tap inserts. There's more free stock available than we've ever seen before, though what you can get depends on your supplier. Free water-saving gadgets New longest balance transfer credit card - shift debt to 29mths at 0%, 2.75% fee. If you pay credit or store card interest, a balance transfer helps slash costs. Always check which cards you're most likely to get first, but the new HSBC* card, like the M&S Bank* card, offers accepted new cardholders the joint-longest 0% period, for 29mths, with a one-off 2.75% fee (min £5). Golden rules: 1) Pay at least the monthly min. 2) Pay it off in the 0% period or transfer again, or they're both 21.9% rep APR. 3) Don't spend/withdraw cash. More help and deals, incl shorter NO-FEE cards, in Top Balance Transfers (APR Examples). Barclaycard slashing 100,000+ credit limits (some by £1,000s) - what to do. See Barclaycard help.

WARNING: Financial regulator issues alert over scammers using fake MSE & Martin email addresses. It's issued an alert over a 'clone firm' fraudulently using our names. Remember, we won't send out emails except this one (or if you're signed up to one of our services such as Cheap Energy Club). If you're unsure, go directly to the MSE site - we always put the content there. Full info and what to watch out for in MSE 'clone firm' warning. PS: Nor will we ever call you or send anyone to knock on your door. Beware of all of 'em. | New. Top 0% spending card - get up to 21mths INTEREST-FREE Done right, 0% credit cards are the best way to borrow as there's no interest. Done wrong, they're one of the worst There's no cheaper way to borrow than at zero interest, so a 0% credit card could be your secret weapon, provided you can buy what you need on a card and you've a high enough credit limit. And now there's a new top pick - the longest fee-free spending card we've seen in over nine months... - Only borrow if it's NEEDED and AFFORDABLE. Done right, these cards allow longer-term borrowing at no cost whatsoever. That's powerful, but only do it for a needed, planned, affordable, one-off purchase (eg, replacing a broken fridge). Never do it willy-nilly to fill gaps in your income. And if you're already struggling with debt, further borrowing won't help - instead read our Debt Help guide.

THE LONGEST 0% PURCHASE CREDIT CARDS

RECOMMENDED: Use our 0% Cards Eligibility Calc first to see which cards you're most likely to get | | CARD | DETAILS | New. Lloyds Bank

Best to check acceptance odds first. Or apply* | Longest card, but it's an 'up to' so some accepted get fewer 0% months

- Up to 21mths 0% (some with poorer credit scores get 12mths)

- 19.9% rep APR after | M&S Bank

Best to check acceptance odds first. Or apply* | Longest card with a definite 0% period if accepted, plus you get M&S points

- 20mths 0%

- 21.9% rep APR after

- Earn 1 point (worth 1p) per £1 spent at M&S or £5 elsewhere. Plus get a bonus 500 M&S points (worth £5) when you buy anything at M&S via a coupon it sends | Sainsbury's Bank

Best to check acceptance odds first. Or apply* | Long 0% card & gives Nectar points, but some accepted get fewer 0% months

- Up to 20mths 0% (some with poorer credit scores get 12mths)

- 21.9% rep APR after

- 750 bonus Nectar points worth £3.75 per £35+ spend at Sainsbury's in the first 2mths (max 7,500 points, worth £37.50) | Aqua

It's asked us to send people via our eligibility calc | Short 0% period, on a card designed for poor credit scorers

- 4mths 0%

- A big 34.9% rep APR after, so ensure you clear it by then. See how best to use it | - Need to borrow to buy something but the store won't take credit card, or it's £5,000+? 0% money transfers pay cash in to your bank account, so can be used where cards can't. And if what you're buying's £5,000+, you may not get the credit limit you need - a cheap loan may be a better option.

- Follow the 0% Card Golden Rules. Full info in 0% Credit Cards (APR Examples), but in brief...

a) Always pay at least the set monthly minimum and stick within the credit limit, or you can lose the 0%.

b) These cards are usually only cheap for spending - avoid cash withdrawals or shifting debt to them.

c) Plan to clear the card (or balance-transfer away) before the 0% period ends, or rates jump to the rep APR. | Azalea potted plant £10 all-in (norm £25). MSE Blagged. Suitable for indoor and outdoor life. 2,500 avail Self-employed grant 4 - sadly you can still only unofficially check when YOU can apply. The fourth Covid Self-Employment Income Support Scheme grant - worth up to £7,500 - opened applications for some this week, but everyone gets a personalised 'earliest application' date. If you've not had yours, HMRC had told us you'd be able to log in and check your date from Mon just gone, and all dates would be sent out by next Mon - but it now says it's still working on letting you check online and aims to send out dates by the 'end of Apr'. Yet there is an unofficial checker that will work for some. See the latest in Self-Employed & Small Ltd Co Help. £39 Barbour prescription specs via code (norm £145). MSE Blagged. See our Specky Four Eyes deal. 'Thank you, we're saving £400 on our family's mobiles'. Success of the week. David emailed: "Thank you for giving me a spur to check my family's mobile tariffs on MSE's Cheap Mobile Finder - we went back to our provider and got a better deal. Across the year we'll be saving just under £400." (Send us your success on this or any topic.) Posh 'zero-plastic' shampoo bar for £4 delivered (norm £12). MSE Blagged. From beauty and grooming brand Gruum - lasts up to 60 washes. 20,000 avail New London Capital & Finance redress scheme - investors may get up to £68,000 back. They have struggled to reclaim money since the bonds firm collapsed in 2019. Now 8,800 will likely be able to claim under a new Govt scheme, but payouts will be capped at 80% of deposits, up to £68,000. Full info in LCF news. Want to discuss what's in this week's Money Tips email? Have your say on our new board in the MSE Forum. | Tell your friends about us They can get this email free every week | | AT A GLANCE BEST BUYS | | New. Free £125 for switching + £20 Uber Eats vch: HSBC

Free £100 for switchers + top service: First Direct | | THIS WEEK'S POLL What is it appropriate to borrow for? The financial impact of the pandemic has left many needing to borrow more to make ends meet. We want to know if it has also changed attitudes about when it's right or wrong to borrow. Tell us in this week's poll. Two-thirds of MoneySavers still reuse passwords. Last week, we asked how you use passwords - over 6,600 people responded. Overall, 66% told us they use the same password for more than one account - and 14% admitted to using the same or mostly the same password for everything. Password manager apps were most popular among those with lots of accounts - 53% of those with over 100 accounts use one, compared to just 4% of those with 25 or fewer. See the full password poll results. | MARTIN'S APPEARANCES (WED 21 APR ONWARDS) Wed 21 Apr - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 22 Apr - This Morning, ITV, 10.45am, then phone-in from 11.10am MSE TEAM APPEARANCES (SUBJECTS TBC) Sat 24 Apr - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 11am

Mon 26 Apr - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 27 Apr - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | 'IT TAUGHT ME TO SAVE FOR WHAT I WANTED...' WHAT DID YOU LEARN FROM YOUR SATURDAY JOB? That's all for this week, but before we go... we asked you what you learned about money if you had a Saturday job as a teenager. While many told of important life lessons about the value of money, or how to save up for something they wanted, others learned more, erm, 'diverse' skills. For example, one MoneySaver's Woolworths checkout job 25 years ago means she thinks she can still accurately estimate the weight of any pick 'n' mix bag. Read the full list of lessons and add your wisdom in our 'What did you learn from your Saturday job?' Facebook post. We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment